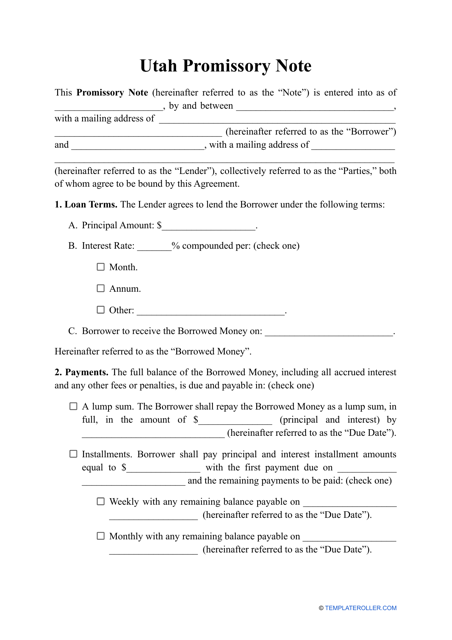

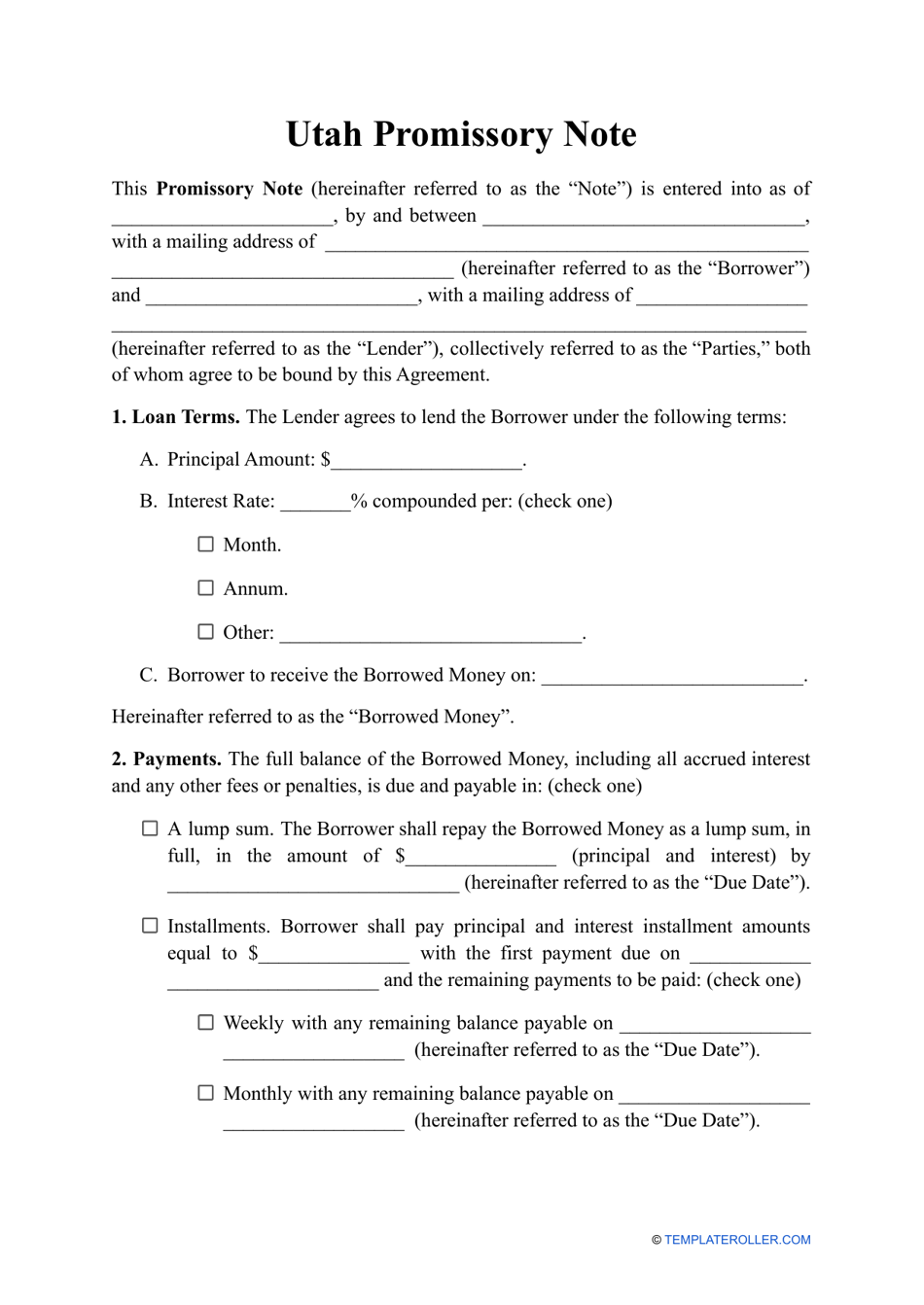

Promissory Note Template - Utah

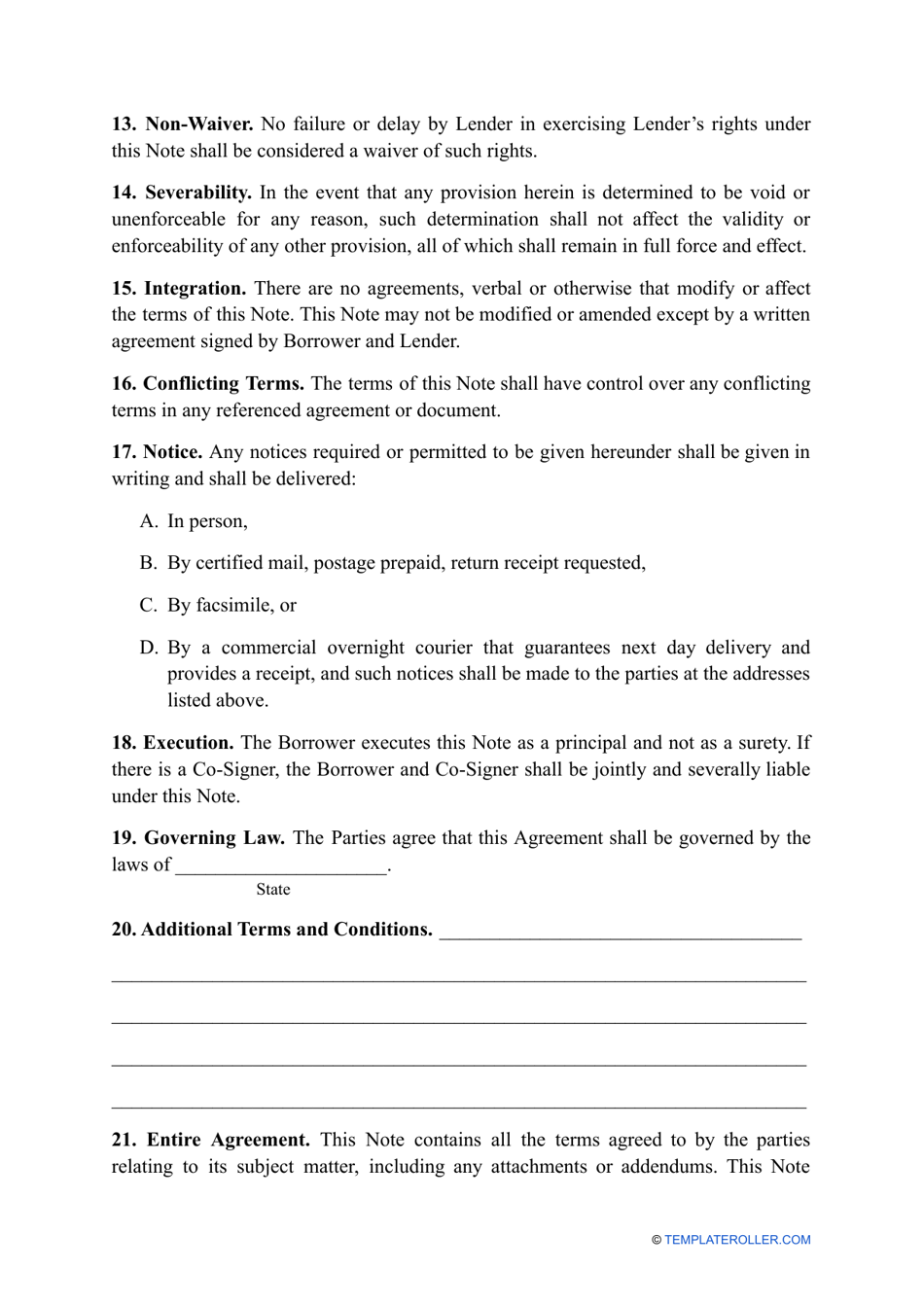

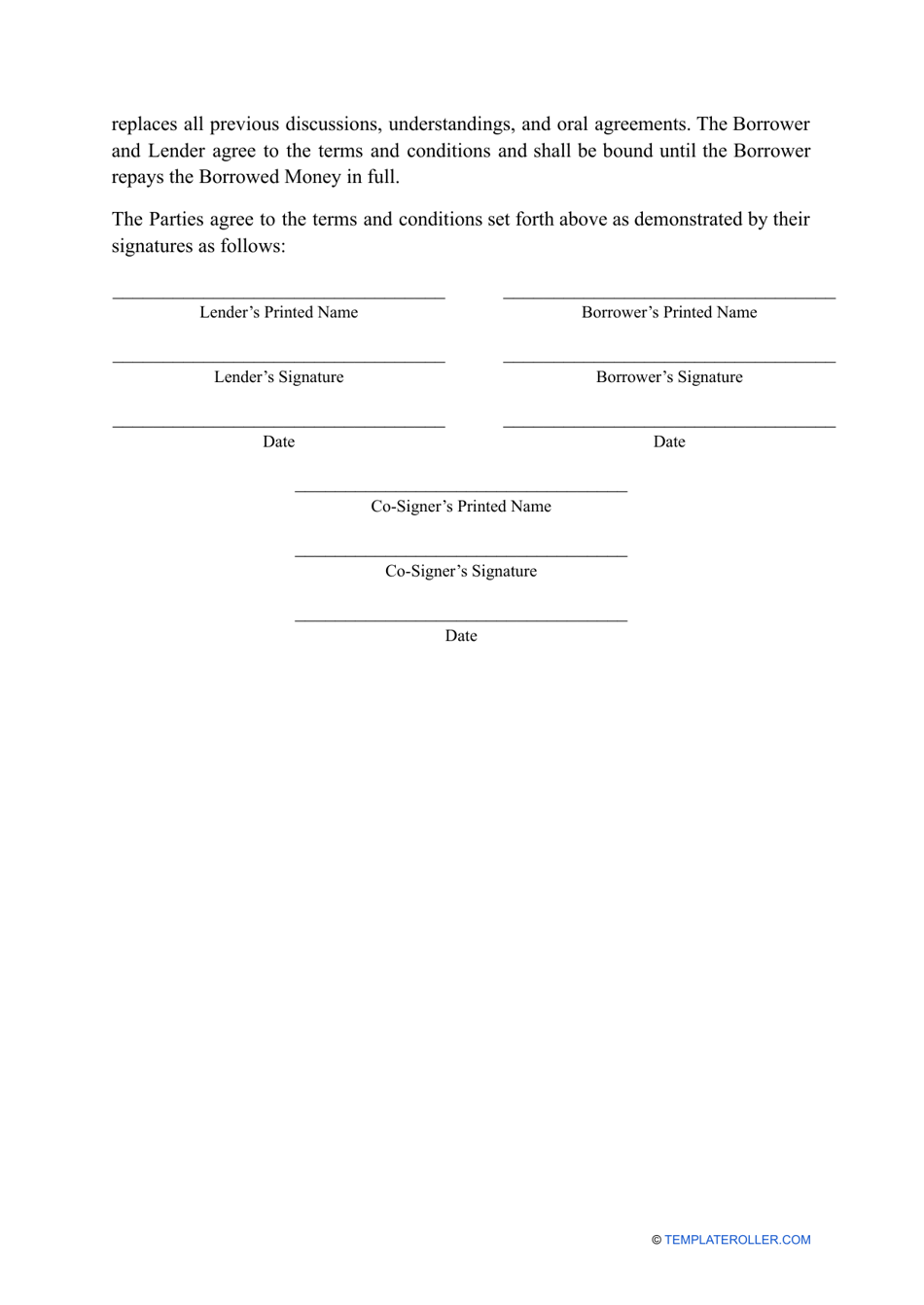

A promissory note template in Utah is a standardized form that outlines the terms and conditions of a loan agreement between two parties. It is used to legally document the borrower's promise to repay the lender a specific amount of money within a designated time frame, including any interest or fees.

Promissory notes are typically filed by the borrower, not the state. The template can be prepared and signed by the borrower and lender, but it does not need to be filed with the state in Utah.

FAQ

Q: What is a promissory note?

A: A promissory note is a legal document that outlines a borrower's promise to repay a specific amount of money, along with the terms and conditions of the repayment.

Q: What is a promissory note template?

