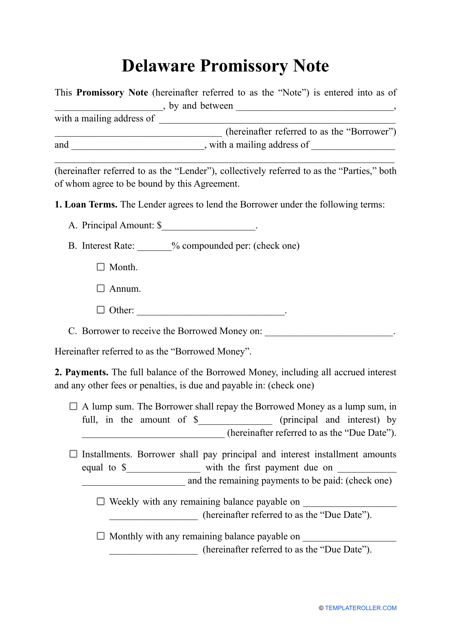

Promissory Note Template - Delaware

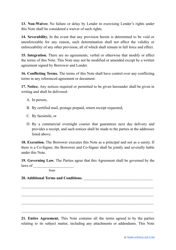

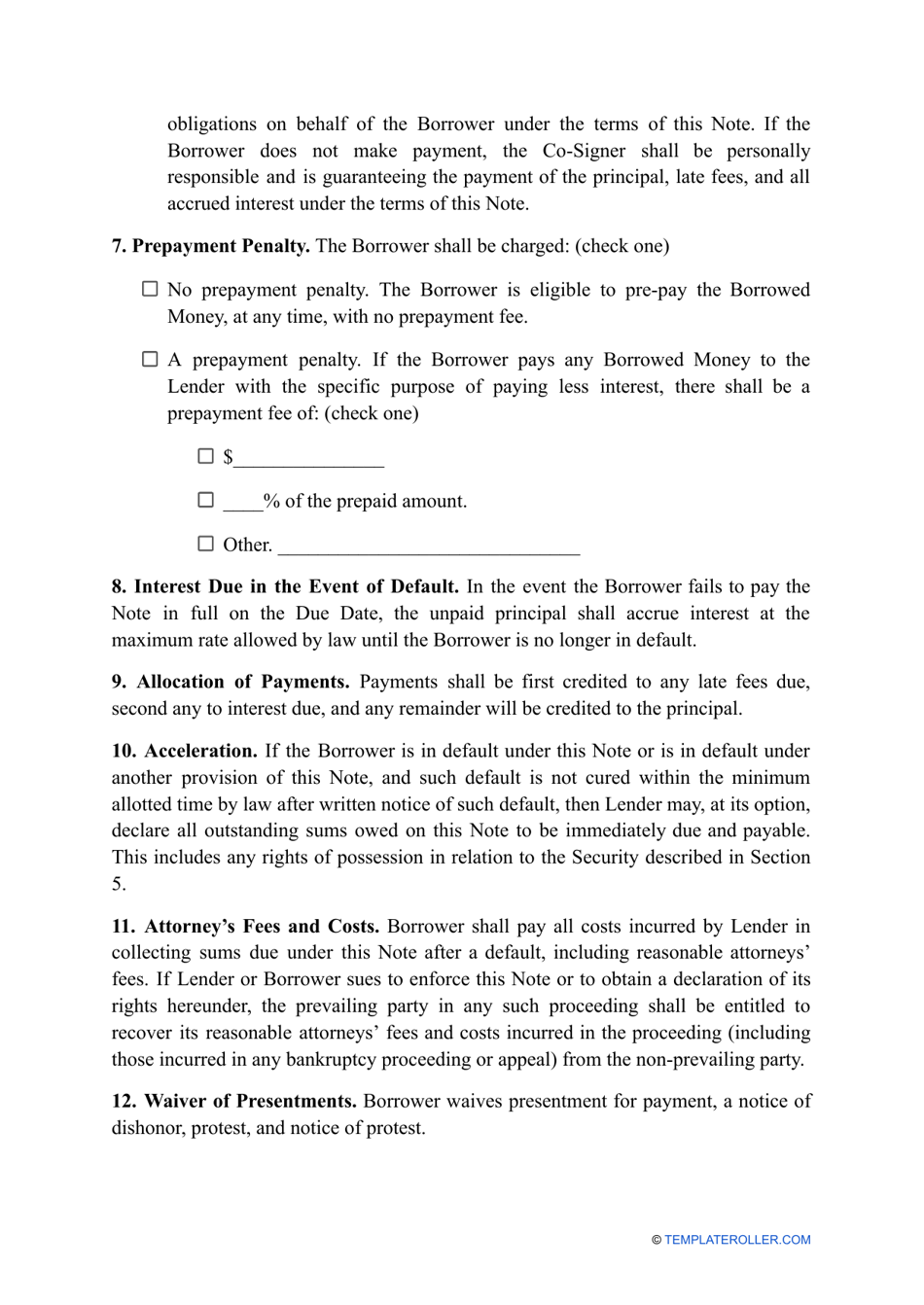

A Promissory Note Template in Delaware is a legal document used to outline the terms and conditions of a loan or debt between two parties. It acts as a written promise to repay a specified amount of money with interest on a designated date.

