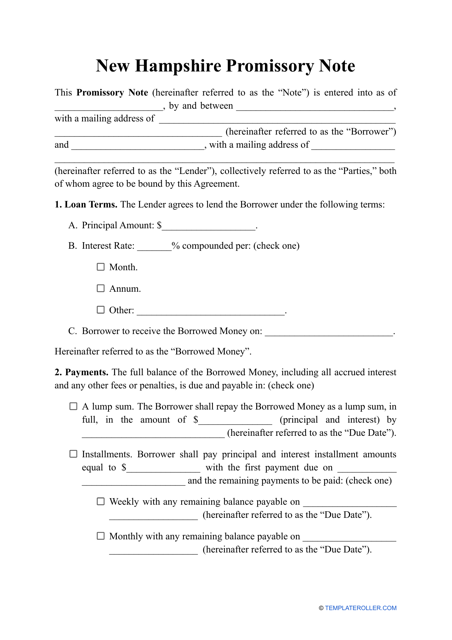

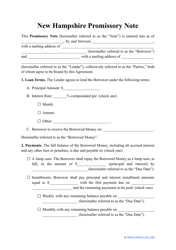

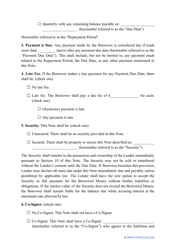

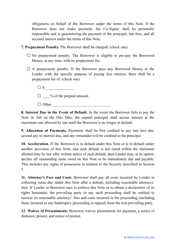

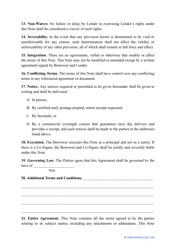

Promissory Note Template - New Hampshire

A promissory note template in New Hampshire is a legal document that outlines the terms and conditions of a loan or debt. It is used to formalize the agreement between a borrower and a lender and includes details such as the amount borrowed, repayment terms, interest rate, and any applicable late fees. It serves as a written evidence of the debt and provides protection for both parties involved.

In New Hampshire, the lender typically files the promissory note template.

FAQ

Q: What is a promissory note?

A: A promissory note is a legally binding document that outlines the terms and conditions of a loan or debt repayment.

Q: Do I need a promissory note in New Hampshire?

A: Having a promissory note is not required by law, but it is strongly recommended to have one to protect both the lender and the borrower.

Q: What should be included in a promissory note?

