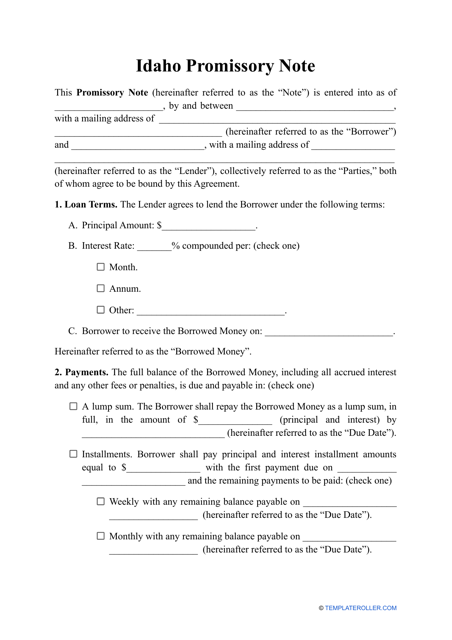

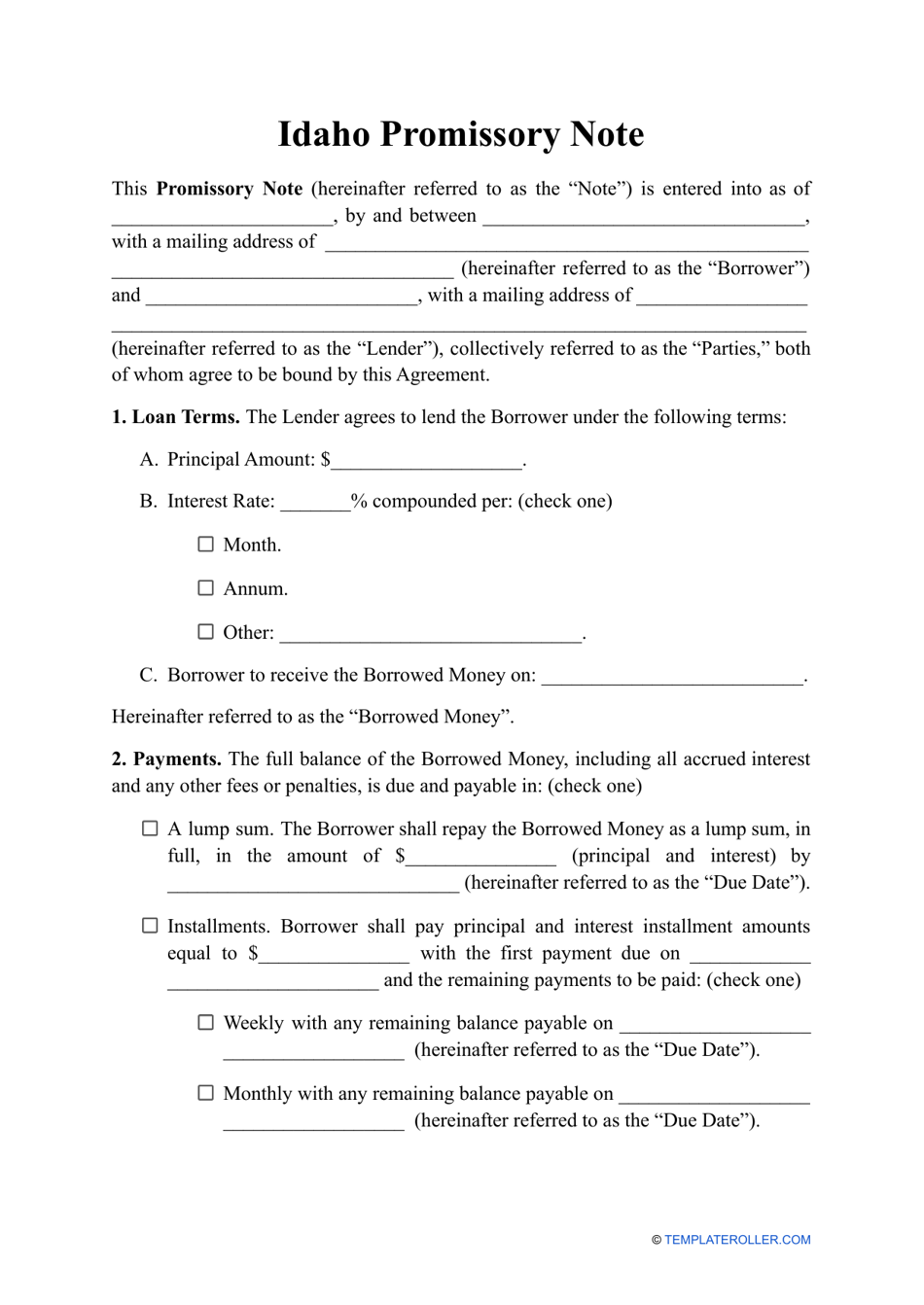

Promissory Note Template - Idaho

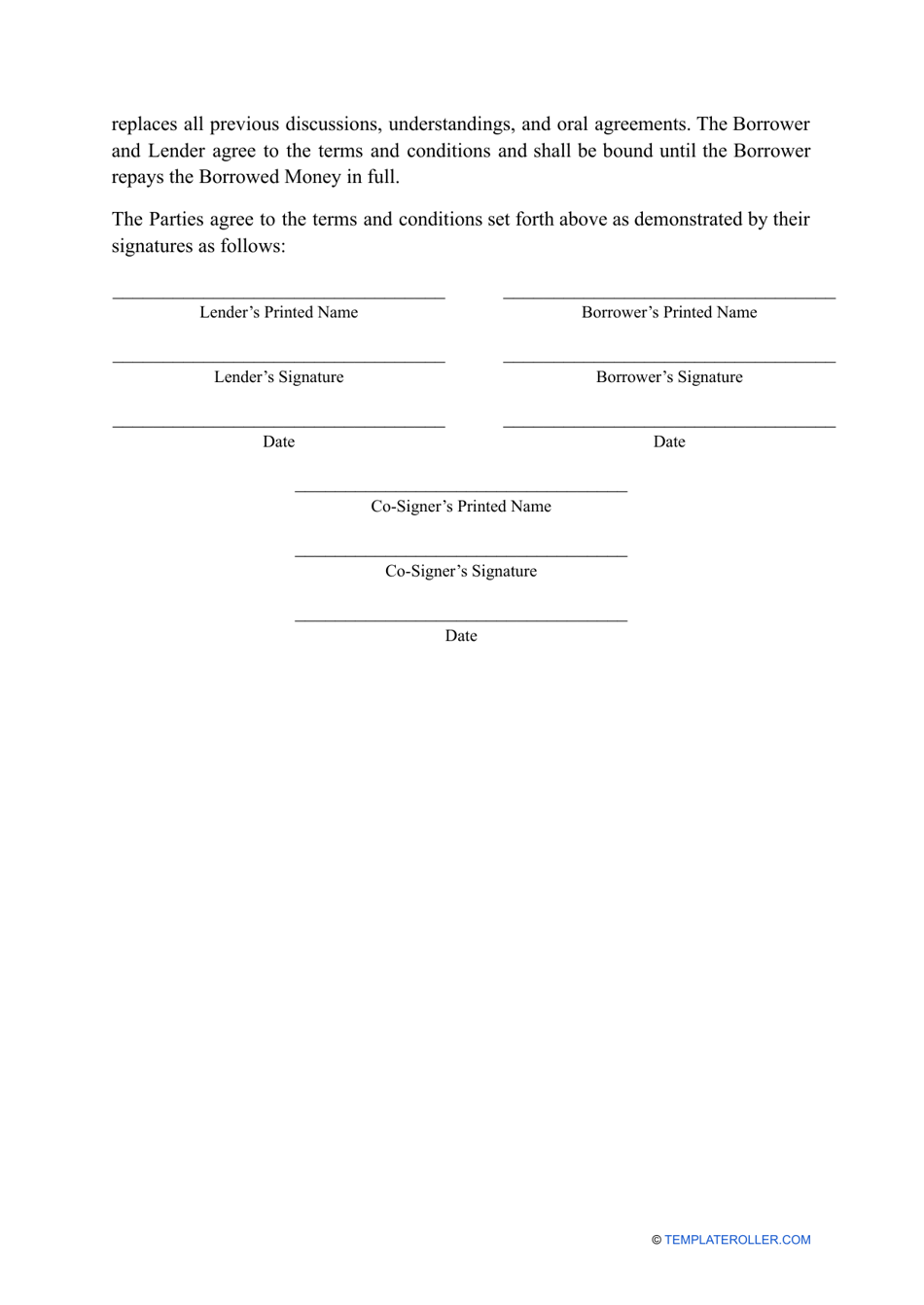

A Promissory Note Template in Idaho is a legal document used to outline the terms and conditions of a loan agreement between a lender and a borrower. It serves as a written promise by the borrower to repay a specific amount of money within a specified time frame.

