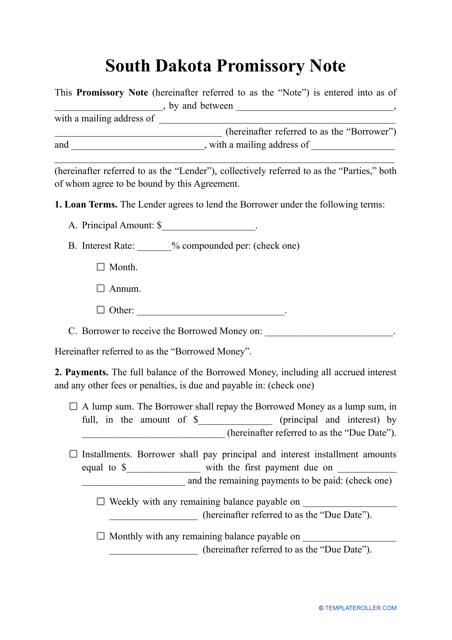

Promissory Note Template - South Dakota

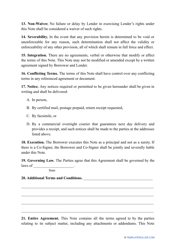

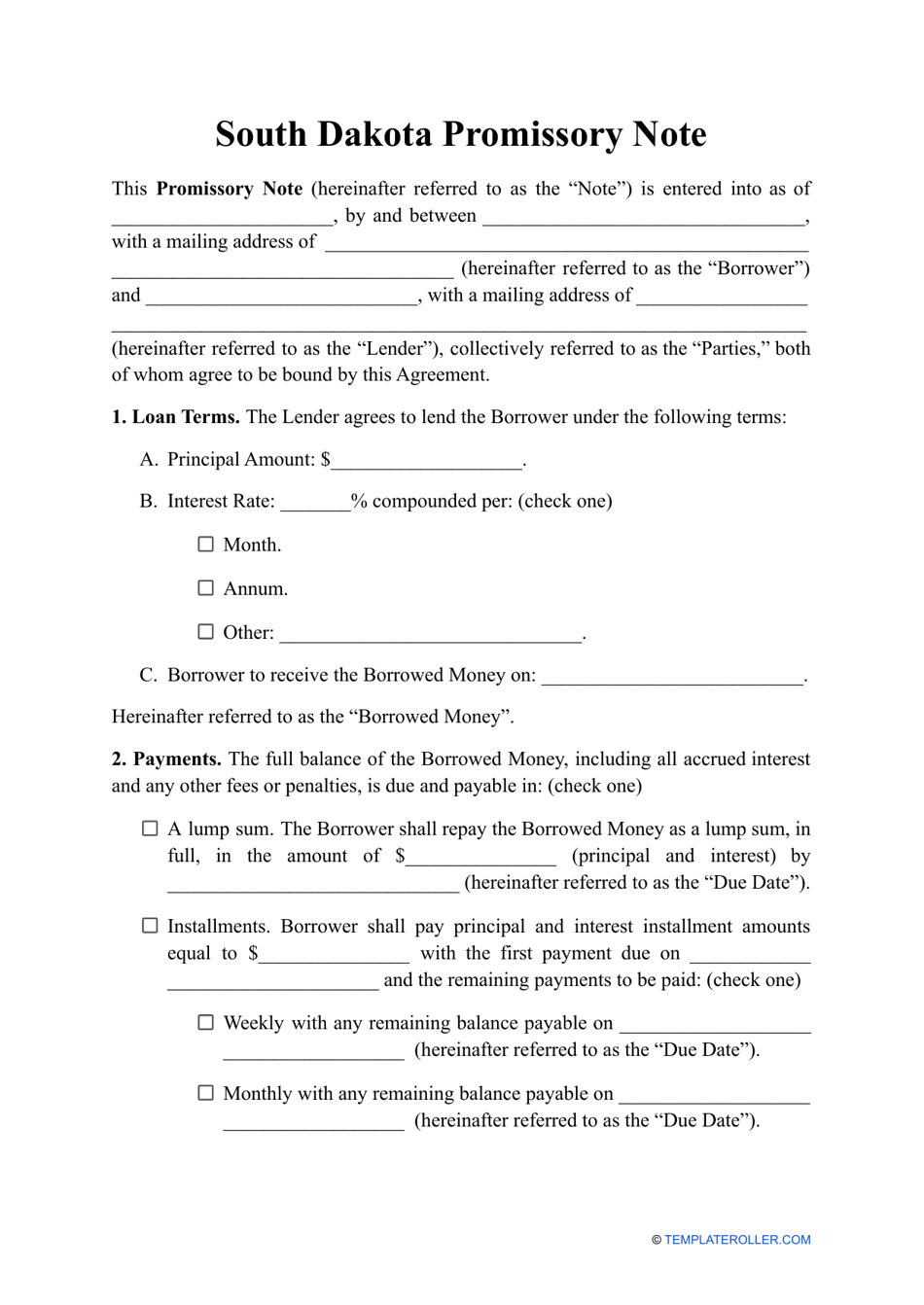

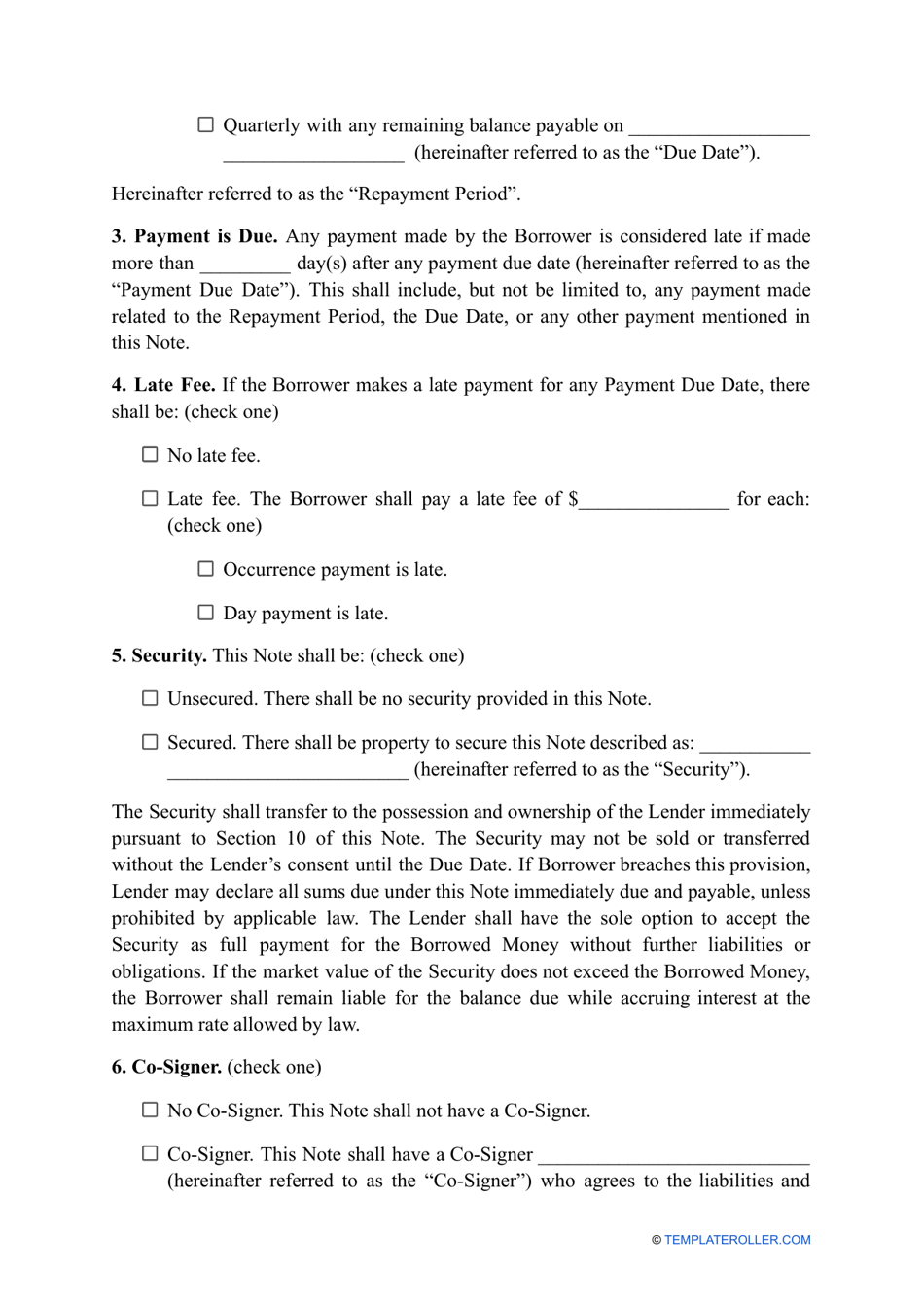

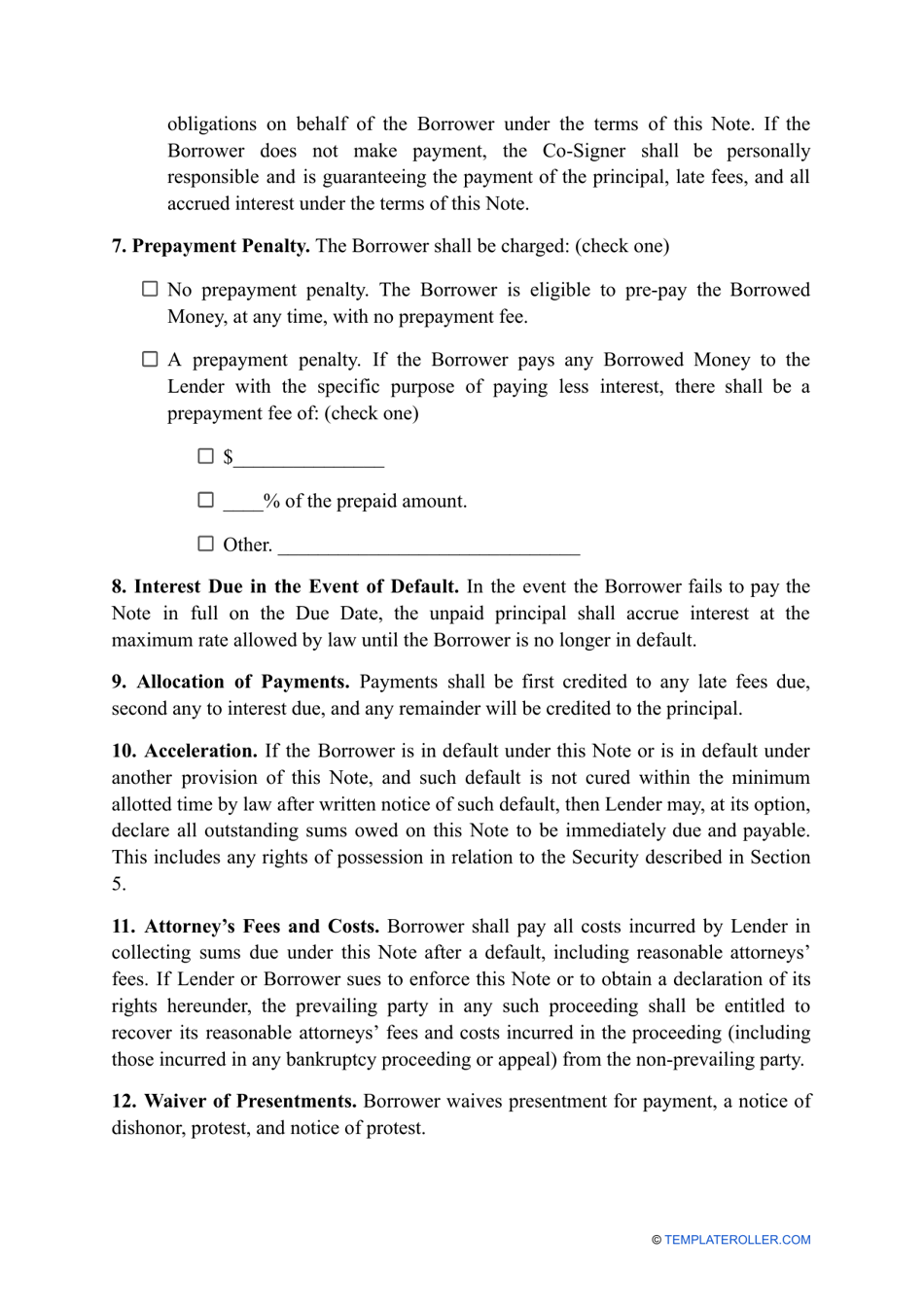

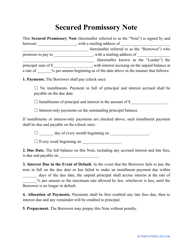

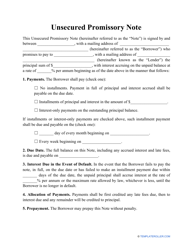

A promissory note template in South Dakota is typically used for documenting a borrower's promise to repay a specific sum of money to a lender. It outlines the terms and conditions of the loan, including the repayment schedule and any interest rate that may apply.

FAQ

Q: What is a promissory note?

A: A promissory note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower.

Q: What is the purpose of a promissory note?

A: The purpose of a promissory note is to establish a written record of a loan and to ensure that both the lender and the borrower are aware of their rights and obligations.

