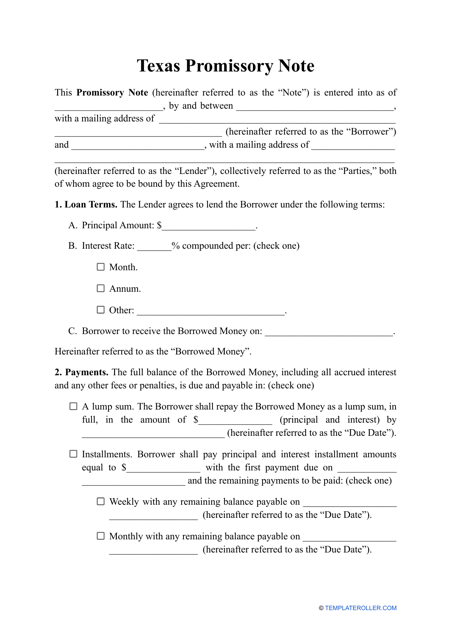

Promissory Note Template - Texas

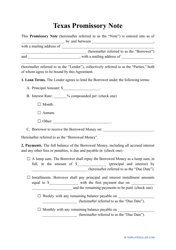

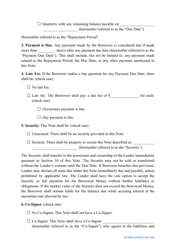

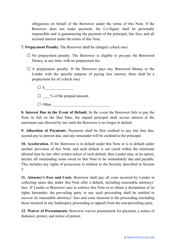

