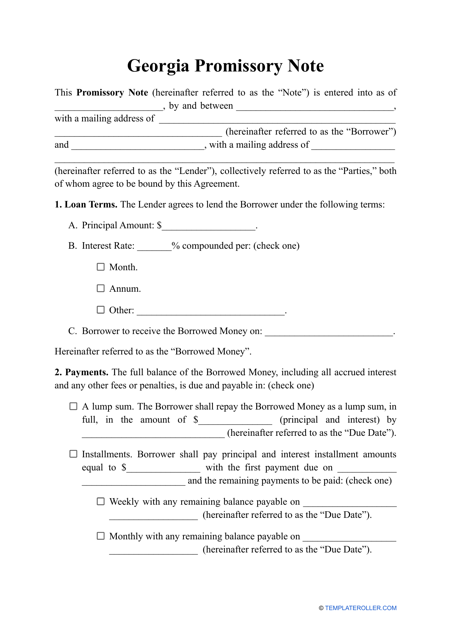

Promissory Note Template - Georgia (United States)

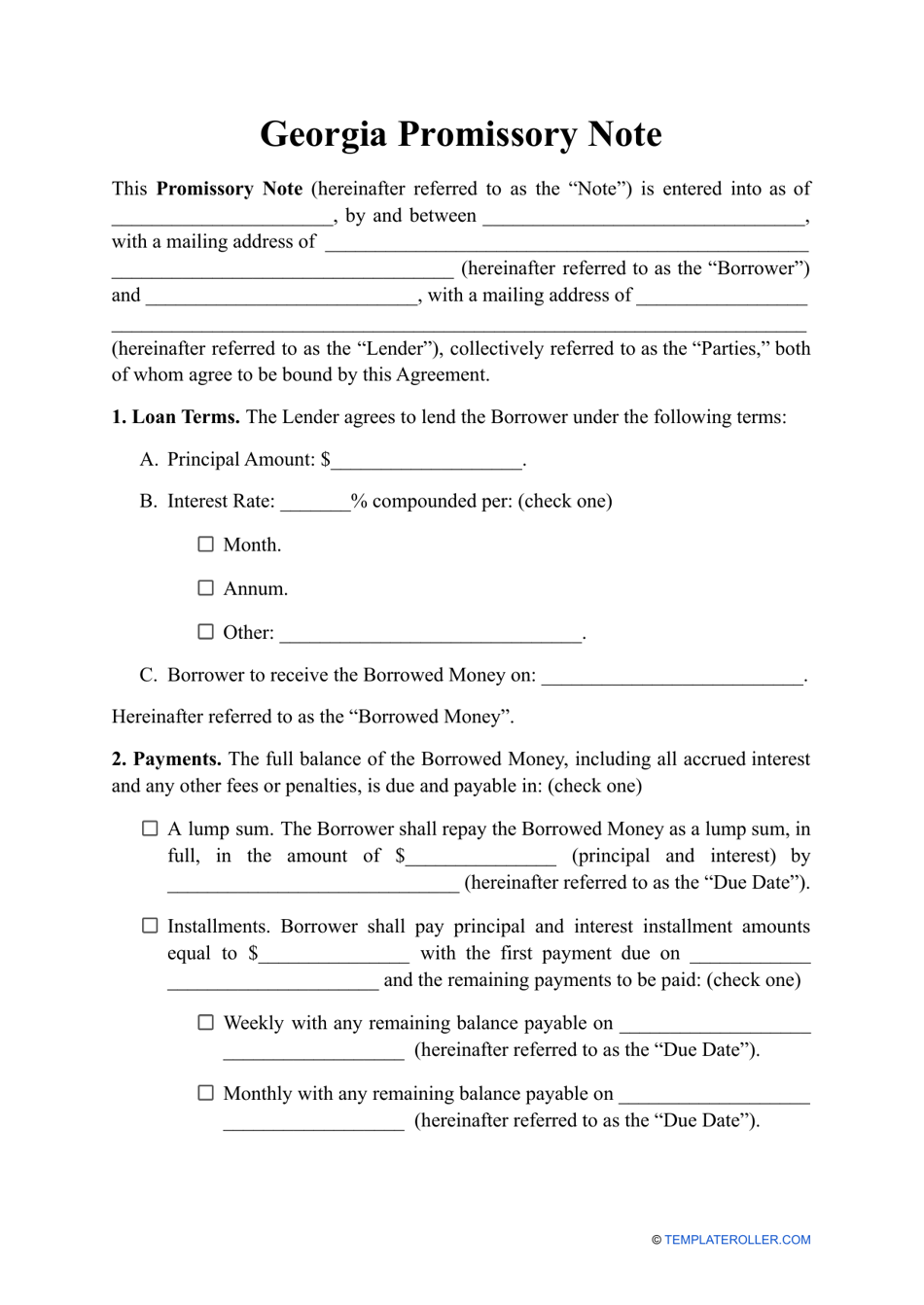

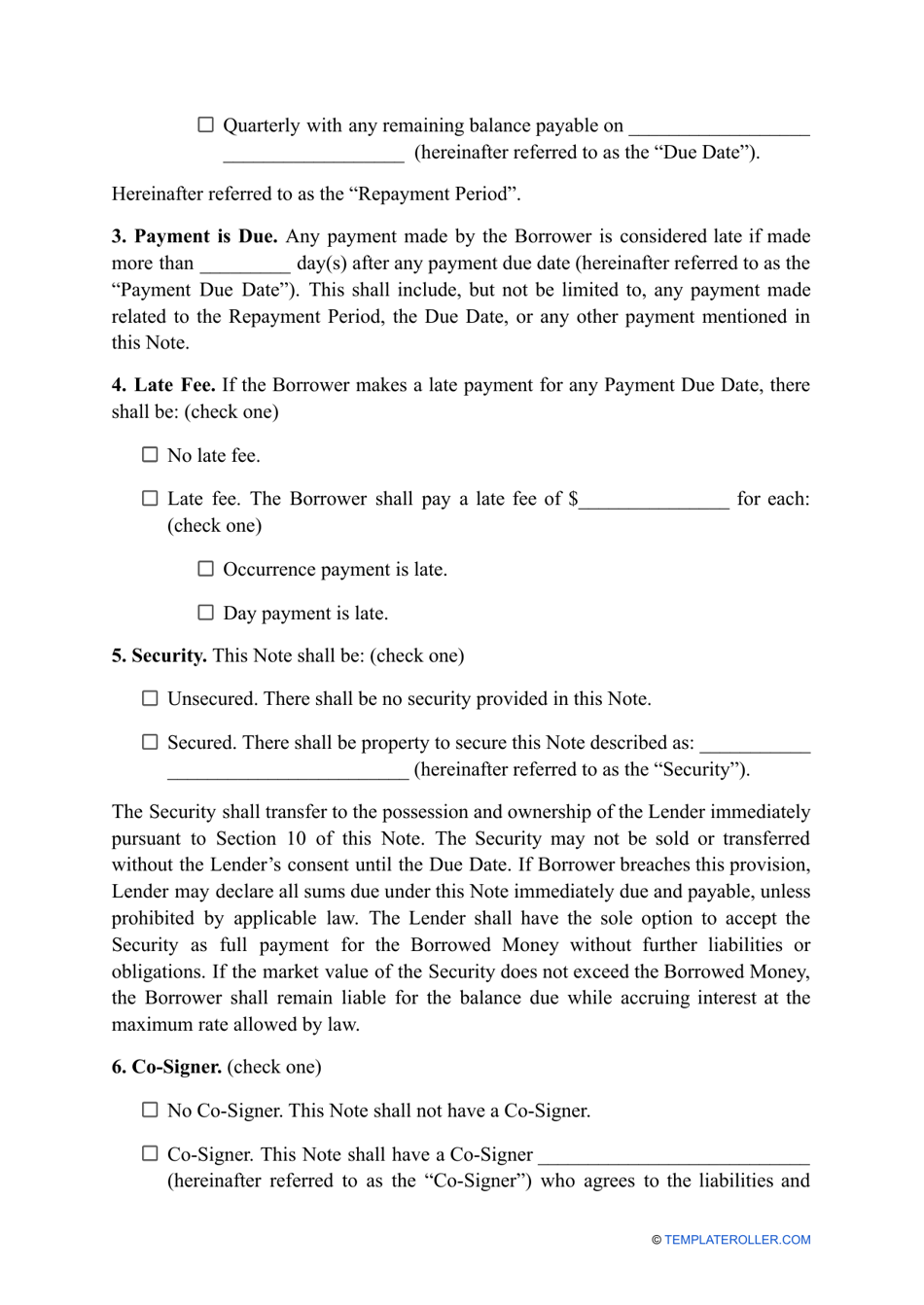

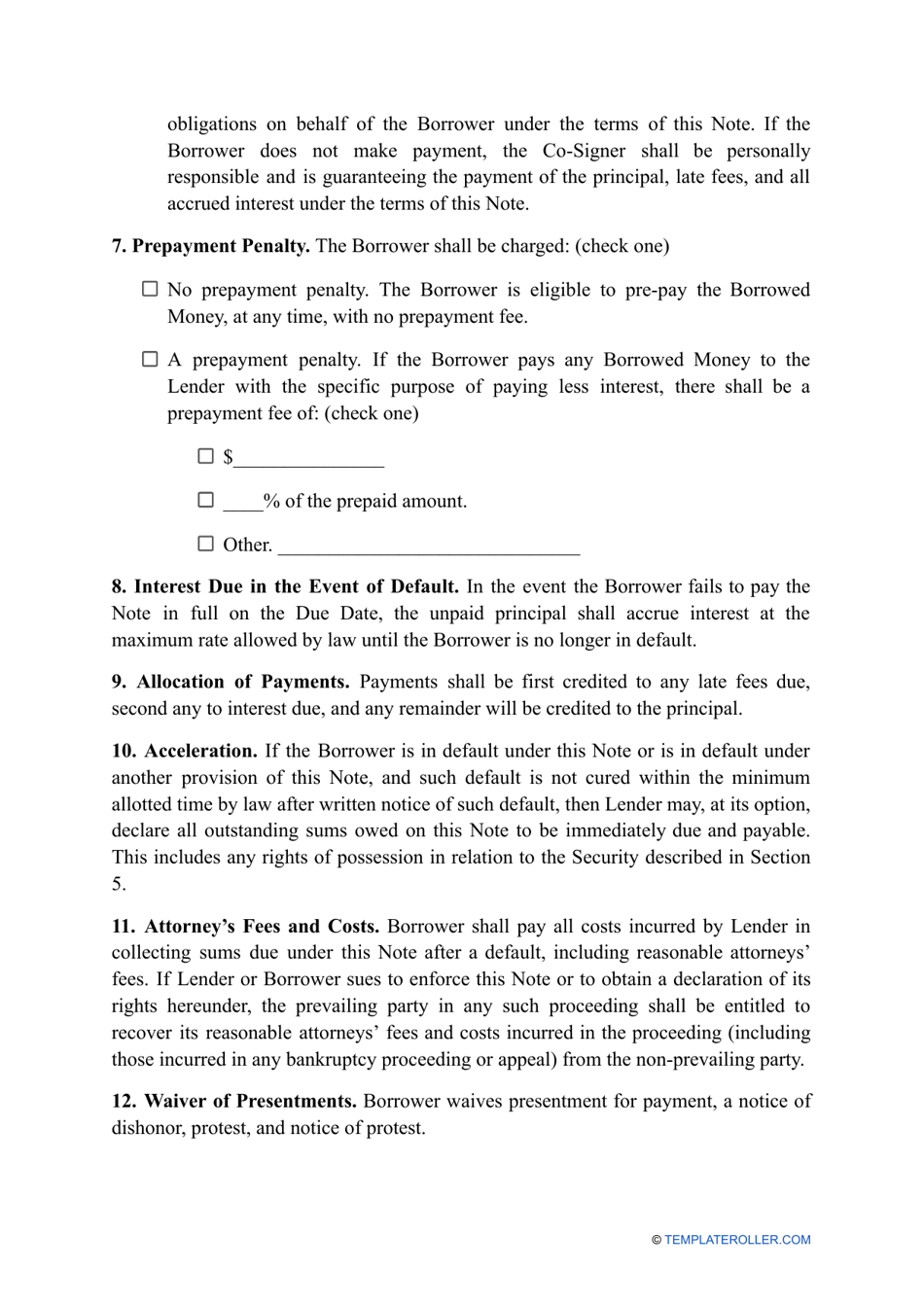

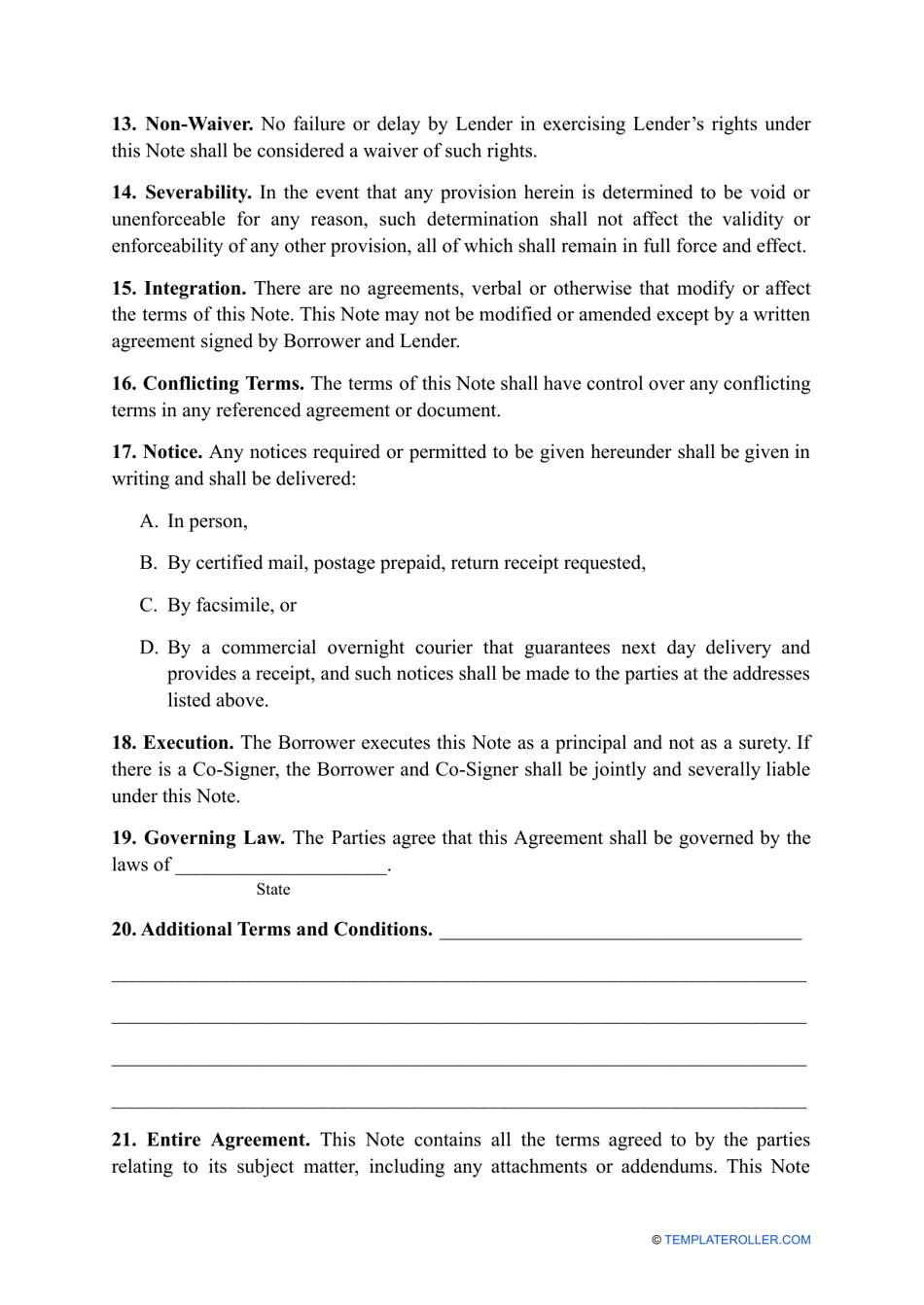

A Promissory Note Template in Georgia (United States) is used as a legal document to record a promise to repay a debt. It outlines the terms and conditions of the loan, including the amount borrowed, interest rate, repayment schedule, and consequences for non-payment. It is important for both the lender and the borrower to have a written agreement in order to protect their rights and obligations.

The individual or party who is lending the money typically files the promissory note template in Georgia (United States).

FAQ

Q: What is a promissory note?

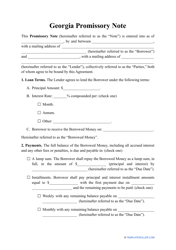

A: A promissory note is a legally binding document that outlines the terms and conditions of a loan, including the amount borrowed, the interest rate, and the repayment schedule.

Q: Why do I need a promissory note?

A: A promissory note provides written evidence of a loan and helps protect the lender's rights by specifying the borrower's obligations and repayment terms.

Q: What should be included in a promissory note?

