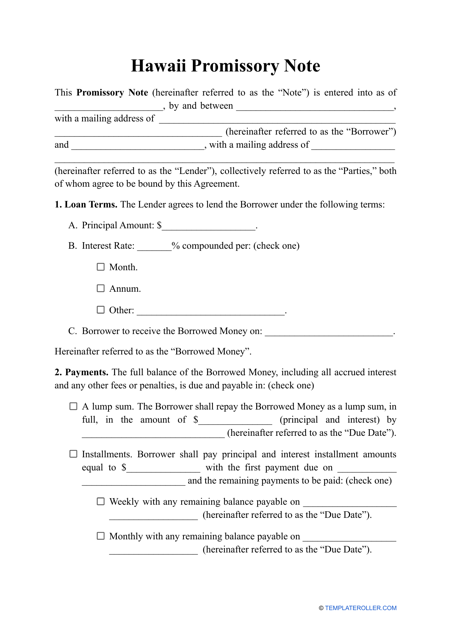

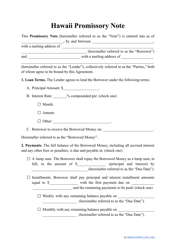

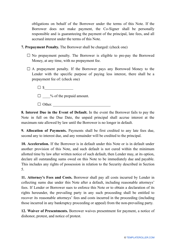

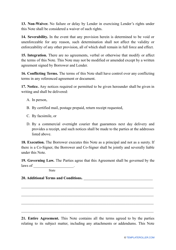

Promissory Note Template - Hawaii

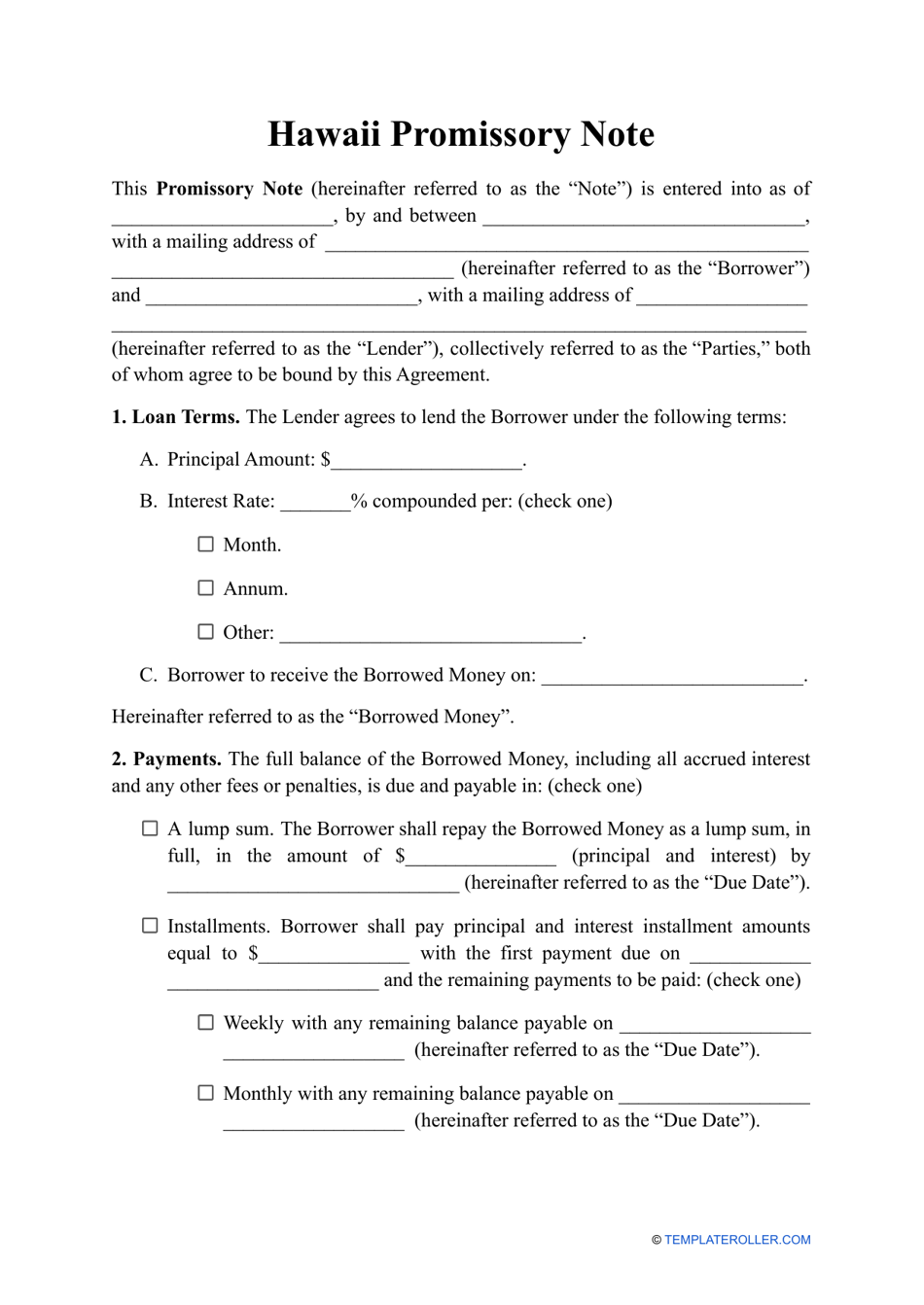

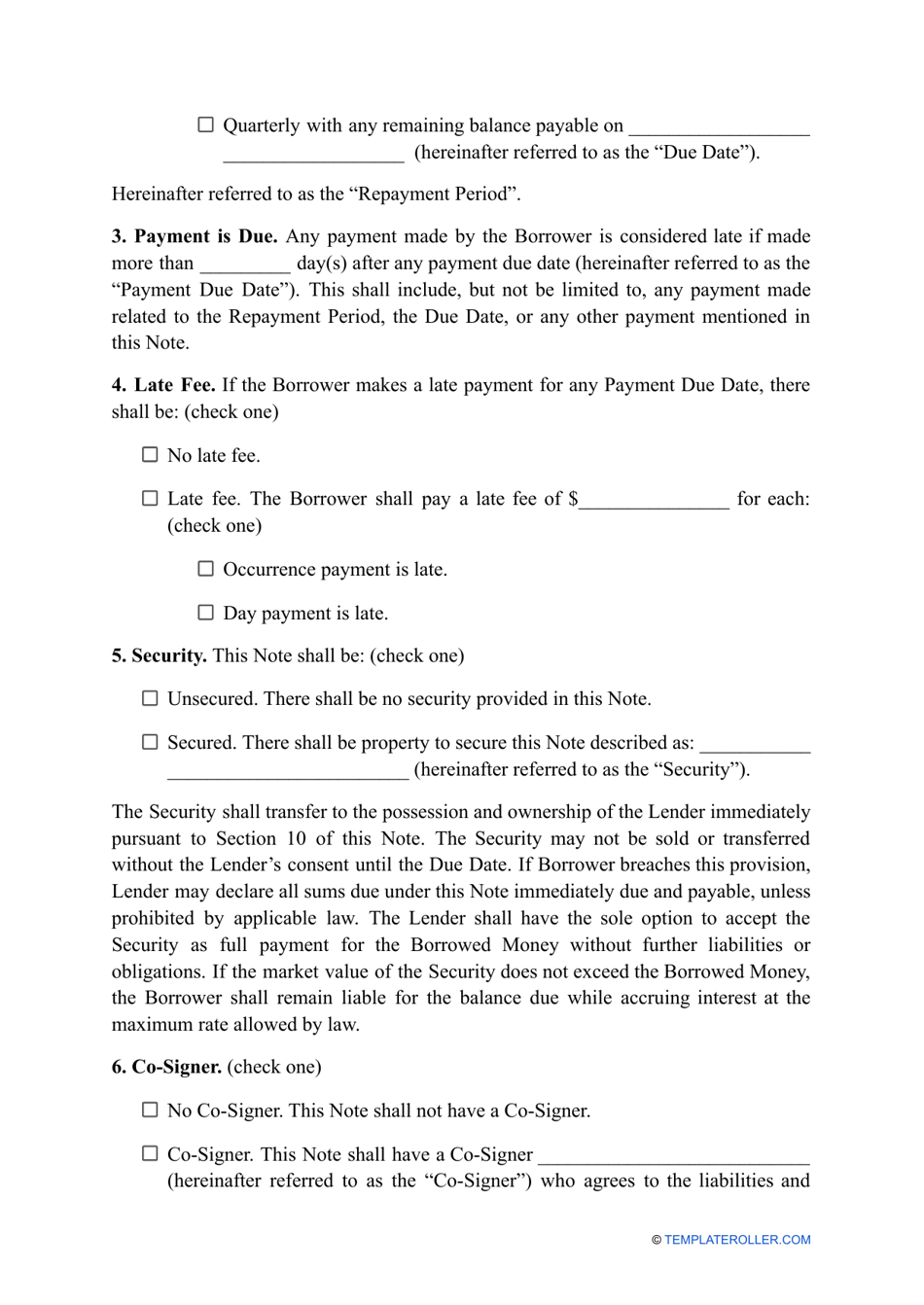

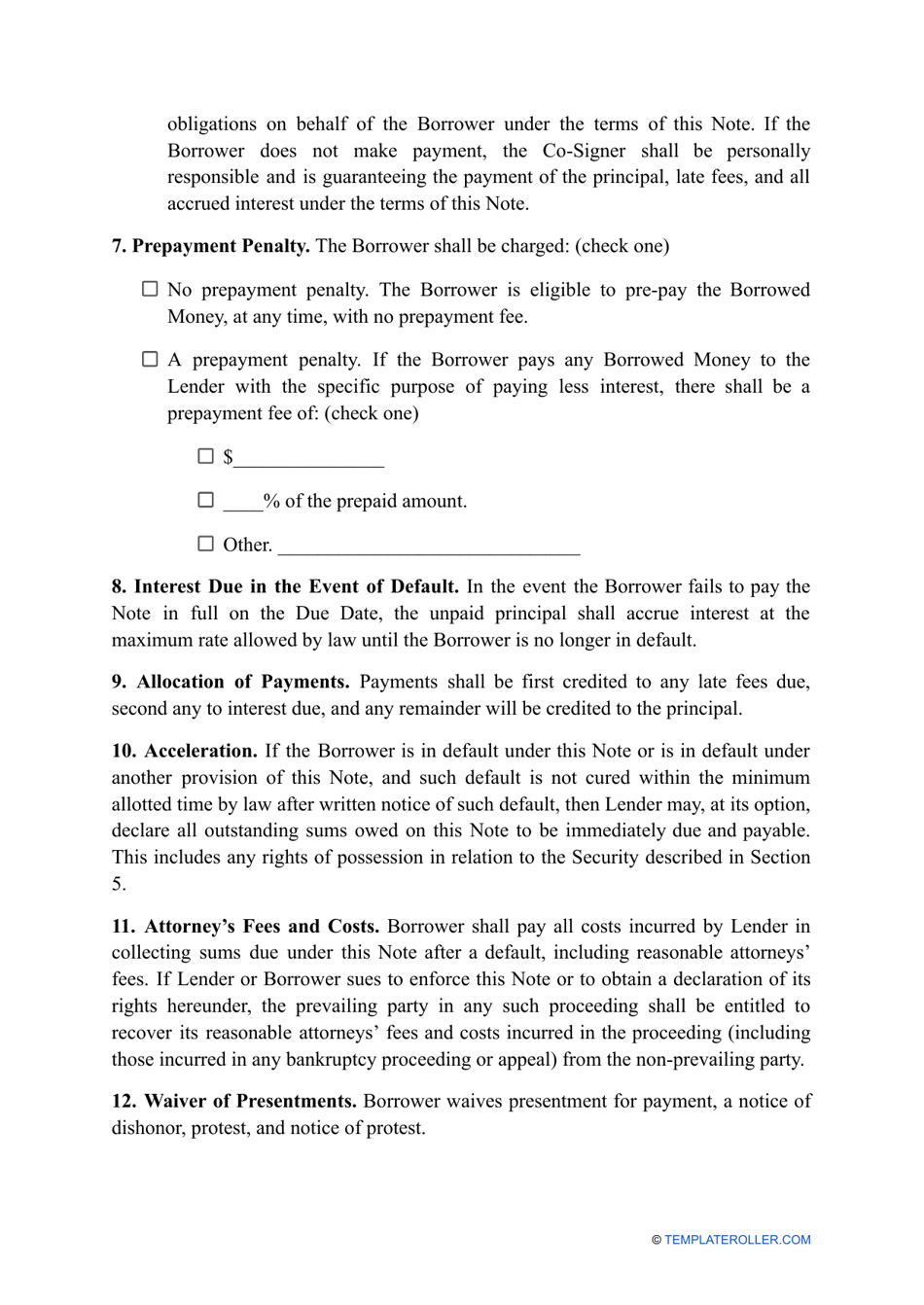

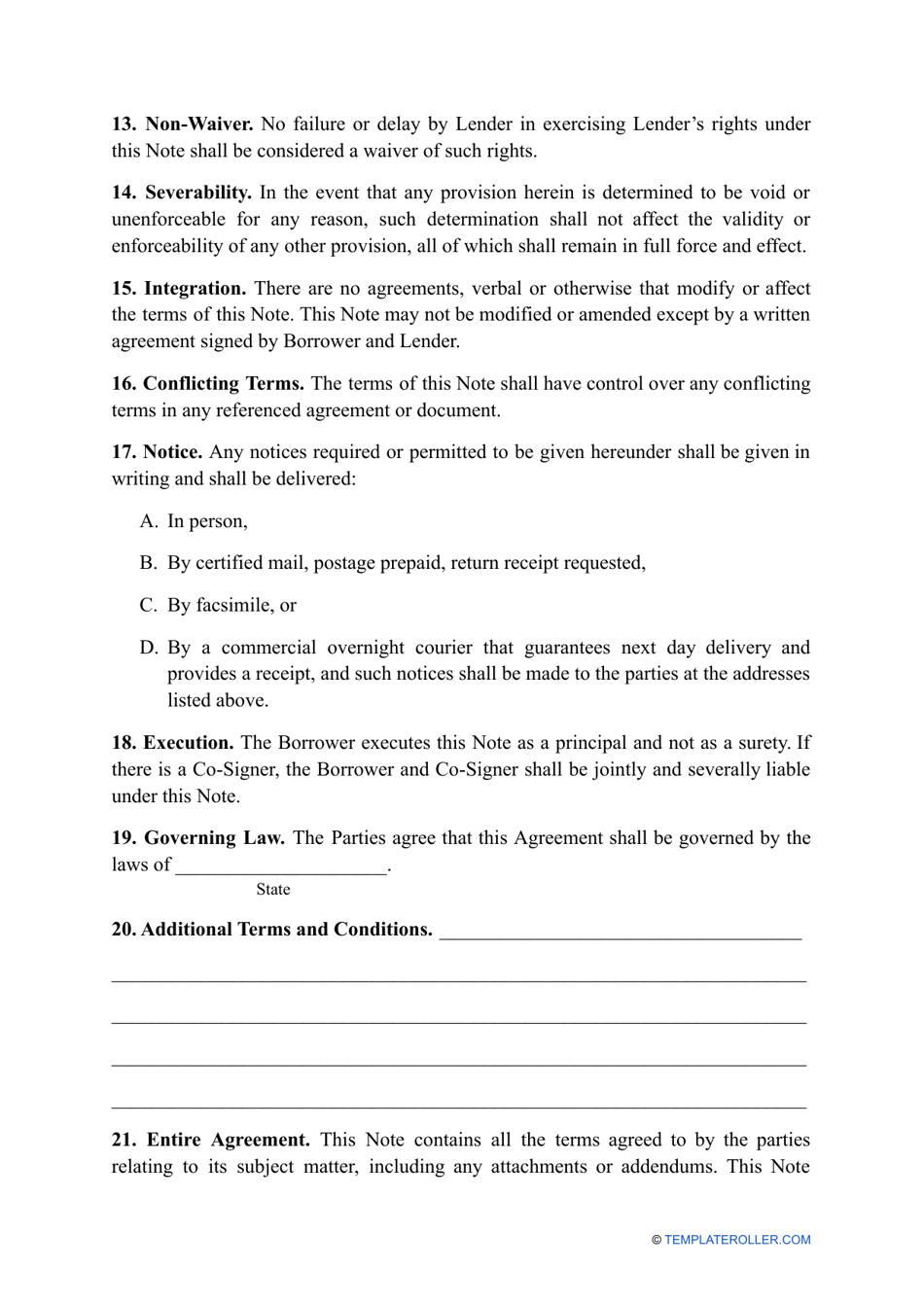

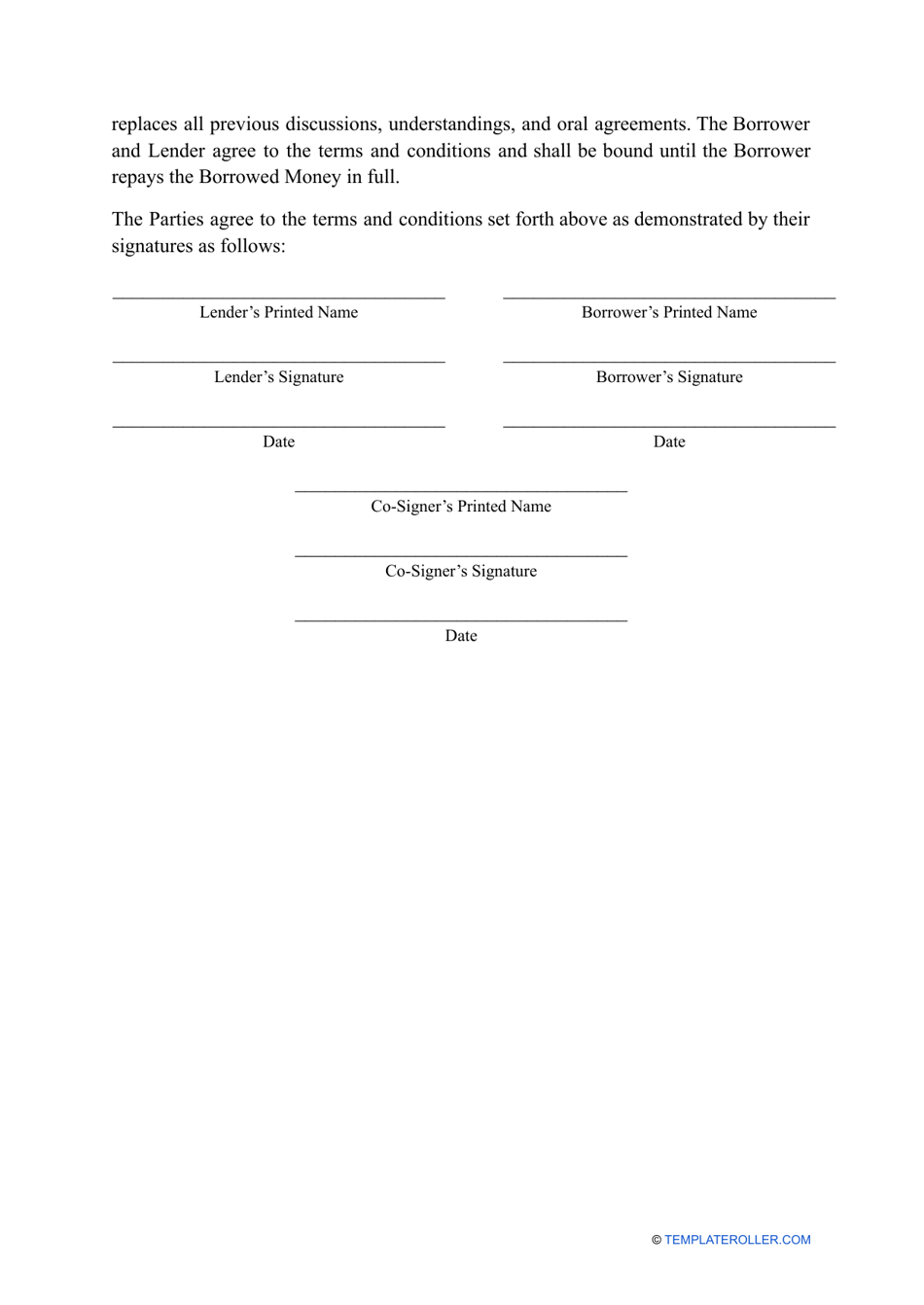

