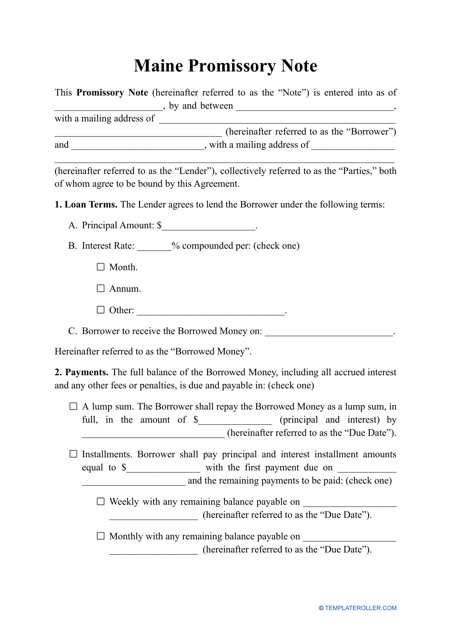

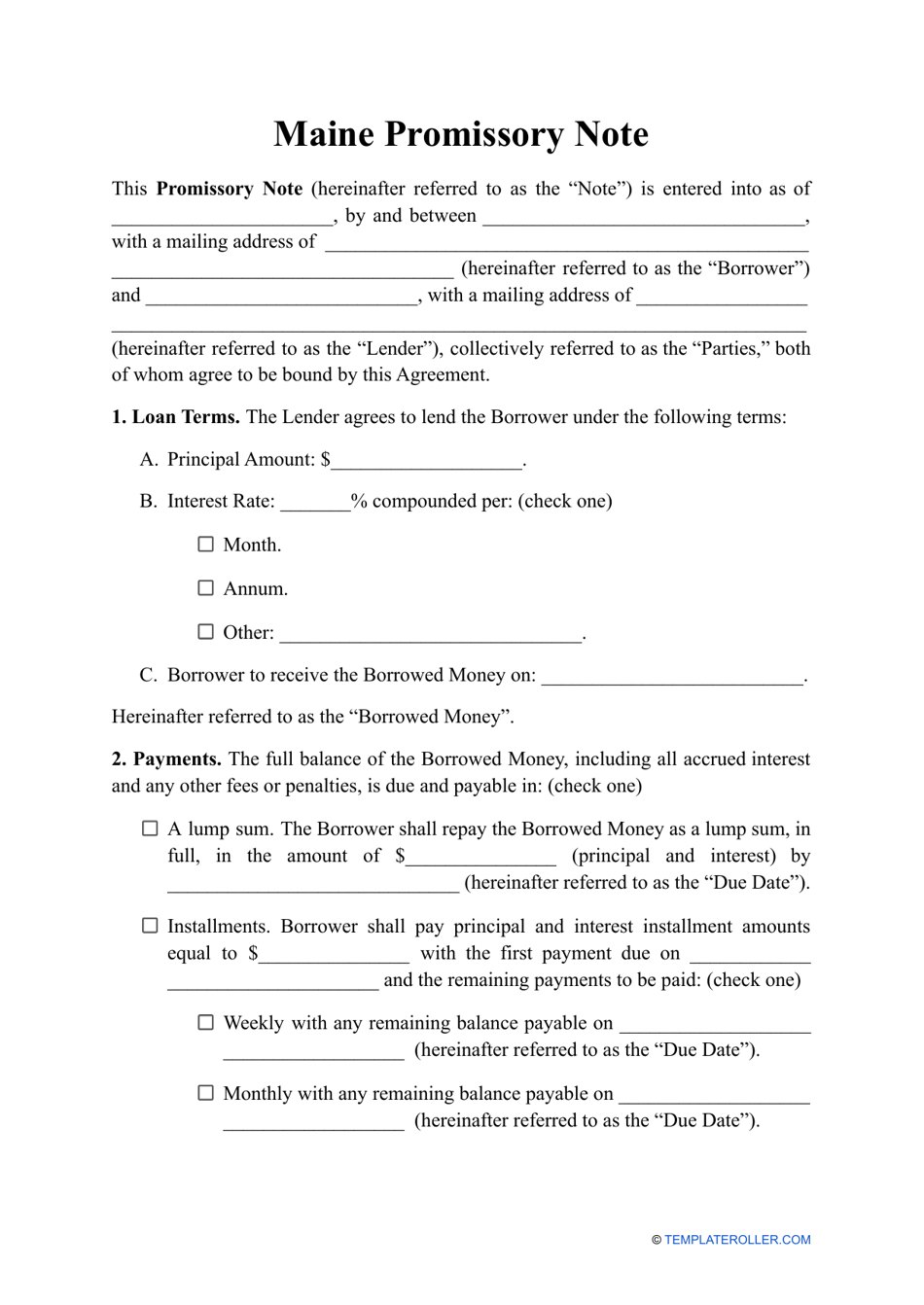

Promissory Note Template - Maine

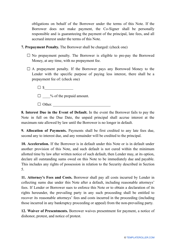

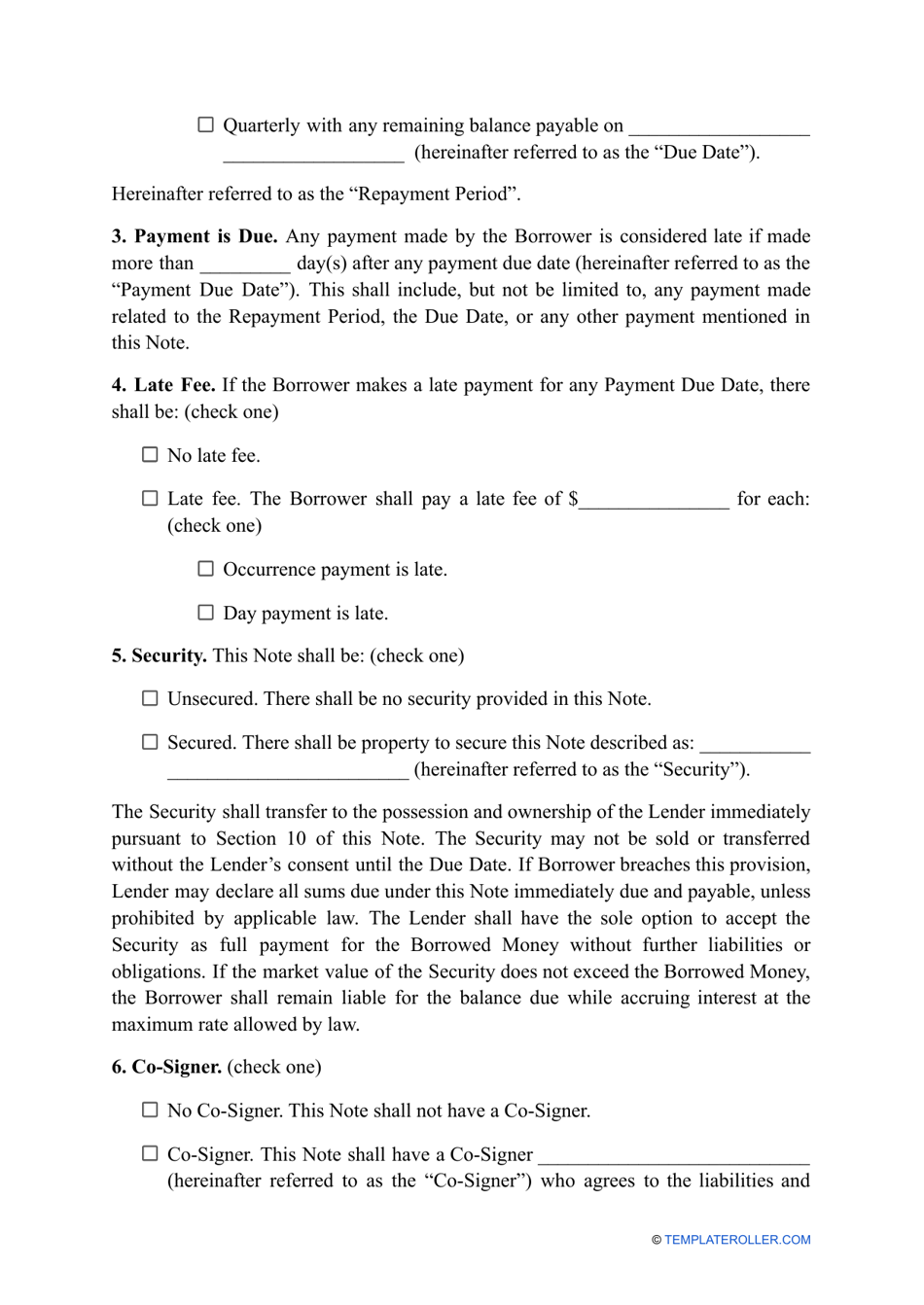

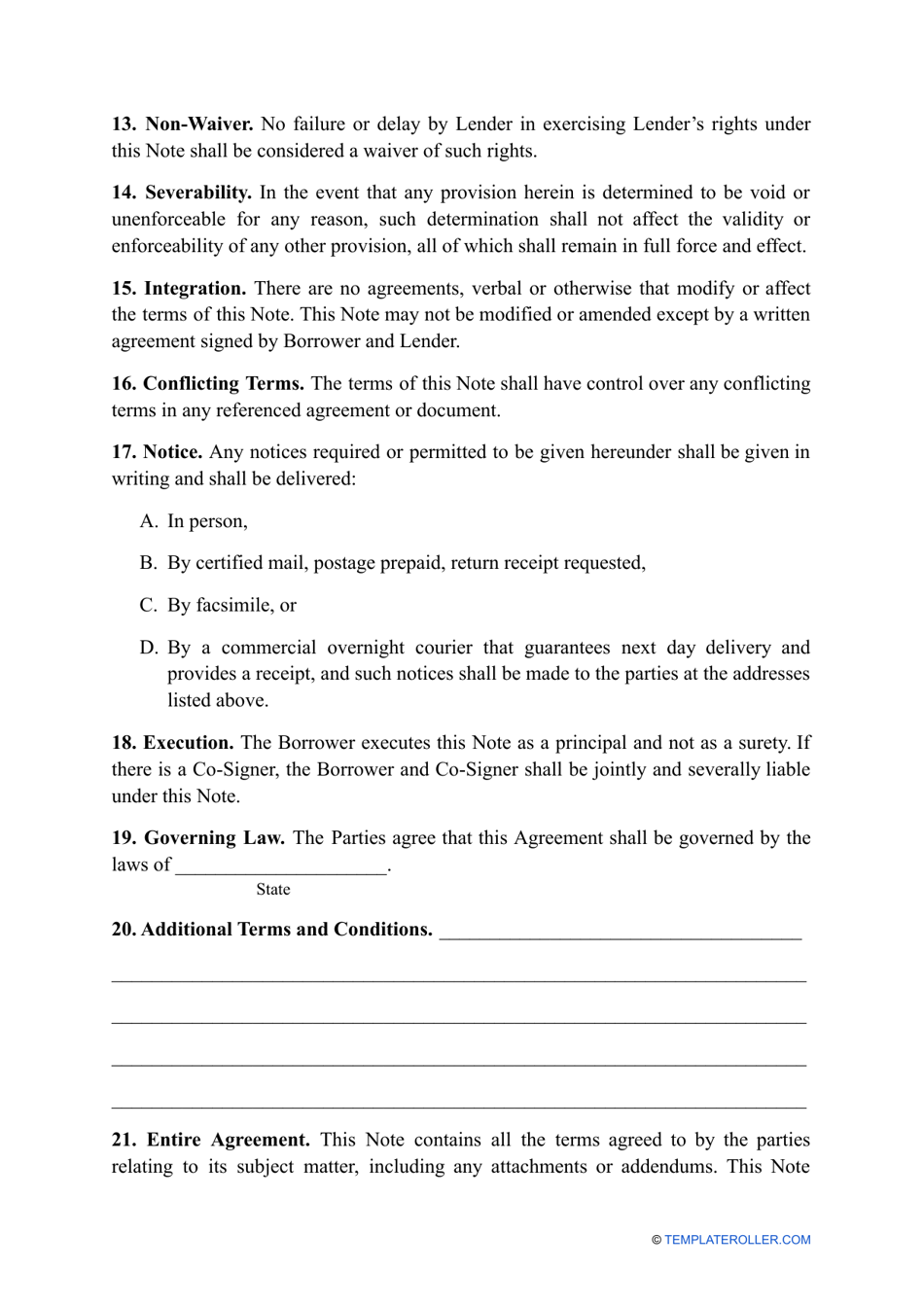

A Promissory Note Template - Maine is used in the state of Maine to create a legally binding agreement between a borrower and a lender. It outlines the terms of a loan, including the amount borrowed, interest rate, repayment schedule, and any penalties for late or missed payments. The template serves as a guide for creating a customized promissory note that complies with Maine's laws.

The lender typically files the promissory note template in Maine.

FAQ

Q: What is a promissory note?

A: A promissory note is a written agreement in which one party (the borrower) promises to pay another party (the lender) a specific sum of money by a certain date.

Q: Why would someone use a promissory note?

A: A promissory note is commonly used to formalize a loan agreement between individuals or entities, providing legal documentation of the borrower's promise to repay the borrowed amount.

Q: What information should be included in a promissory note?

A: A promissory note should include details such as the names and contact information of the borrower and lender, the amount borrowed, the interest rate (if any), the repayment terms, and the due date.

Q: Is a promissory note legally binding?

A: Yes, a properly executed promissory note is legally binding and enforceable in a court of law.

Q: Can a promissory note be modified or canceled?

A: Yes, a promissory note can be modified or canceled if both the borrower and lender agree to the changes in writing.

Q: Can a promissory note be used for personal loans?

A: Yes, a promissory note can be used for personal loans between individuals, including friends and family members.

Q: Is a promissory note required for small loans?

A: While not always required, having a promissory note for small loans helps protect both the borrower and lender, providing a clear record of the loan agreement and repayment terms.