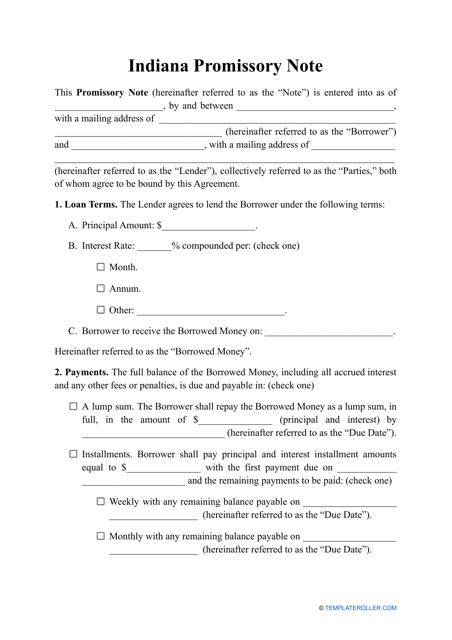

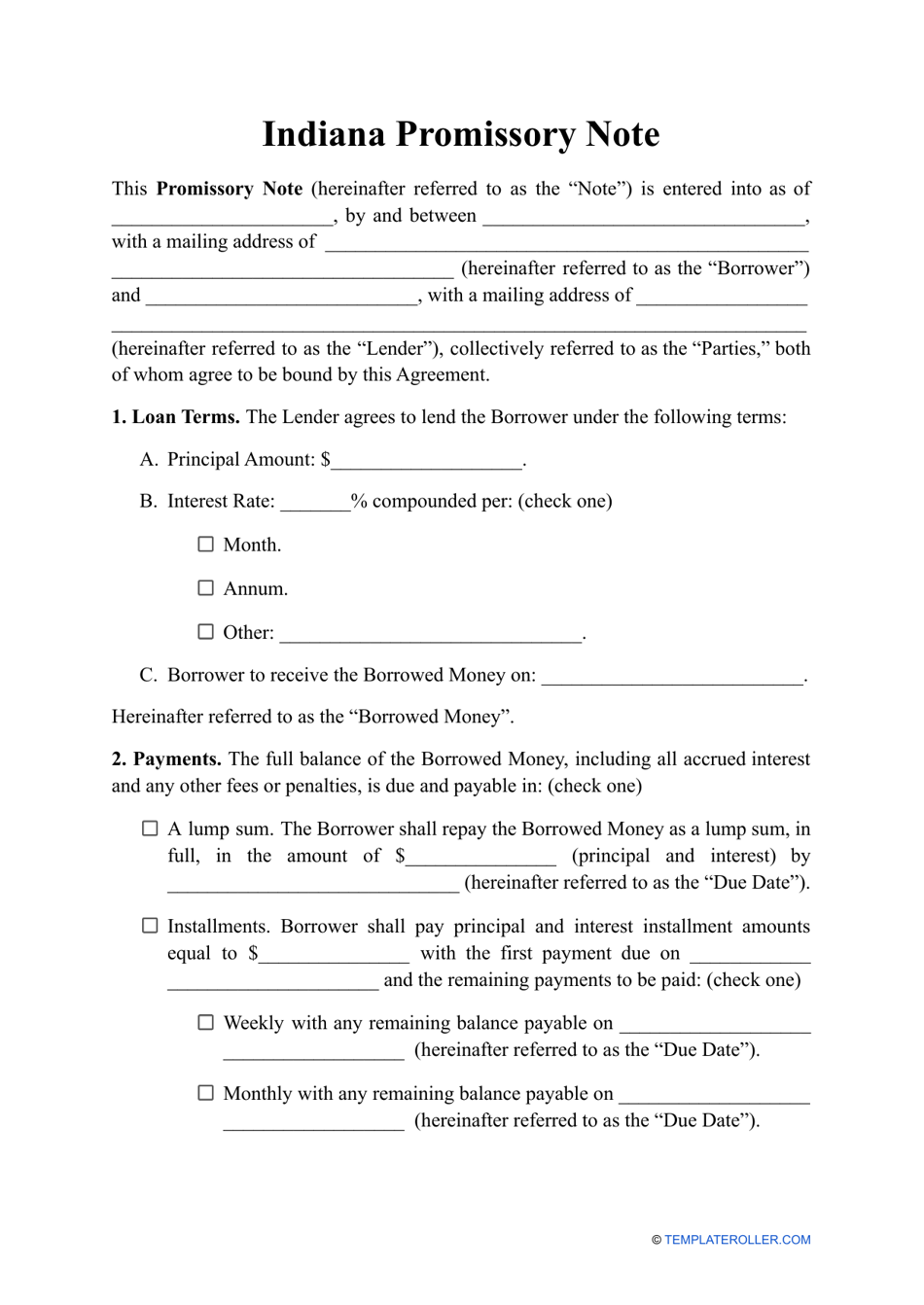

Promissory Note Template - Indiana

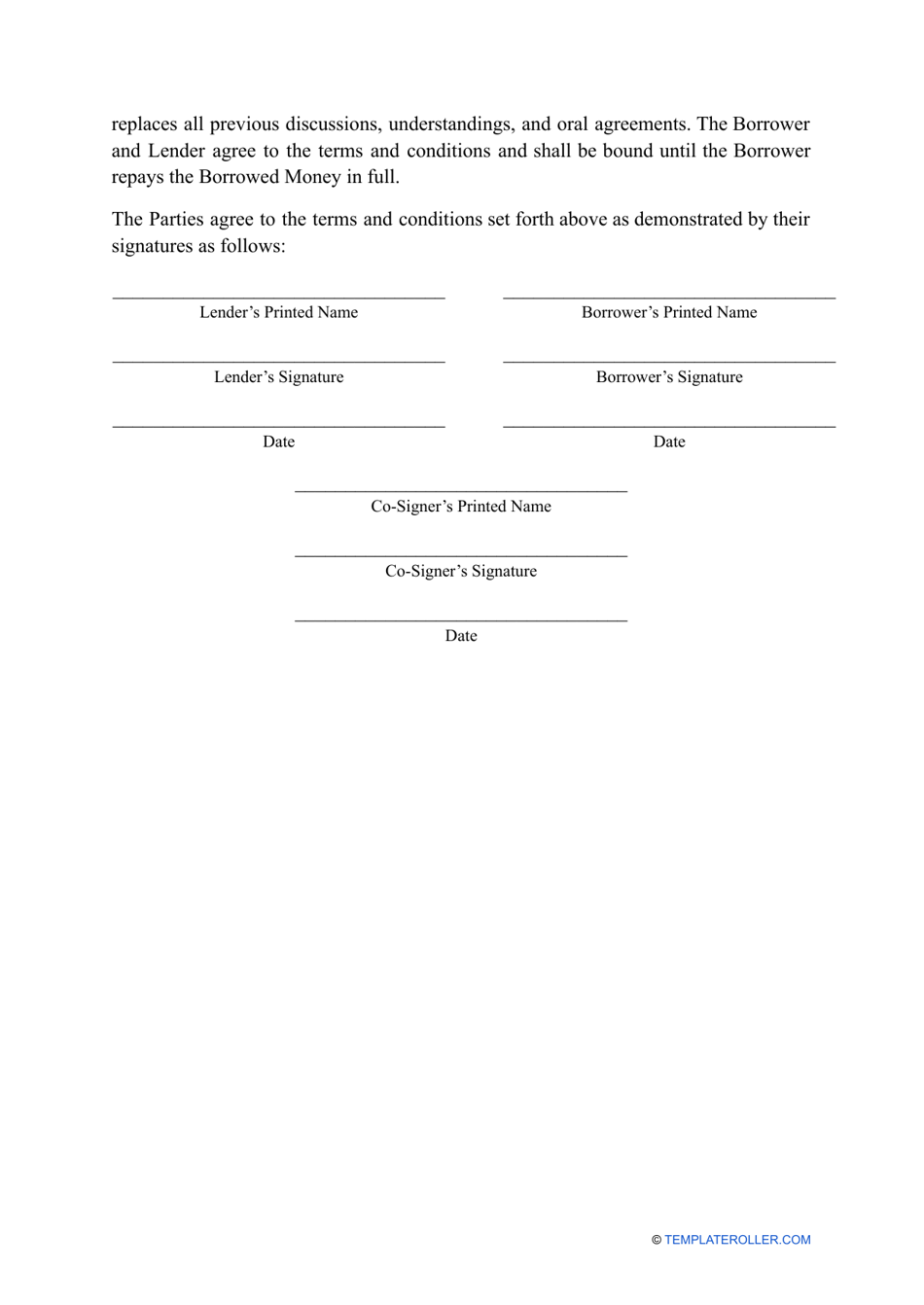

A promissory note template in Indiana is a standardized form that outlines the terms and conditions of a loan agreement between two parties. It is used to legally document the borrower's promise to repay a specific amount of money to the lender within a specified time frame.

The promissory note template in Indiana is typically filed by the borrower.

FAQ

Q: What is a promissory note?

A: A promissory note is a legal document that outlines the terms and conditions of a loan or debt agreement.

Q: Why would I need a promissory note?

A: You may need a promissory note if you are lending or borrowing money and want to establish a formal agreement.