The promissory note template in Idaho is typically filed by the borrower.

FAQ

Q: What is a promissory note?

A: A promissory note is a legal document that outlines the terms of a loan, including the amount borrowed, the interest rate, and the repayment schedule.

Q: Why would I need a promissory note?

A: A promissory note is typically used when lending or borrowing money between individuals or businesses to establish a legally binding agreement and provide documentation of the loan terms.

Q: What information should be included in a promissory note?

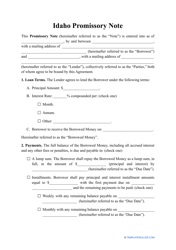

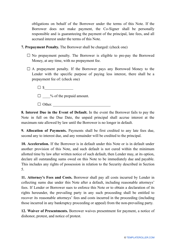

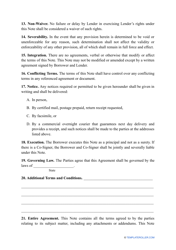

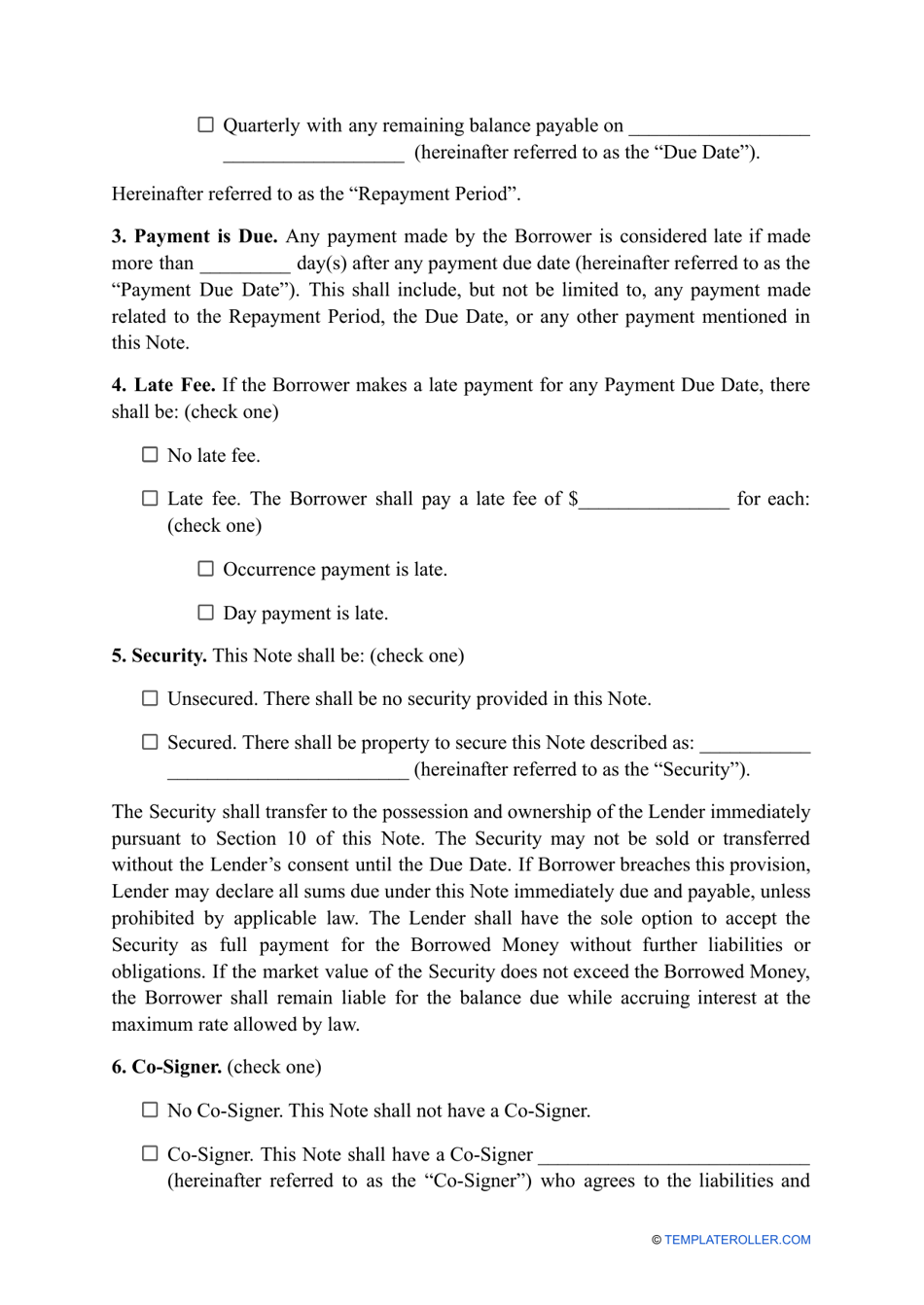

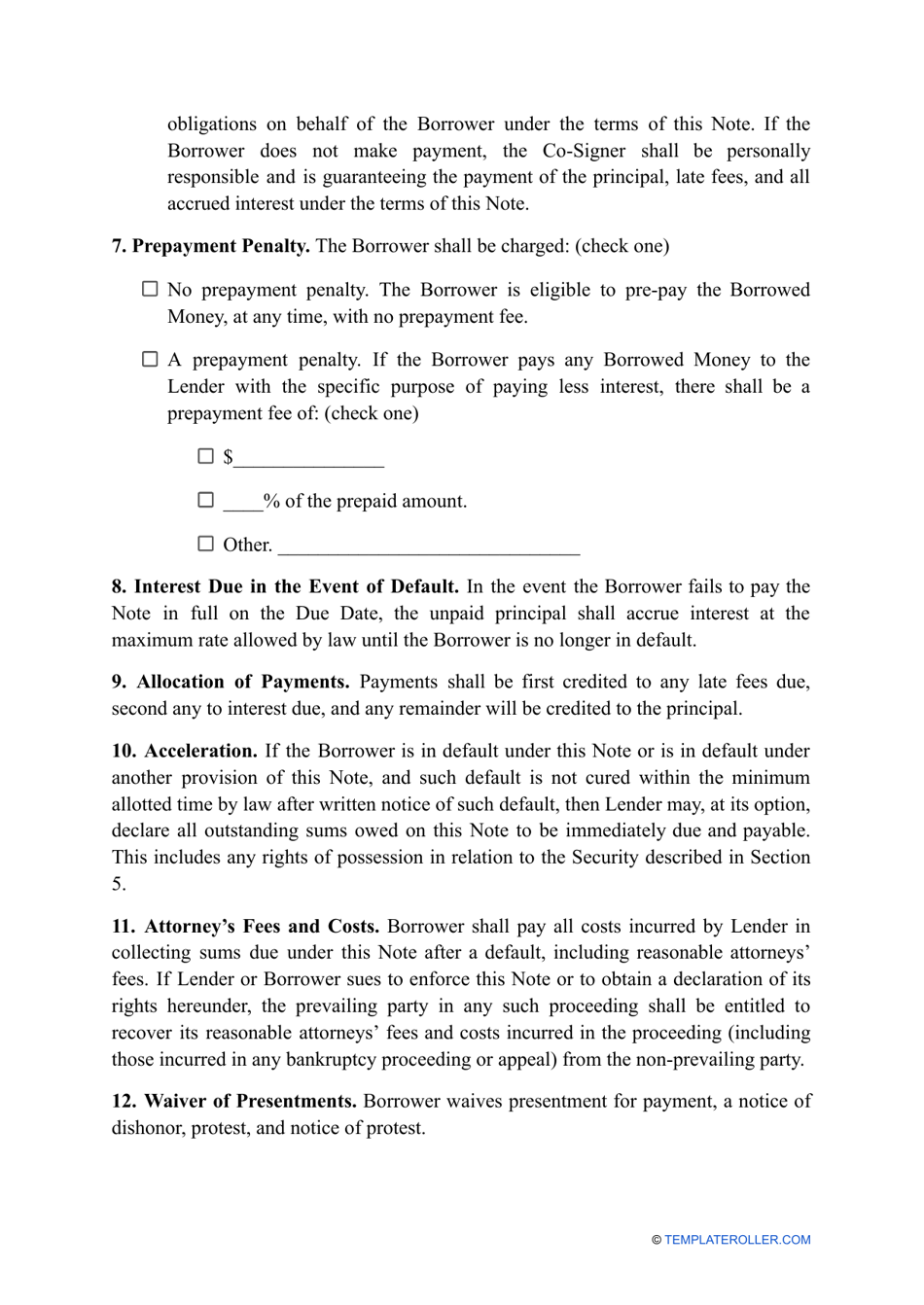

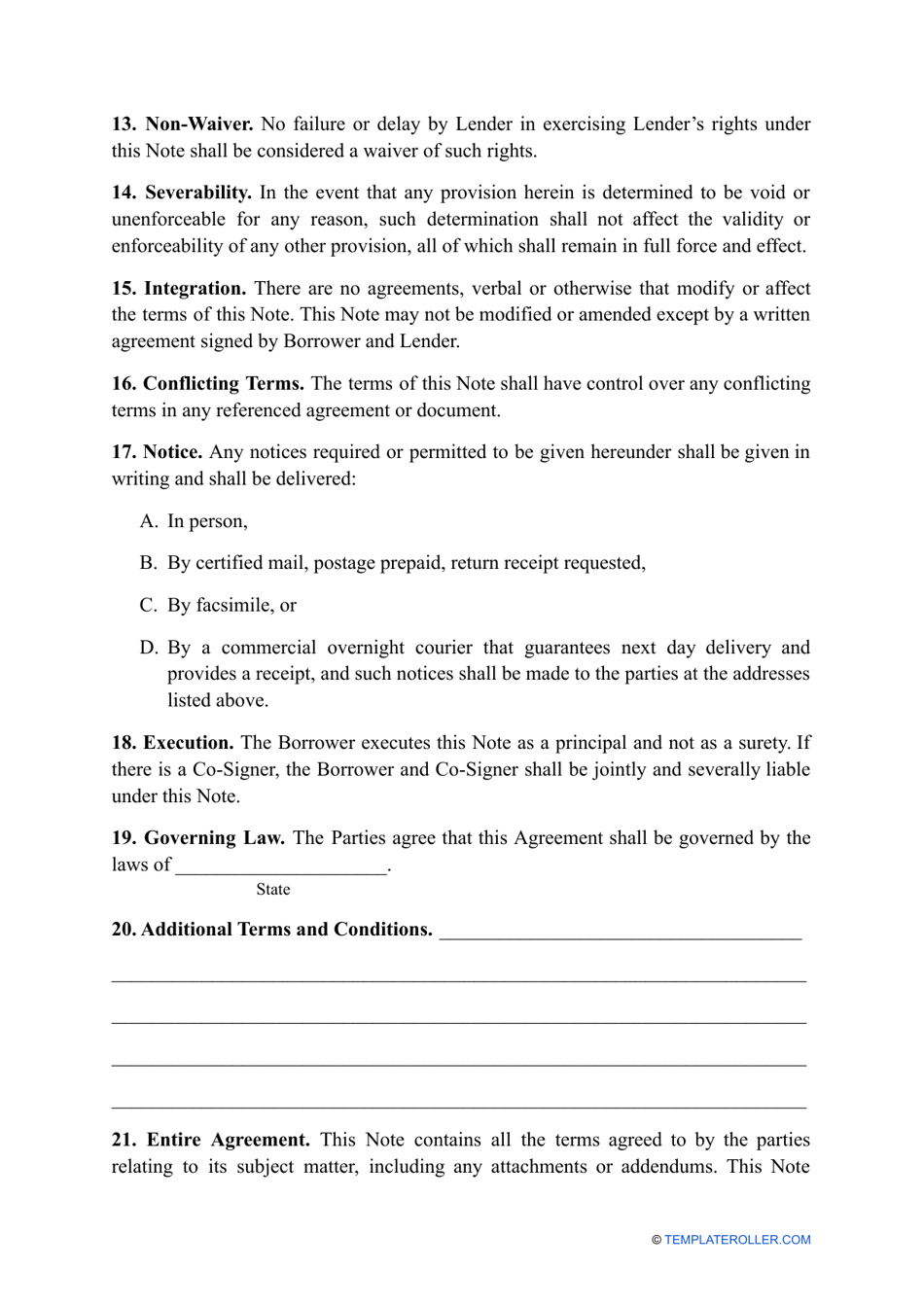

A: A promissory note should include the names and contact information of the lender and borrower, the loan amount, the interest rate, the repayment terms, and any other relevant details such as late payment fees or collateral.

Q: Is a promissory note legally enforceable in Idaho?

A: Yes, a properly executed promissory note is legally enforceable in Idaho, and a court can enforce its terms if necessary.