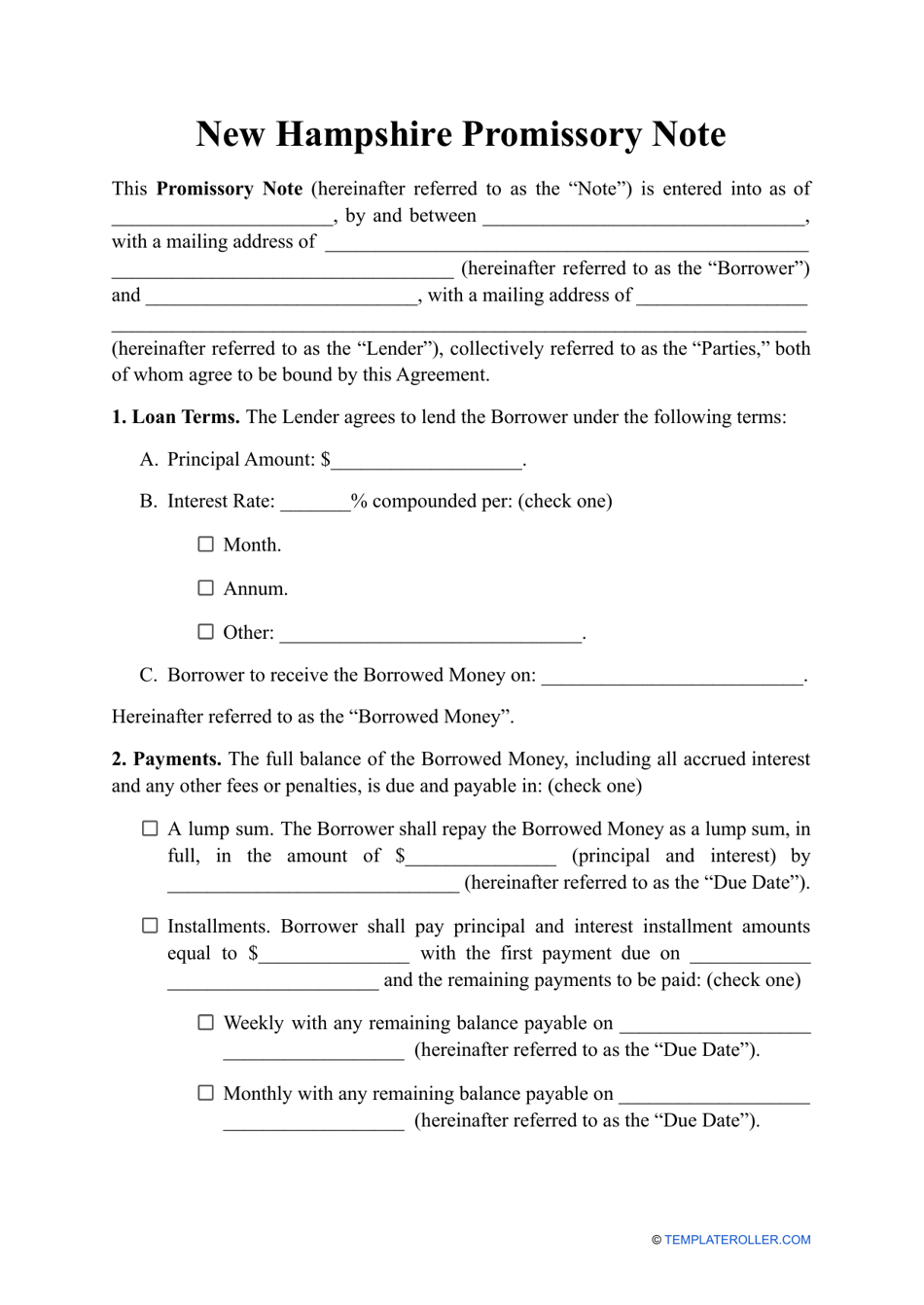

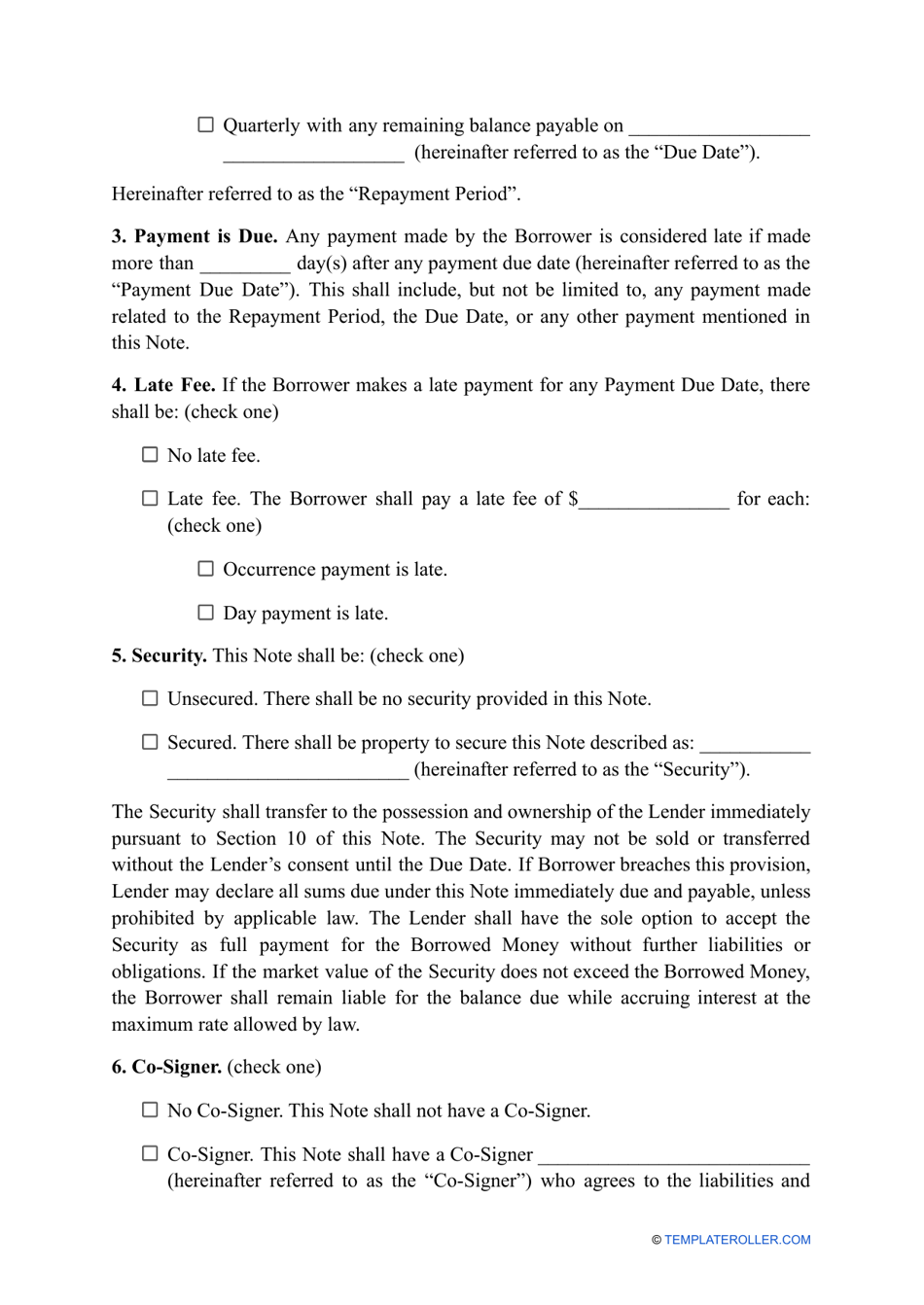

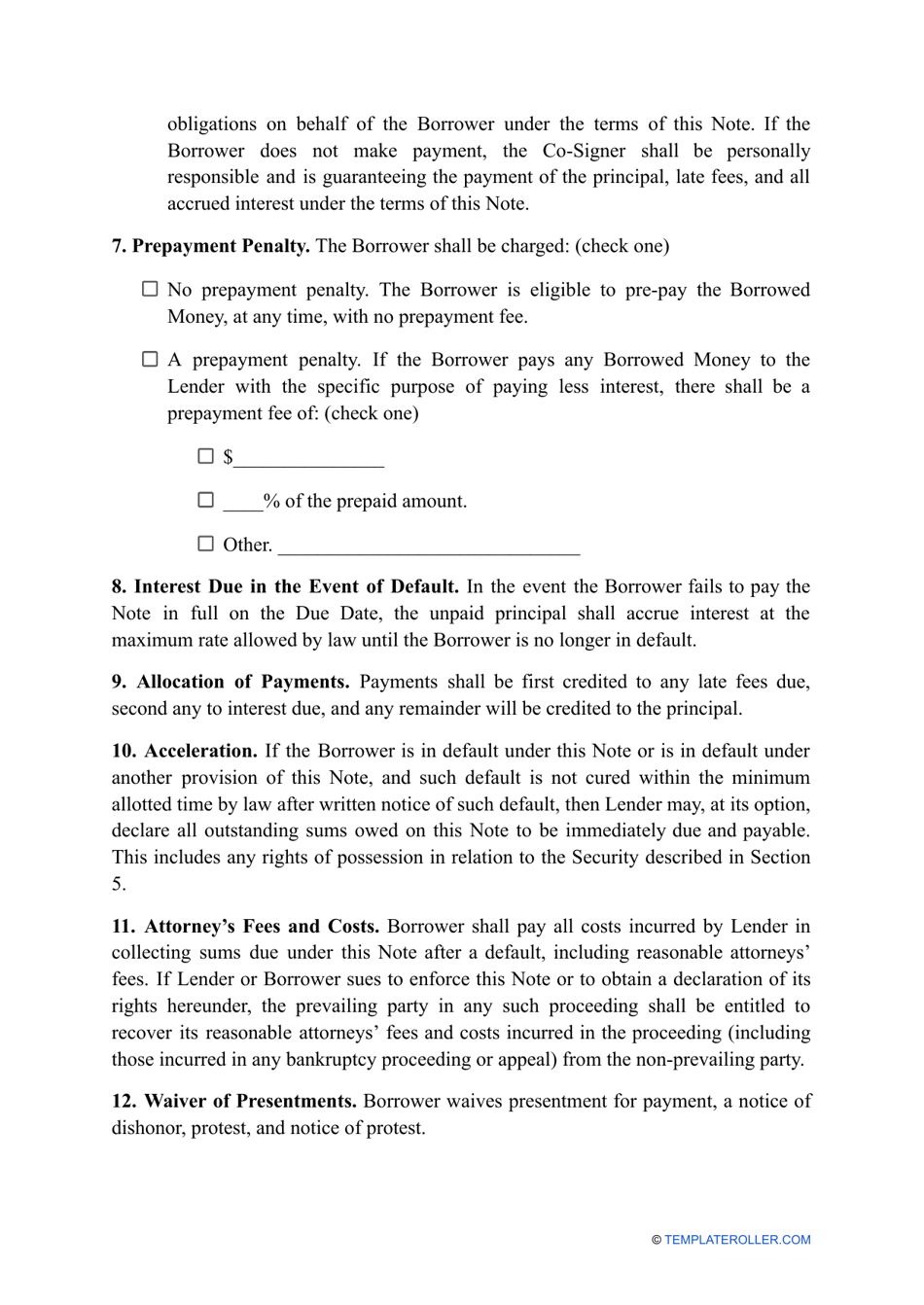

A: A promissory note should include the names of the parties involved, the loan amount, the interest rate (if applicable), repayment terms, and any other agreed-upon conditions.

Q: Can I use a template for a promissory note in New Hampshire?

A: Yes, you can use a template for a promissory note in New Hampshire. It is important to customize the template to reflect the specific details of your loan agreement.

Q: Is a promissory note legally enforceable in New Hampshire?

A: Yes, a promissory note is legally enforceable in New Hampshire. If the borrower fails to repay the loan according to the terms outlined in the note, the lender can take legal action to recover the debt.