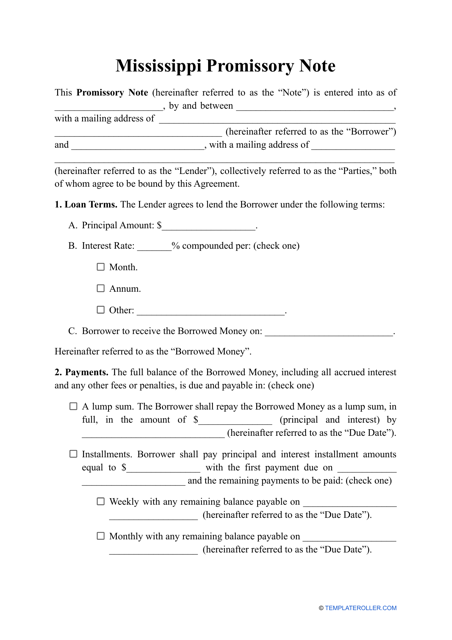

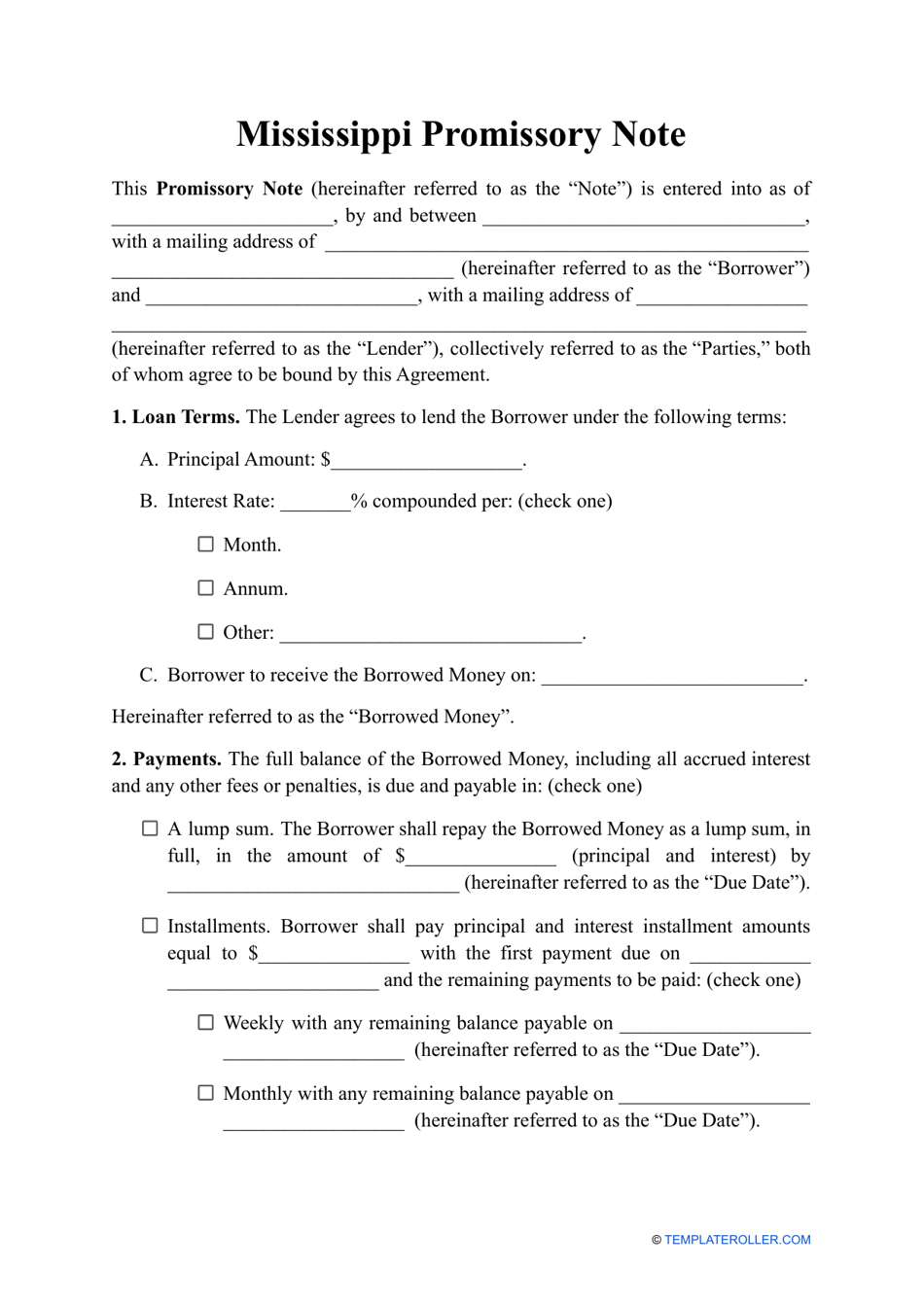

Promissory Note Template - Mississippi

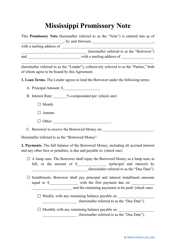

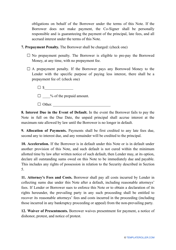

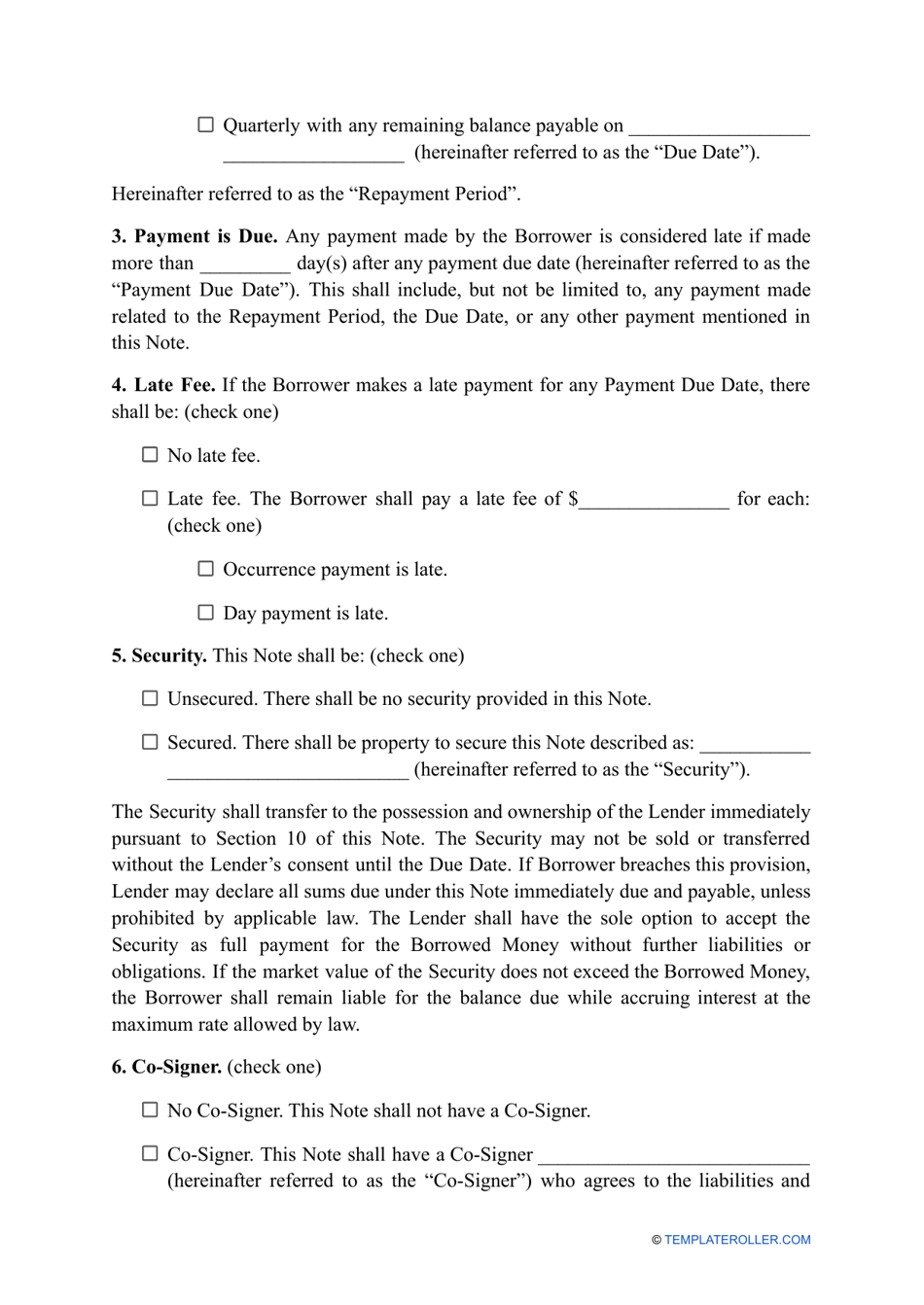

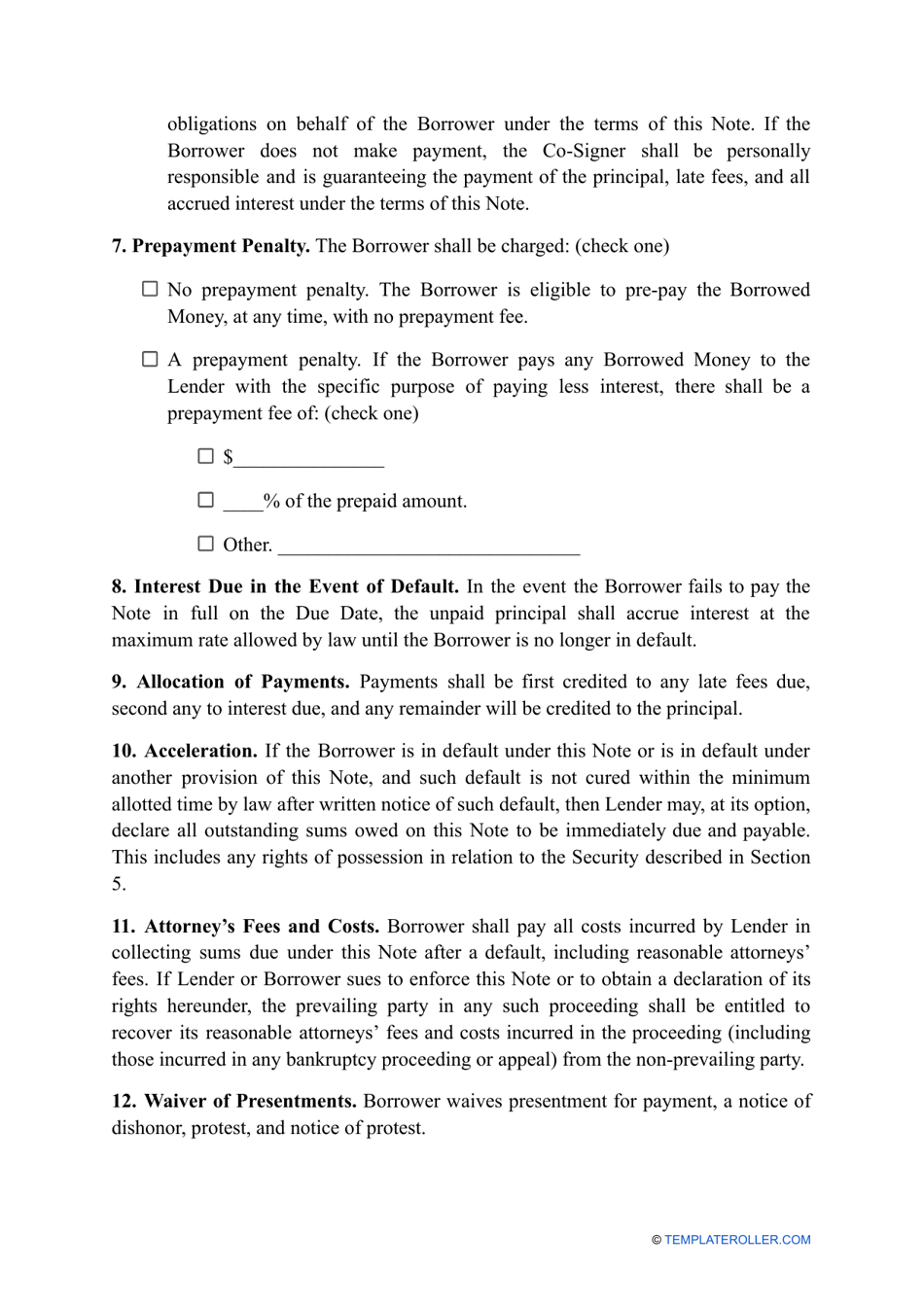

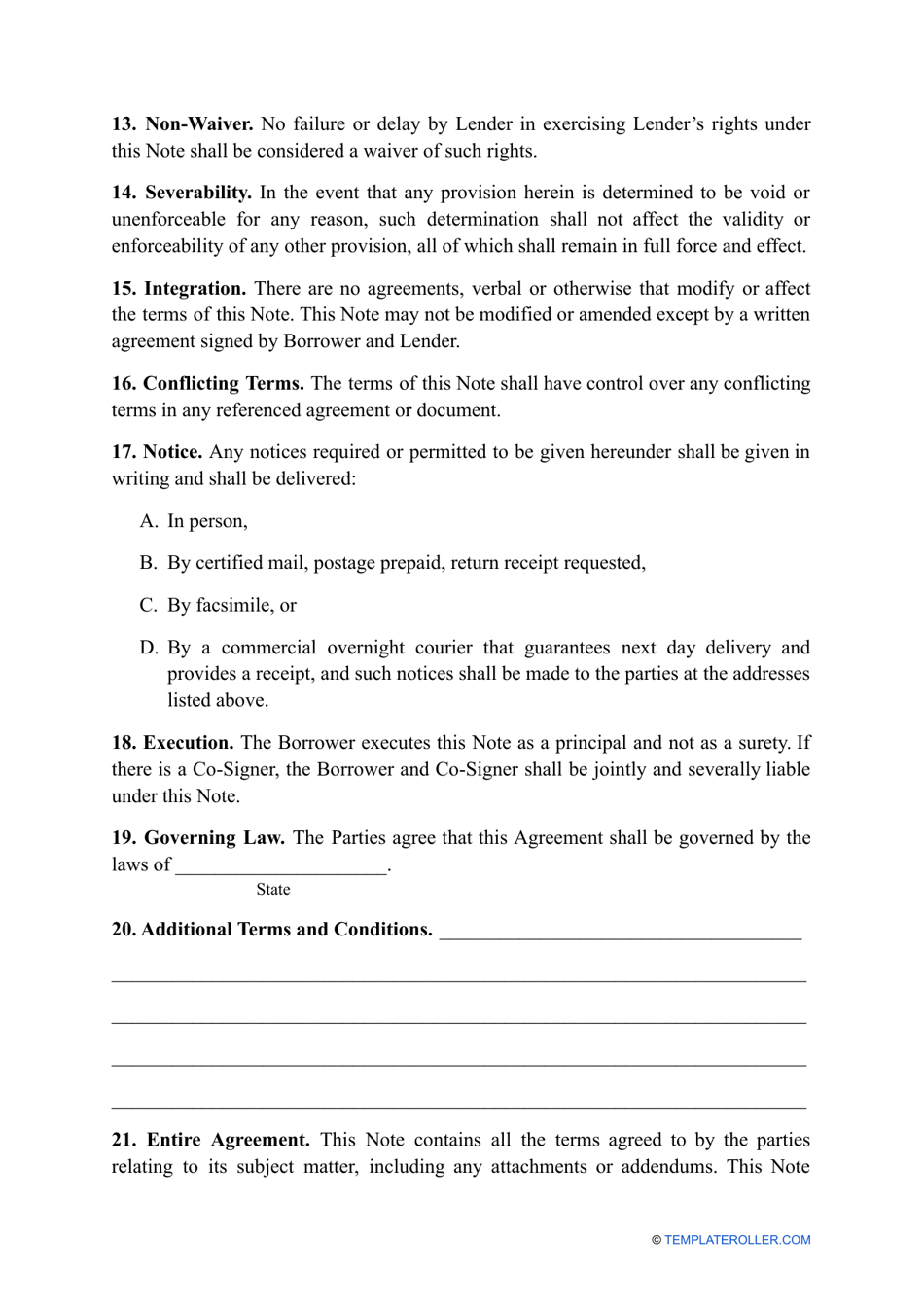

A promissory note template in Mississippi is a legal document used to outline the terms and conditions of a loan or debt between two parties. It includes details such as the loan amount, repayment terms, interest rate (if applicable), and consequences for non-payment.

