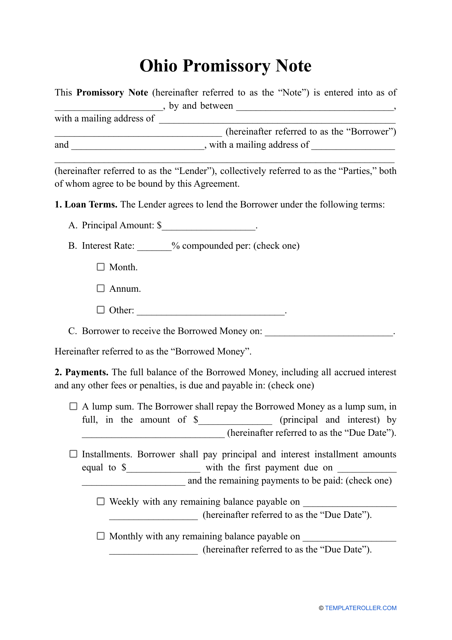

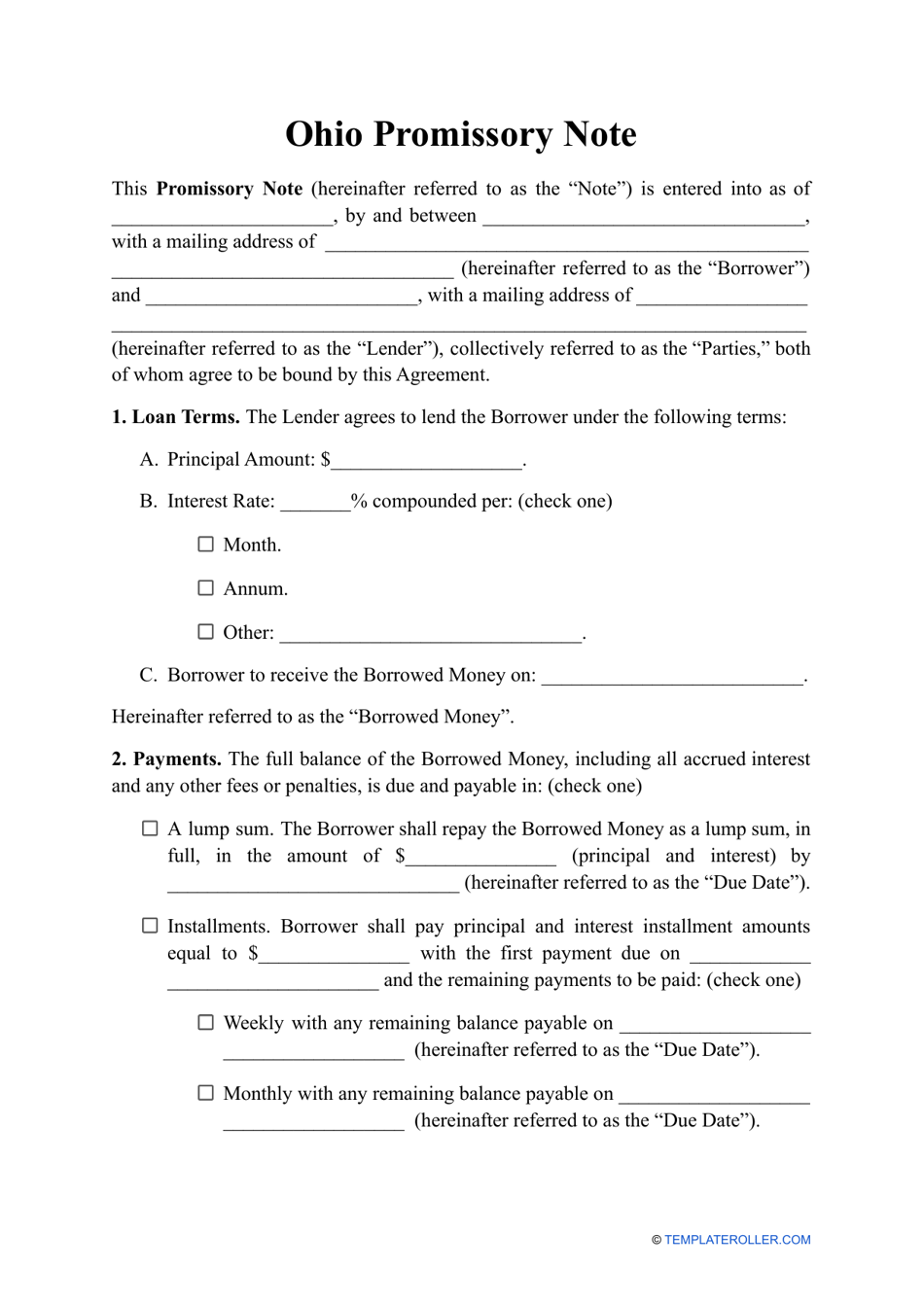

Promissory Note Template - Ohio

A Promissory Note Template in Ohio is a document used to outline the terms and conditions of a loan or debt between two parties. It serves as a legal agreement that establishes the borrower's promise to repay the loan to the lender within a specified time frame.