The promissory note template in Delaware is typically filed by the individual or party offering the loan, commonly known as the lender.

FAQ

Q: What is a promissory note?

A: A promissory note is a written agreement in which one party promises to pay a certain amount of money to another party at a set time.

Q: Why would I need a promissory note?

A: A promissory note is useful for formalizing a loan or debt agreement between individuals or businesses.

Q: What should be included in a promissory note?

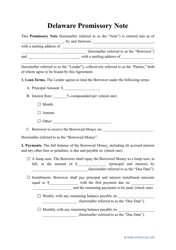

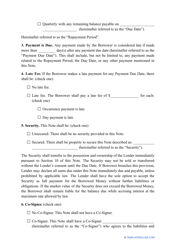

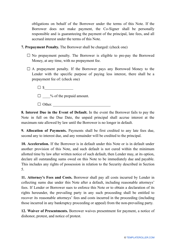

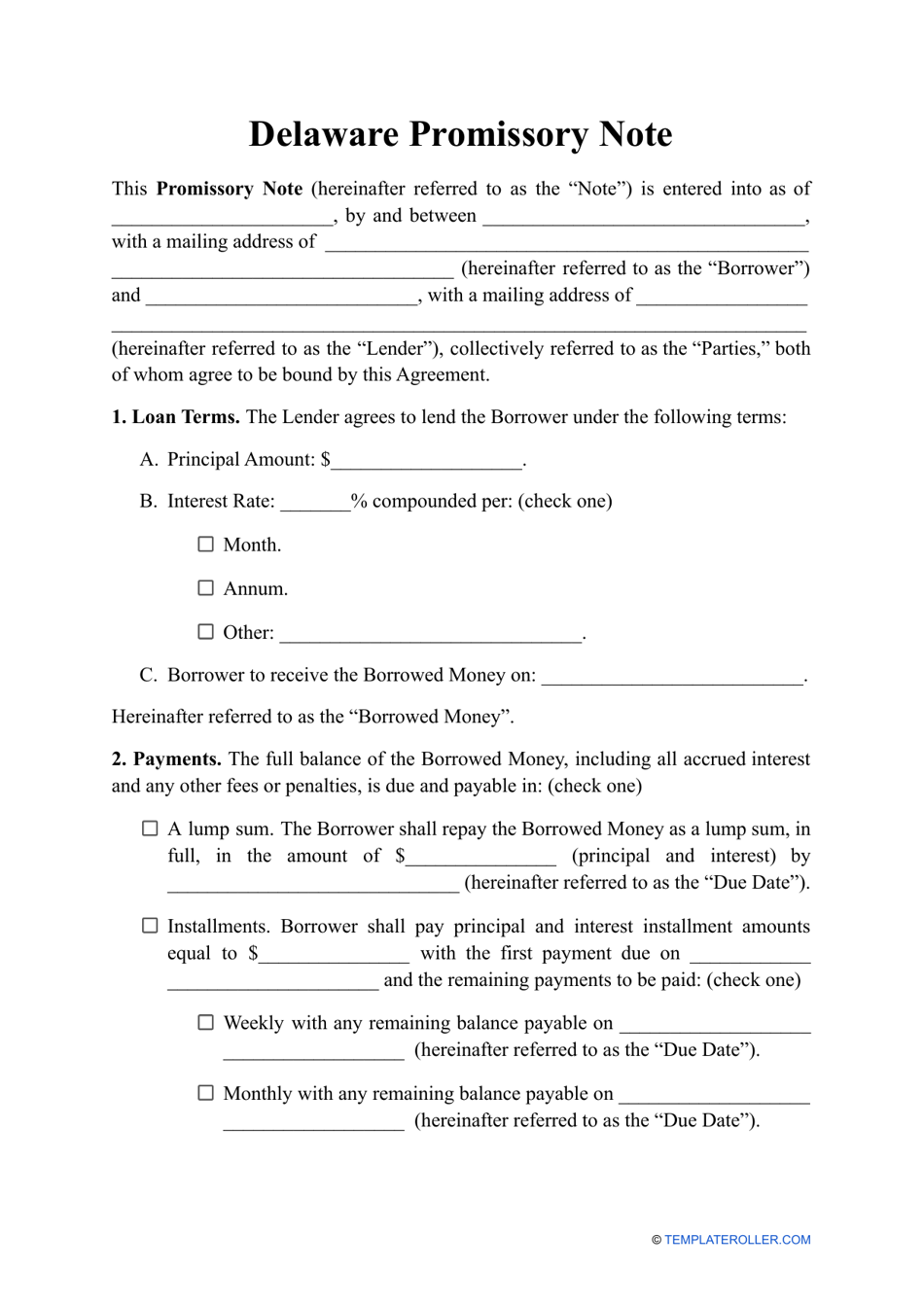

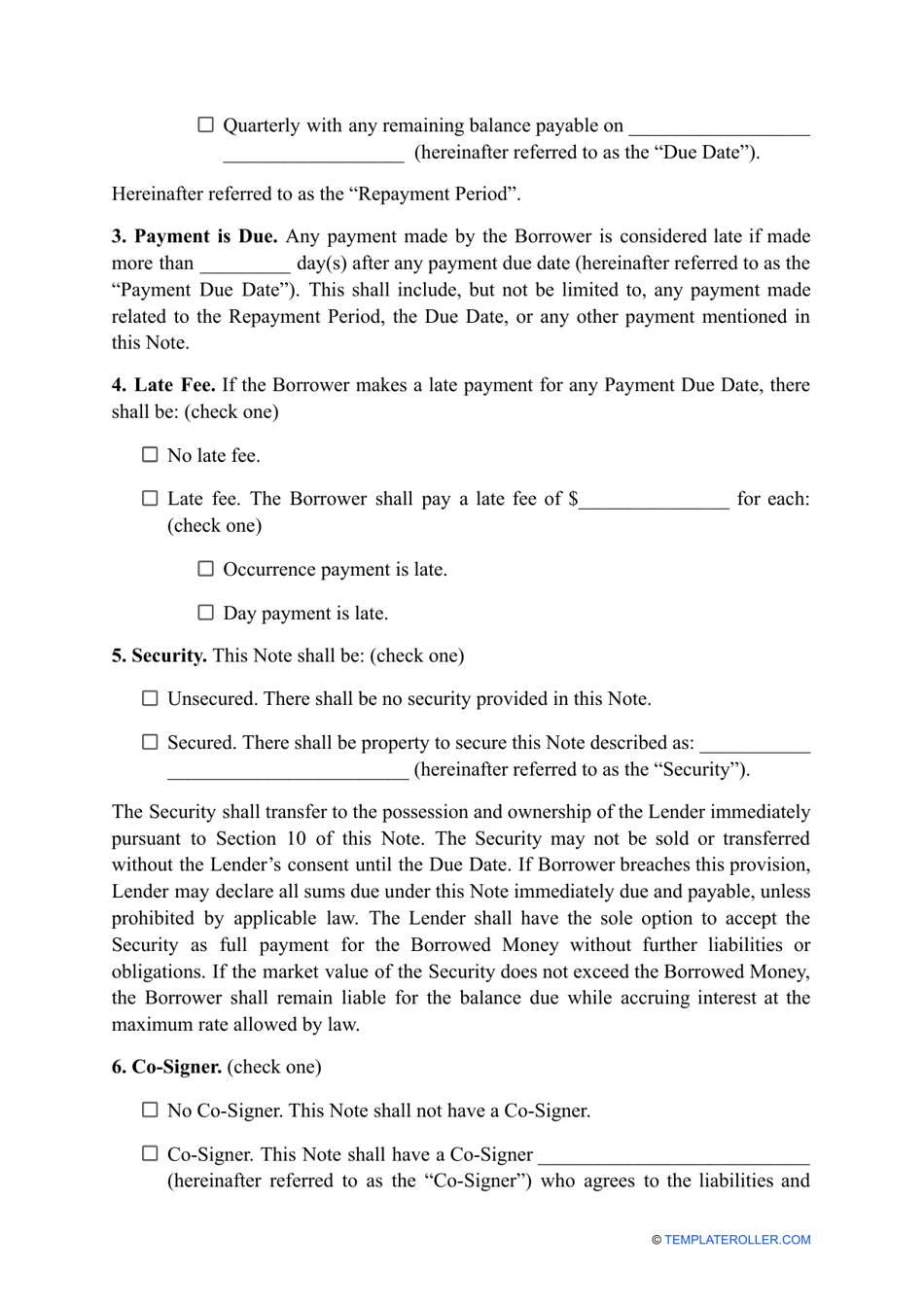

A: A promissory note should include details such as the amount borrowed, interest rate (if any), repayment terms, and signatures of the parties involved.

Q: Is a promissory note legally binding?

A: Yes, a properly executed promissory note is legally binding and can be used as evidence in a court of law.

Q: Can I use a promissory note to collect interest on a loan?

A: Yes, you can include an interest rate in a promissory note to collect interest on a loan. However, you should check the usury laws in your state to ensure you are not charging illegal interest rates.

Q: Do I need to notarize a promissory note in Delaware?

A: While notarization is not strictly required for a promissory note in Delaware, it can add an extra layer of authenticity and credibility.

Q: What is the statute of limitations for enforcing a promissory note in Delaware?

A: In Delaware, the statute of limitations for enforcing a promissory note is typically three years.

Q: What happens if a borrower fails to repay the promissory note?

A: If a borrower fails to repay the promissory note, the lender may take legal action to seek repayment, including filing a lawsuit and potentially obtaining a judgment to garnish wages or seize assets.