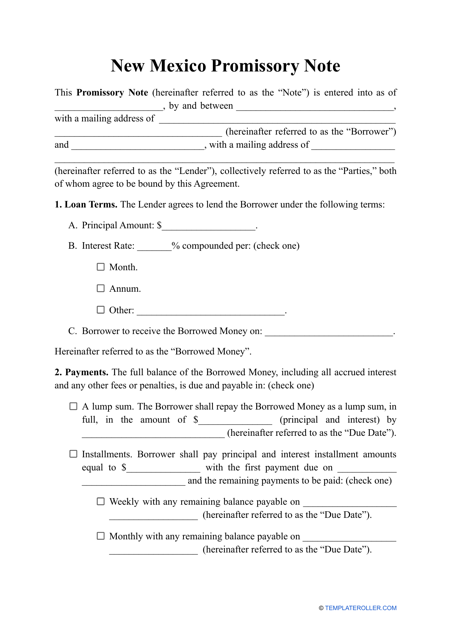

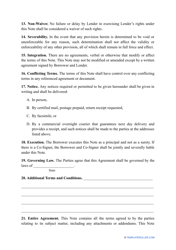

Promissory Note Template - New Mexico

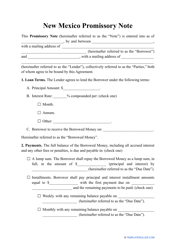

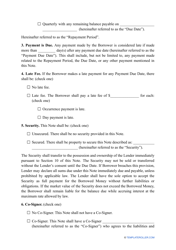

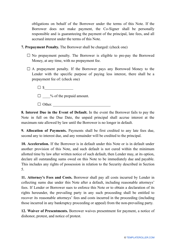

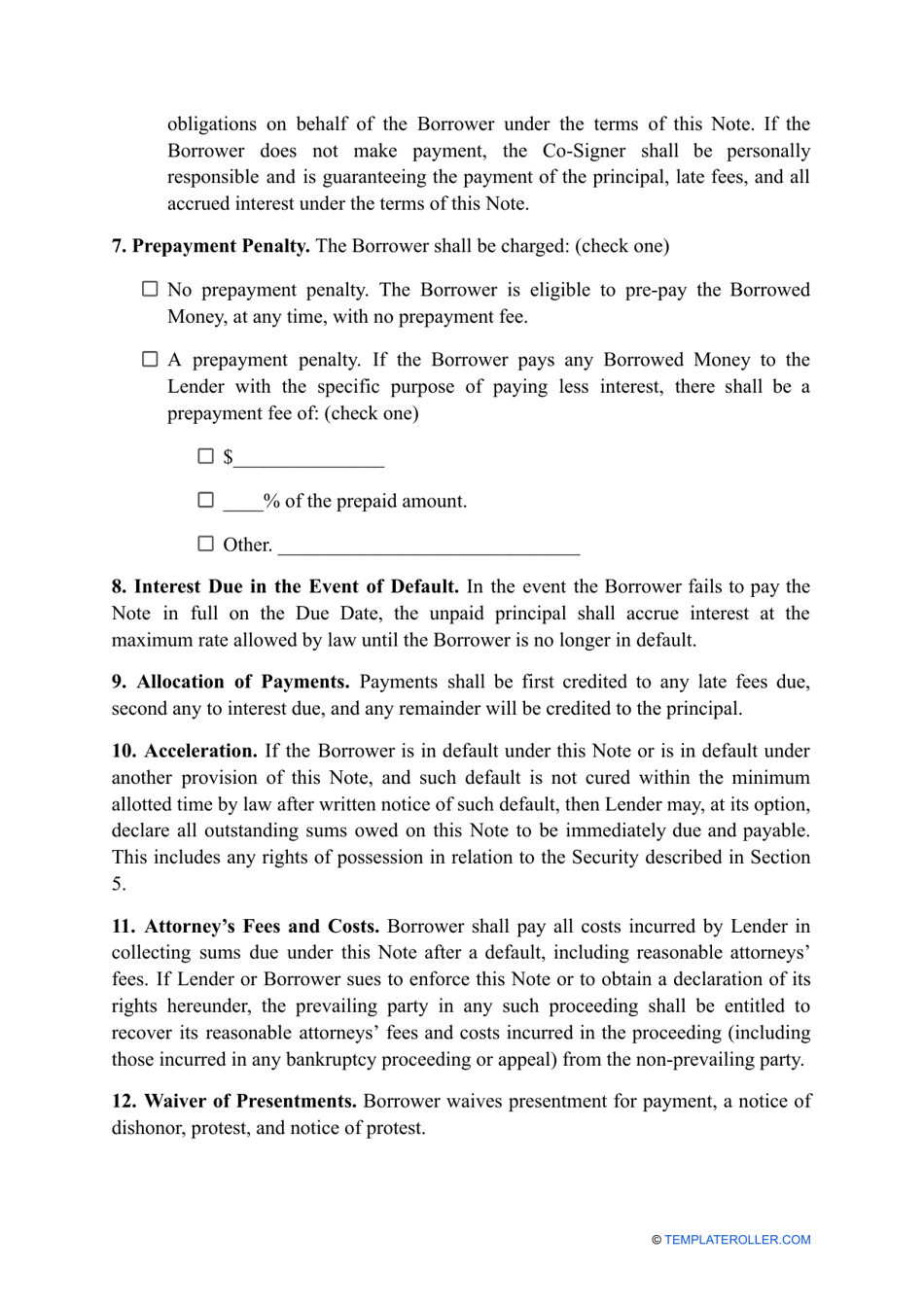

A promissory note template in New Mexico is used to create a legally binding agreement between a borrower and a lender. It outlines the terms and conditions of a loan, including the repayment schedule and any applicable interest rates.

The person or party who creates the Promissory Note Template in New Mexico typically files it.

FAQ

Q: What is a promissory note?

A: A promissory note is a legal document that details the terms of a loan or debt agreement between two parties.

Q: What is the purpose of a promissory note?

A: The purpose of a promissory note is to outline the borrower's promise to repay a loan, including the terms and conditions of repayment.

Q: Do I need a promissory note for a loan in New Mexico?

A: While not required by law, it is highly recommended to use a promissory note for any loan transaction in New Mexico to protect the rights of both parties.

Q: What should be included in a promissory note?

