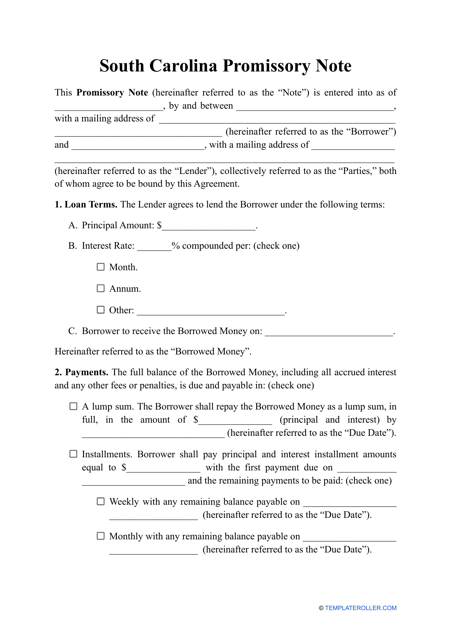

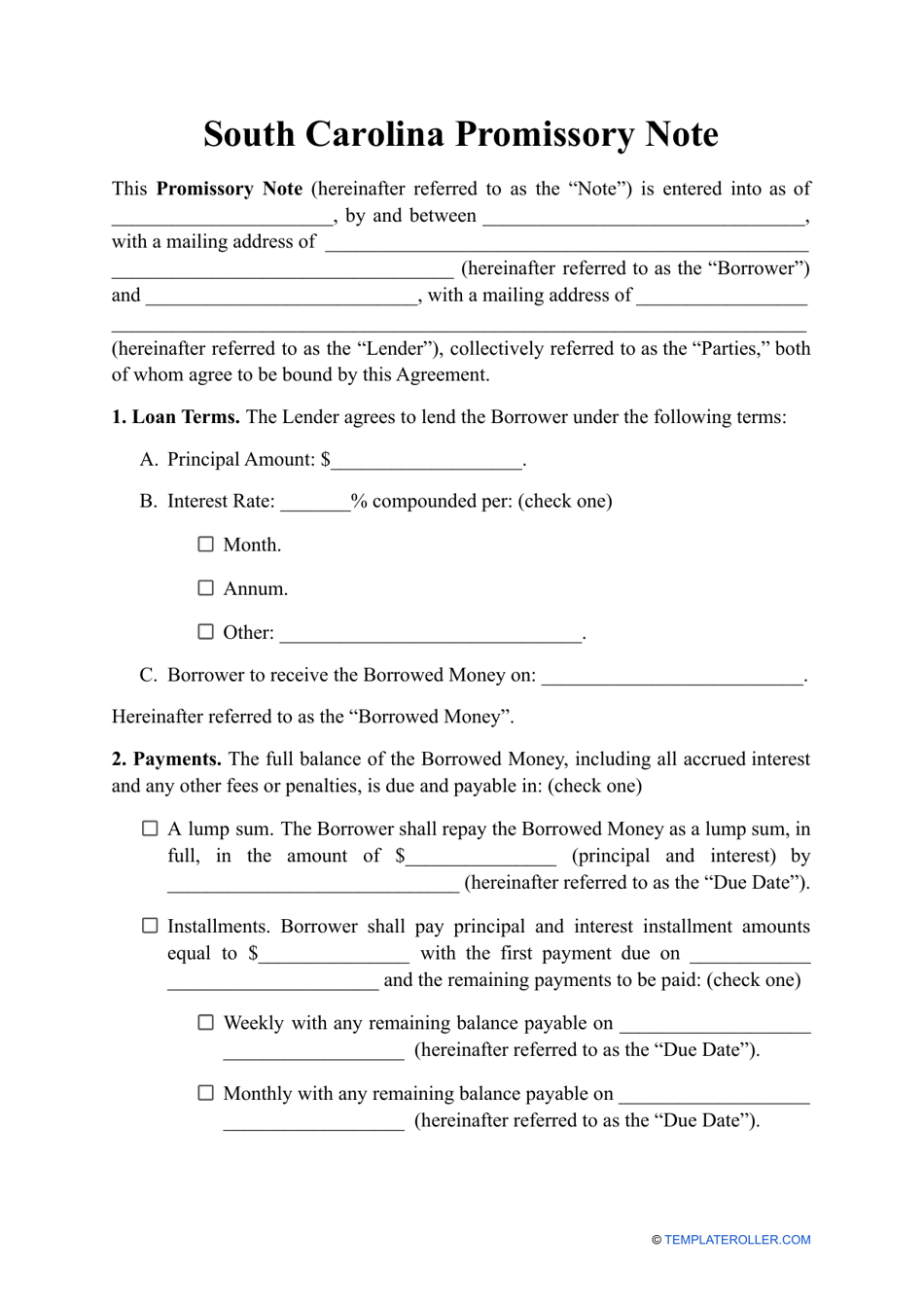

Promissory Note Template - South Carolina

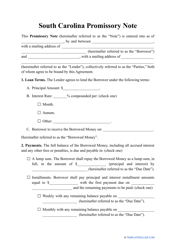

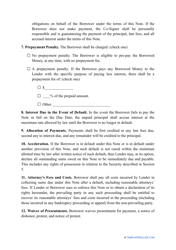

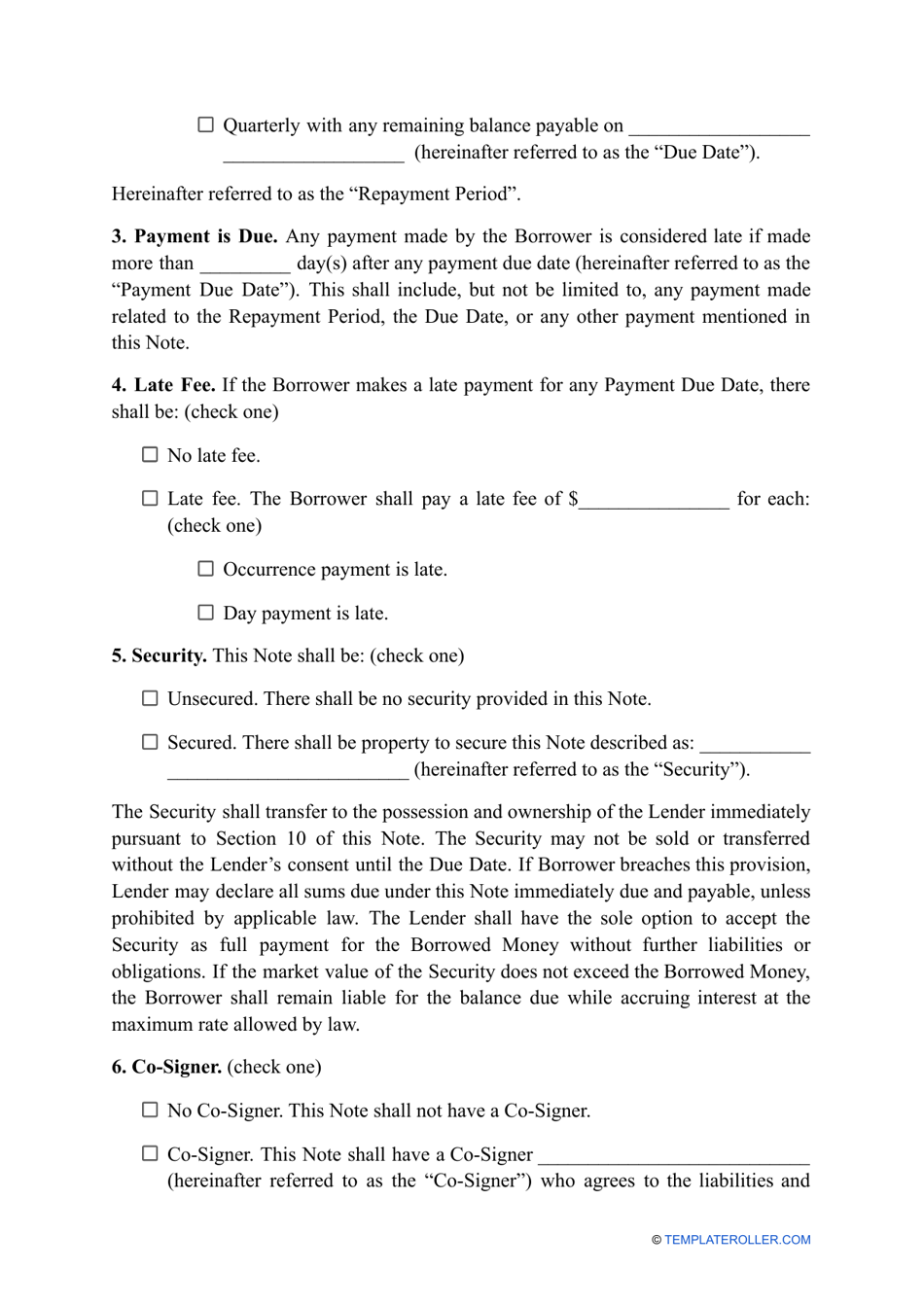

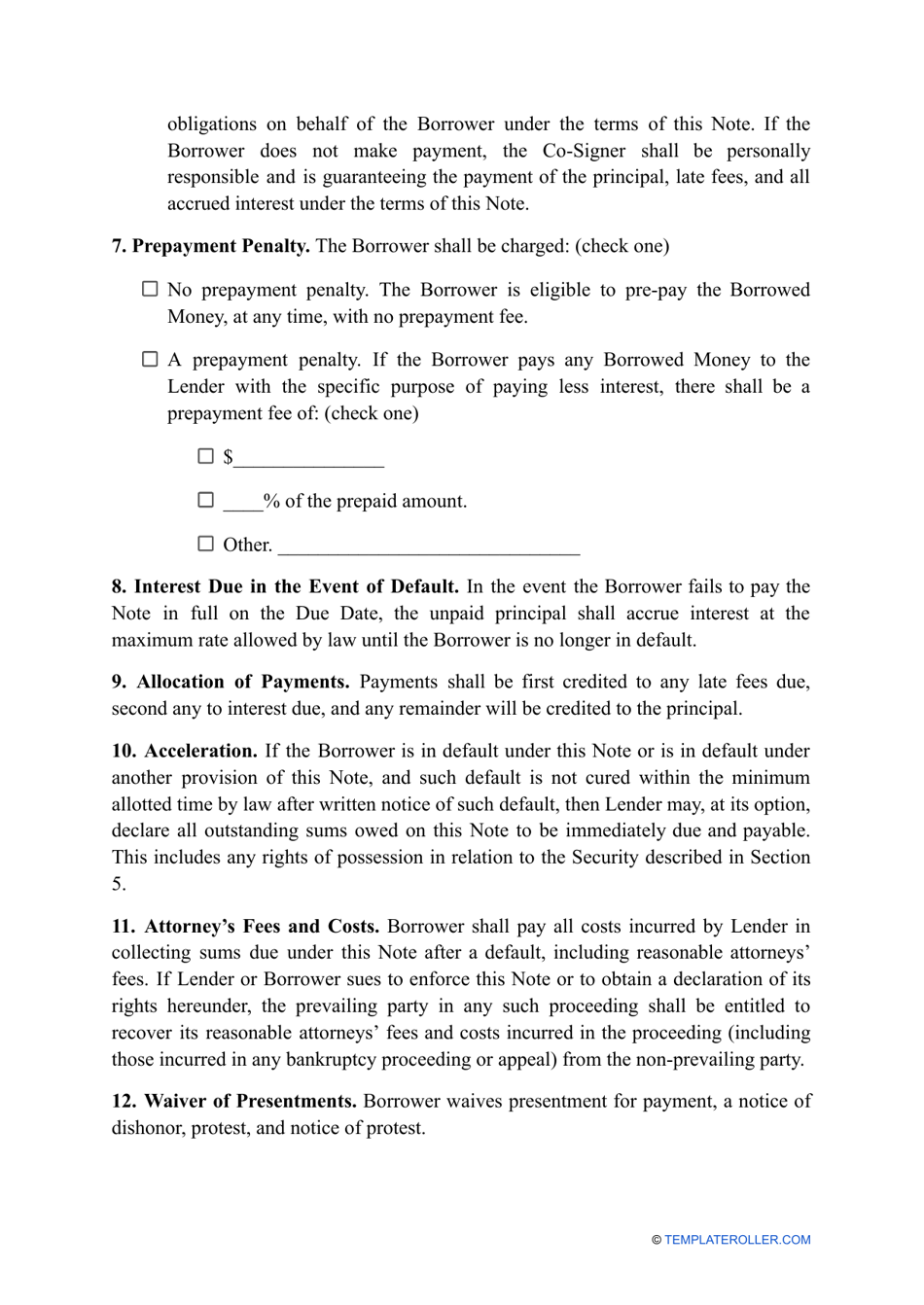

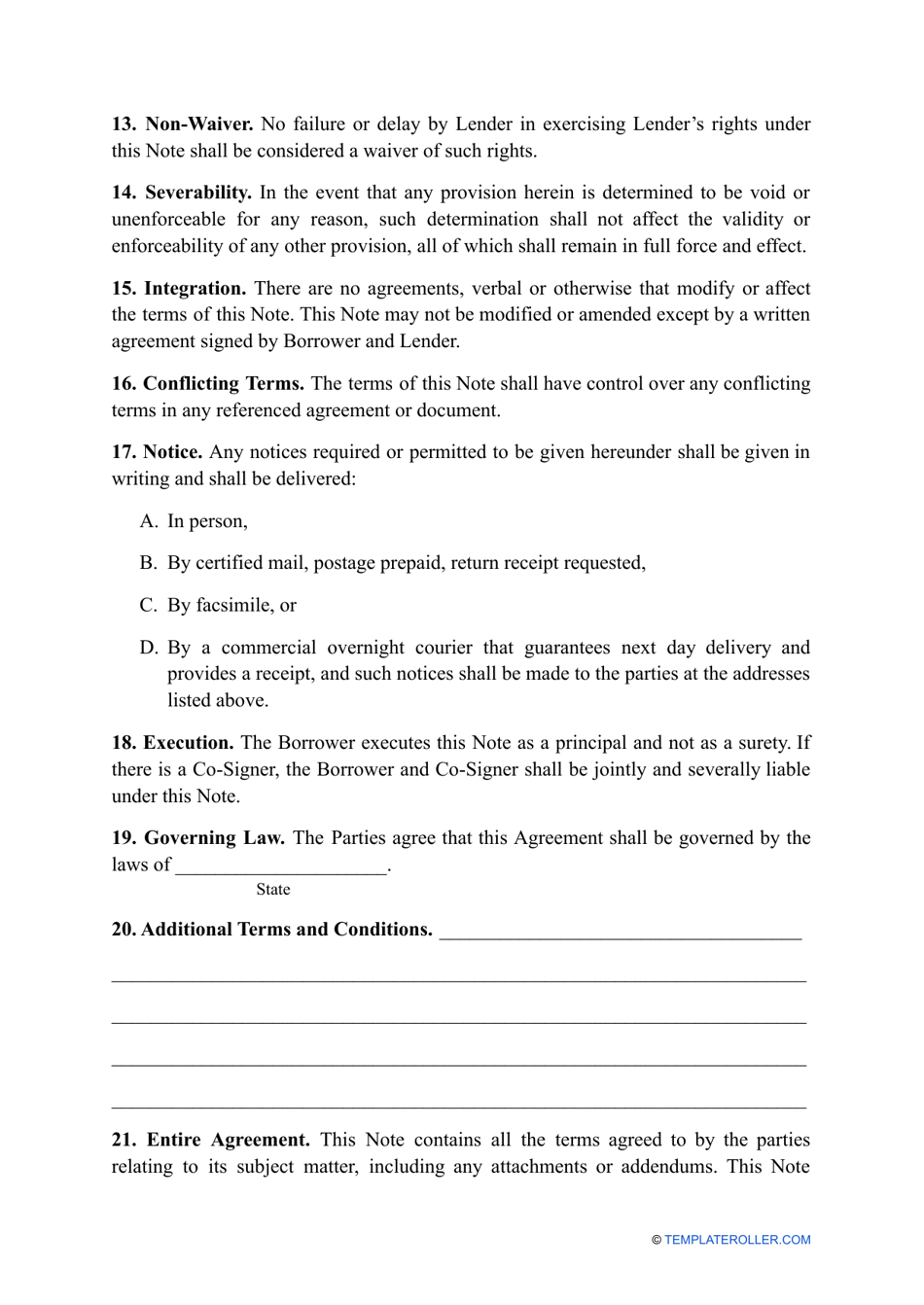

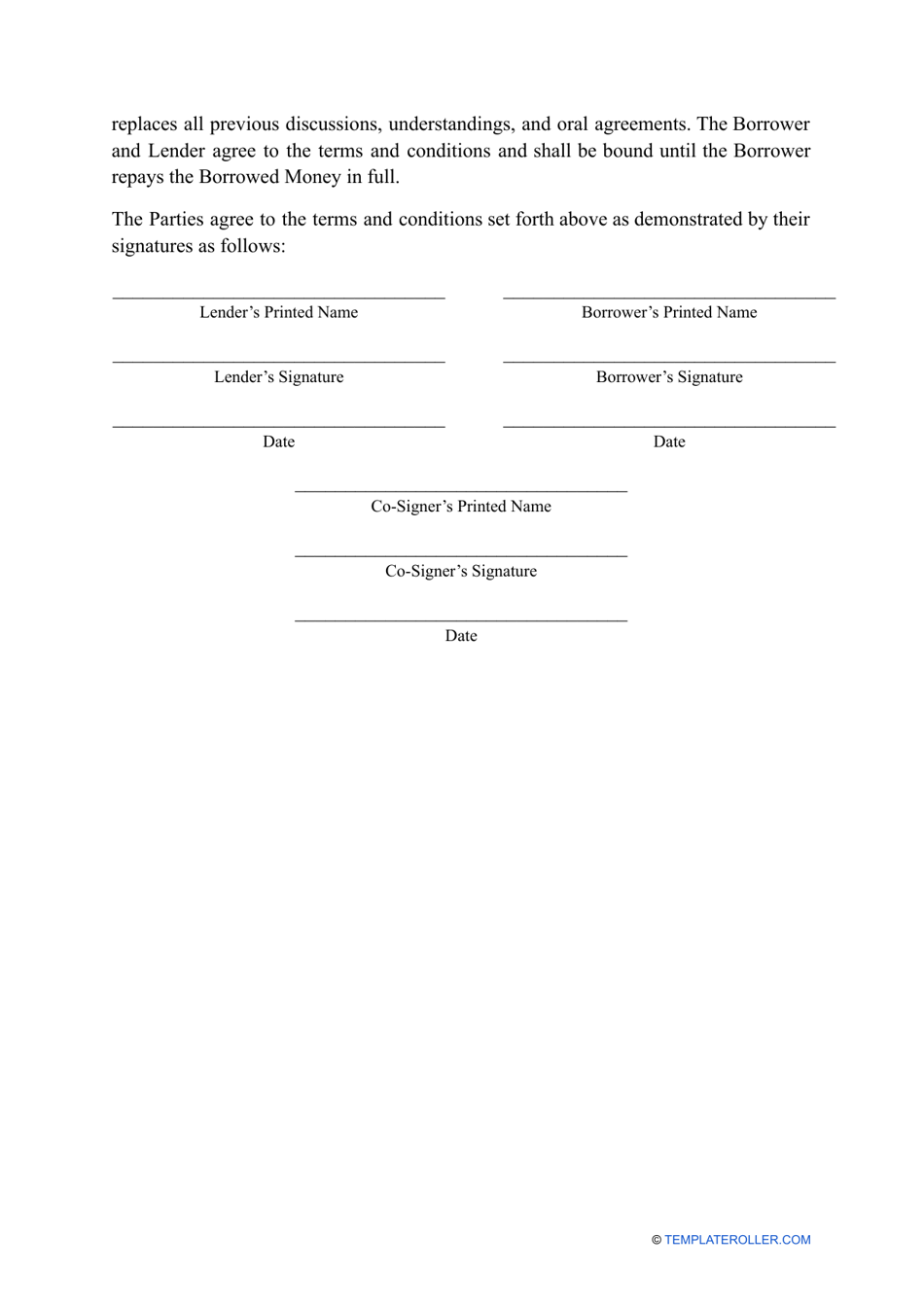

