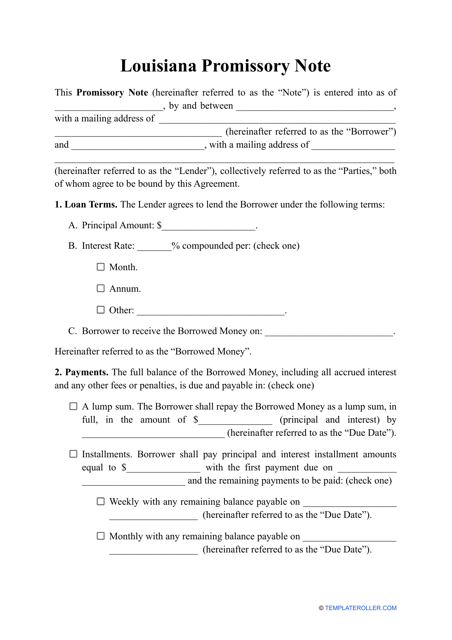

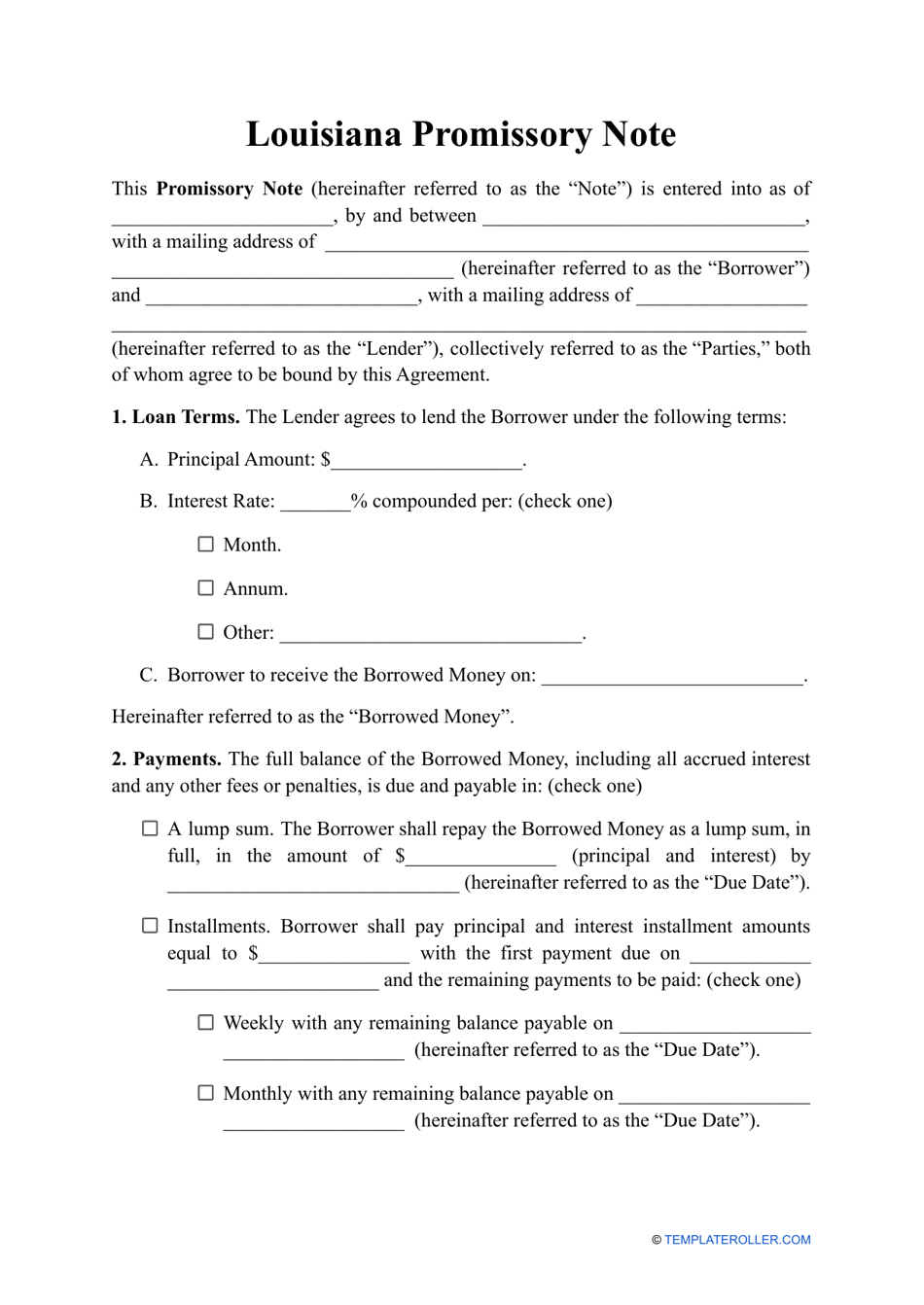

Promissory Note Template - Louisiana

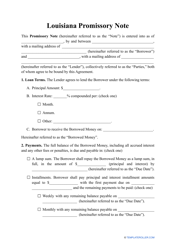

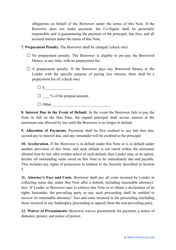

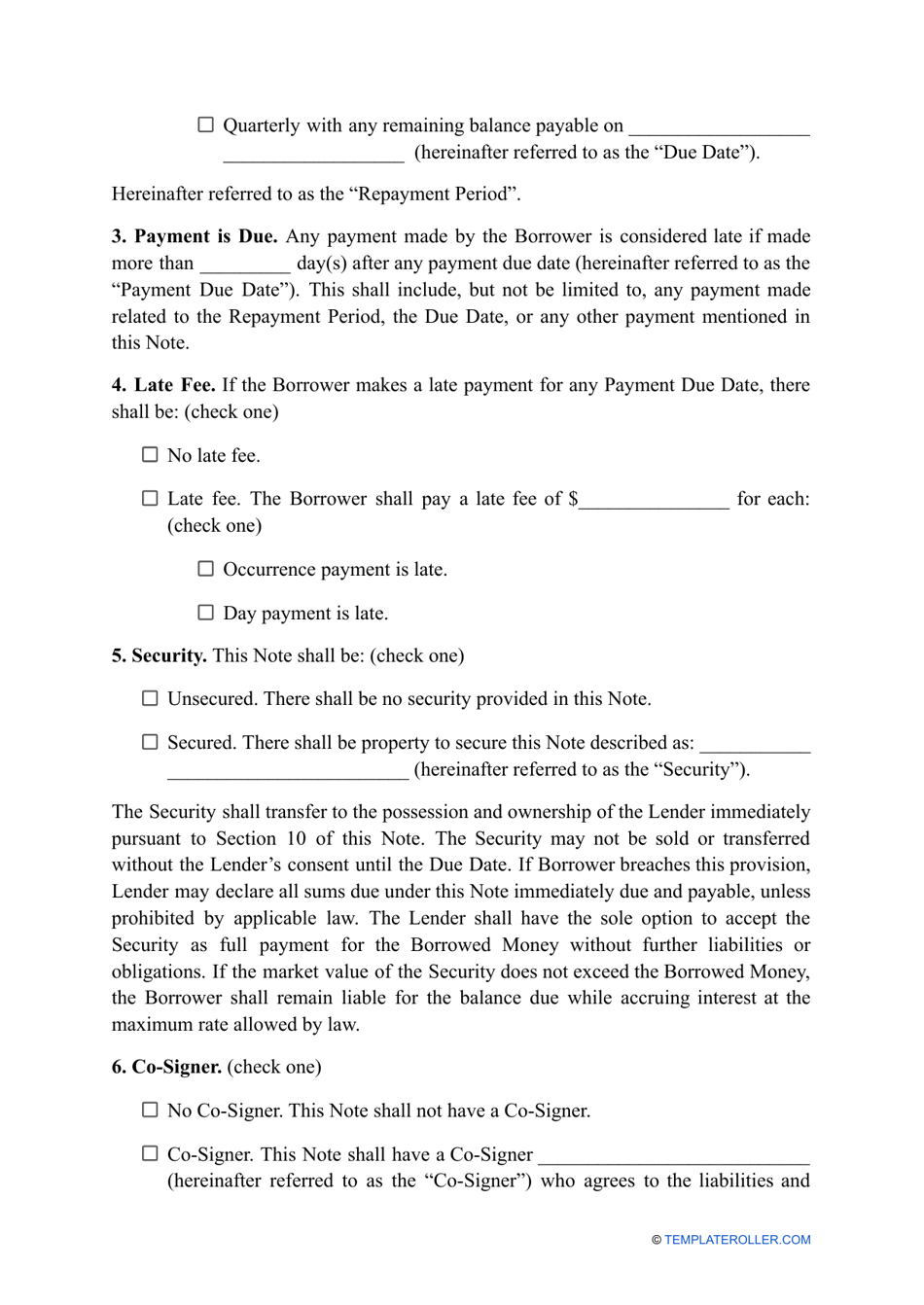

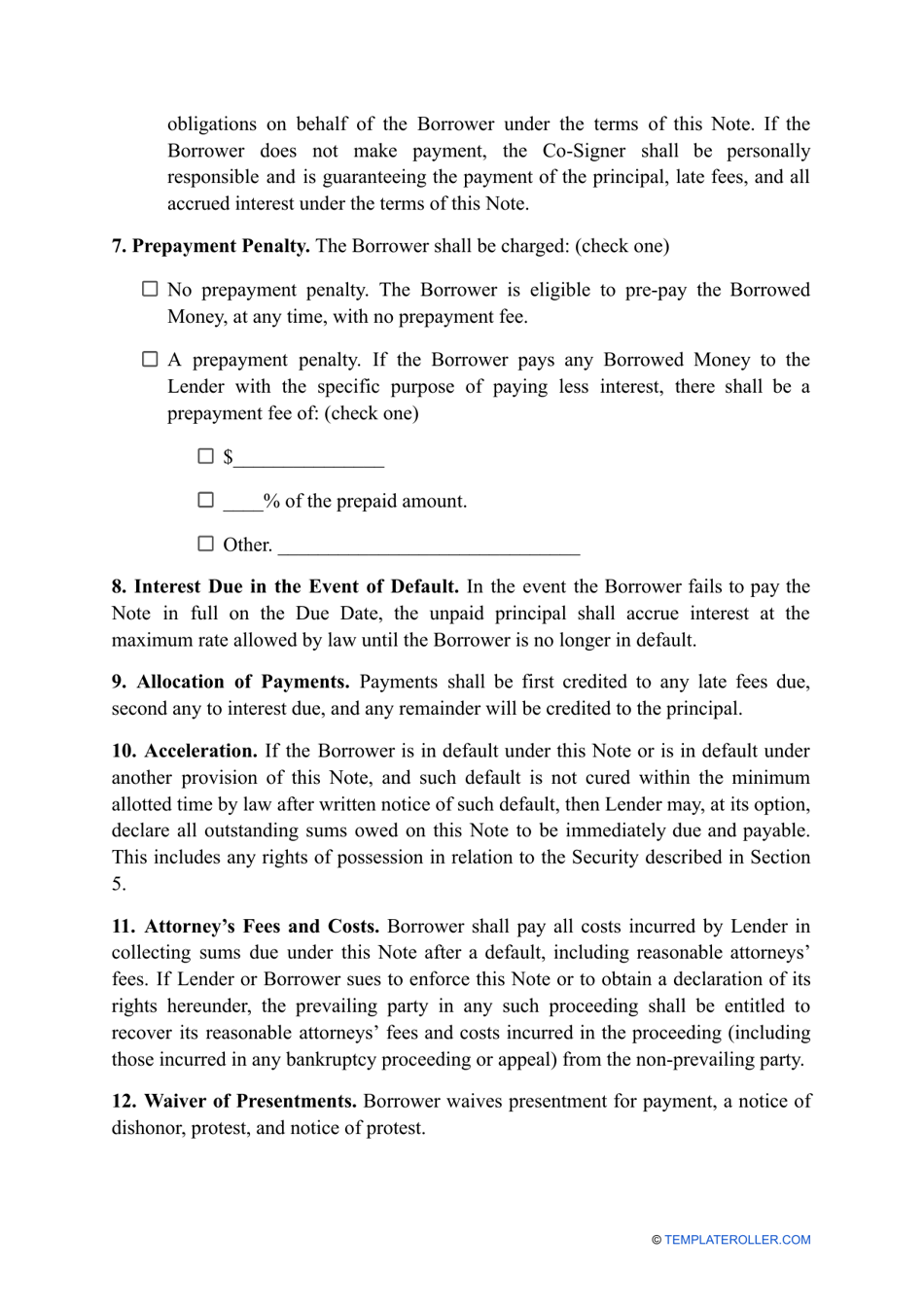

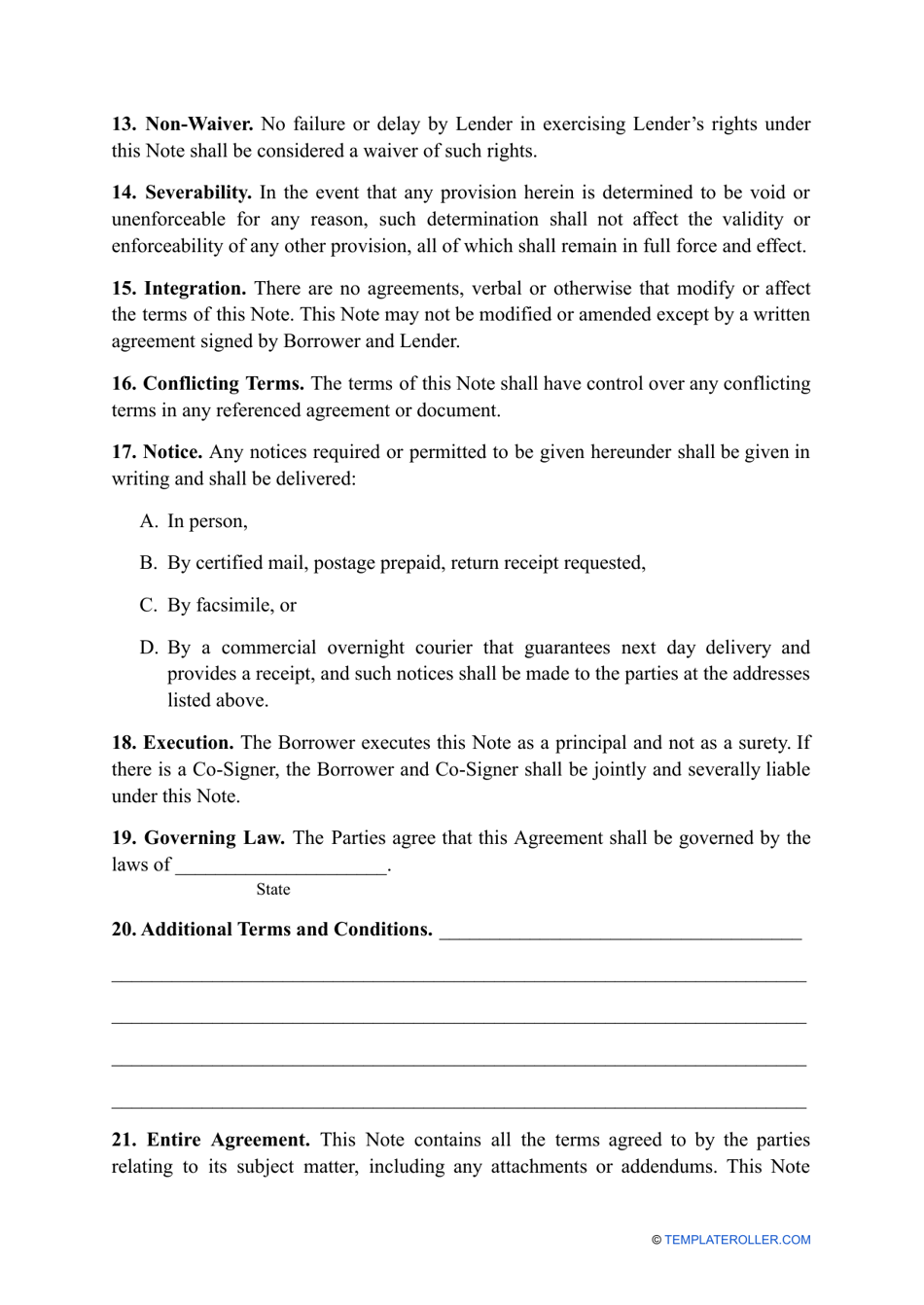