A: A promissory note template is a pre-designed form that provides a structured layout for creating a promissory note. It helps simplify the process of drafting a promissory note.

Q: Why would I need a promissory note template in Utah?

A: You may need a promissory note template in Utah if you are lending or borrowing money and want to document the agreement in a legally binding manner.

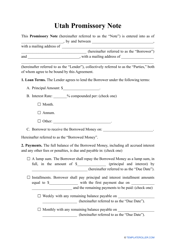

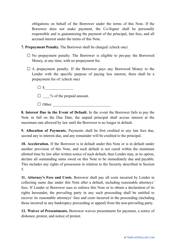

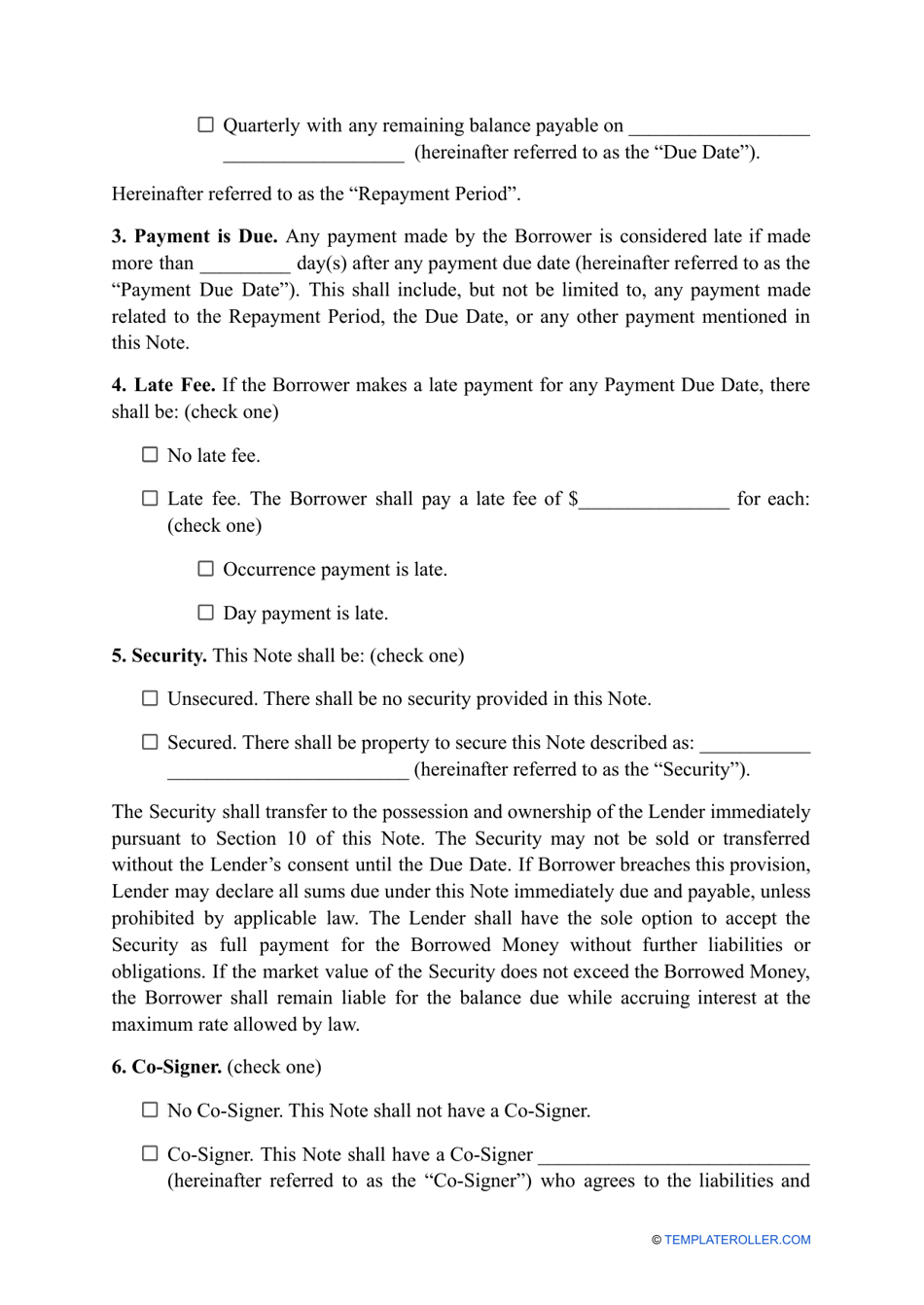

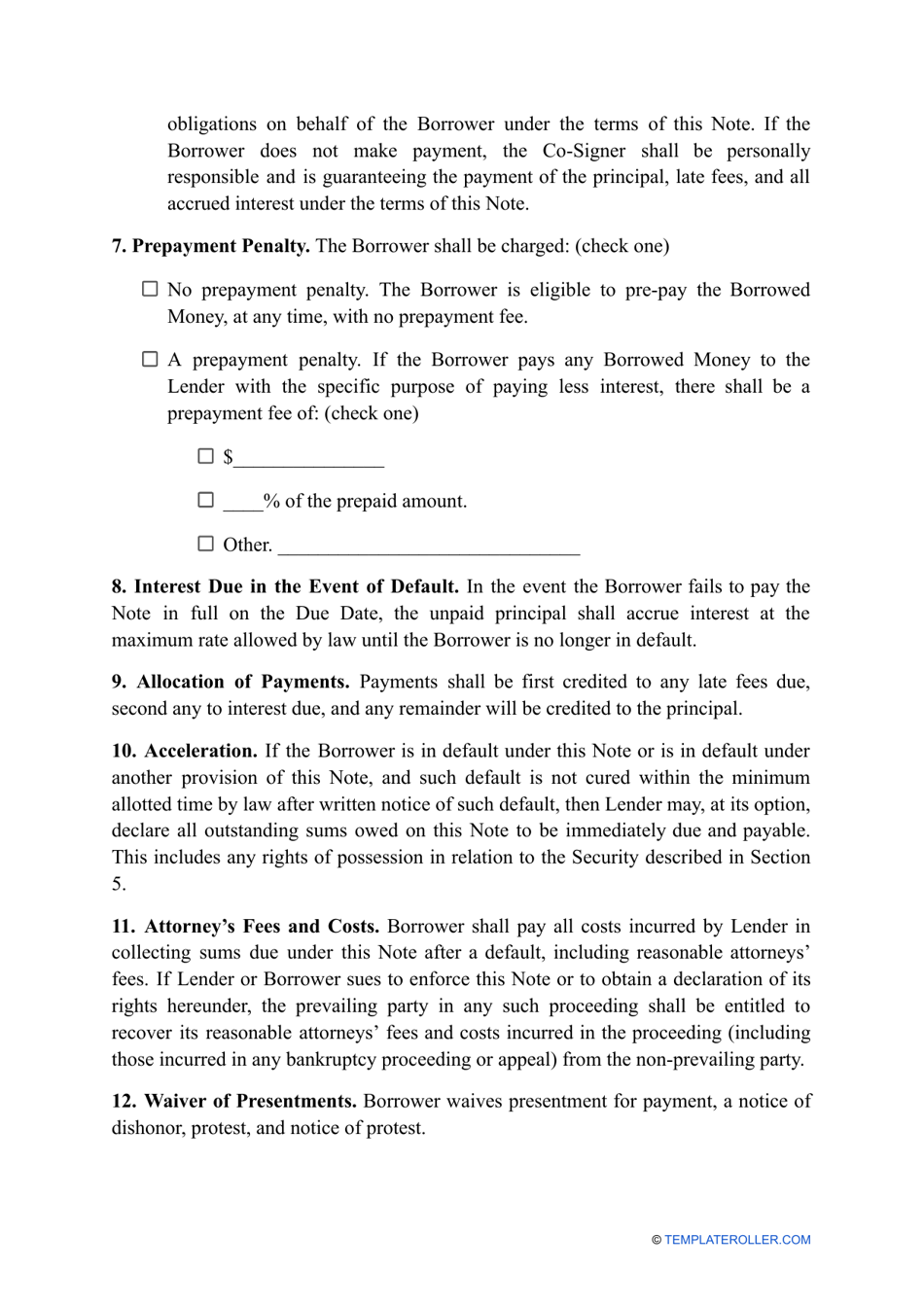

Q: What should be included in a promissory note template?

A: A promissory note template should include information such as the names of the borrower and lender, the loan amount, the interest rate, the repayment terms, and any collateral or security for the loan.

Q: Can I modify a promissory note template to suit my specific needs?

A: Yes, you can modify a promissory note template to include any additional terms or conditions that are relevant to your specific lending or borrowing situation.

Q: Is it legally binding to use a promissory note template?

A: Yes, a properly executed and signed promissory note, whether created from a template or not, is legally binding in Utah.