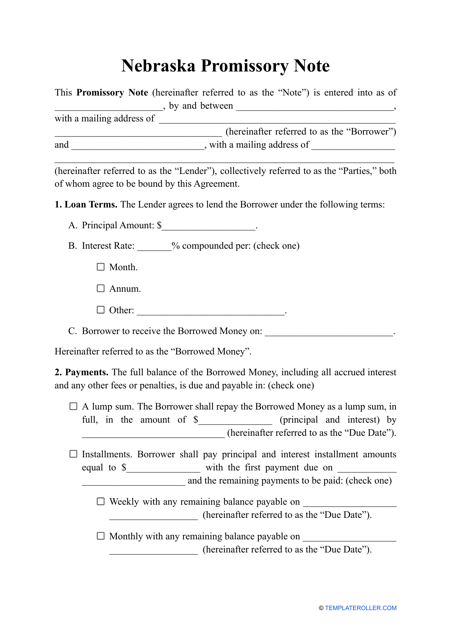

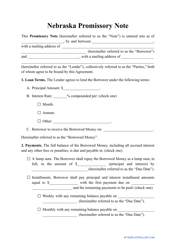

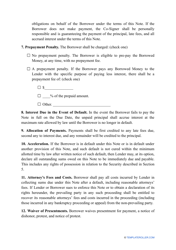

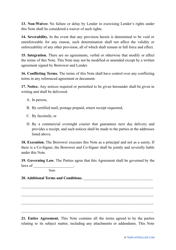

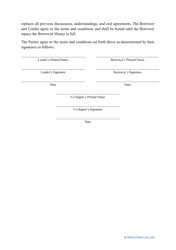

Promissory Note Template - Nebraska

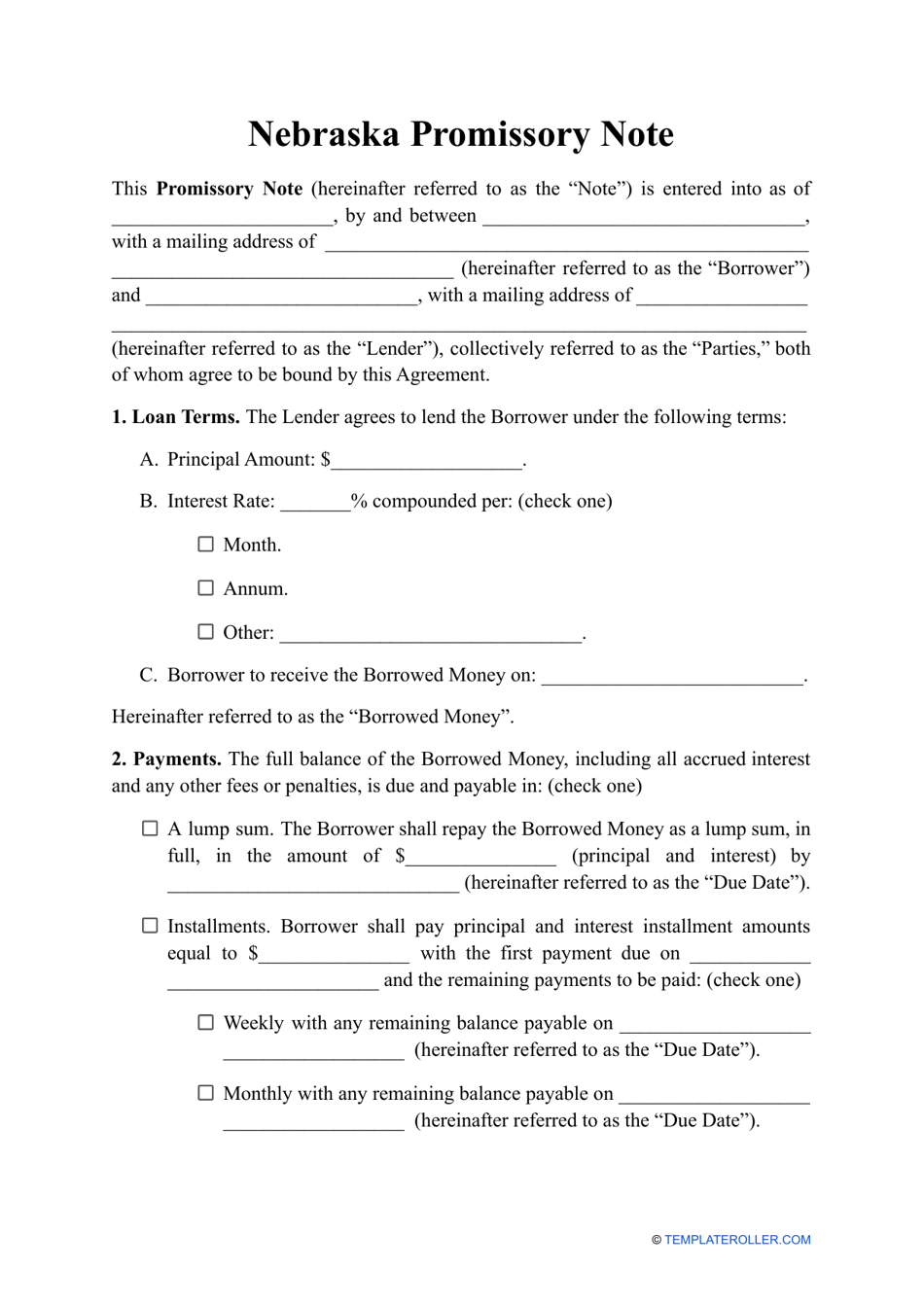

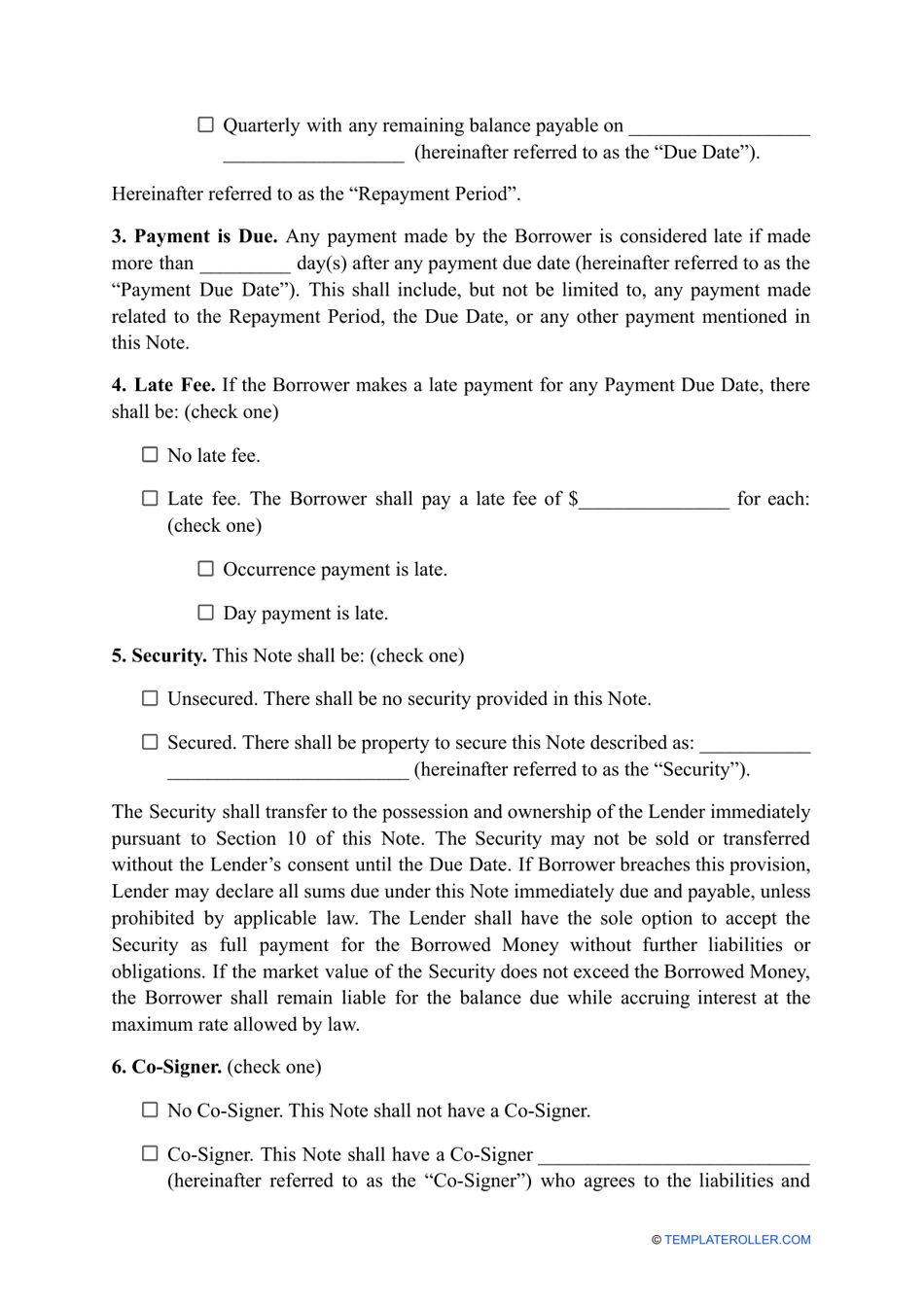

A promissory note template in Nebraska is used to create a legally binding document that outlines a promise to repay a loan. It includes details such as the amount borrowed, repayment terms, and interest rate.

The person who borrows the money files the promissory note in Nebraska.

FAQ

Q: What is a promissory note?

A: A promissory note is a written agreement to repay a debt.

Q: Why would I need a promissory note?

A: You may need a promissory note if you are borrowing or lending money.