A promissory note template in South Carolina is a standardized form that outlines the terms and conditions of a loan or debt agreement between two parties. It serves as a legally binding document, ensuring that the borrower agrees to repay the borrowed amount. The template includes information such as the amount borrowed, interest rate, repayment schedule, and consequences of defaulting on the loan.

The promissory note template in South Carolina is typically filed by the borrower or the party who owes the debt.

FAQ

Q: What is a promissory note?

A: A promissory note is a legal document that outlines a borrower's promise to repay a specific amount of money to a lender within a specified timeframe.

Q: Why would I need a promissory note?

A: You would need a promissory note to document and formalize a loan agreement between you and another party.

Q: What information should be included in a promissory note?

A: A promissory note should include the names and contact information of both the lender and borrower, the loan amount, the interest rate (if applicable), and the repayment terms.

Q: Is a promissory note enforceable in South Carolina?

A: Yes, a promissory note is legally enforceable in South Carolina as long as it meets the state's requirements for validity and enforceability.

Q: Are there different types of promissory notes?

A: Yes, there are different types of promissory notes, such as secured promissory notes (backed by collateral) and unsecured promissory notes (not backed by collateral).

Q: Do I need to consult a lawyer to create a promissory note?

A: While it is not required to consult a lawyer, it is recommended to seek legal advice when creating a promissory note to ensure it is legally sound and meets your specific needs.