Q: Who can use a promissory note?

A: Anyone who is providing a loan or borrowing money can use a promissory note to formalize the agreement.

Q: What information should be included in a promissory note?

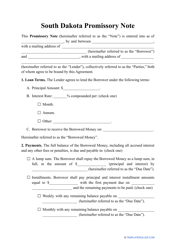

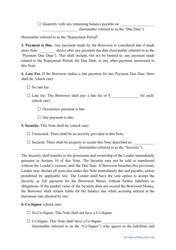

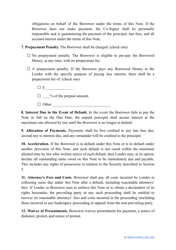

A: A typical promissory note should include the names and addresses of both the lender and borrower, the loan amount, the interest rate, the repayment terms, and any collateral or security provided.

Q: Is a promissory note legally binding?

A: Yes, a promissory note is a legally binding document and can be used as evidence in a court of law if necessary.

Q: Can the terms of a promissory note be negotiated?

A: Yes, the terms of a promissory note can be negotiated between the lender and the borrower, as long as both parties agree to the changes in writing.

Q: Do I need a lawyer to create a promissory note?

A: While it is not required to have a lawyer create a promissory note, it is recommended to seek legal advice to ensure that the document is legally enforceable and meets all legal requirements.

Q: Can I use a generic promissory note template for South Dakota?

A: While a generic promissory note template may contain the basic elements of a promissory note, it is recommended to use a template specific to South Dakota to ensure that it complies with the state's laws and regulations.

Q: What happens if a borrower defaults on a promissory note?

A: If a borrower defaults on a promissory note, the lender has the right to take legal action to collect the outstanding balance, which may include pursuing a lawsuit or seeking the assistance of a debt collection agency.