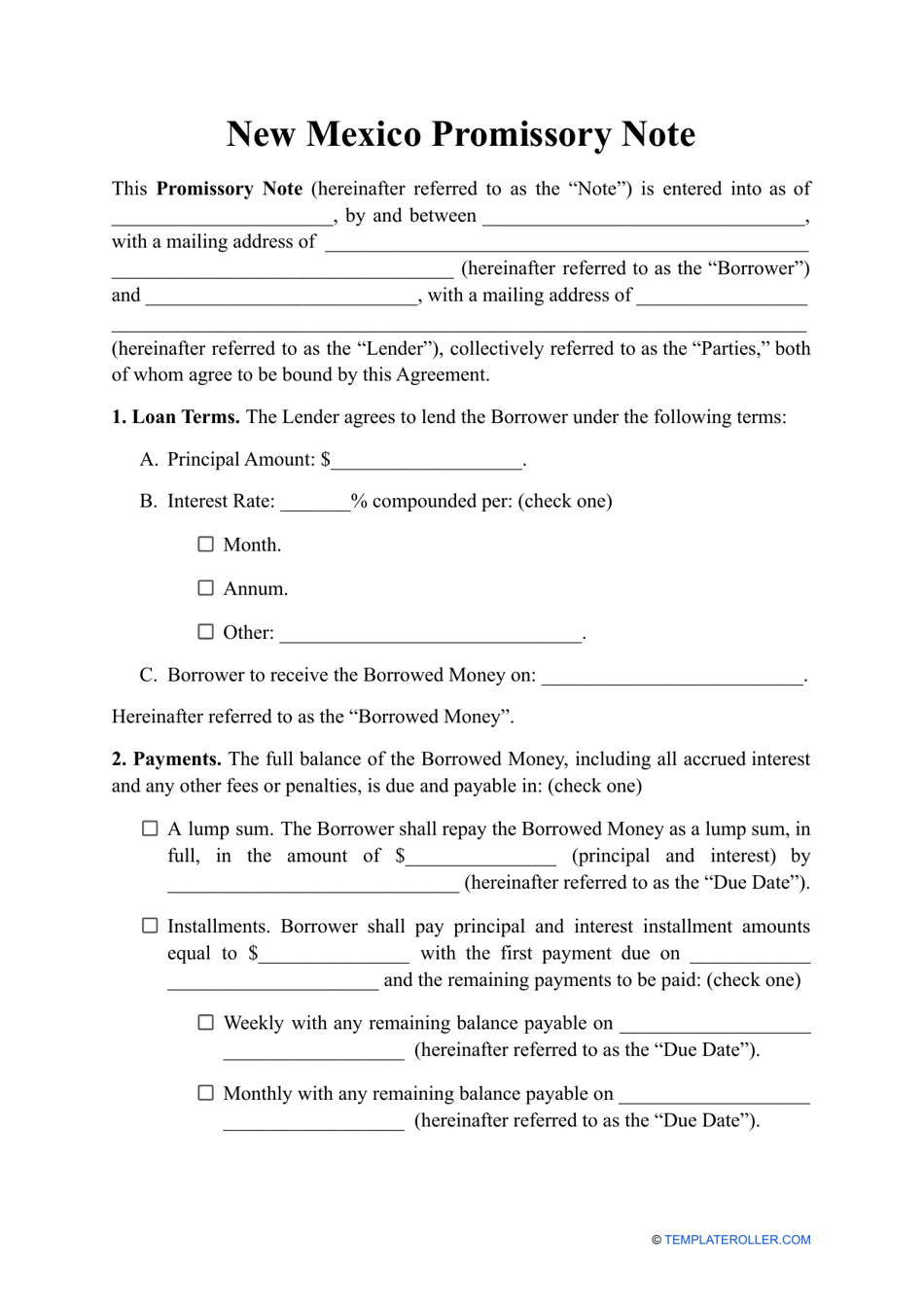

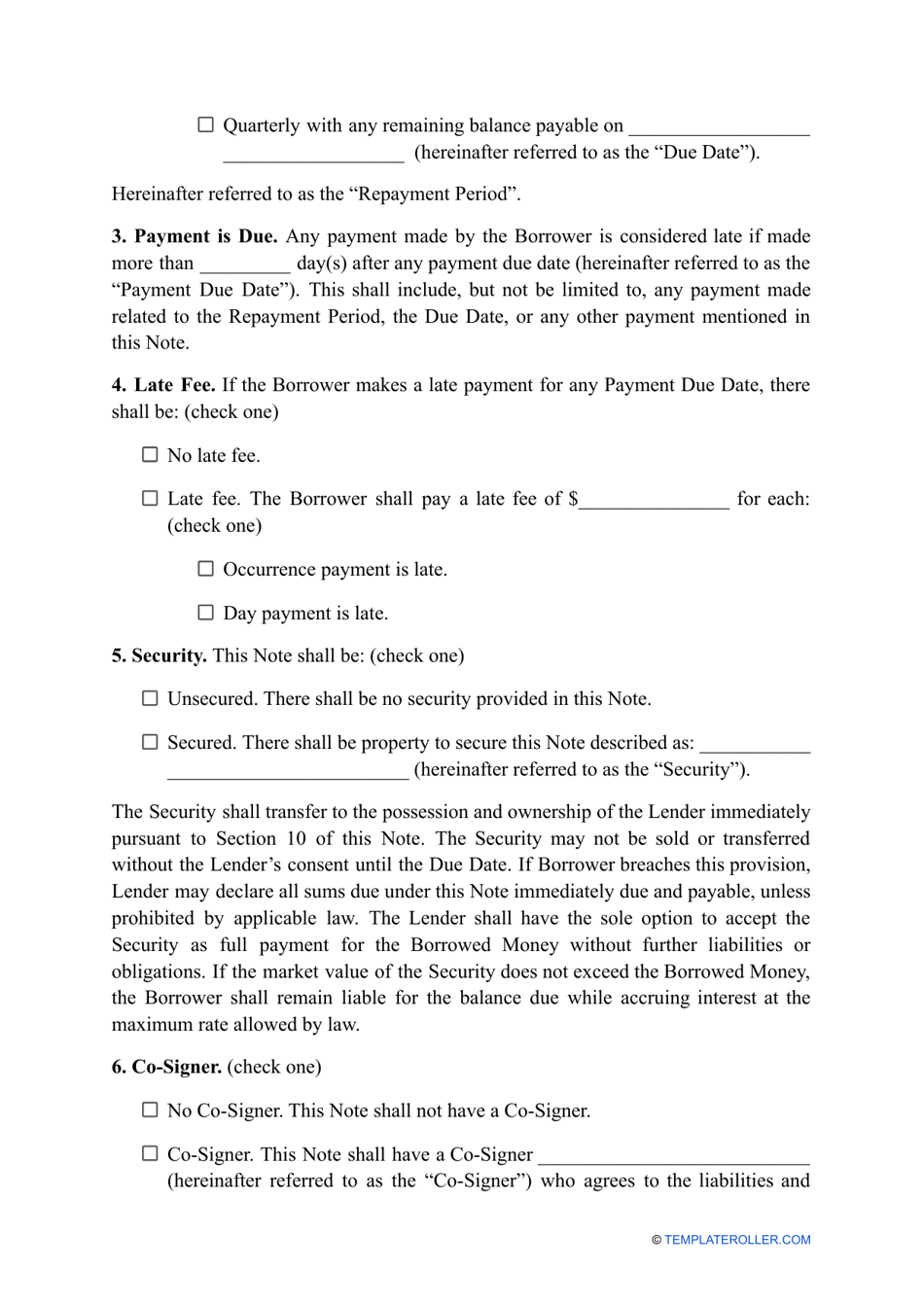

A: A promissory note should include the names of the borrower and lender, the loan amount, the repayment terms, interest rate (if applicable), and any late fees or penalties.

Q: Can I create my own promissory note?

A: Yes, you can create your own promissory note using a promissory note template, which provides a basic framework for the document.

Q: Do I need a witness or notary for a promissory note in New Mexico?

A: While not required by law, having a witness or notary sign the promissory note can add an extra layer of authenticity and can be useful in case of any future disputes.