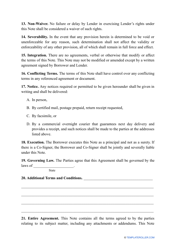

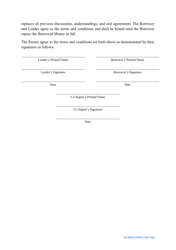

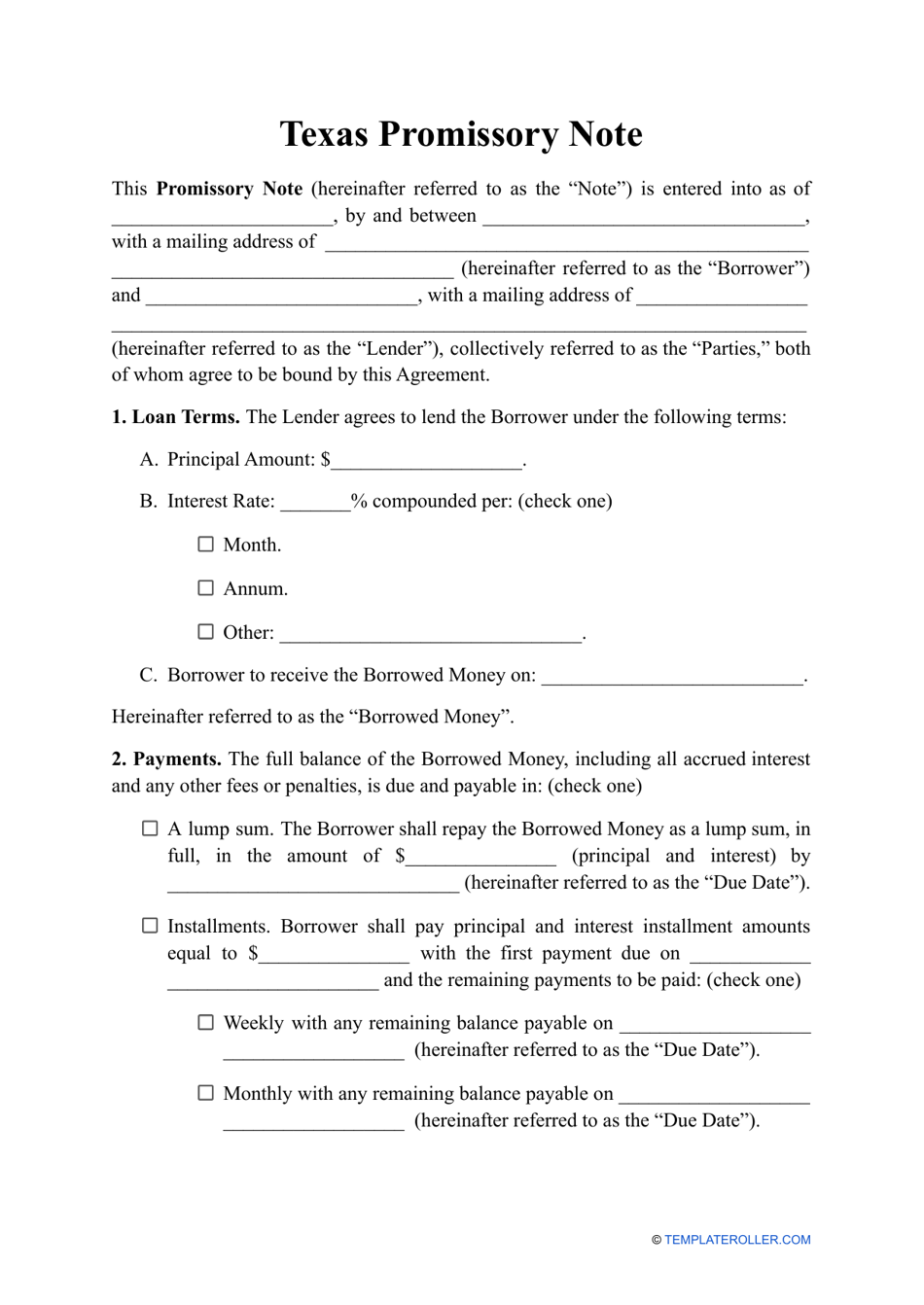

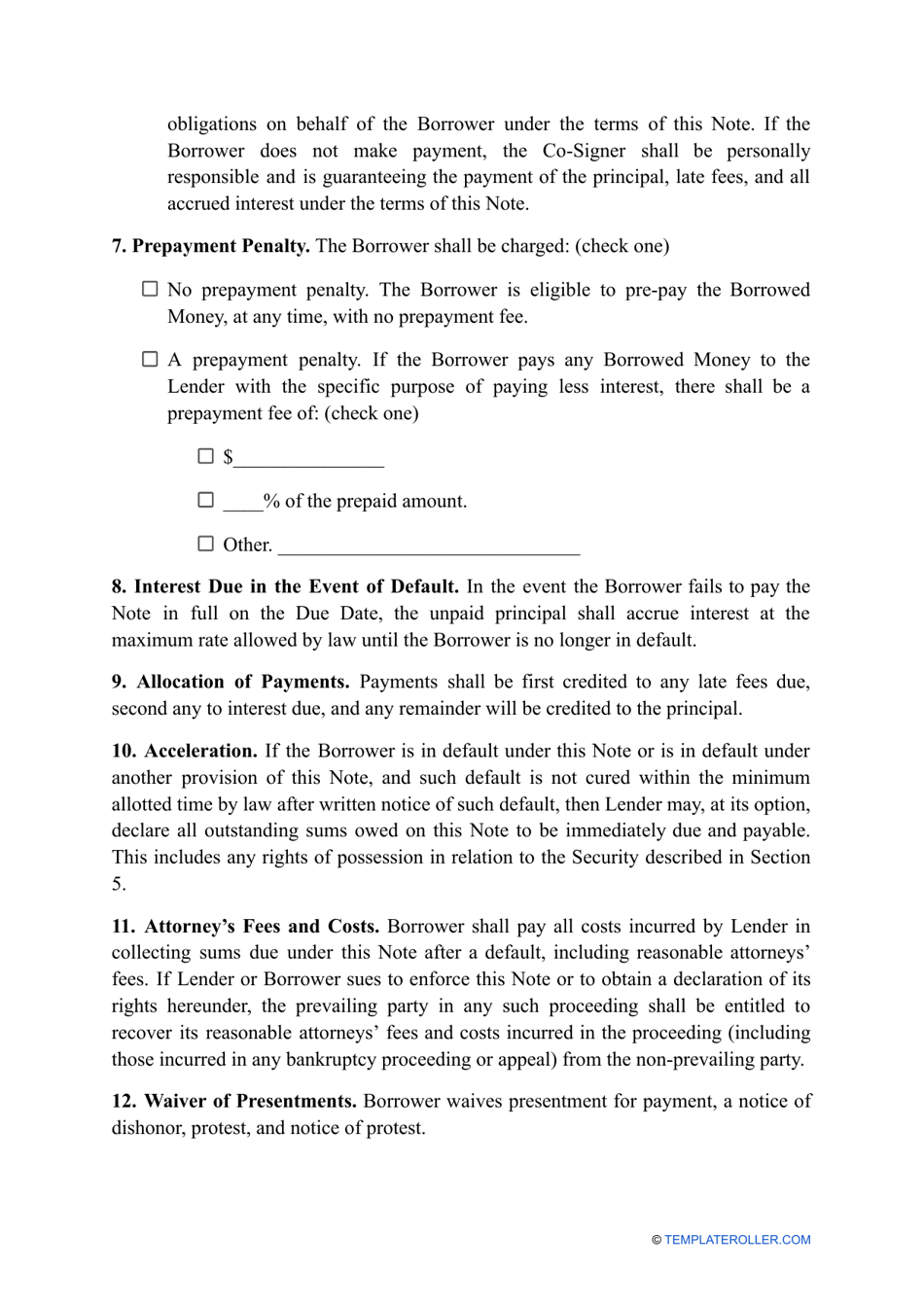

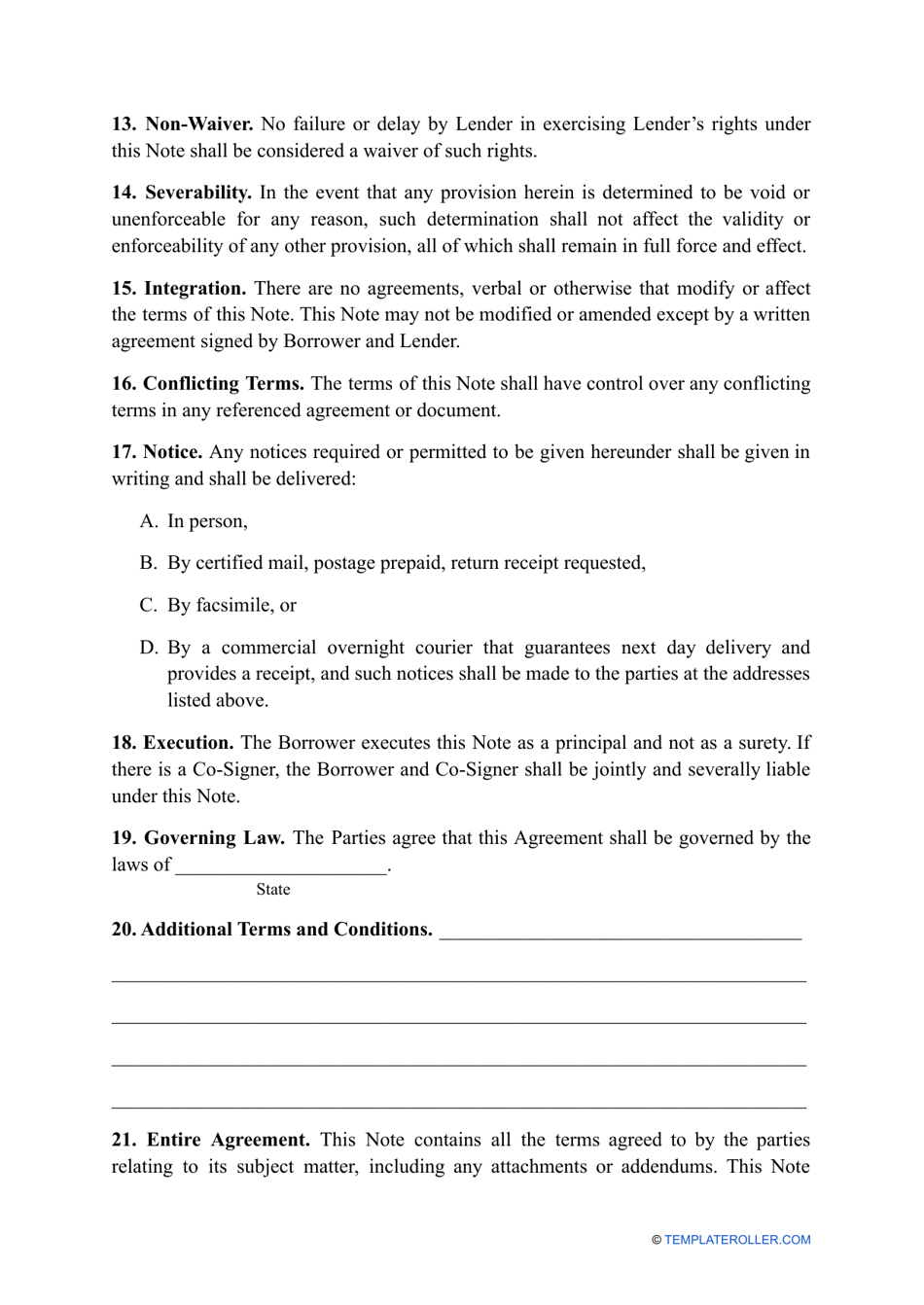

A Promissory Note Template in Texas is used for documenting a loan agreement between two parties. It outlines the terms and conditions of the loan, such as the amount borrowed, repayment schedule, and any applicable interest rates.

