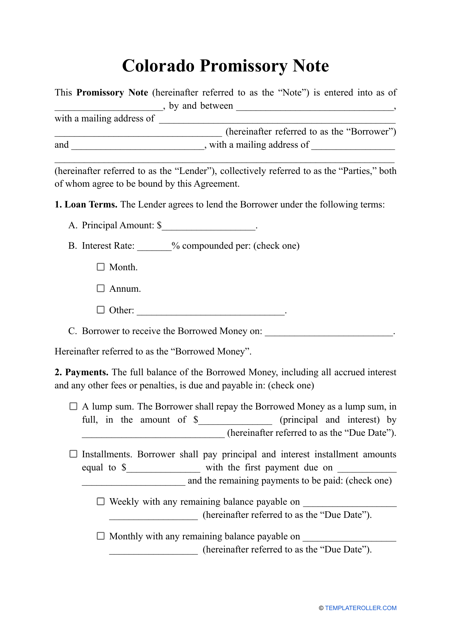

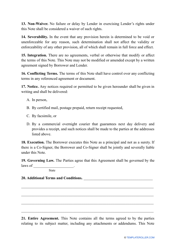

Promissory Note Template - Colorado

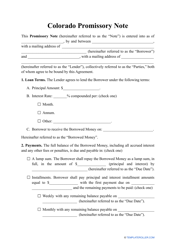

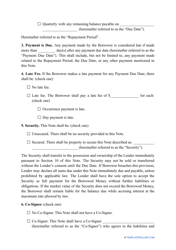

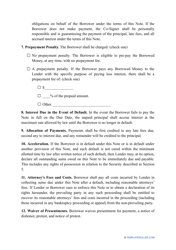

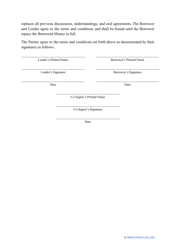

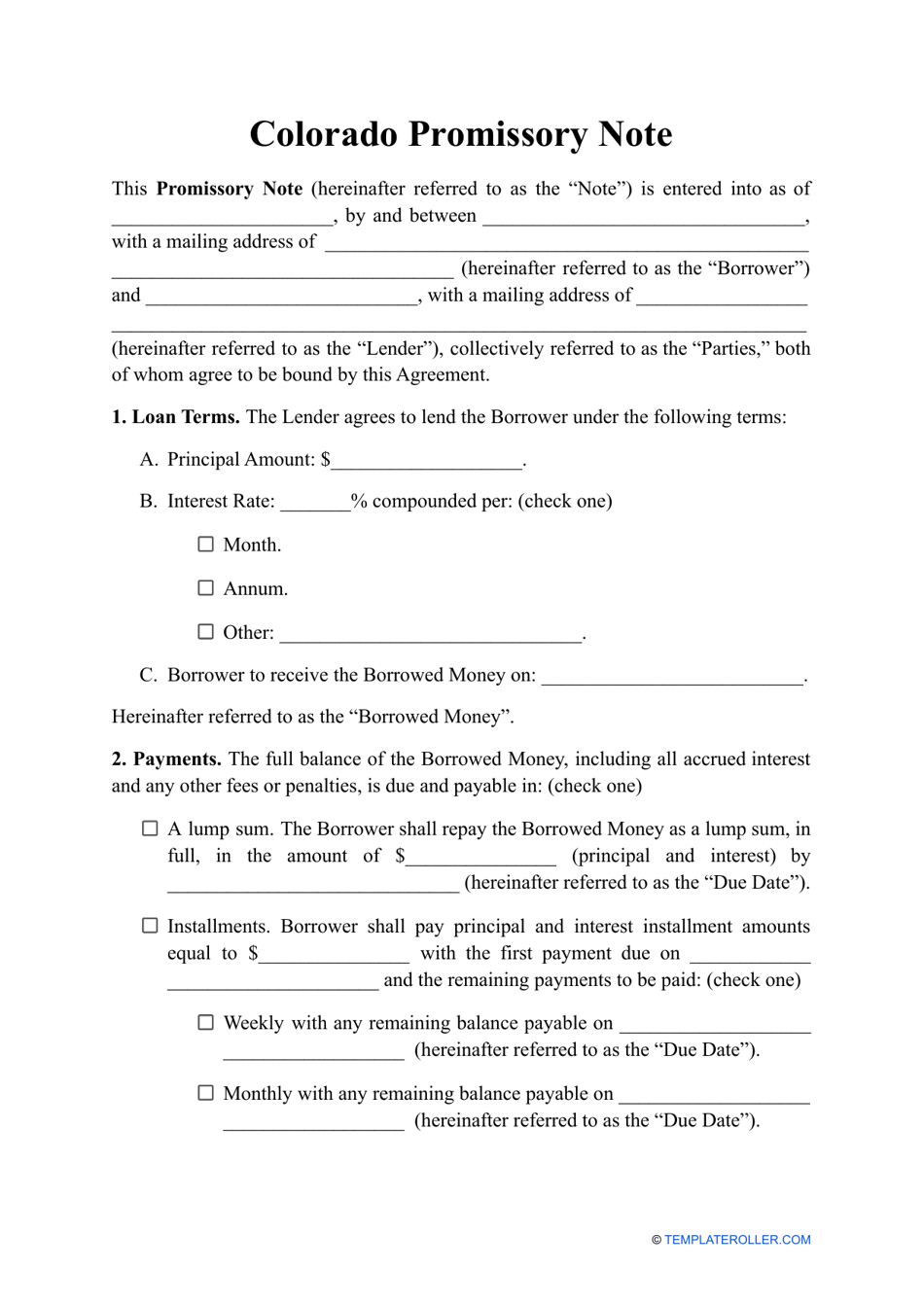

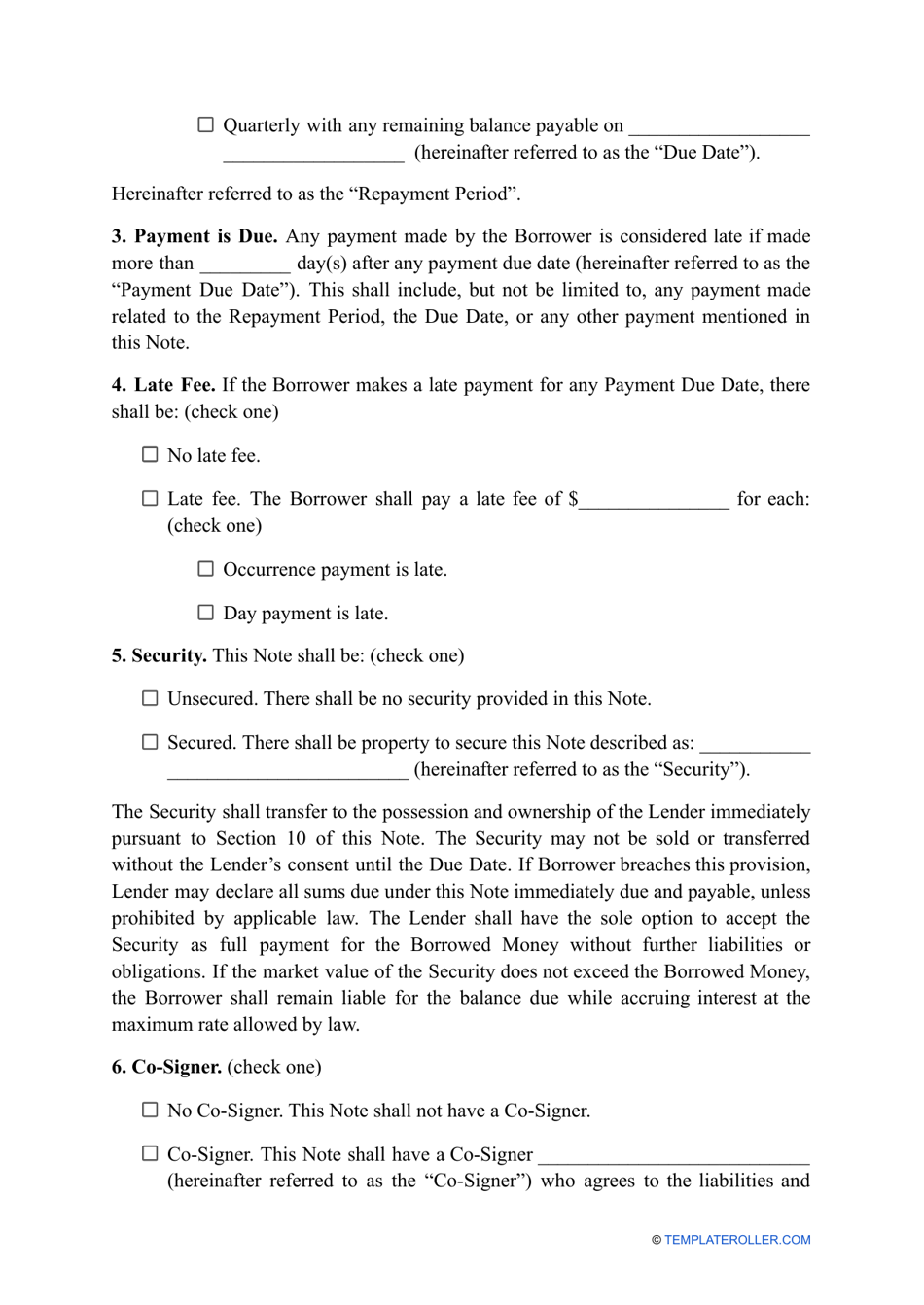

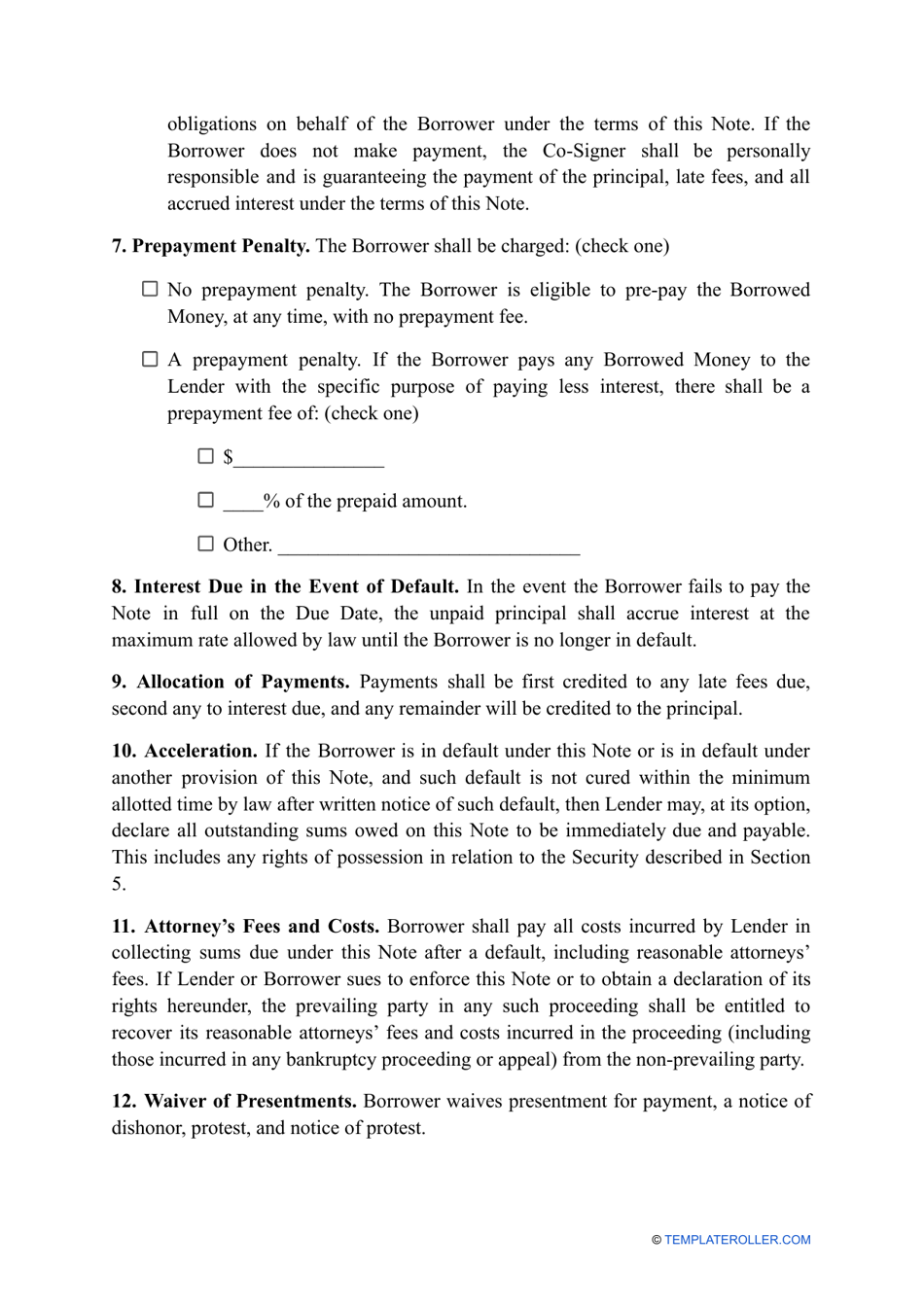

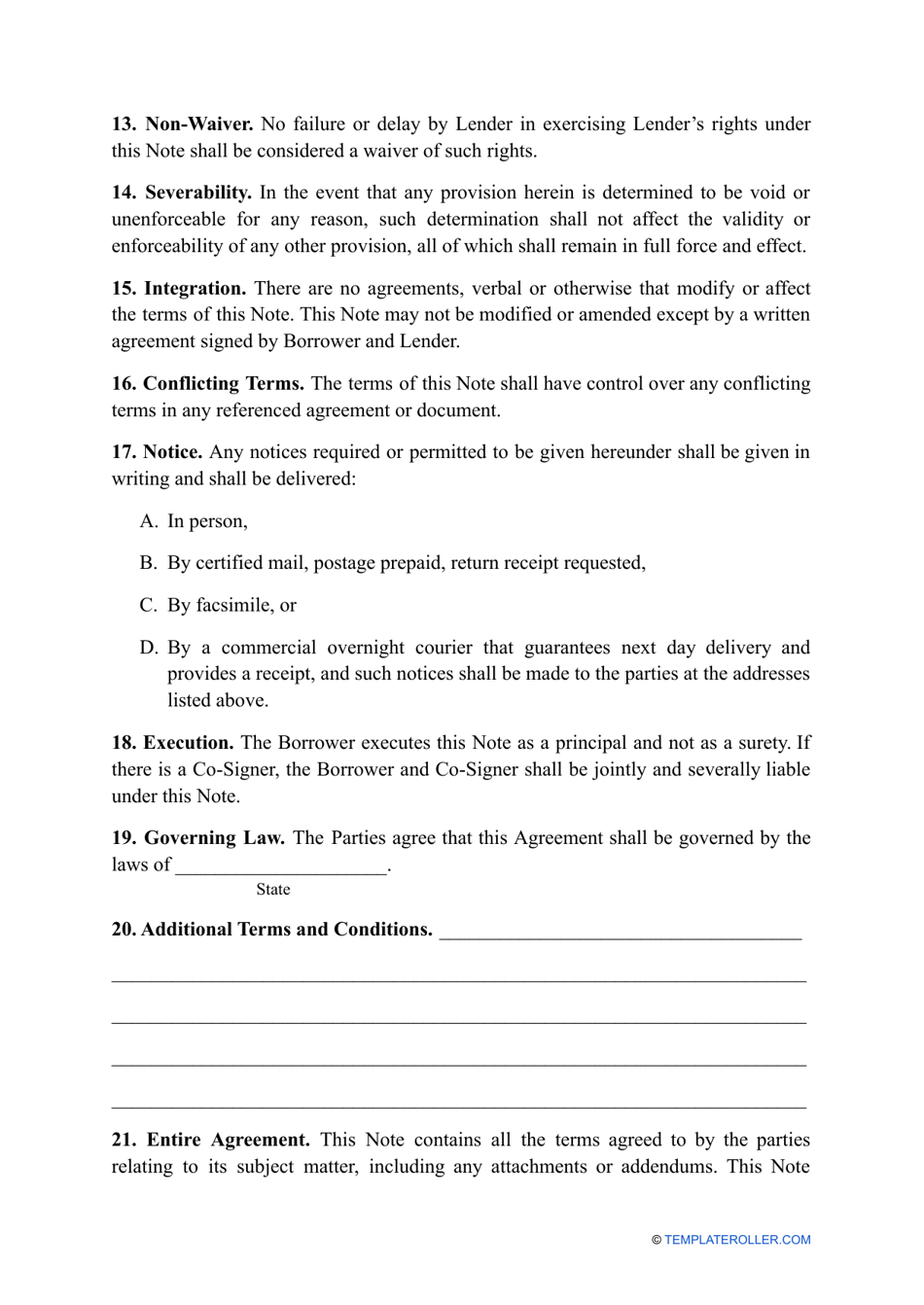

A Promissory Note Template - Colorado is a legal document used for documenting a loan agreement