In Ohio, anyone can file a promissory note template. There is no specific party responsible for filing it.

FAQ

Q: What is a promissory note?

A: A promissory note is a legally binding document that outlines the terms and conditions of a loan agreement.

Q: Who is involved in a promissory note?

A: A promissory note involves two parties: the borrower (who promises to repay the loan) and the lender (who provides the loan money).

Q: What should be included in a promissory note?

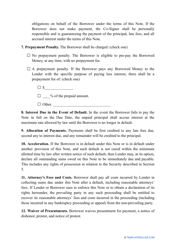

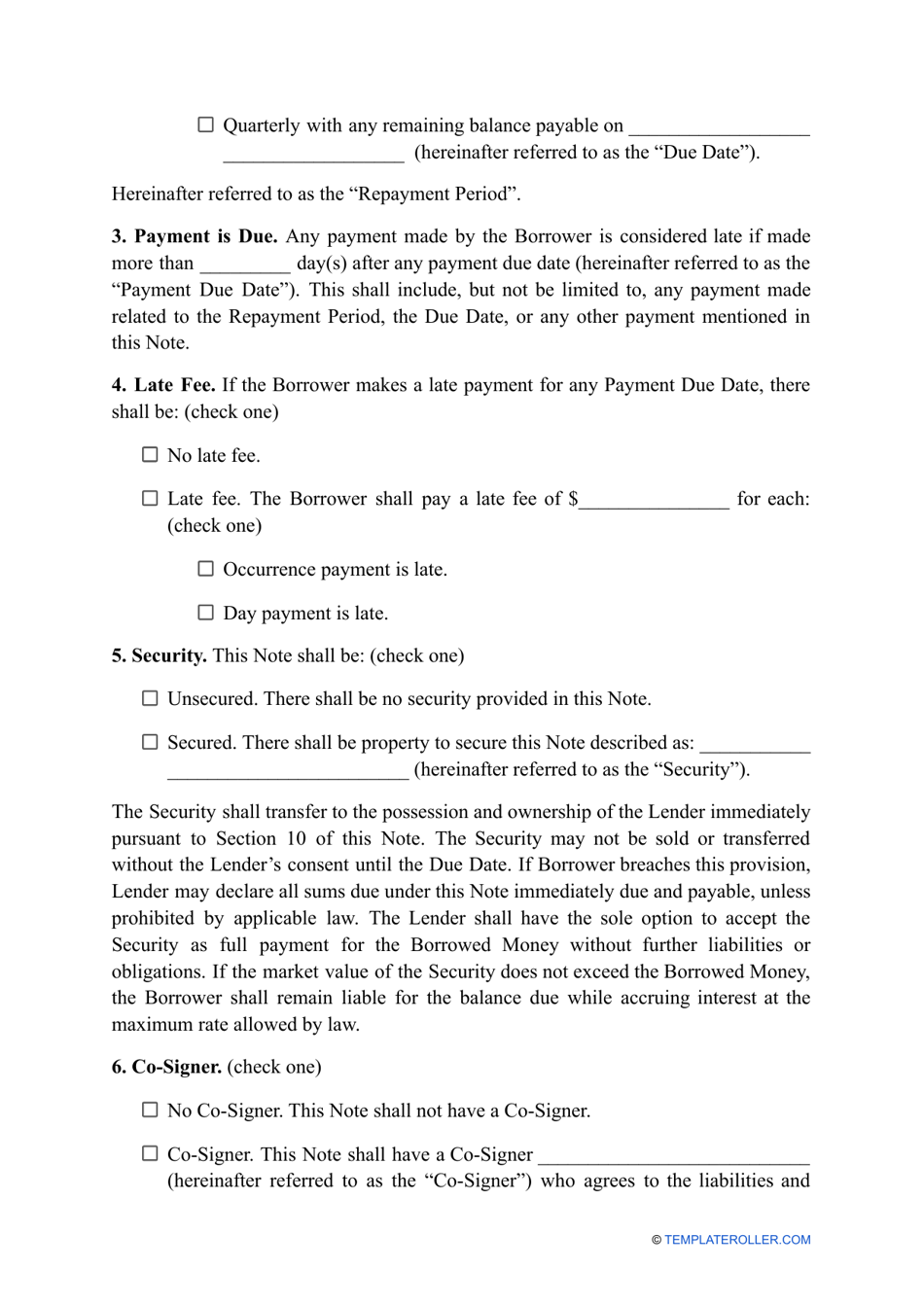

A: A promissory note should include the names and contact information of the borrower and lender, the loan amount, repayment terms, interest rate (if applicable), and any collateral or guarantees.