Q: What information should be included in a promissory note?

A: A promissory note should include the names of the borrower and lender, the amount borrowed, the interest rate (if applicable), and the repayment terms.

Q: Does Nebraska have any specific requirements for promissory notes?

A: Nebraska does not have any specific requirements for promissory notes, but it is recommended to have the note notarized for added legal protection.

Q: Can a promissory note be used for business loans?

A: Yes, a promissory note can be used for both personal and business loans.

Q: Can a promissory note be modified?

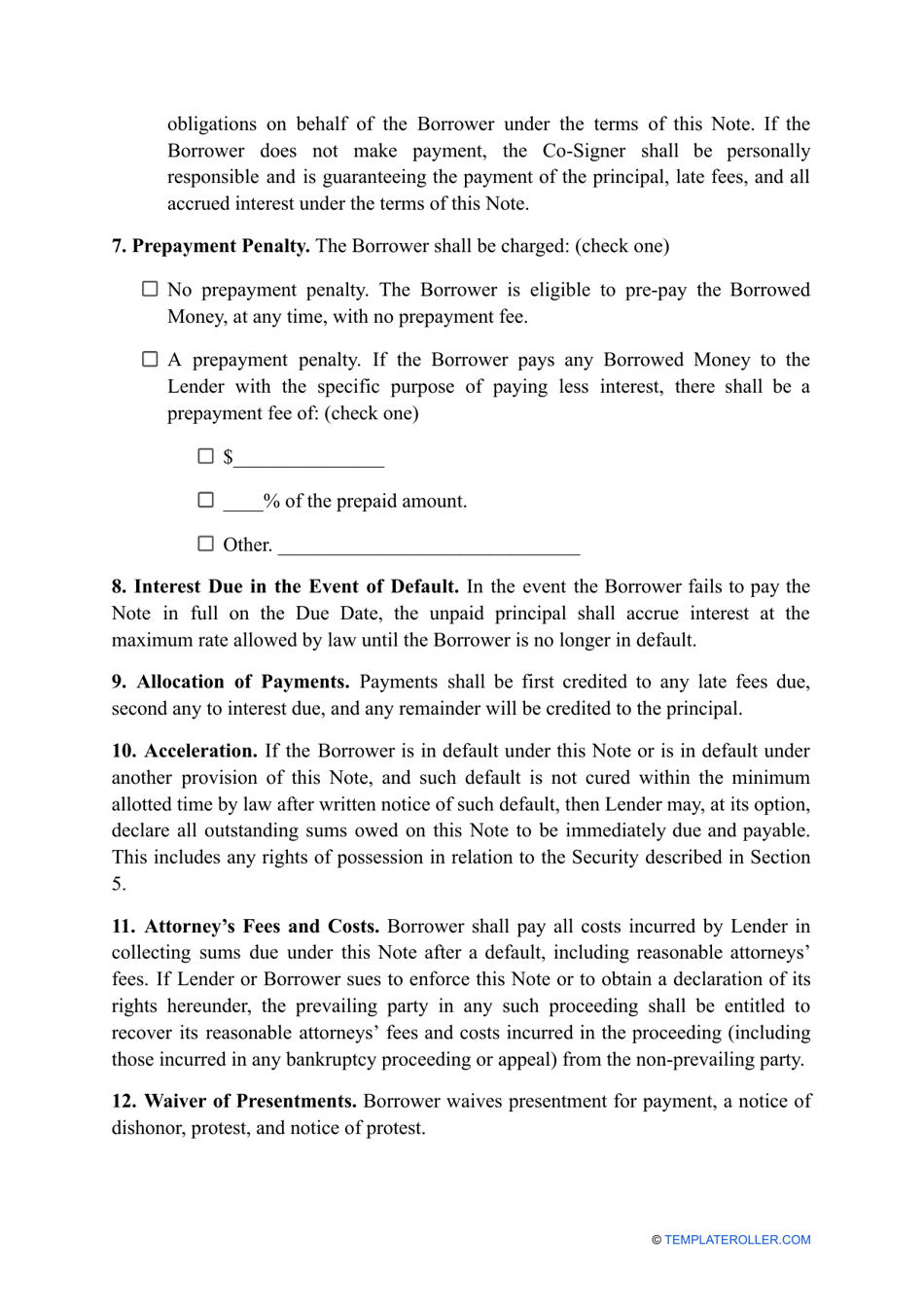

A: Yes, a promissory note can be modified if both parties agree to the changes and document them in writing.

Q: What happens if the borrower fails to repay the loan according to the promissory note?

A: If the borrower fails to repay the loan, the lender may take legal action to collect the debt, which may include filing a lawsuit or seeking wage garnishment.

Q: Can a promissory note be canceled?

A: Yes, a promissory note can be canceled if both parties agree to cancel the debt and document it in writing.

Q: Is it necessary to have a lawyer review a promissory note?

A: It is not necessary to have a lawyer review a promissory note, but it can provide added legal protection and ensure that the note is enforceable.