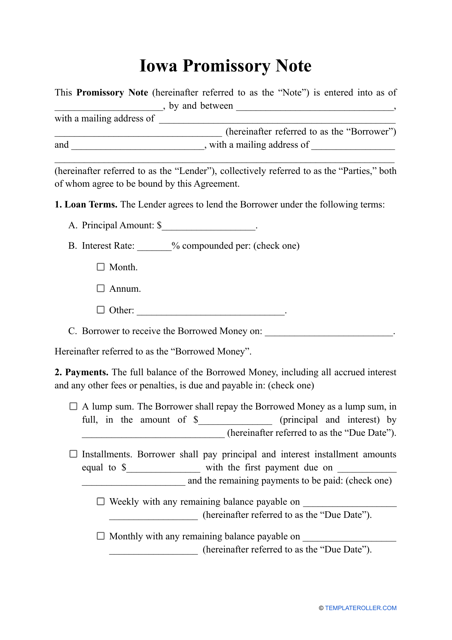

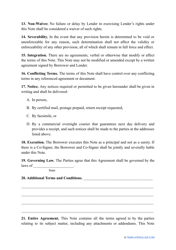

Promissory Note Template - Iowa

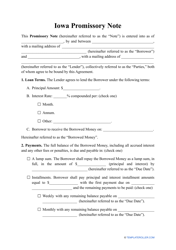

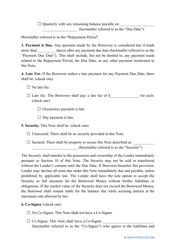

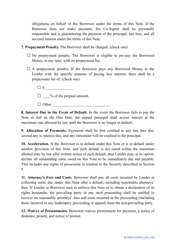

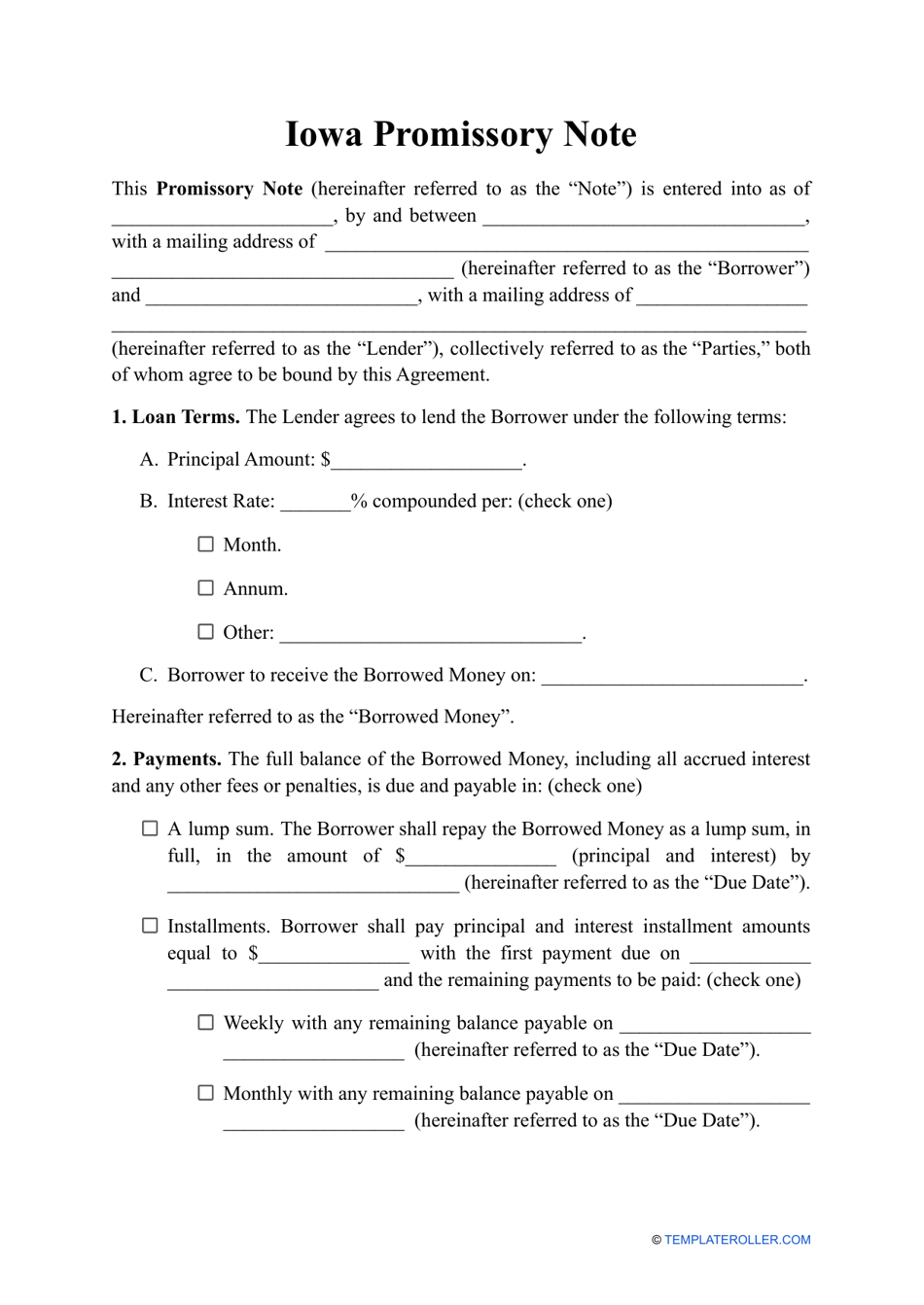

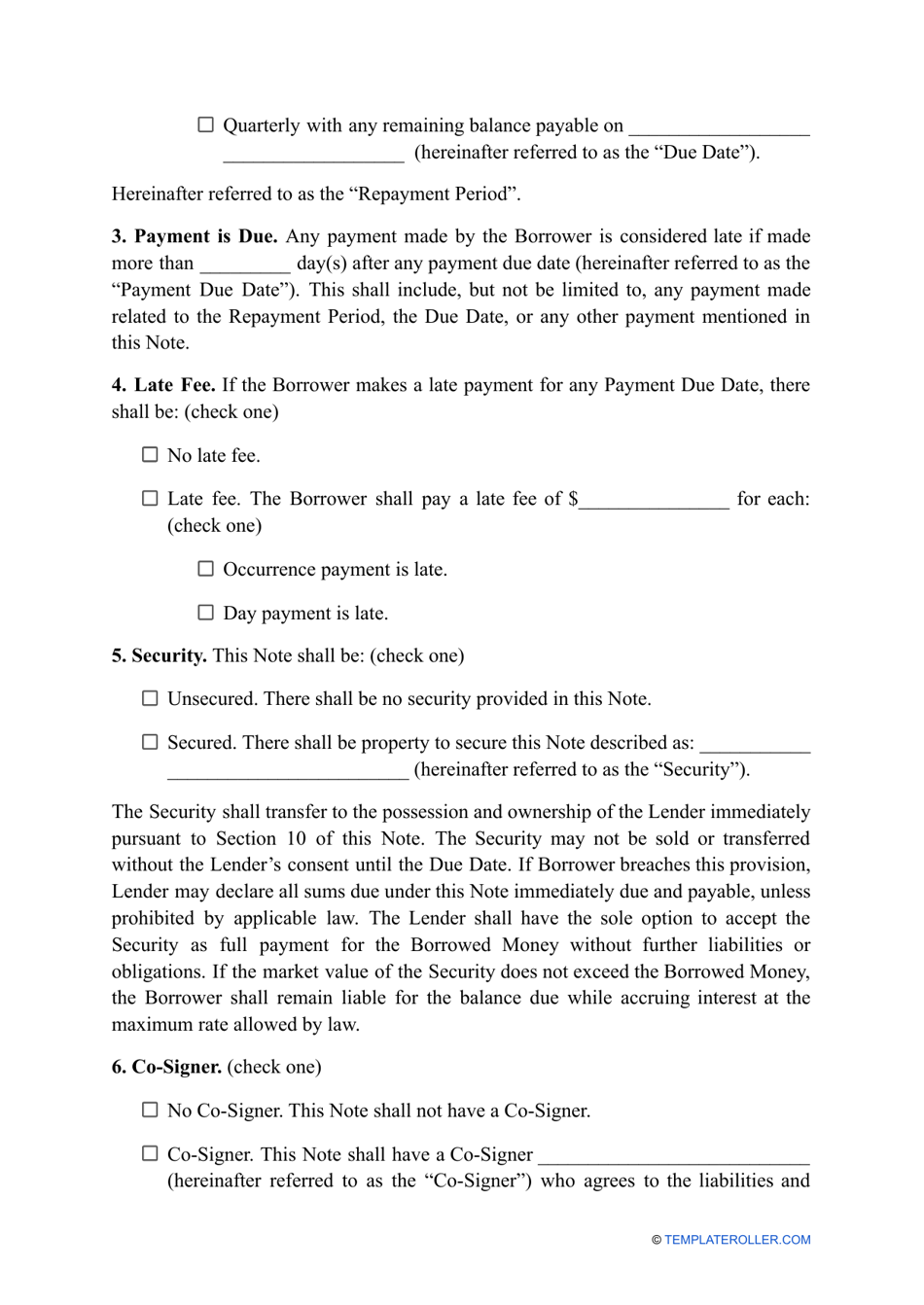

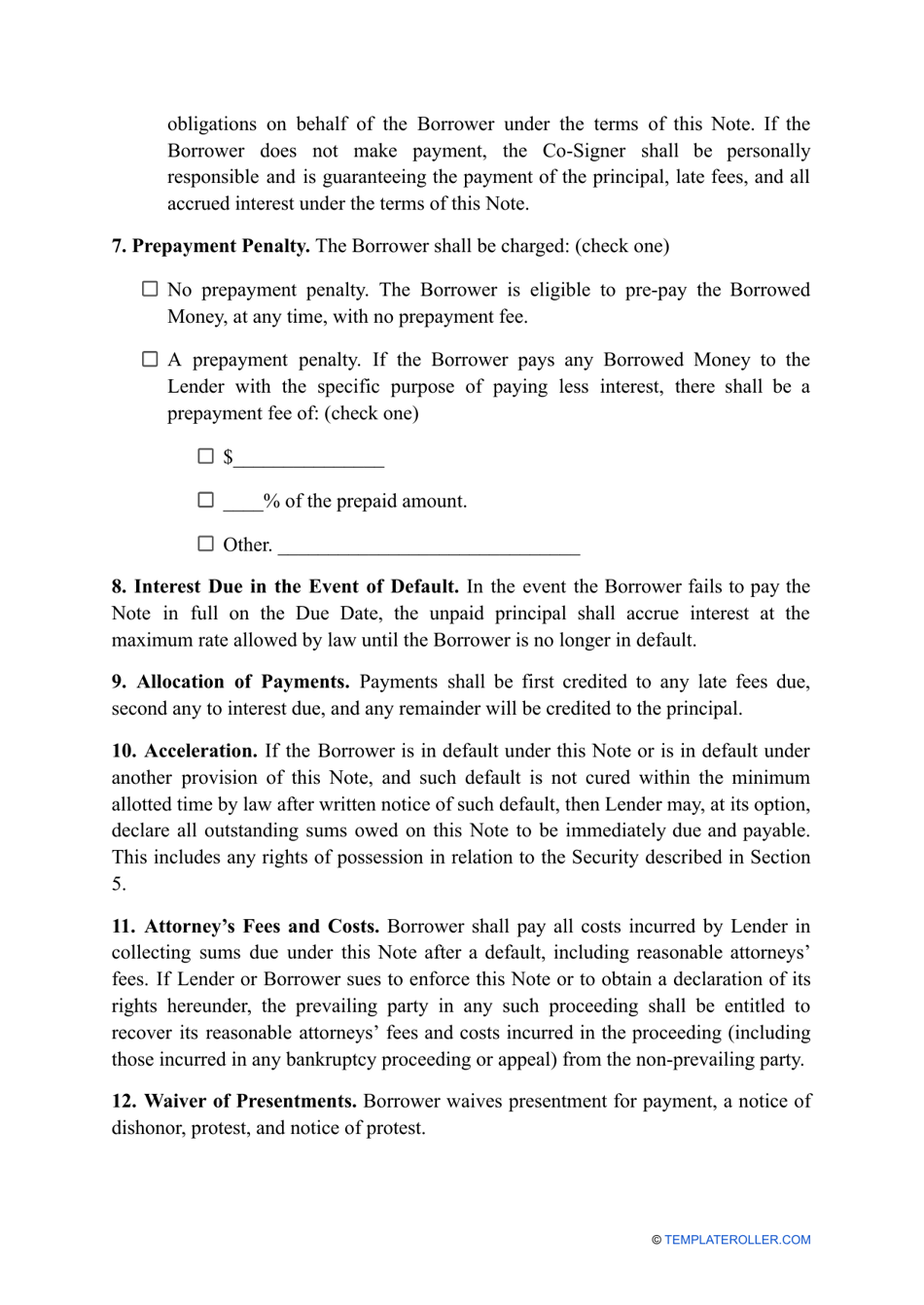

A promissory note template in Iowa is used to formalize a written agreement between a borrower and a lender. It outlines the terms and conditions of a loan, including the amount borrowed, interest rate, repayment schedule, and consequences for non-payment.

The promissory note template in Iowa is typically filed by the person who is borrowing the money and promising to repay it.

FAQ

Q: What is a promissory note?

