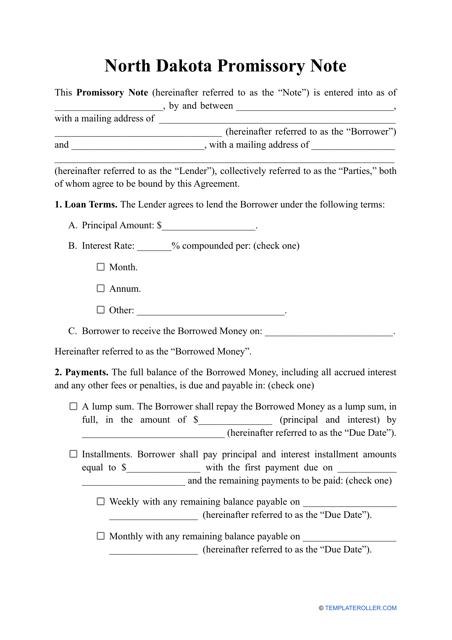

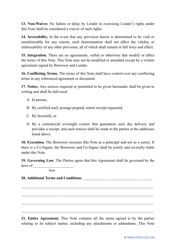

Promissory Note Template - North Dakota

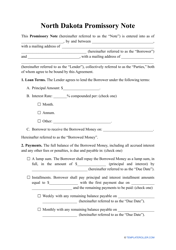

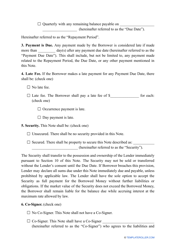

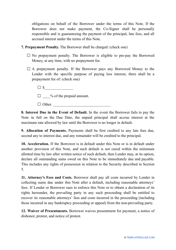

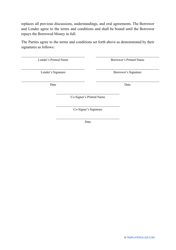

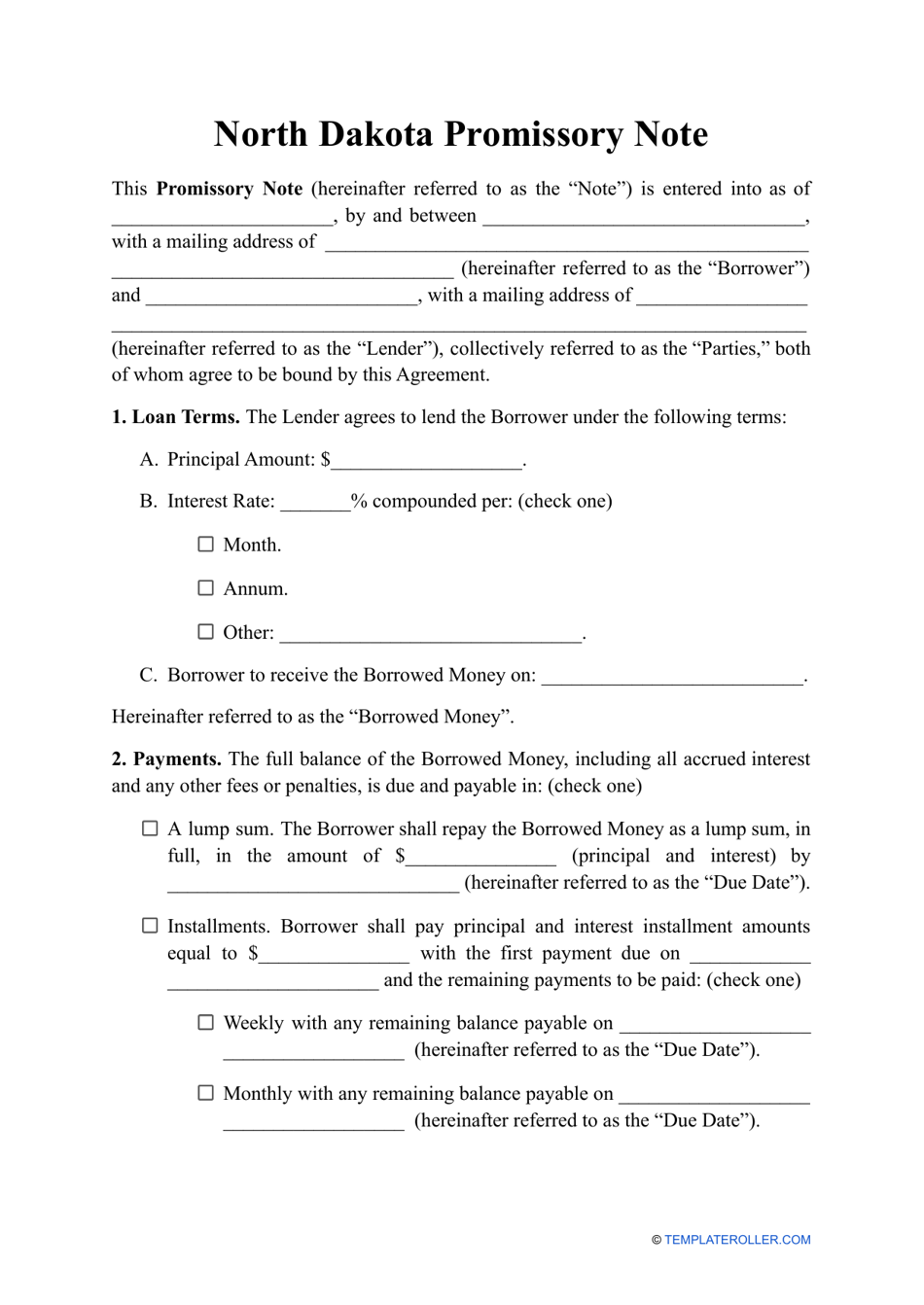

The Promissory Note Template - North Dakota is a standardized form that can be used as a written agreement between a borrower and a lender in North Dakota. It outlines the terms and conditions of a loan, including the amount borrowed, interest rate, repayment schedule, and any additional provisions.

