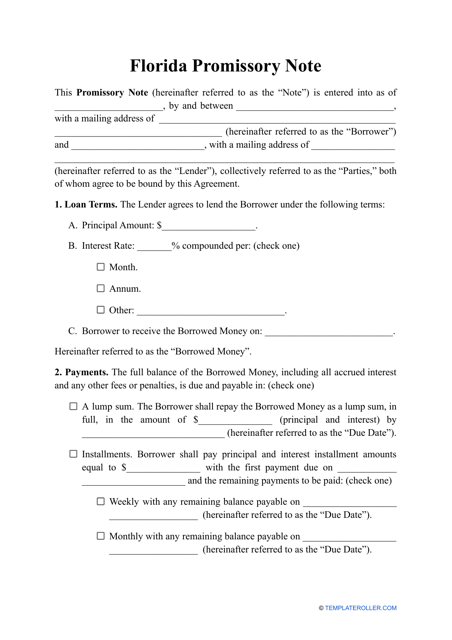

Promissory Note Template - Florida

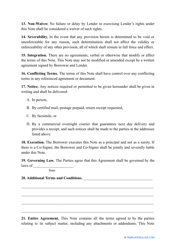

A Promissory Note Template in Florida is a legal document used to outline the terms and conditions of a loan or debt agreement between two parties. It specifies the amount borrowed, the interest rate, repayment terms, and other relevant details.

In Florida, the promissory note template is typically filed by the borrower.

FAQ

Q: What is a promissory note?

A: A promissory note is a legally binding document that outlines the terms and conditions of a loan agreement.

Q: When is a promissory note used?

A: A promissory note is used when one party lends money to another party and wants written proof of the loan terms.

Q: What should be included in a promissory note?