A: A promissory note is a written agreement that outlines the terms and conditions of a loan, including the amount borrowed, the interest rate, and the repayment schedule.

Q: Why would I need a promissory note?

A: You would need a promissory note if you are lending money to someone or borrowing money from someone and want a legally binding document that outlines the terms of the loan.

Q: Is a promissory note legally enforceable in Iowa?

A: Yes, a promissory note is legally enforceable in Iowa if it meets the necessary requirements, such as being in writing, signed by the borrower, and properly executed.

Q: What should be included in a promissory note?

A: A promissory note should include the names and contact information of the lender and borrower, the loan amount, the interest rate, the repayment terms, and any penalties for late payments.

Q: Can I use a generic promissory note template for Iowa?

A: While a generic promissory note template may be used as a starting point, it is generally recommended to consult with a lawyer to ensure that the specific requirements of Iowa law are met.

Q: How can I enforce a promissory note if the borrower defaults?

A: If the borrower defaults on a promissory note, you may need to take legal action, such as filing a lawsuit, to enforce the terms of the note and recover the outstanding balance.

Q: Can I charge interest on a promissory note in Iowa?

A: Yes, you can charge interest on a promissory note in Iowa. However, there may be limitations on the maximum interest rate that can be charged, so it is advisable to consult with a lawyer.