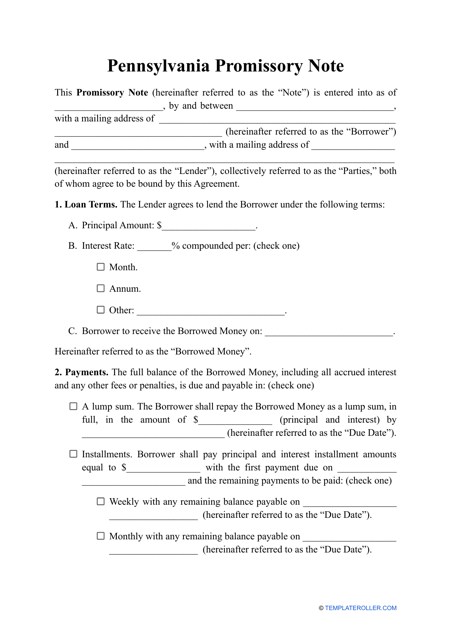

Promissory Note Template - Pennsylvania

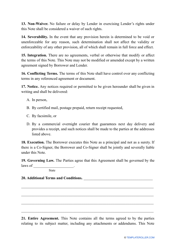

A Promissory Note Template in Pennsylvania is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender. It serves as a written promise by the borrower to repay a specific amount of money, along with any interest, within a specified timeframe. This template is used to create a customized promissory note for loans in Pennsylvania.

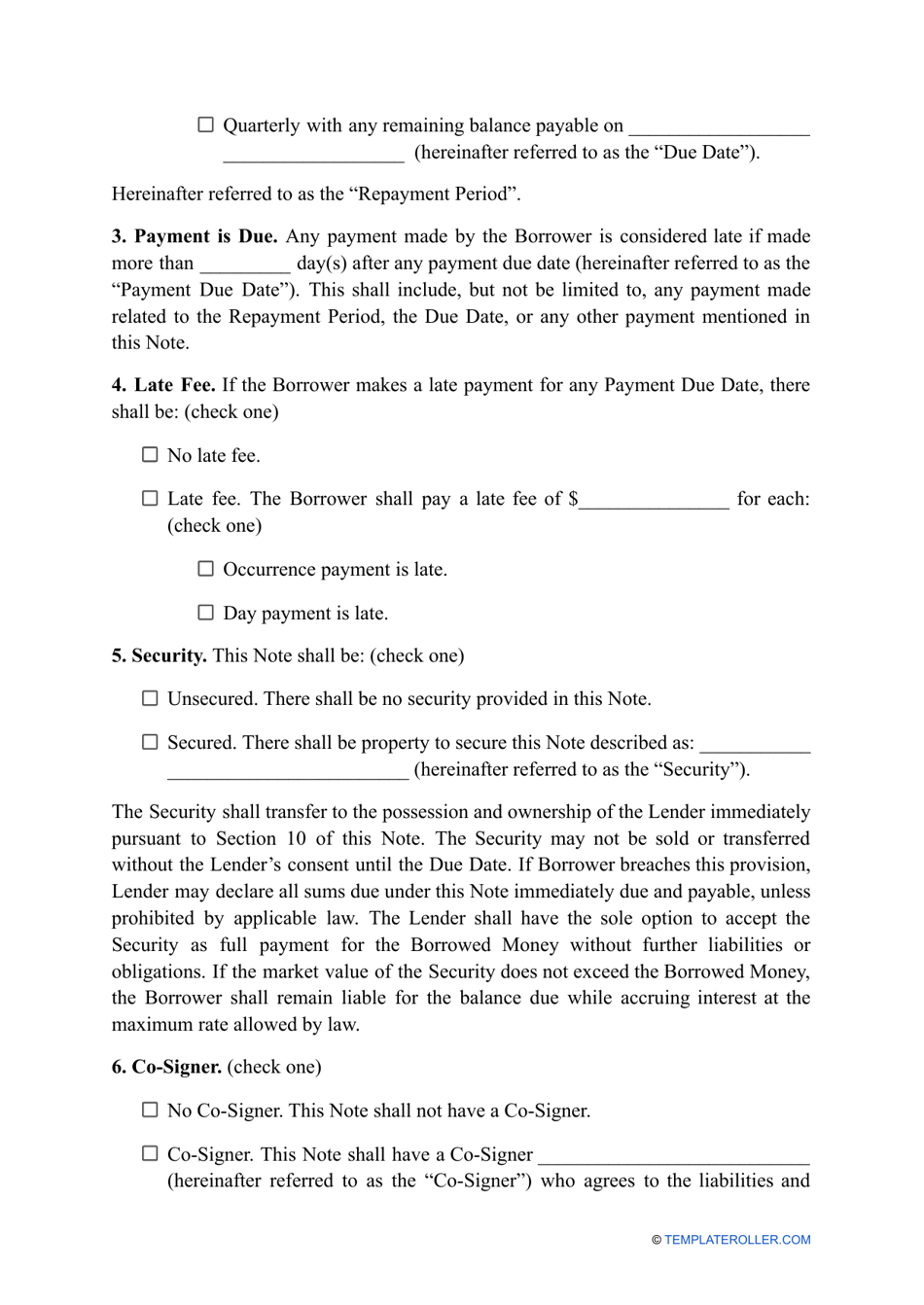

The person who borrows money and promises to repay it files the Promissory Note Template in Pennsylvania.

FAQ

Q: What is a promissory note?

A: A promissory note is a legal document that outlines the details of a loan, including the borrower's promise to repay the borrowed amount according to specified terms.

Q: Do I need a promissory note in Pennsylvania for every loan?

