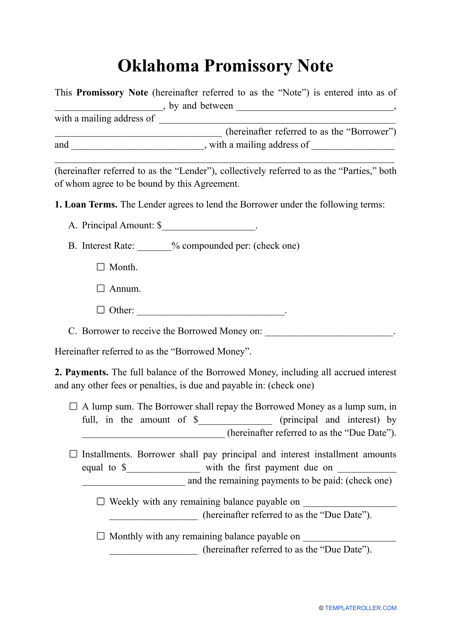

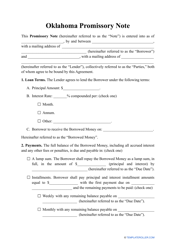

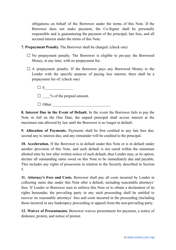

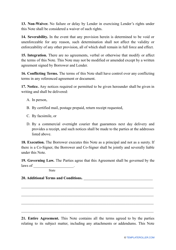

Promissory Note Template - Oklahoma

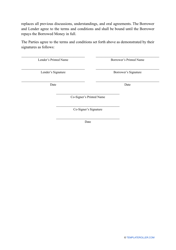

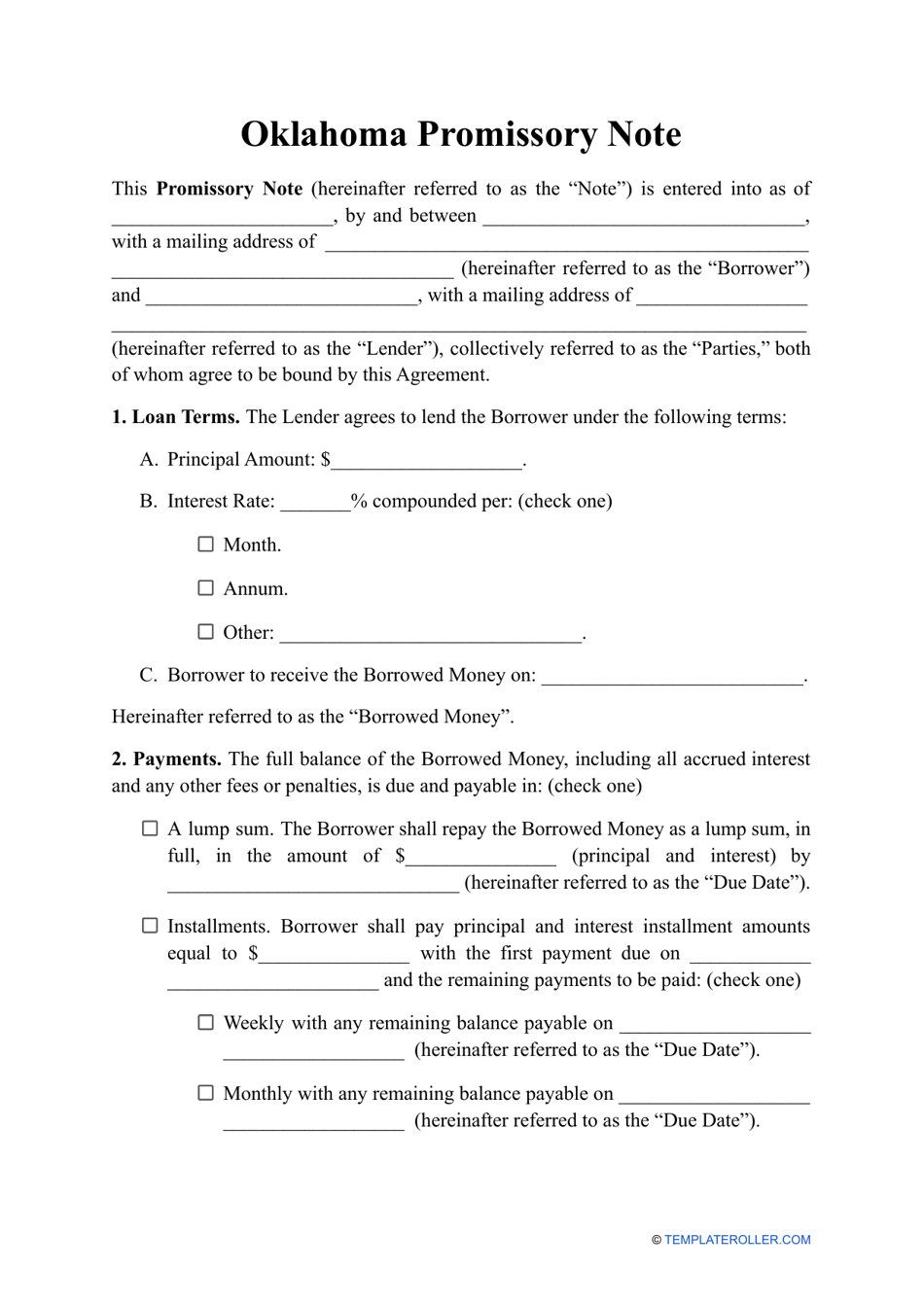

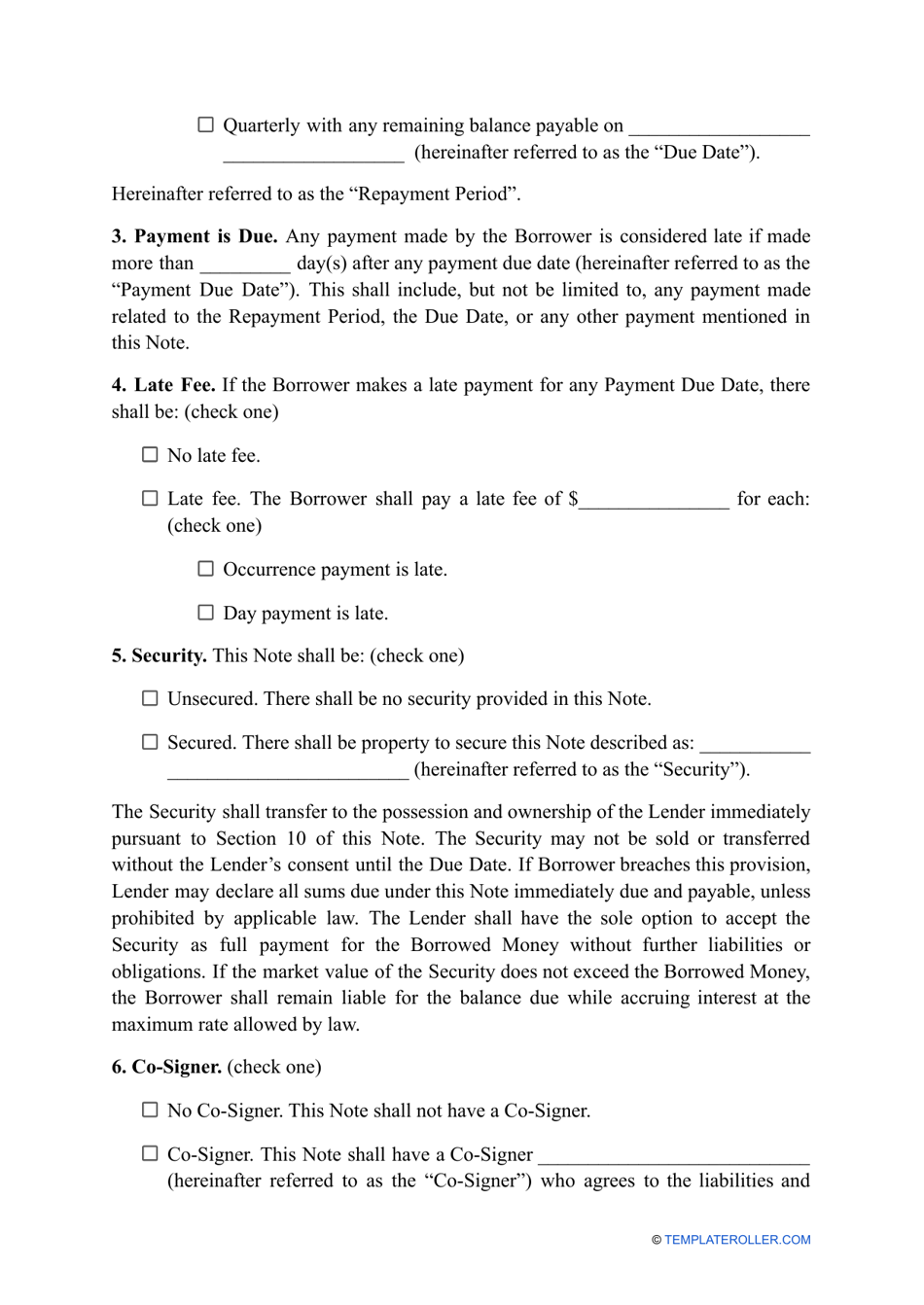

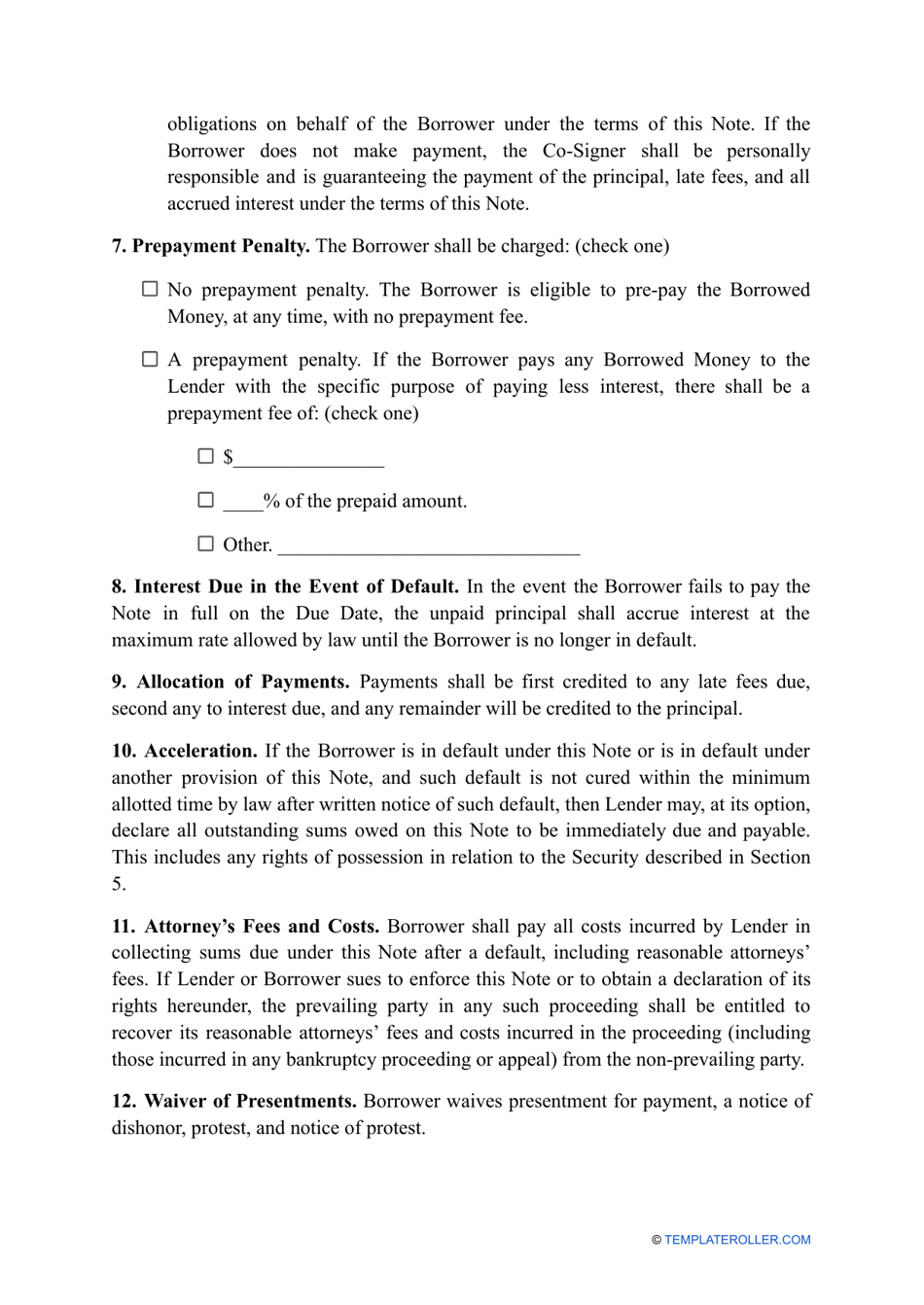

A Promissory Note Template in Oklahoma is a legal document used to outline the terms and conditions of a loan agreement between two parties. It serves as a written promise to repay a specific amount of money borrowed within a specified period of time.

The promissory note template in Oklahoma is typically filed by the borrower.

FAQ

Q: What is a promissory note?

A: A promissory note is a legal document that outlines the terms and conditions of a loan, including the repayment terms.

Q: Do I need a promissory note for a personal loan?

A: It is not legally required to have a promissory note for a personal loan, but it is highly recommended to have one to protect both parties' interests.

Q: What information should be included in a promissory note?

A: A promissory note should include the date, names of the borrower and lender, loan amount, repayment terms, interest rate (if applicable), and repayment schedule.

Q: Is a promissory note enforceable in court?

A: Yes, a promissory note is a legally binding agreement and can be enforced in court if necessary.

Q: Can a promissory note be modified or cancelled?

A: A promissory note can be modified or cancelled if both parties agree to the changes and document them in writing.

Q: Do I need a lawyer to create a promissory note?

A: While it is not required to have a lawyer create a promissory note, it is recommended to seek legal advice, especially for complex loans or significant amounts of money.

Q: What happens if the borrower defaults on a promissory note?

A: If the borrower defaults on a promissory note, the lender has the right to take legal action to recover the remaining balance, which may include litigation and collection efforts.