Q: Is a promissory note enforceable in Ohio?

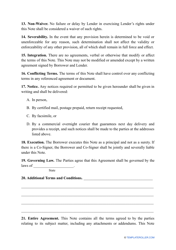

A: Yes, a properly executed and signed promissory note is legally enforceable in Ohio.

Q: Can a promissory note be modified in Ohio?

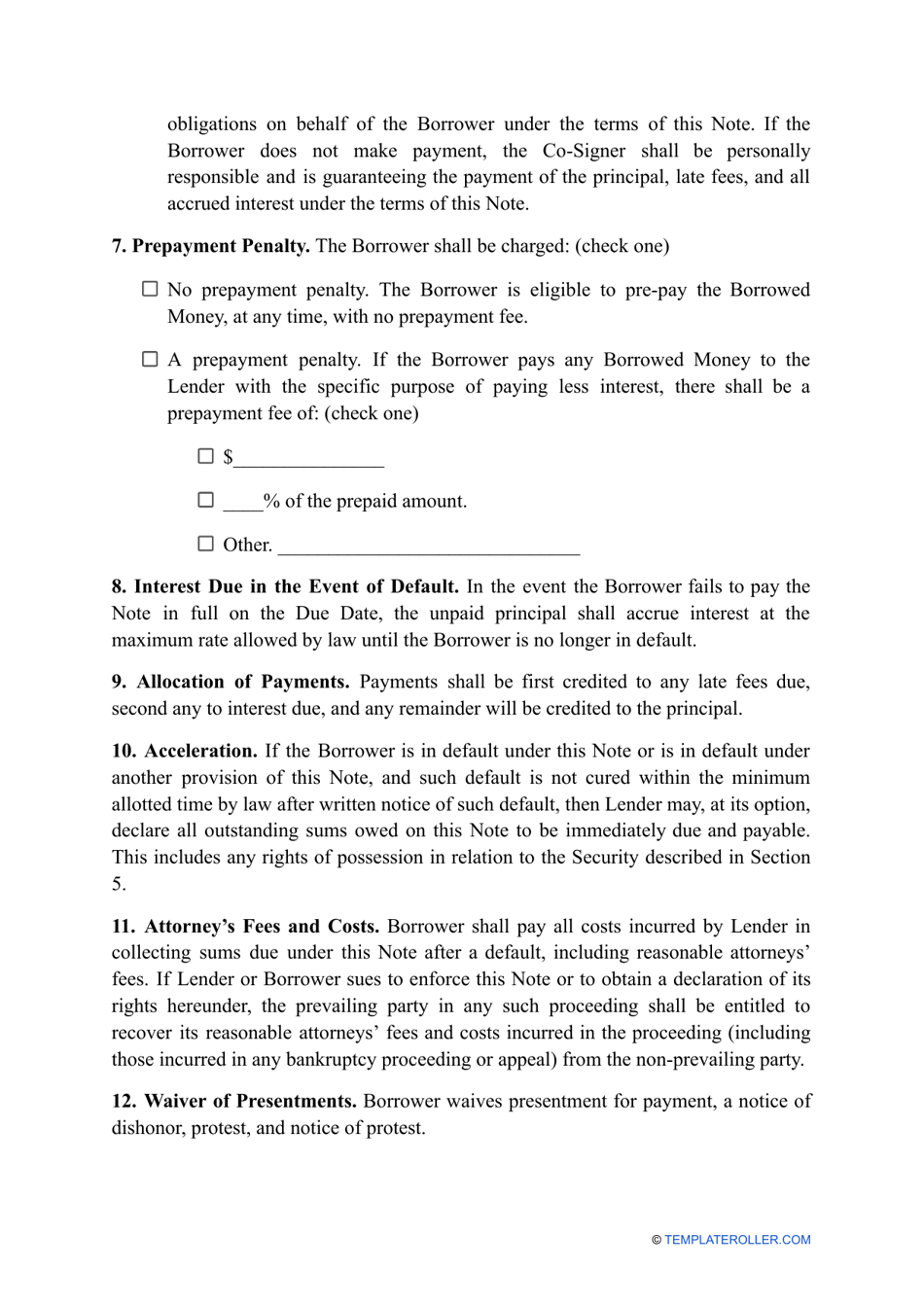

A: Yes, a promissory note can be modified if both the borrower and lender agree to the changes.

Q: What happens if a borrower defaults on a promissory note in Ohio?

A: If a borrower fails to repay the loan as per the terms of the promissory note, the lender may take legal action to collect the debt, such as filing a lawsuit or seeking wage garnishment or property liens.

Q: Can a promissory note be used for personal loans in Ohio?

A: Yes, a promissory note can be used for personal loans, business loans, or any other type of loan in Ohio.