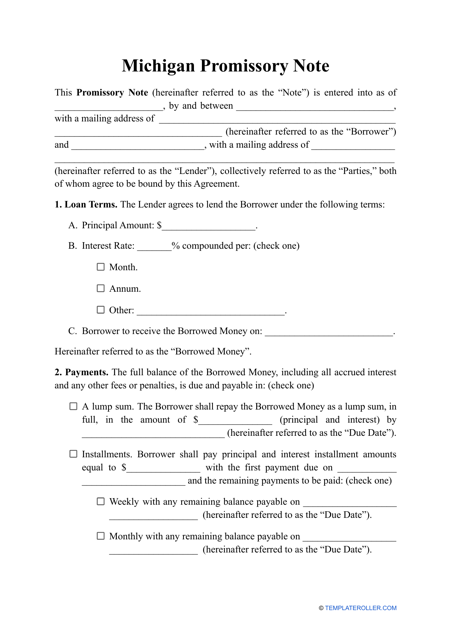

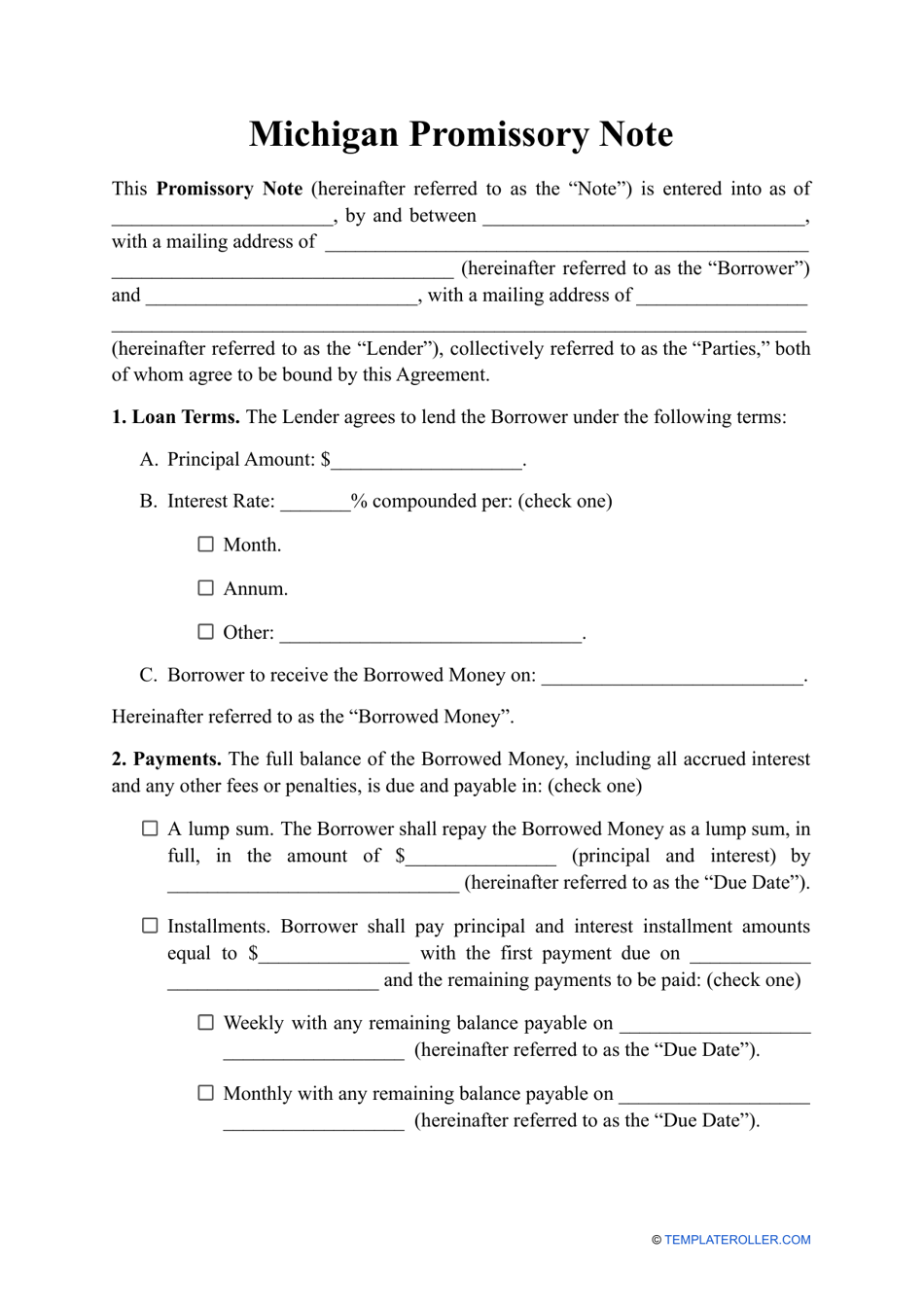

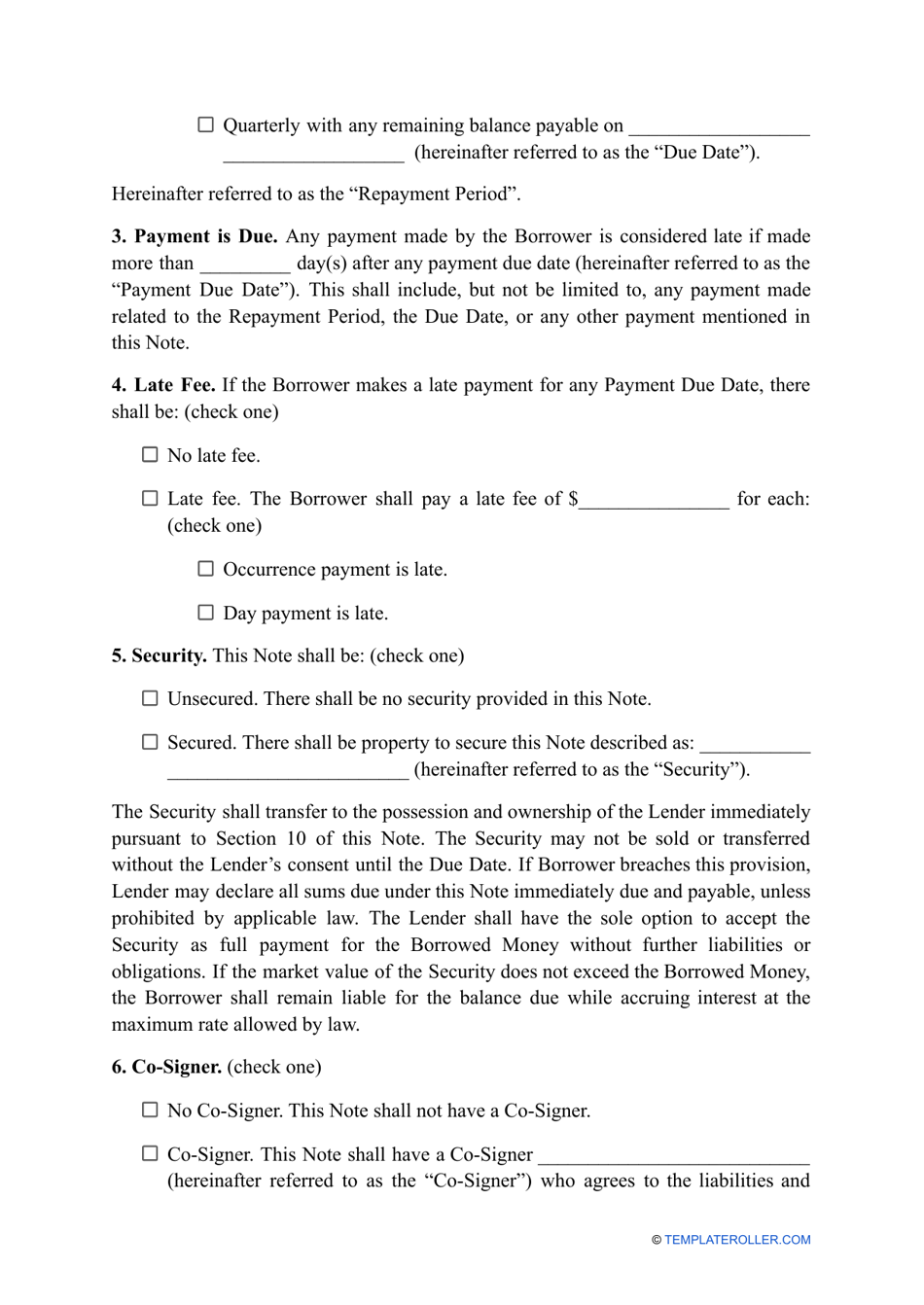

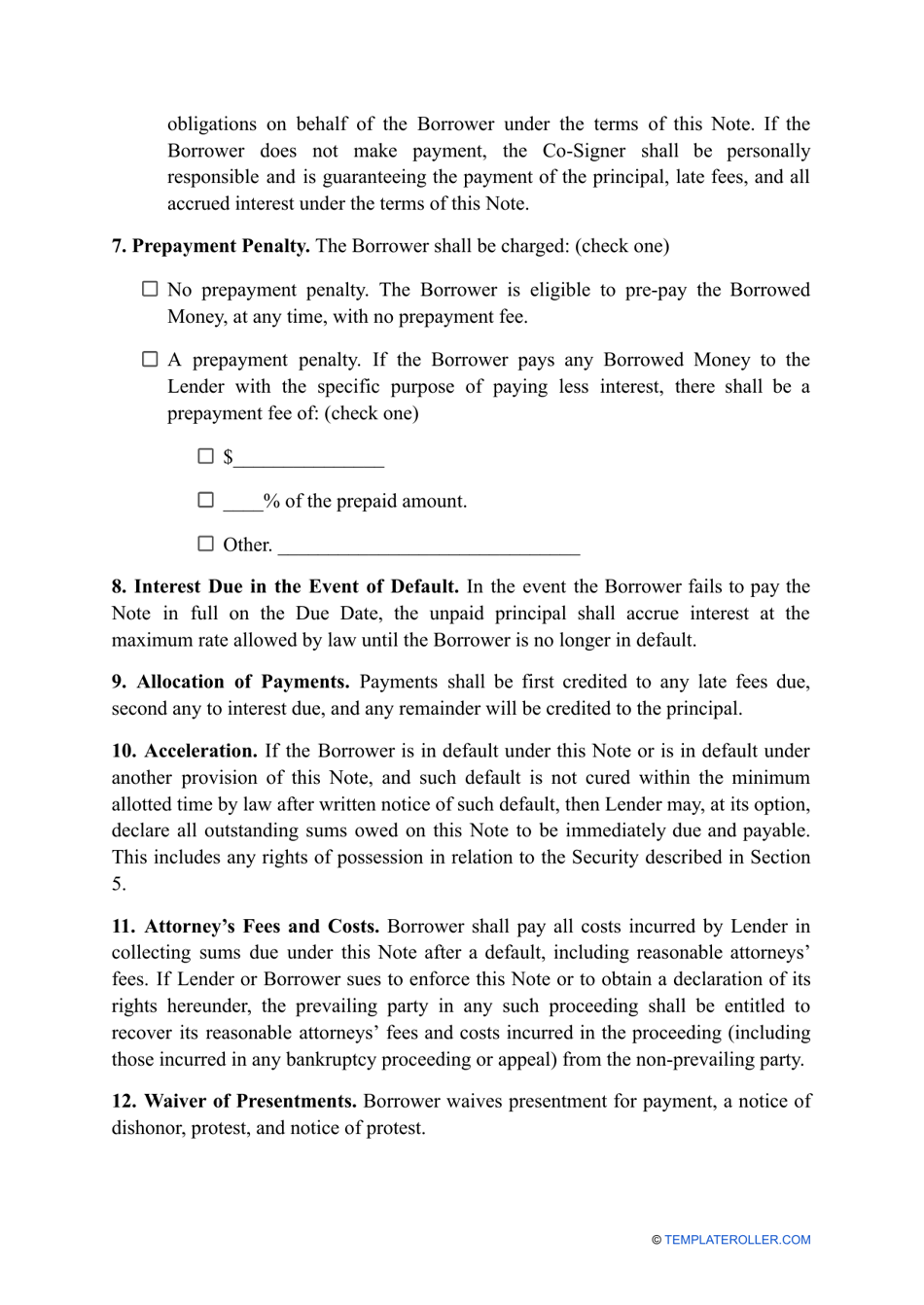

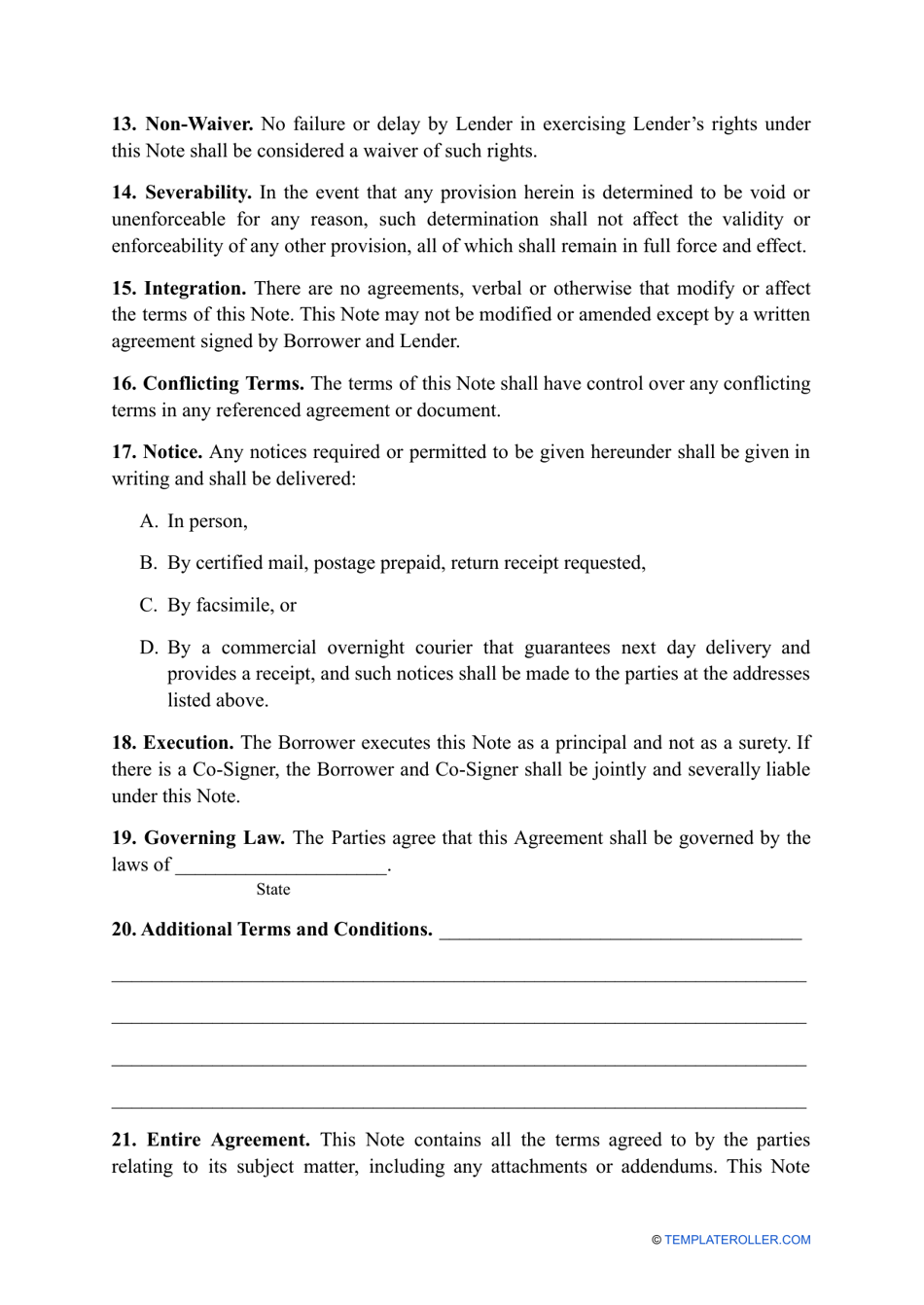

Promissory Note Template - Michigan

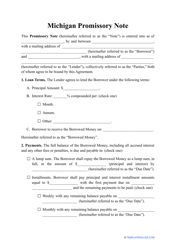

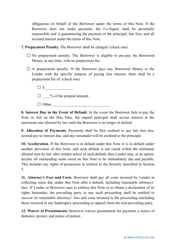

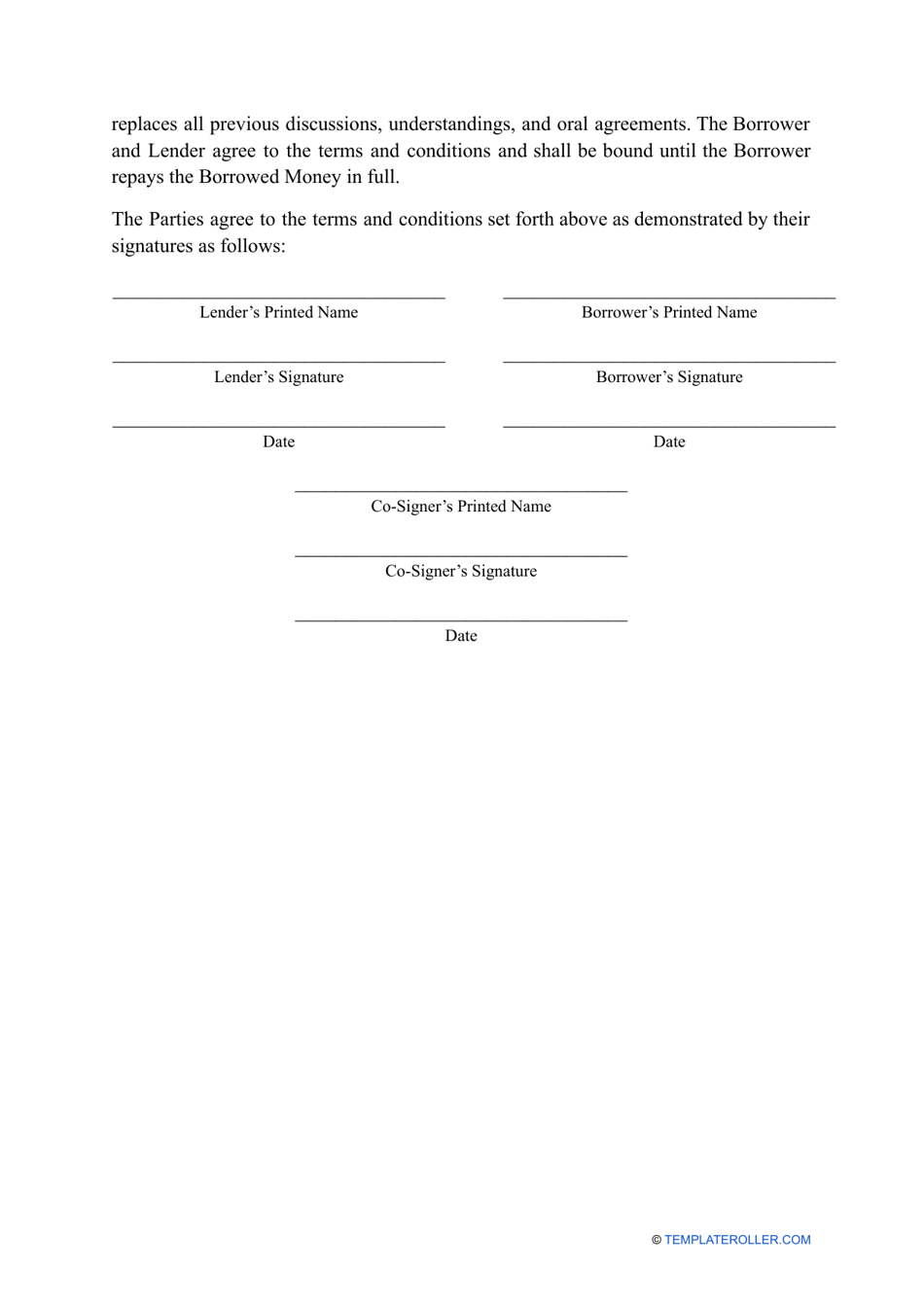

A promissory note template in Michigan is a legal document that outlines the terms of a loan or debt between two parties. It is used to establish a written agreement and protect the rights and obligations of both the lender and the borrower in the state of Michigan.

