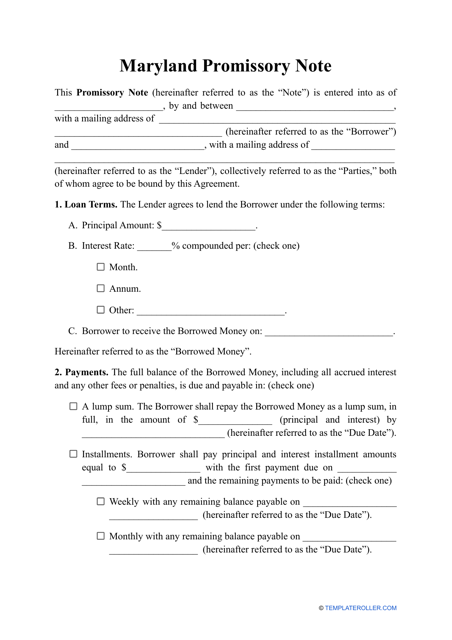

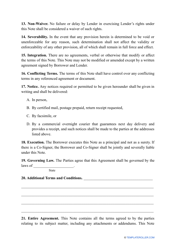

Promissory Note Template - Maryland

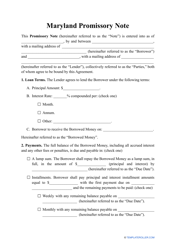

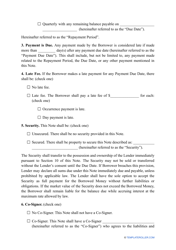

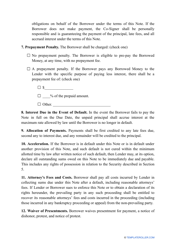

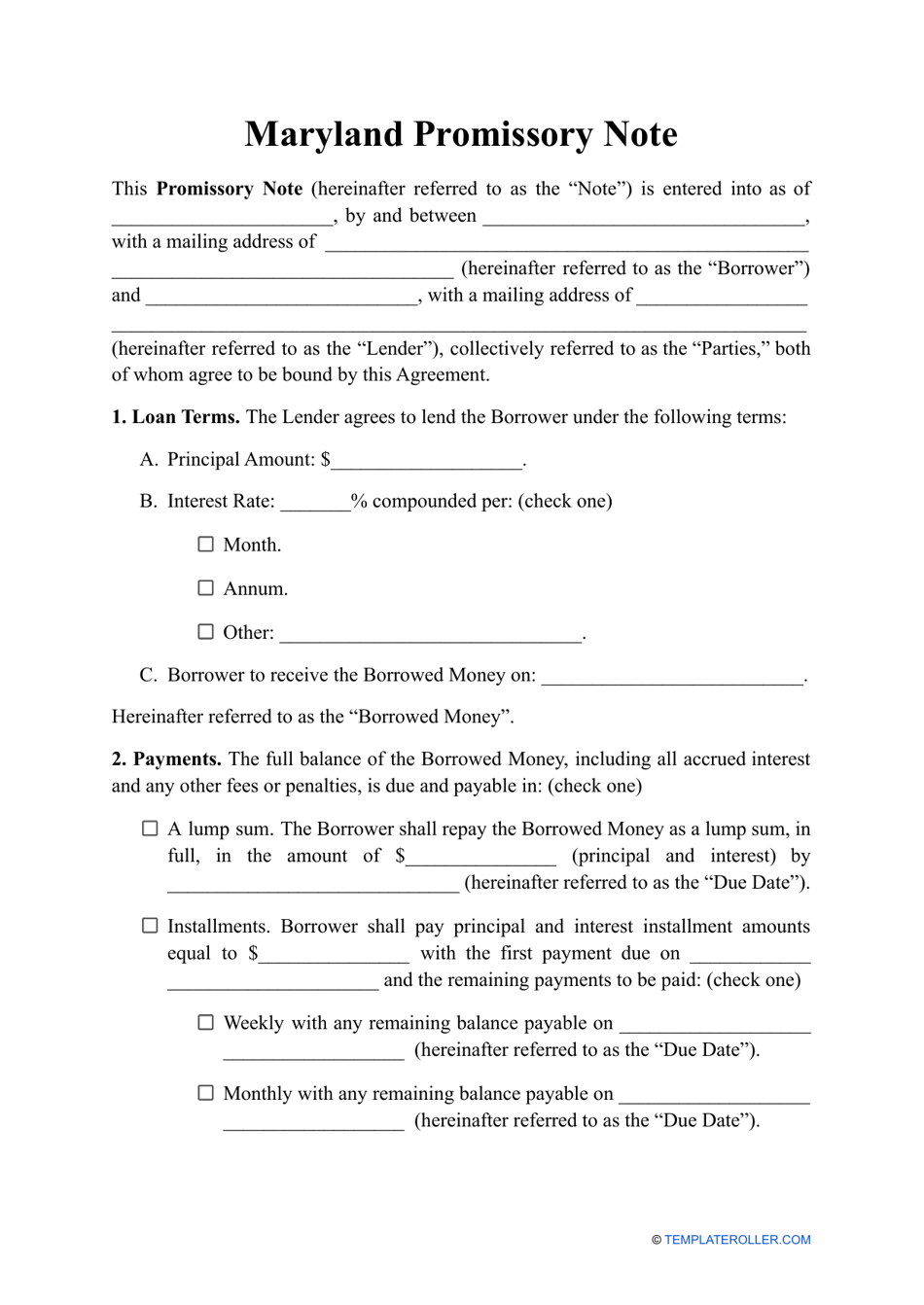

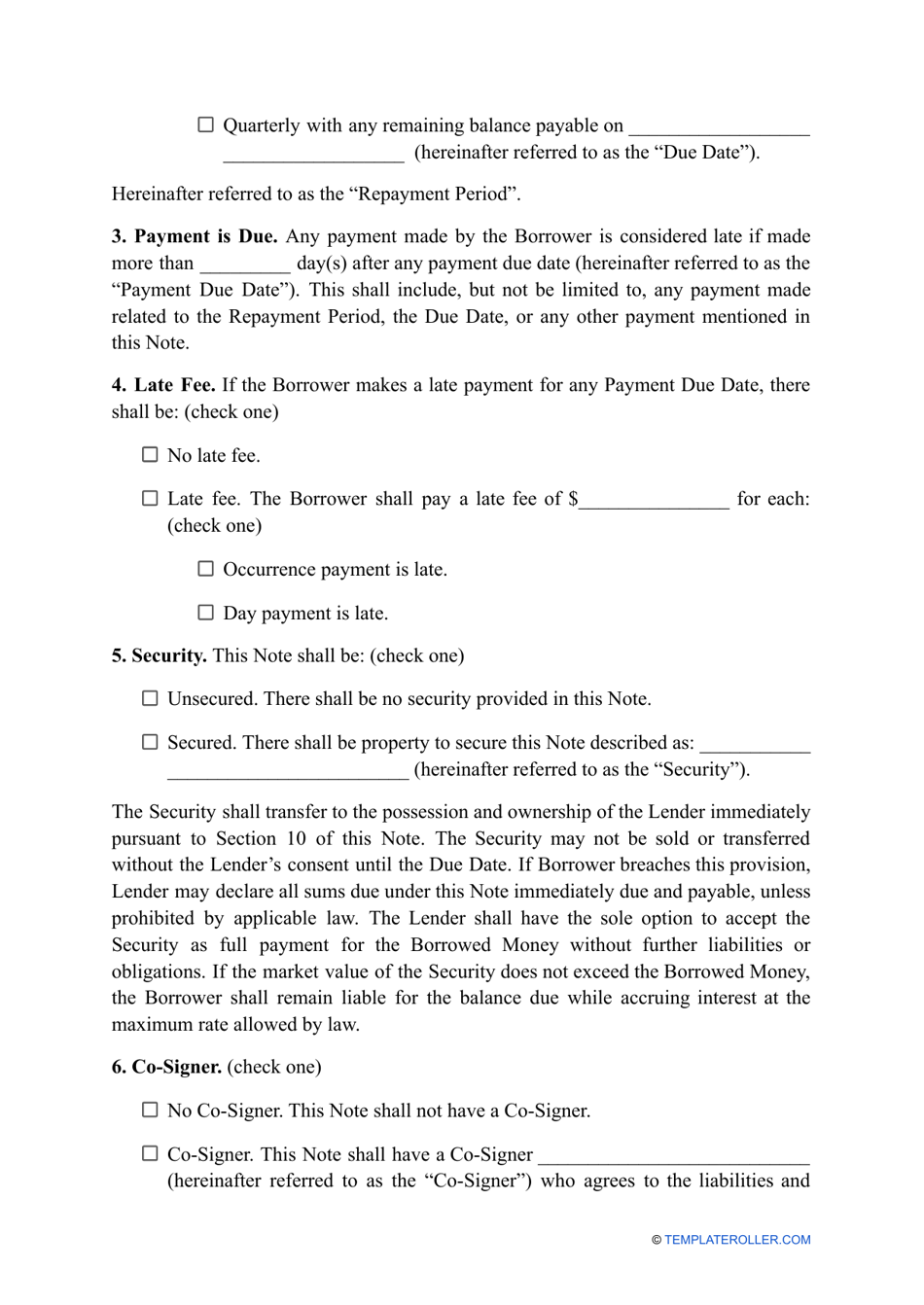