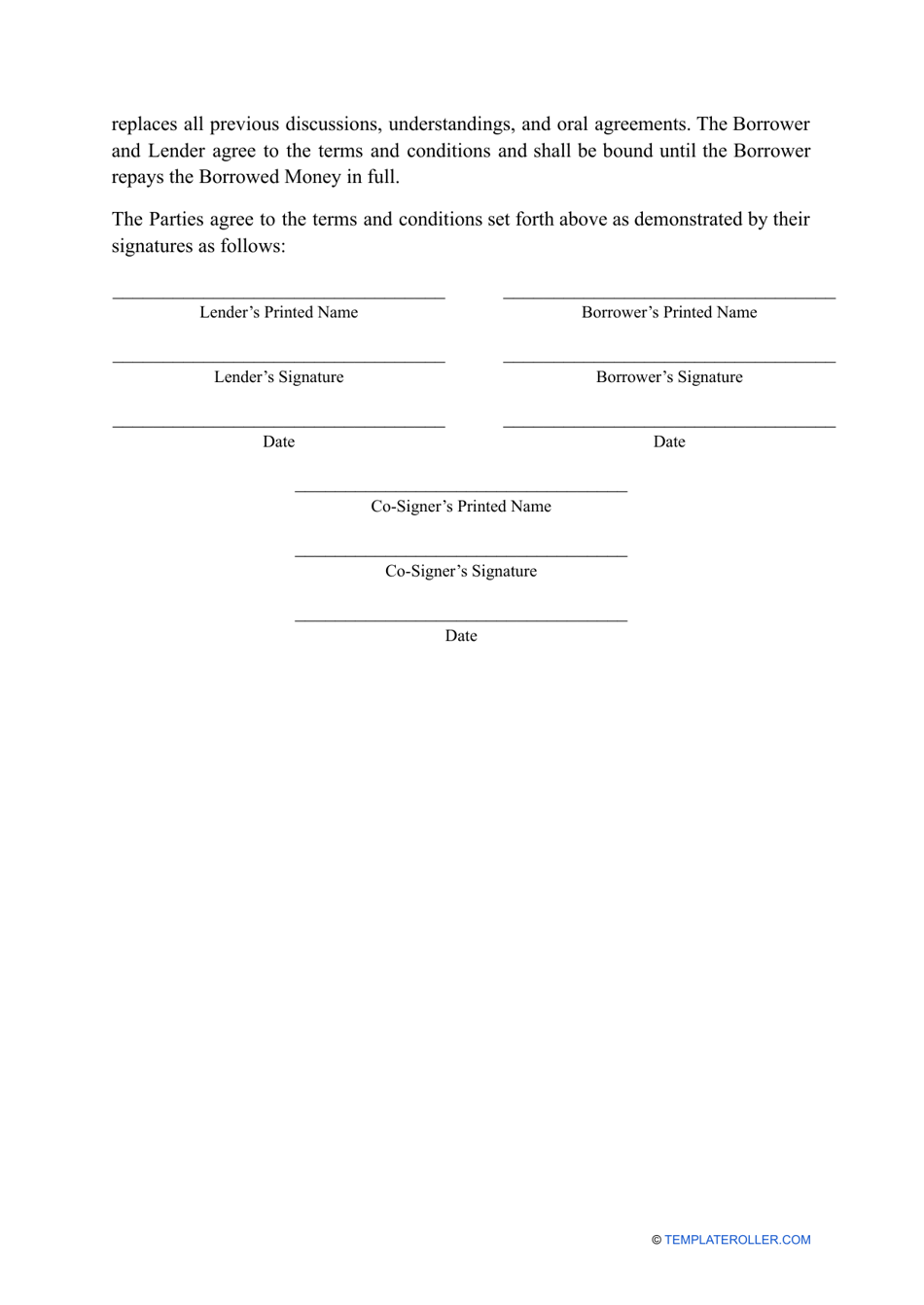

A promissory note template in Louisiana is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower. It serves as an evidence of the debt owed by the borrower to the lender and includes important details such as the amount of money borrowed, the interest rate, repayment terms, and any other specific conditions agreed upon by both parties.

In Louisiana, the person who borrows money and agrees to repay it is typically the one who files the promissory note template.

FAQ

Q: What is a promissory note?

A: A promissory note is a written promise to repay a debt.

Q: How is a promissory note different from a loan agreement?

A: A promissory note is a legally binding document that only includes the borrower's promise to repay the debt, while a loan agreement includes more detailed terms and conditions of the loan.

Q: Is a promissory note enforceable in Louisiana?

A: Yes, a properly executed promissory note is enforceable in Louisiana.

Q: What information should be included in a promissory note?

A: A promissory note should include the names of the borrower and lender, the amount of the loan, the interest rate, the repayment terms, and any late fees or penalties.

Q: Can a promissory note be modified?

A: Yes, a promissory note can be modified if both the borrower and lender agree to the changes and amend the original note in writing.