A promissory note template in Hawaii is used to create a legal document that outlines a promise to repay a specified amount of money to another party. It serves as a written agreement for a loan or debt and includes details such as the amount borrowed, repayment terms, and any applicable interest rates.

The promissory note template in Hawaii is typically filed by the borrower.

FAQ

Q: What is a promissory note?

A: A promissory note is a written agreement to repay a specific amount of money by a certain date.

Q: Why would I need a promissory note?

A: You may need a promissory note when lending or borrowing money, to lay out the terms of the loan.

Q: What should be included in a promissory note?

A: A promissory note should include the names of the lender and borrower, the loan amount, interest rate, repayment terms, and any collateral.

Q: Is a promissory note legally binding?

A: Yes, a promissory note is a legally enforceable contract.

Q: Can I use a promissory note for business loans?

A: Yes, a promissory note can be used for both personal and business loans.

Q: Can I modify a promissory note template?

A: Yes, you can modify a promissory note template to fit your specific needs, but it's important to consult with a legal professional to ensure it remains legally valid.

Q: Do I need a lawyer to create a promissory note?

A: While it's not required to have a lawyer create a promissory note, it's often recommended to ensure that the document is legally sound.

Q: Can I use a promissory note in Hawaii?

A: Yes, you can use a promissory note in Hawaii as long as it meets the necessary legal requirements.

Q: What happens if I don't repay a promissory note?

A: If you don't repay a promissory note, the lender may take legal action to try and recover the money, potentially leading to damage to your credit and additional fees.