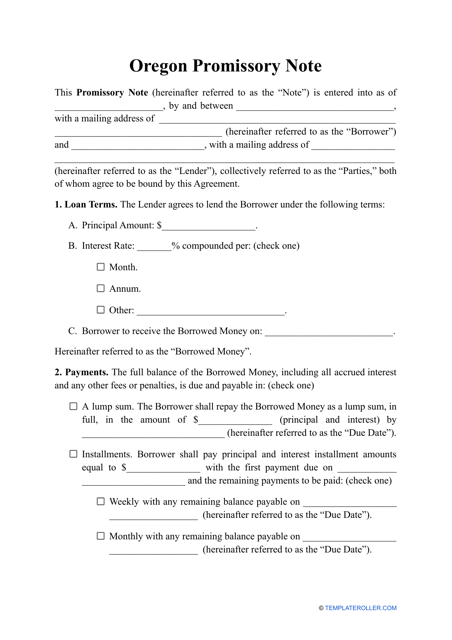

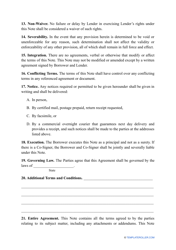

Promissory Note Template - Oregon

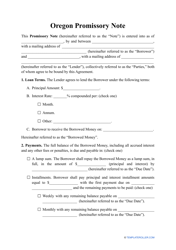

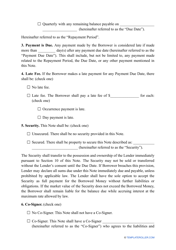

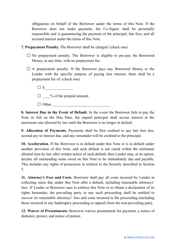

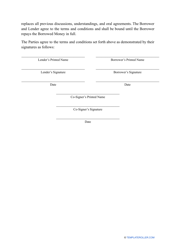

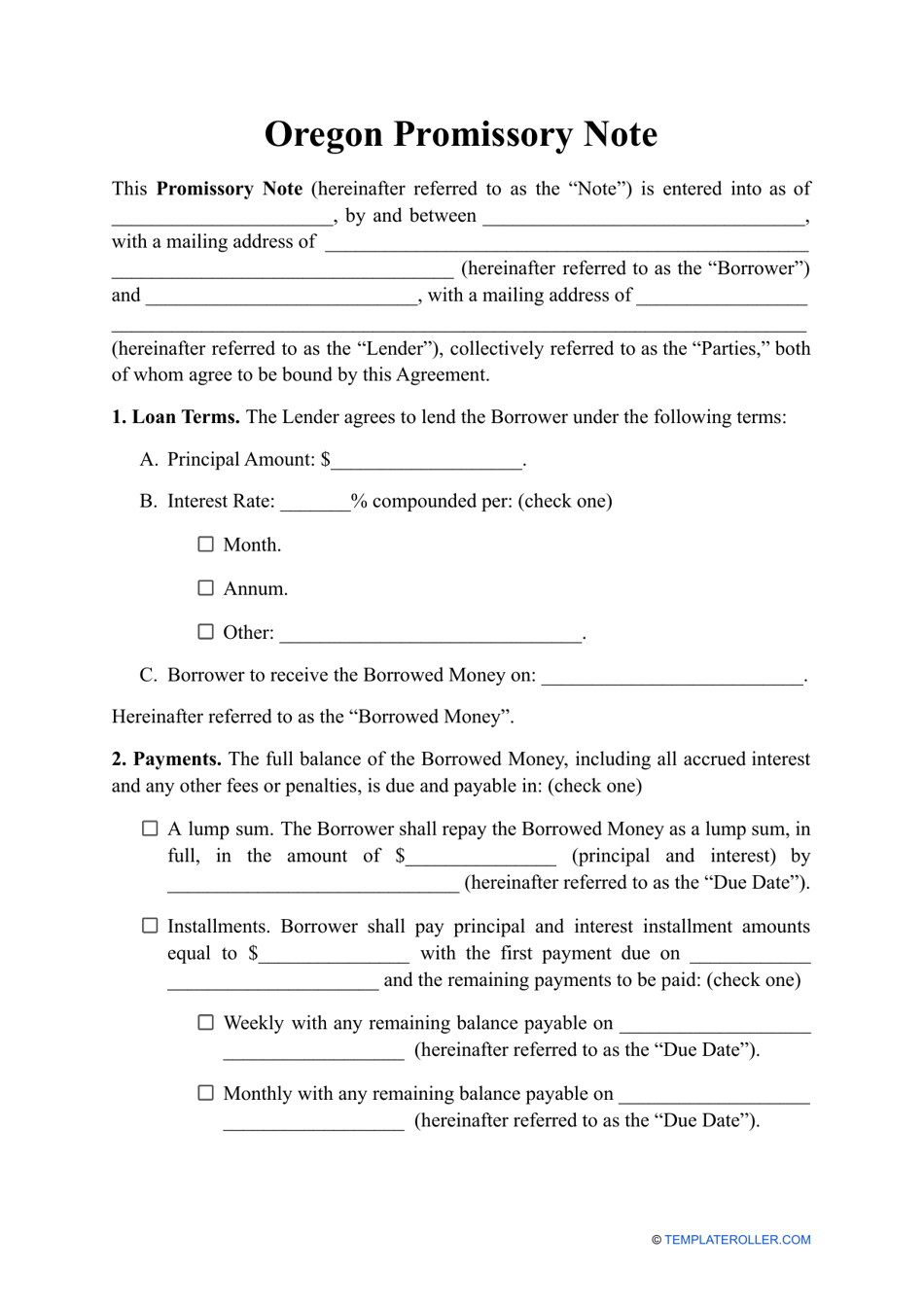

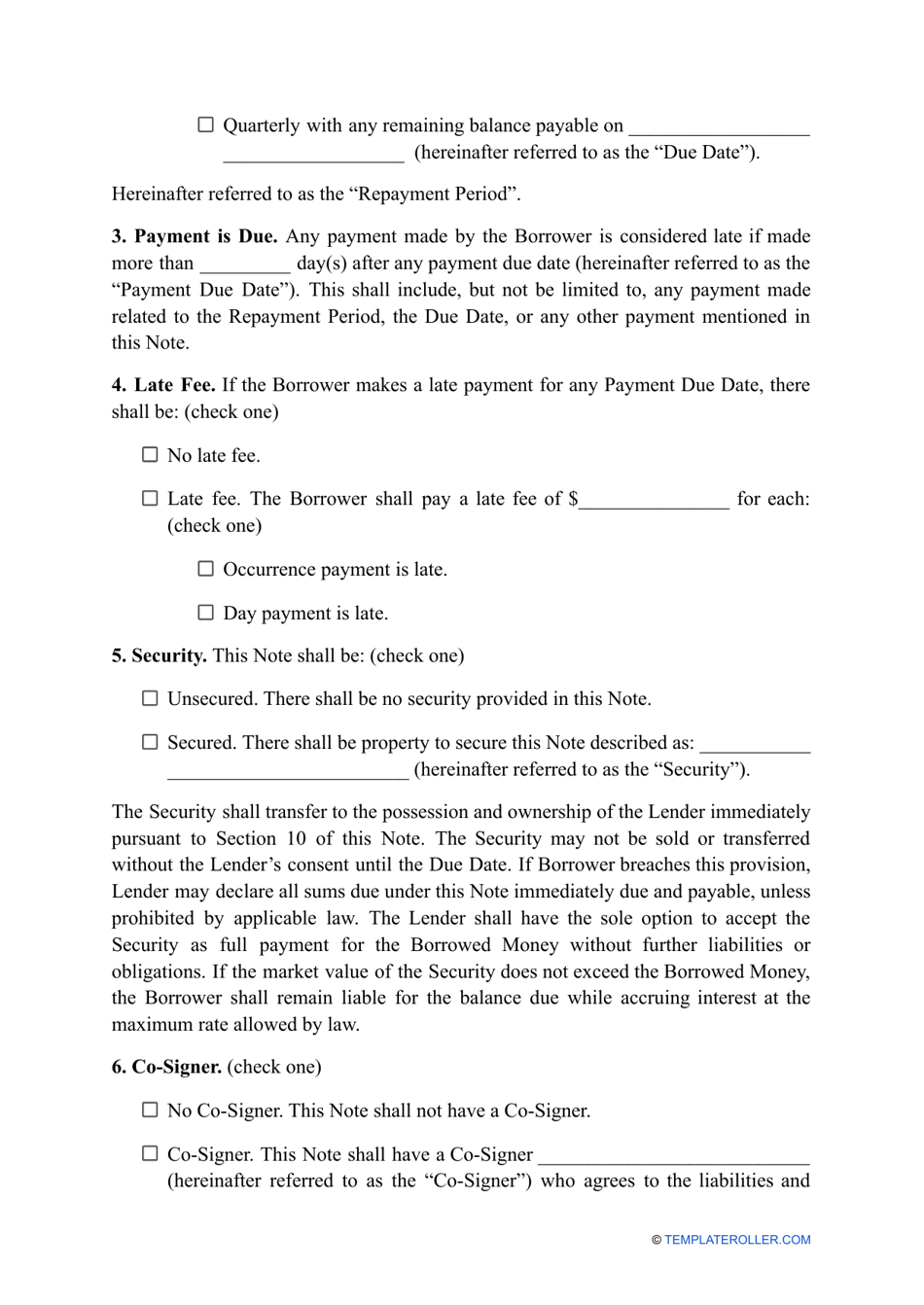

A promissory note template in Oregon is used to create a written promise to repay a loan or debt. It outlines the terms and conditions of the loan, including the repayment schedule, interest rate, and the consequences of non-payment.

The borrower typically files the promissory note template in Oregon.

FAQ

Q: What is a promissory note?

A: A promissory note is a legal document that outlines a borrower's promise to repay a loan.

Q: Is a promissory note legally binding?

A: Yes, a promissory note is a legally binding contract.

Q: What information should be included in a promissory note?

A: A promissory note should include the names of the lender and borrower, the loan amount, the interest rate, the repayment terms, and the date of repayment.

Q: Do I need a lawyer to create a promissory note?

A: While it is not required, it is recommended to consult with a lawyer to ensure that the promissory note adheres to all legal requirements in Oregon.

Q: Can a promissory note be modified?

A: Yes, a promissory note can be modified if both the lender and borrower agree to the changes and document them in writing.

Q: What happens if the borrower fails to repay the loan?

A: If the borrower fails to repay the loan, the lender may take legal action to recover the debt, such as filing a lawsuit or pursuing collections.