A: It is recommended to use a promissory note for every loan transaction in Pennsylvania to ensure clarity and legal protection for both the lender and the borrower.

Q: What information should be included in a promissory note?

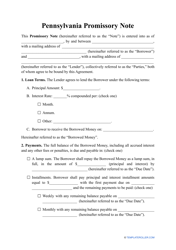

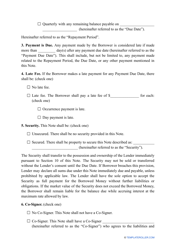

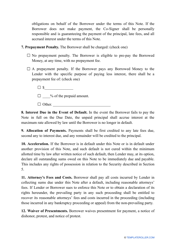

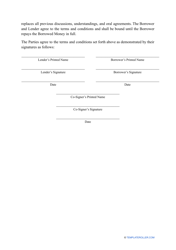

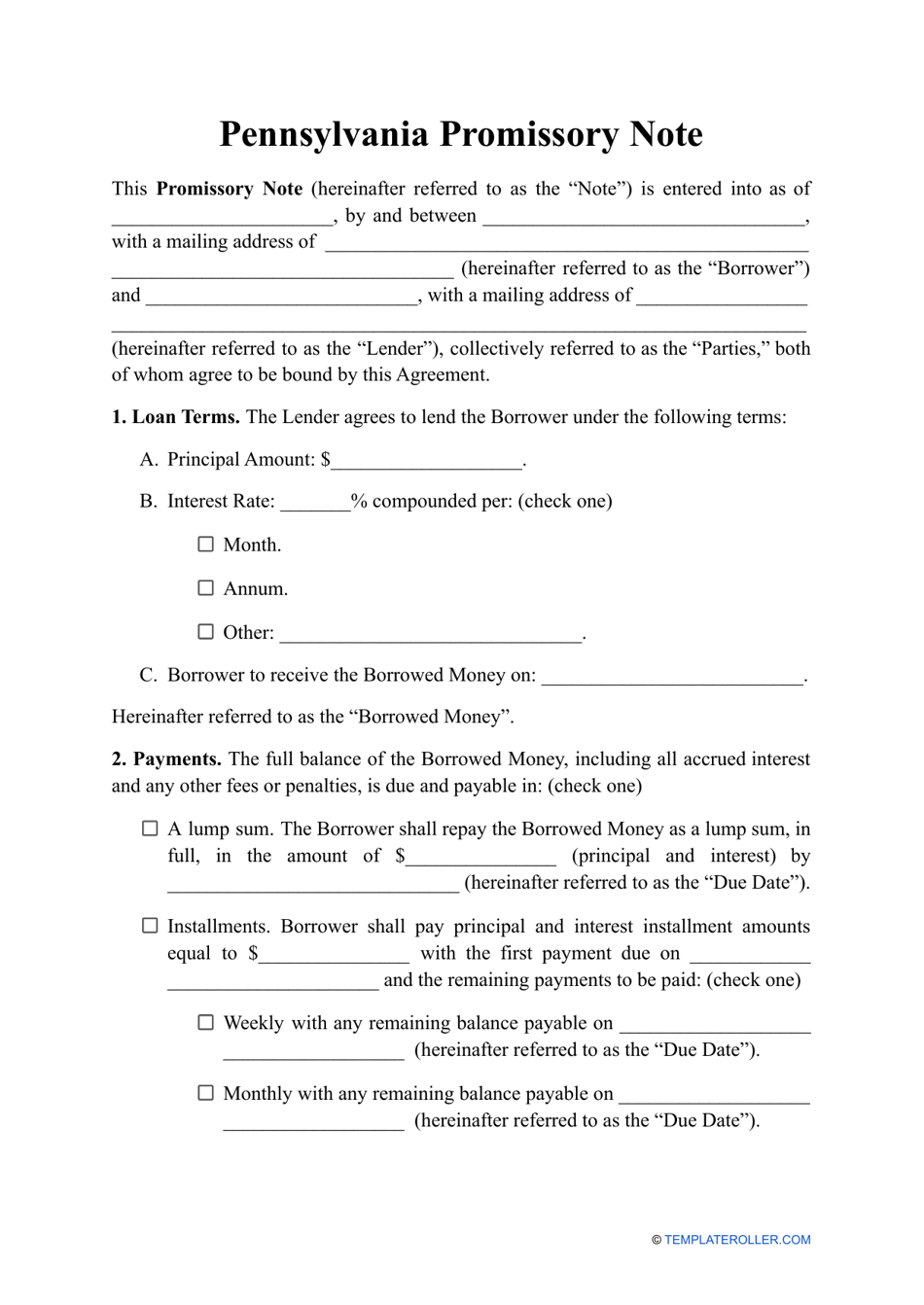

A: A promissory note should include the names of the lender and borrower, the amount borrowed, the interest rate (if applicable), repayment terms, and any applicable late payment or default provisions.

Q: Can I modify a promissory note template to fit my specific loan?

A: Yes, you can modify a promissory note template to include any additional terms or conditions that are applicable to your loan, as long as they comply with Pennsylvania state laws.

Q: Is a promissory note legally enforceable in Pennsylvania?

A: Yes, a properly executed promissory note is legally enforceable in Pennsylvania and can be used as evidence in court to pursue legal remedies for nonpayment.

Q: Is it necessary to have a witness or notary for a promissory note in Pennsylvania?

A: While not legally required in Pennsylvania, having a witness or a notary can provide additional evidentiary support and strengthen the enforceability of the promissory note.

Q: What happens if the borrower defaults on a promissory note in Pennsylvania?

A: If the borrower defaults on a promissory note in Pennsylvania, the lender may pursue legal action to recover the borrowed amount, interest, and any other applicable damages or fees as outlined in the note.