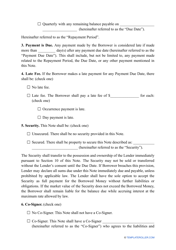

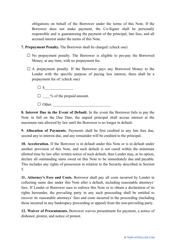

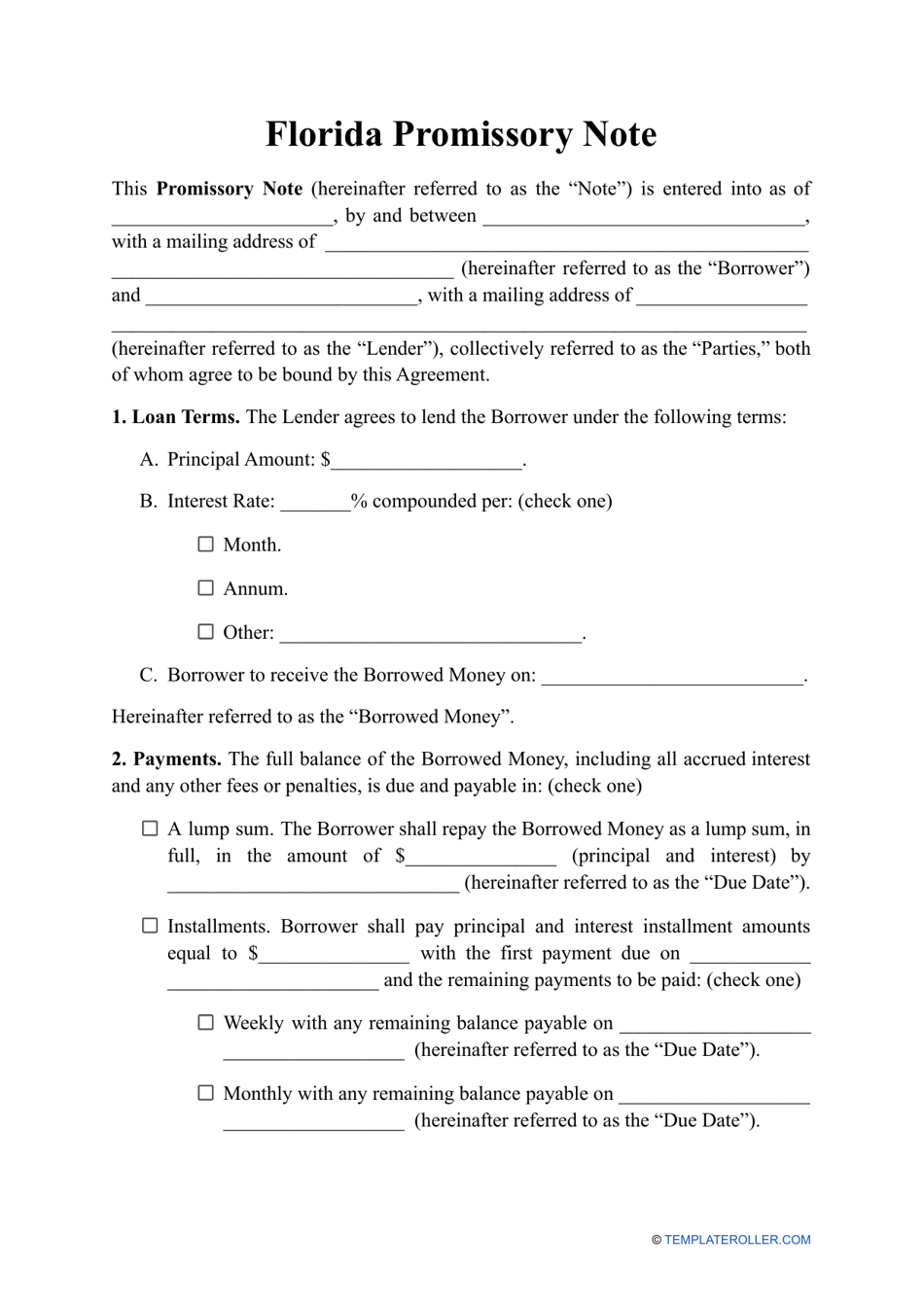

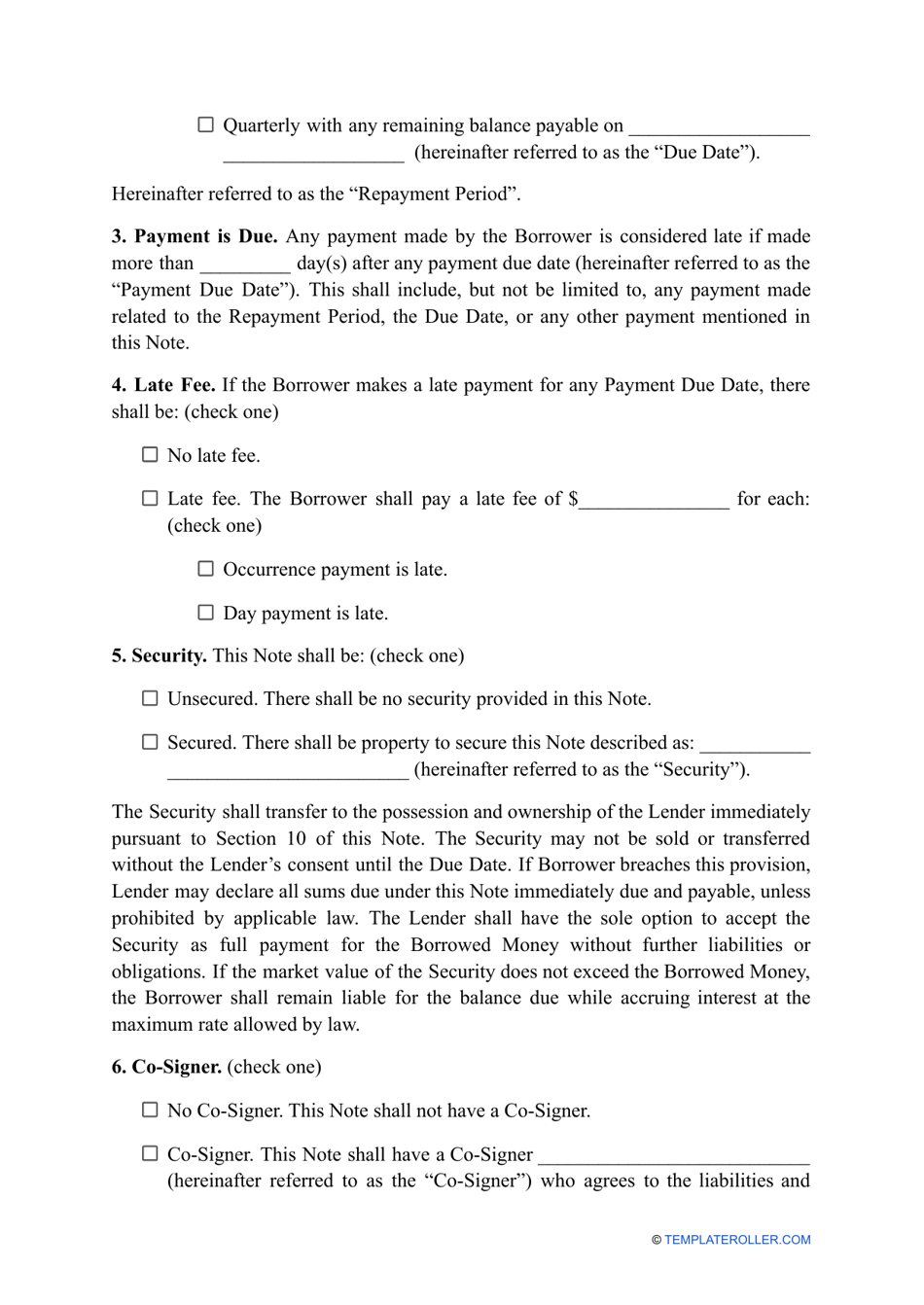

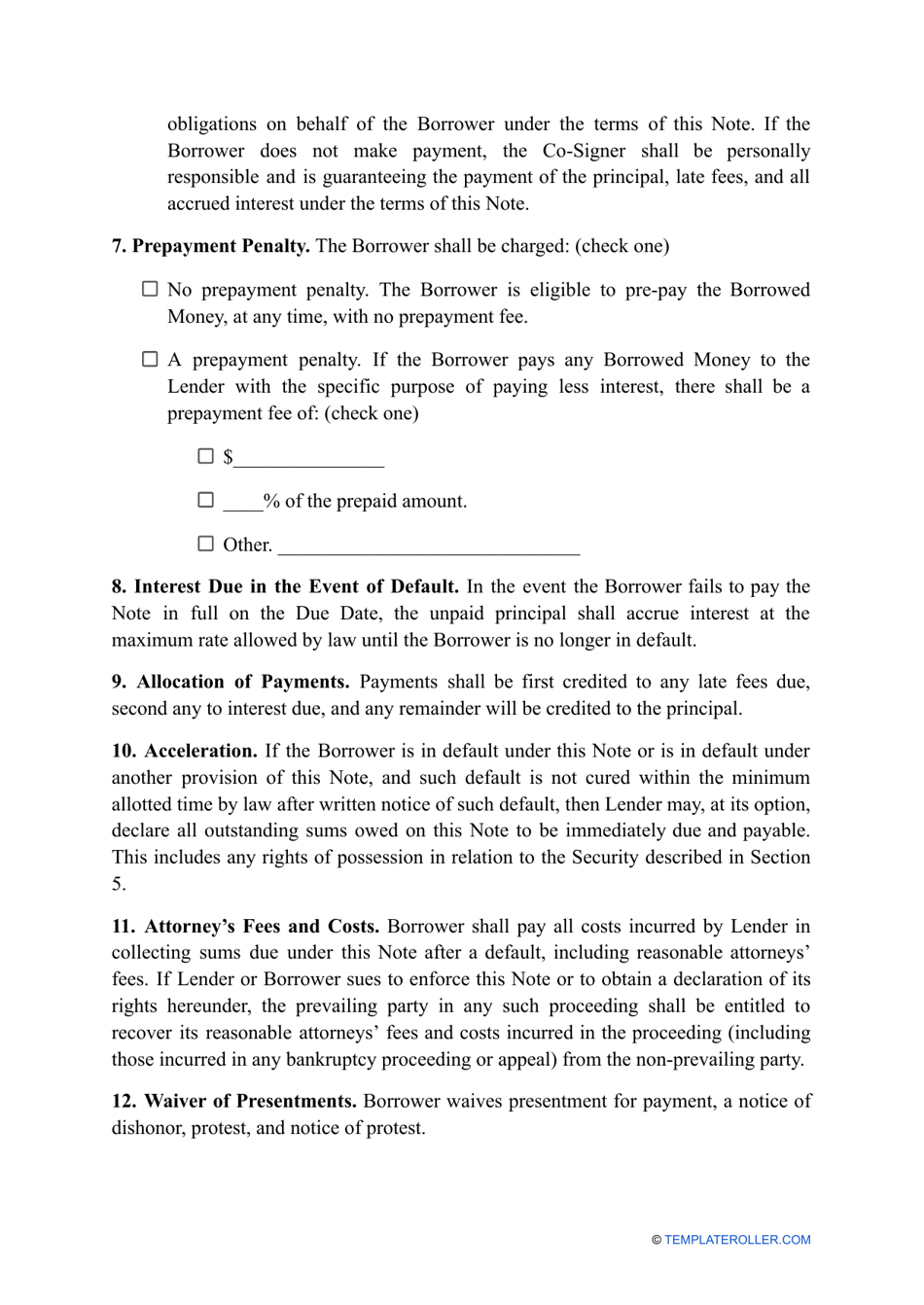

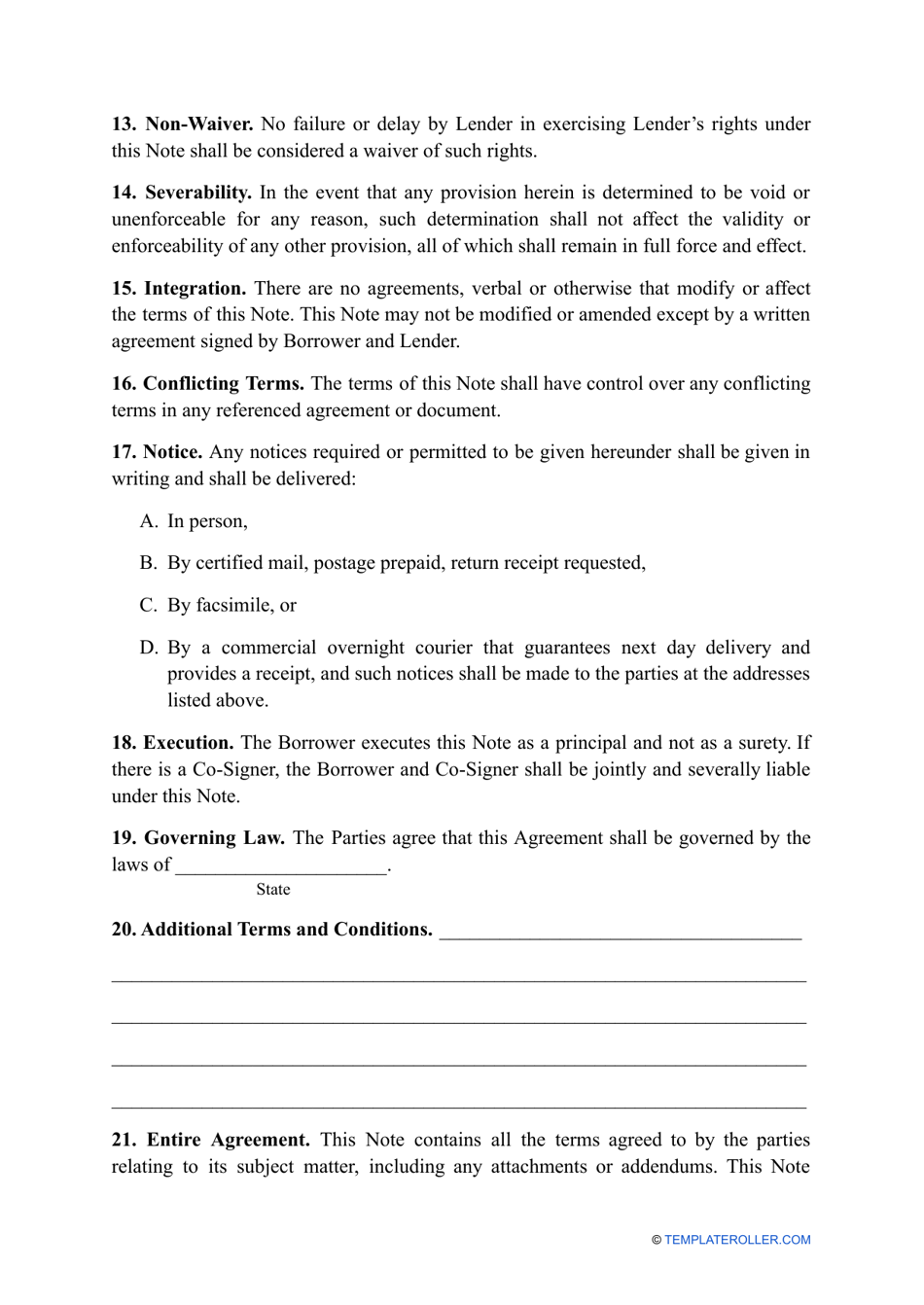

A: A promissory note should include information such as the names of the borrower and lender, the loan amount, the interest rate, the repayment terms, and any penalties for late payments or default.

Q: Do promissory notes need to be notarized in Florida?

A: No, promissory notes do not need to be notarized in Florida, but having them notarized can provide additional legal protection.

Q: Is a promissory note enforceable in court?

A: Yes, a promissory note is a legally binding contract and can be enforced in court if the borrower fails to repay the loan according to the terms.

Q: Can I use a promissory note for any type of loan?

A: Yes, a promissory note can be used for various types of loans, such as personal loans, business loans, or loans for purchasing a car or house.

Q: Can I modify a promissory note?

A: Yes, both parties can agree to modify the terms of a promissory note, but any changes should be documented in writing and signed by both parties.