Q: Is a promissory note enforceable in Indiana?

A: Yes, a properly executed promissory note is enforceable in Indiana.

Q: What information should be included in a promissory note?

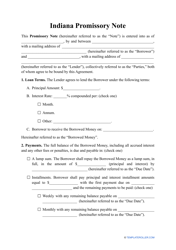

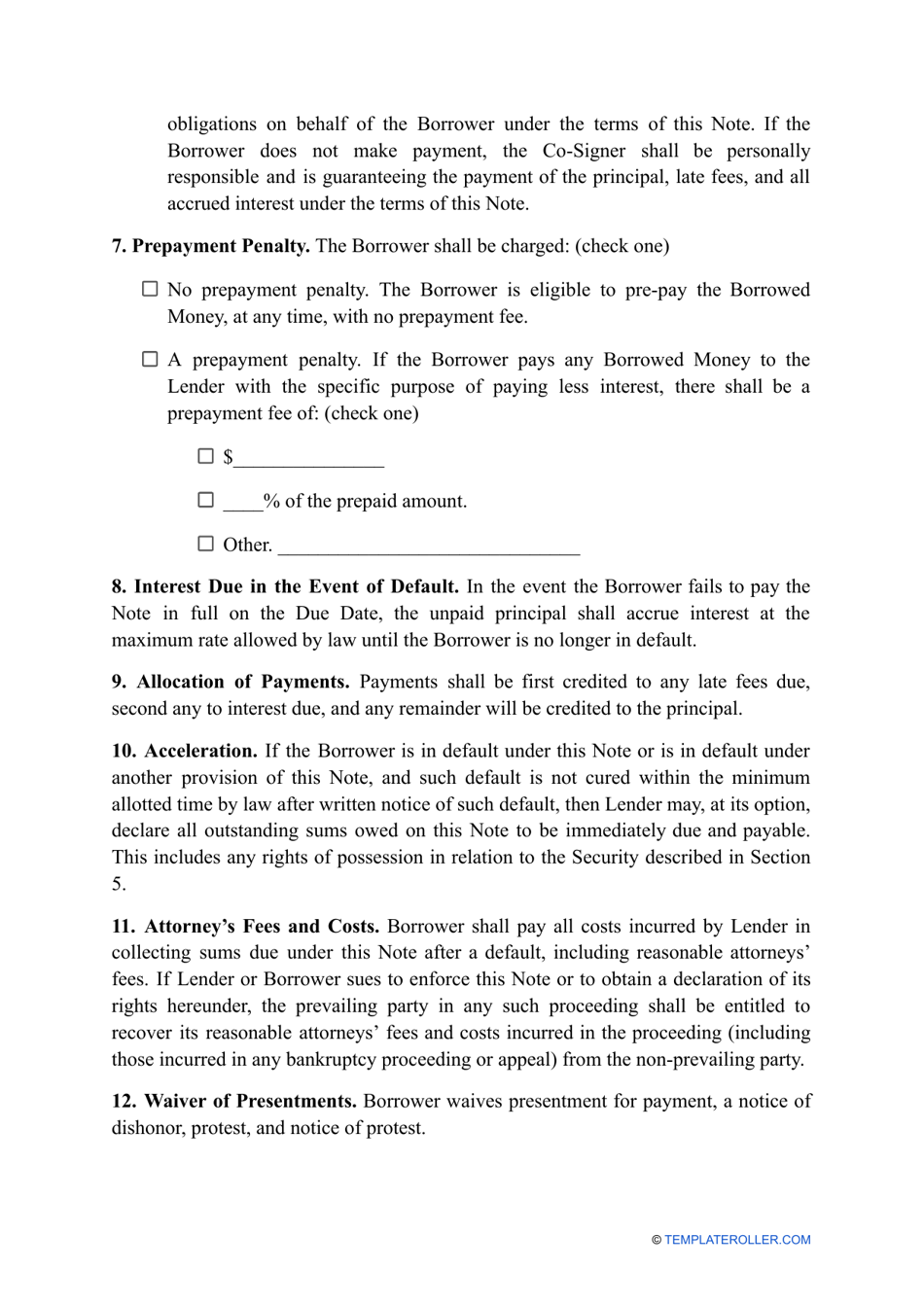

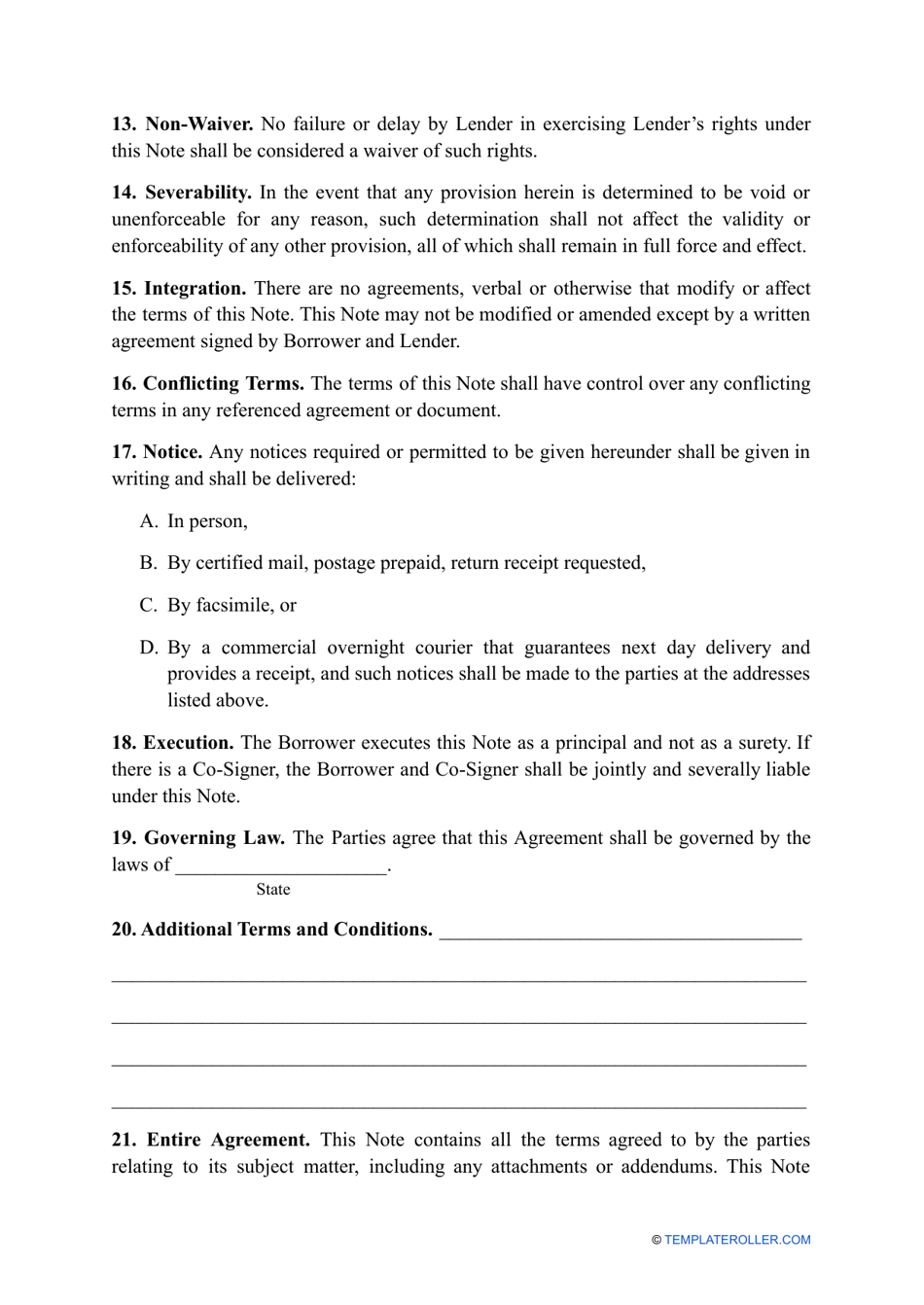

A: A promissory note should include the names of the parties involved, the loan amount, the interest rate (if applicable), the repayment schedule, and any penalties for late payment.

Q: Can I use a promissory note for any type of loan?

A: Yes, a promissory note can be used for personal loans, business loans, or any other type of loan agreement.

Q: Do I need to consult a lawyer to create a promissory note?

A: It is not required, but it may be helpful to consult a lawyer to ensure that the promissory note is legally enforceable and meets your specific needs.

Q: What happens if the borrower fails to repay the loan as agreed?

A: If the borrower fails to repay the loan as agreed upon in the promissory note, the lender may take legal action to recover the outstanding balance.

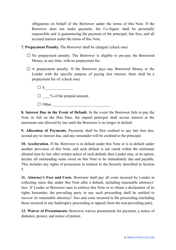

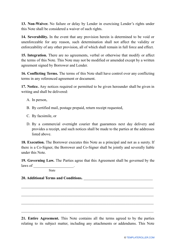

Q: Can the terms of a promissory note be modified?

A: Yes, the terms of a promissory note can be modified if both parties agree to the changes in writing.

Q: How long is a promissory note valid?

A: The validity of a promissory note will depend on the agreed-upon terms and repayment schedule as outlined in the document.