between two parties in the state of Colorado. It outlines the terms and conditions of the loan, including the amount borrowed, repayment schedule, and any interest rates or penalties.

In Colorado, the person who borrows money and promises to repay it is typically the one who files the promissory note template.

FAQ

Q: What is a promissory note?

A: A promissory note is a legal document that outlines the terms and conditions of a loan, including the repayment schedule and interest rate.

Q: What is a promissory note used for?

A: A promissory note is used to formalize a loan agreement between a borrower and a lender.

Q: Is a promissory note legally binding?

A: Yes, a promissory note is a legally binding document that can be enforced in court if necessary.

Q: What information should be included in a promissory note?

A: A promissory note should include the names and contact information of both the borrower and lender, the loan amount and repayment terms, and any applicable interest rate or late fees.

Q: Can a promissory note be modified?

A: Yes, a promissory note can be modified if both parties agree to the changes and document them in writing.

Q: What happens if a borrower fails to repay a promissory note?

A: If a borrower fails to repay a promissory note, the lender may take legal action to enforce the terms of the note and seek repayment through means such as wage garnishment or asset seizure.

Q: Is a promissory note the same as a loan agreement?

A: No, a promissory note is a separate document that outlines the borrower's promise to repay the loan, while a loan agreement includes additional details and terms regarding the loan.