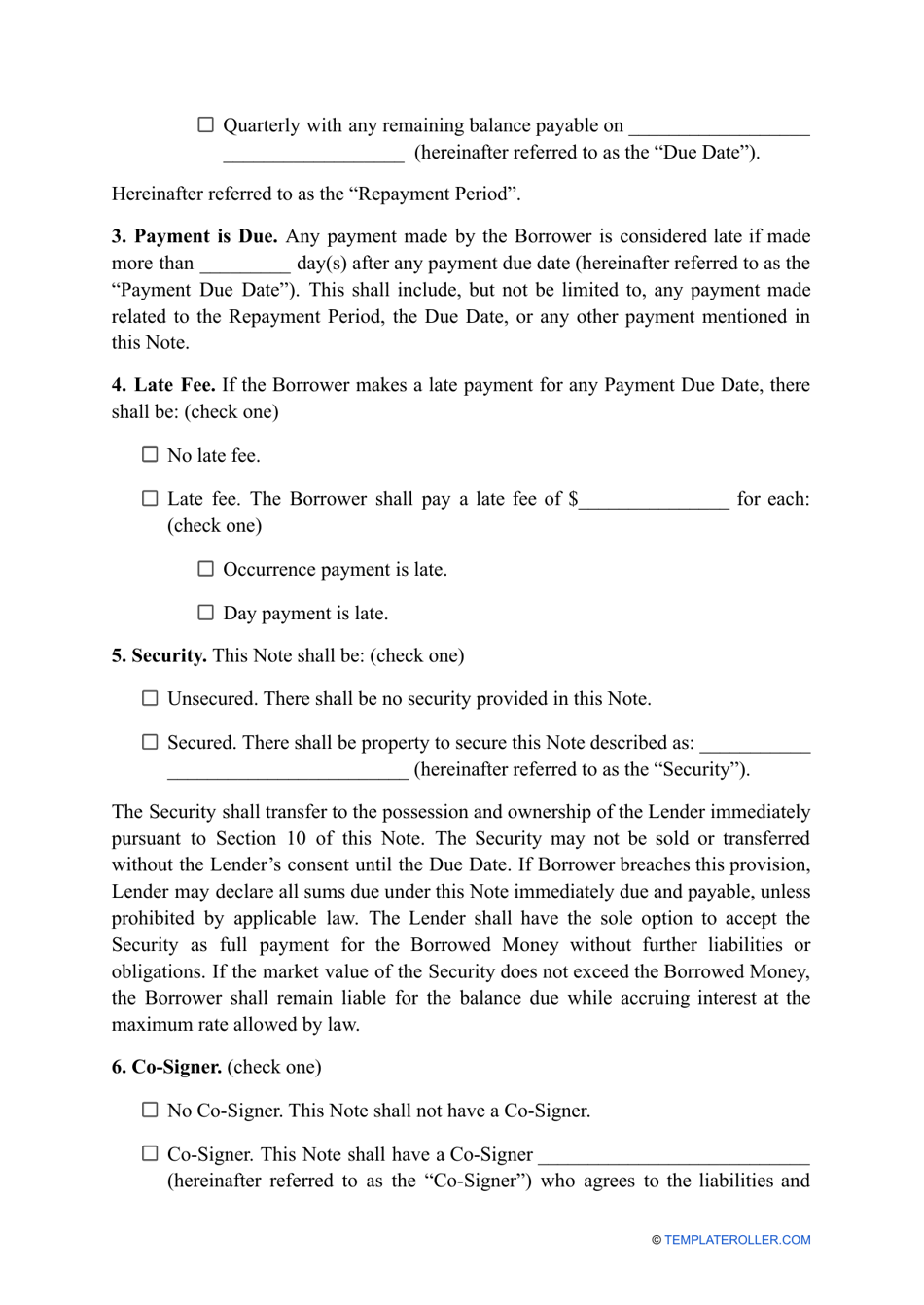

The promissory note template in Texas can be filed by the party creating the document, typically the borrower. However, it is not required to be filed with any government agency.

FAQ

Q: What is a promissory note?

A: A promissory note is a legal document that outlines the details of a loan agreement, including the borrower's promise to pay back the borrowed money.

Q: Why would I need a promissory note?

A: You may need a promissory note if you are lending money to someone and want a legally binding document that outlines the terms of repayment.

Q: What information should be included in a promissory note?

A: A promissory note should include the names of the borrower and lender, the loan amount, the interest rate (if any), the repayment terms, and any other relevant details.

Q: Is a promissory note enforceable in Texas?

A: Yes, promissory notes are legally enforceable in Texas as long as they meet certain requirements and are properly executed.