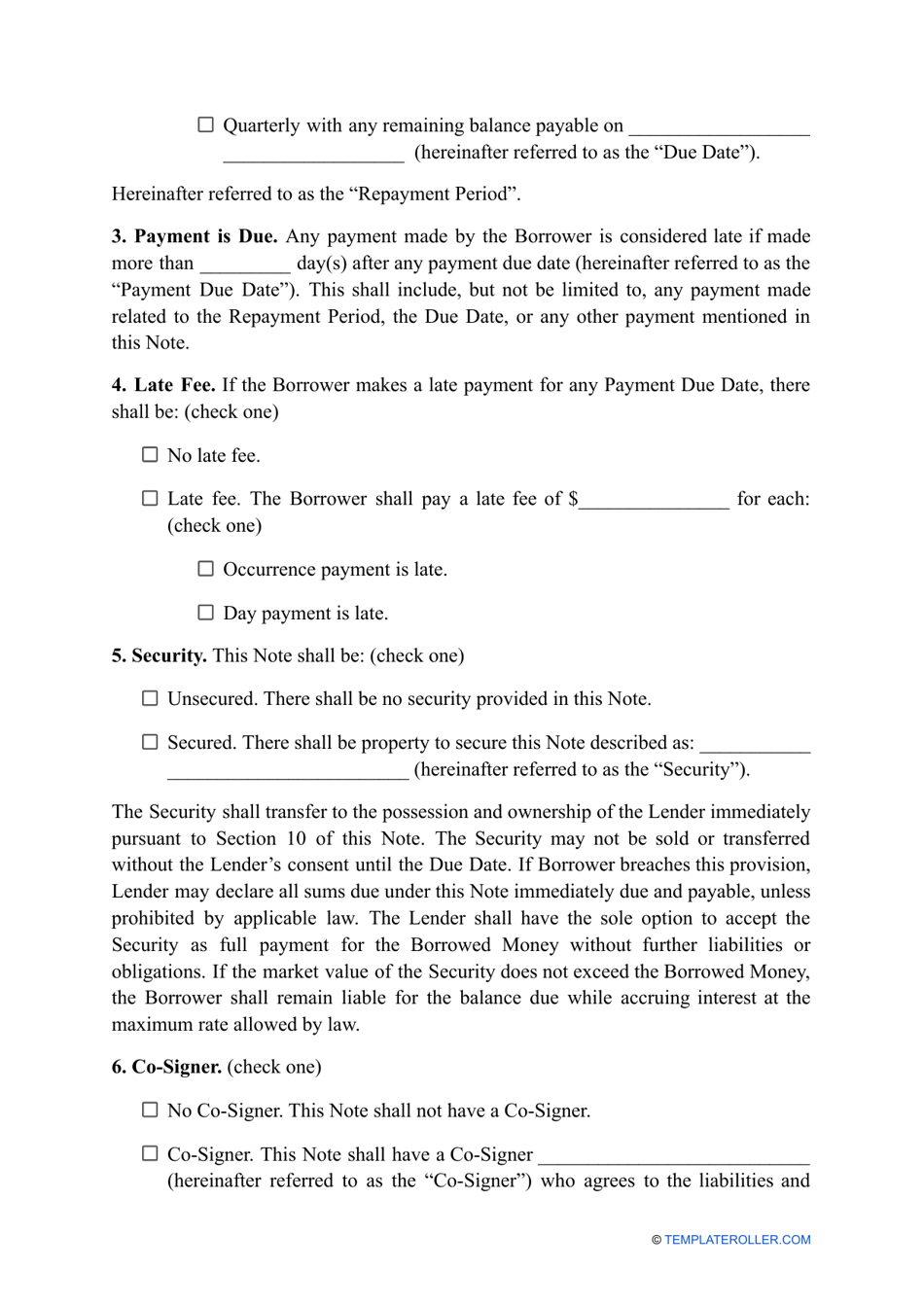

The promissory note template in North Dakota is typically filled out by the borrower or the person responsible for repaying the loan.

FAQ

Q: What is a promissory note?

A: A promissory note is a legal document that outlines a borrower's promise to pay back a specific amount of money to a lender, along with any agreed-upon interest or fees.

Q: Is a promissory note enforceable in North Dakota?

A: Yes, promissory notes are enforceable legal agreements in North Dakota.

Q: What should a promissory note include?

A: A promissory note should include the names of the borrower and lender, the amount of money being borrowed, the repayment terms (including interest rate if applicable), and the date of repayment.

Q: Can a promissory note be used for personal loans?

A: Yes, a promissory note can be used for personal loans between family or friends, as well as for business loans.

Q: What happens if the borrower fails to repay the loan?

A: If the borrower fails to repay the loan according to the terms of the promissory note, the lender may take legal action to recover the money owed.

Q: Can a promissory note be modified or canceled?

A: Yes, a promissory note can be modified or canceled with the agreement of both the borrower and lender, as long as the changes are put in writing and signed by both parties.