In Mississippi, the person or party who agrees to repay the debt files the promissory note template.

FAQ

Q: What is a Promissory Note?

A: A Promissory Note is a legal document that outlines the terms of a loan agreement between a lender and a borrower.

Q: What is the purpose of a Promissory Note?

A: The purpose of a Promissory Note is to establish the borrower's promise to repay a loan, including details such as the loan amount, interest rate, and repayment terms.

Q: Is a Promissory Note legally binding?

A: Yes, a Promissory Note is a legally binding contract that can be enforced in court if either party fails to fulfill their obligations.

Q: What information should be included in a Promissory Note?

A: A Promissory Note should include the names of the lender and borrower, the loan amount, interest rate, repayment terms, and any other relevant details.

Q: Do I need a lawyer to create a Promissory Note?

A: While it is not required to have a lawyer create a Promissory Note, it is advisable to seek legal guidance to ensure the document is properly drafted and meets all legal requirements.

Q: Can a Promissory Note be modified or canceled?

A: A Promissory Note can be modified or canceled if both parties mutually agree to the changes and document them in writing.

Q: What are the consequences of not repaying a Promissory Note?

A: If a borrower fails to repay a Promissory Note, the lender can take legal action to collect the owed amount, potentially resulting in wage garnishment, property liens, or other enforcement measures.

Q: Is a Promissory Note required for all loans?

A: A Promissory Note is not required for all loans, but it is highly recommended to have one in place to protect the interests of both the lender and borrower.