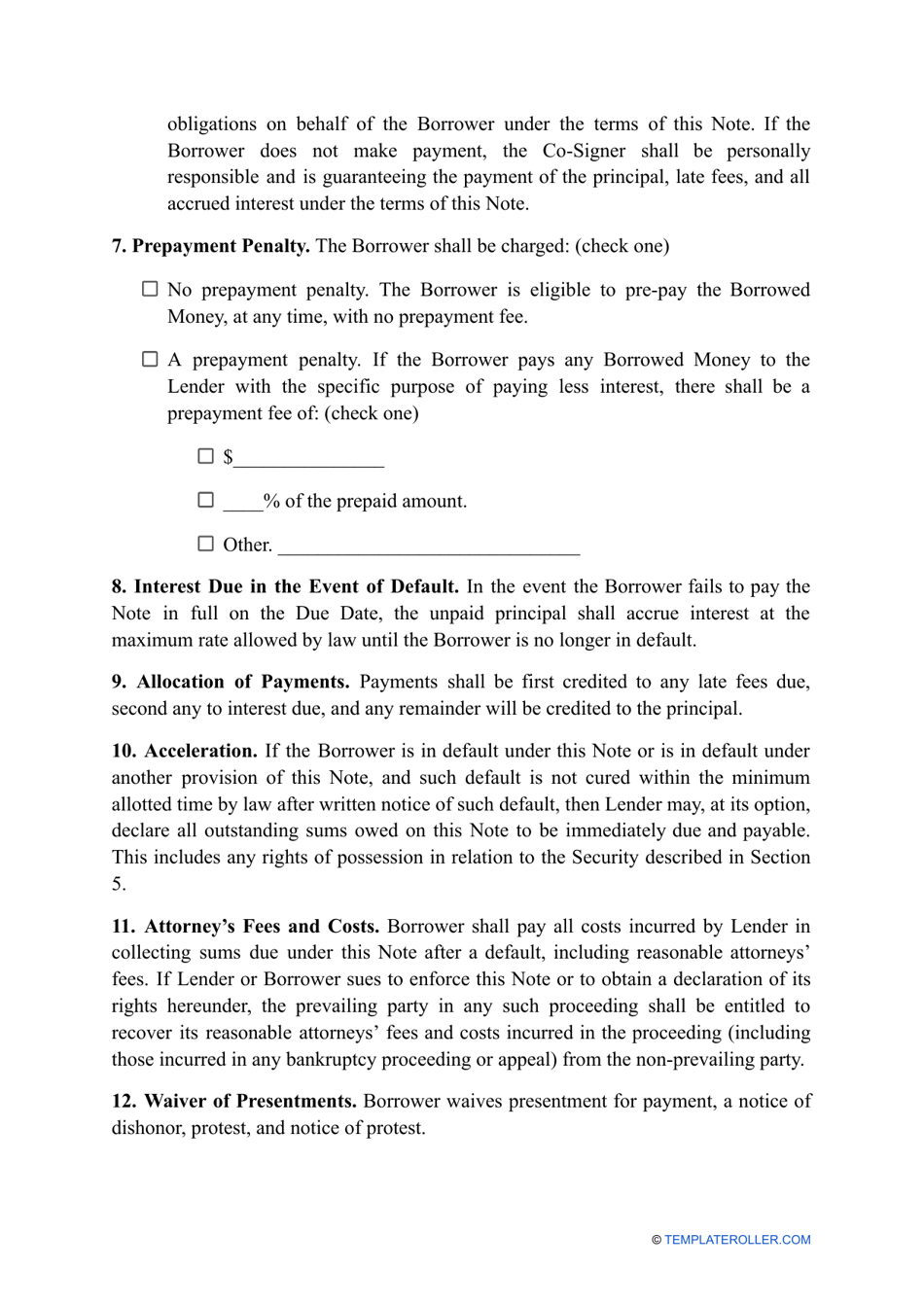

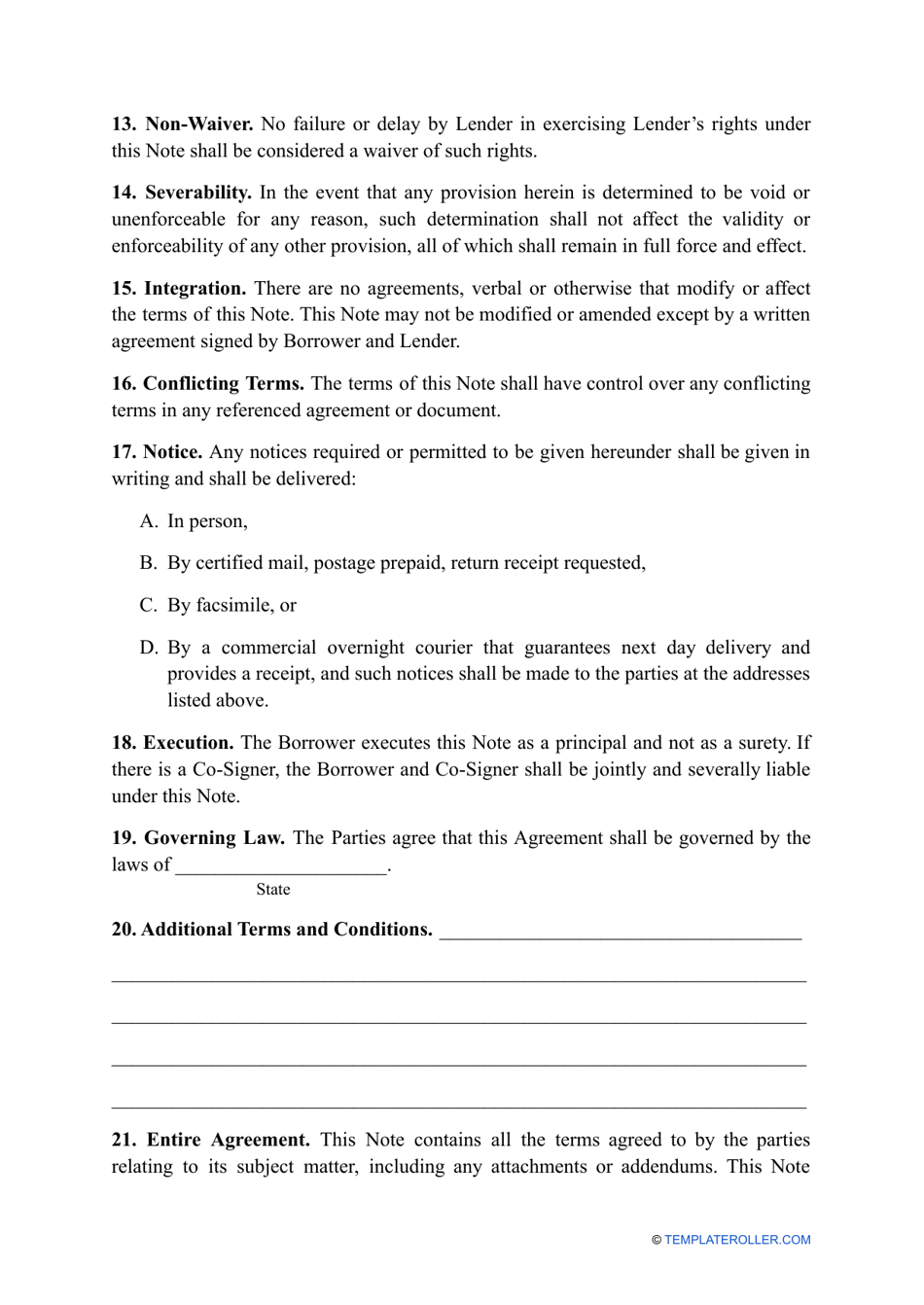

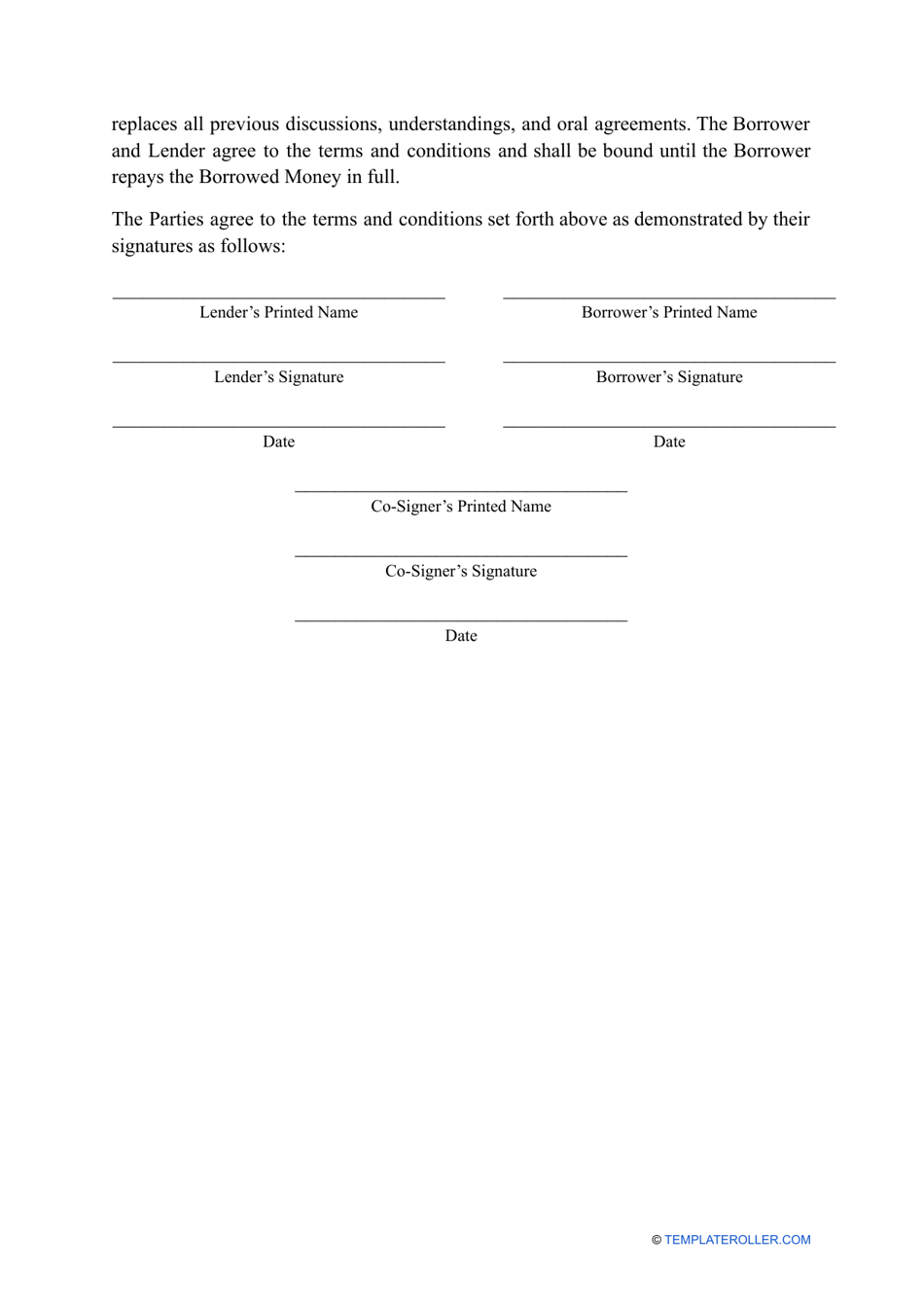

A Promissory Note Template in Maryland is used for creating a legally binding agreement between a borrower and a lender. It outlines the terms and conditions of a loan, including the repayment schedule, interest rate, and consequences for late or non-payment.

The promissory note template in Maryland is typically filed by the person borrowing the money.

FAQ

Q: What is a promissory note?

A: A promissory note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower.

Q: What is the purpose of a promissory note?

A: The purpose of a promissory note is to create a written record of the loan and to specify the amount borrowed, the interest rate, and the repayment terms.

Q: Is a promissory note legally binding?

A: Yes, a promissory note is a legally binding contract between the lender and the borrower.

Q: Do I need a promissory note for every loan?

A: It is recommended to have a promissory note for every loan to protect the rights and obligations of both parties.

Q: Are there any specific requirements for a promissory note in Maryland?

A: Yes, Maryland has specific requirements for promissory notes, such as including the borrower's name and address, the lender's name and address, and a clear description of the loan terms and repayment schedule.