The promissory note template in Michigan is typically filed by the borrower.

FAQ

Q: What is a promissory note?

A: A promissory note is a legally binding document that establishes a written promise to repay a specific amount of money by a certain date.

Q: What is the purpose of a promissory note?

A: The purpose of a promissory note is to outline the terms and conditions of a loan, including the repayment schedule and interest rate, if applicable.

Q: Do I need a promissory note for a loan in Michigan?

A: While not required by law, it is highly recommended to have a promissory note for any loan transaction in Michigan to protect the rights of both parties involved.

Q: What information should be included in a promissory note template?

A: A promissory note template should include the names and contact information of the borrower and lender, the loan amount, repayment terms, interest rate (if applicable), and any other specific details of the loan agreement.

Q: Can I use a generic promissory note template for a loan in Michigan?

A: Yes, a generic promissory note template can be used for a loan in Michigan, but it is important to review and customize the template to ensure it complies with Michigan laws and meets the specific needs of the loan transaction.

Q: Can a promissory note be modified or cancelled?

A: Yes, a promissory note can be modified or cancelled, but it should be done in writing and agreed upon by both the borrower and lender. It is important to consult with a legal professional to ensure the modifications or cancellations are done correctly.

Q: What happens if a borrower fails to repay a loan as stated in the promissory note?

A: If a borrower fails to repay a loan as stated in the promissory note, the lender may take legal action to recover the unpaid amount. This can include filing a lawsuit, obtaining a judgment, and pursuing collection efforts.

Q: Do I need a lawyer to create a promissory note in Michigan?

A: While it is not required to have a lawyer create a promissory note in Michigan, it is highly recommended, especially for complex loan transactions. A lawyer can provide legal advice, customize the note to meet your specific needs, and ensure compliance with Michigan laws.

Q: What are the consequences of not having a promissory note for a loan in Michigan?

A: Not having a promissory note for a loan in Michigan can leave both the borrower and lender vulnerable to misunderstandings, disputes, and difficulty in enforcing the terms of the loan agreement. It is best to have a written agreement to protect the rights and interests of all parties involved.