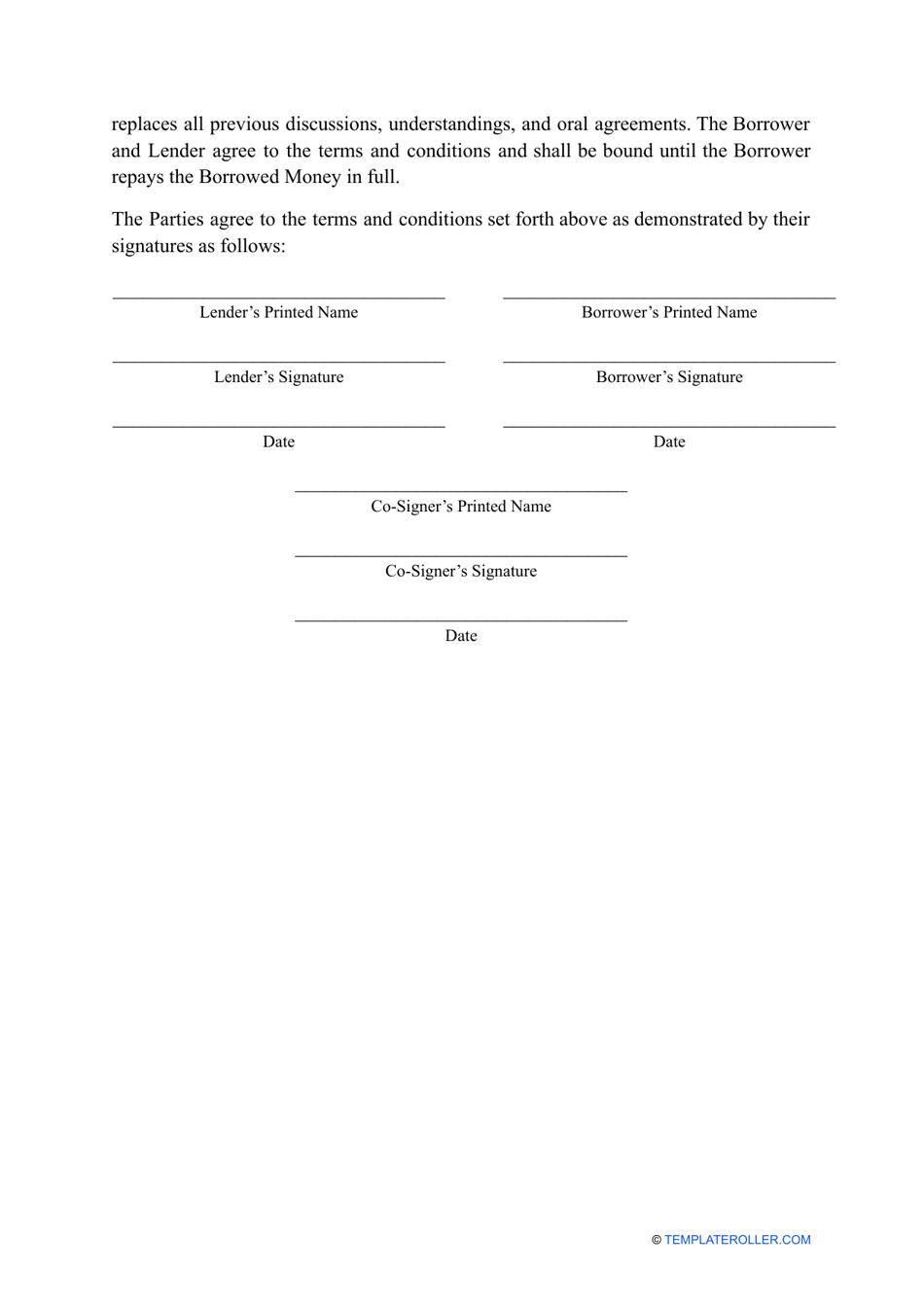

A: A promissory note should include the names of the borrower and lender, the loan amount, the interest rate, the repayment terms, and any late fees or penalties.

Q: Can I use a promissory note for personal loans?

A: Yes, a promissory note can be used for personal loans between family members or friends, as well as for business loans.

Q: Is a promissory note enforceable in court?

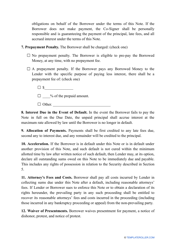

A: Yes, a properly executed promissory note is legally enforceable in court, and the lender can take legal action to recover the loan if the borrower fails to repay according to the terms.

Q: Can I modify a promissory note template?

A: Yes, you can modify a promissory note template to suit your specific loan agreement, but it's important to ensure that all necessary details and legal requirements are included.

Q: Do I need a witness or notary for a promissory note?

A: While it is not required by law, having a witness or notary sign the promissory note can add an extra layer of validity and credibility to the document.

Q: How long is a promissory note valid?

A: The validity of a promissory note depends on the duration specified in the document and the applicable state laws. In Georgia, the statute of limitations for enforcing a promissory note is six years.

Q: What happens if the borrower defaults on a promissory note?

A: If the borrower defaults on a promissory note, the lender may pursue legal action to recover the loan, which could include obtaining a judgment, wage garnishment, or seizing assets.