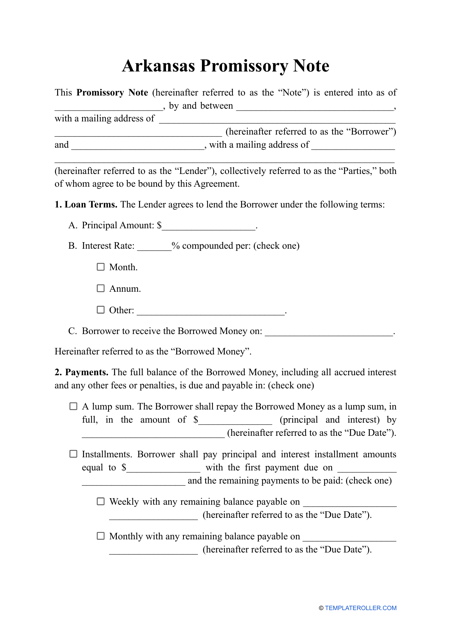

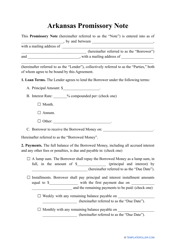

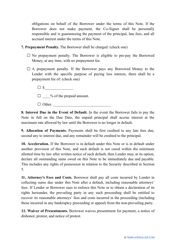

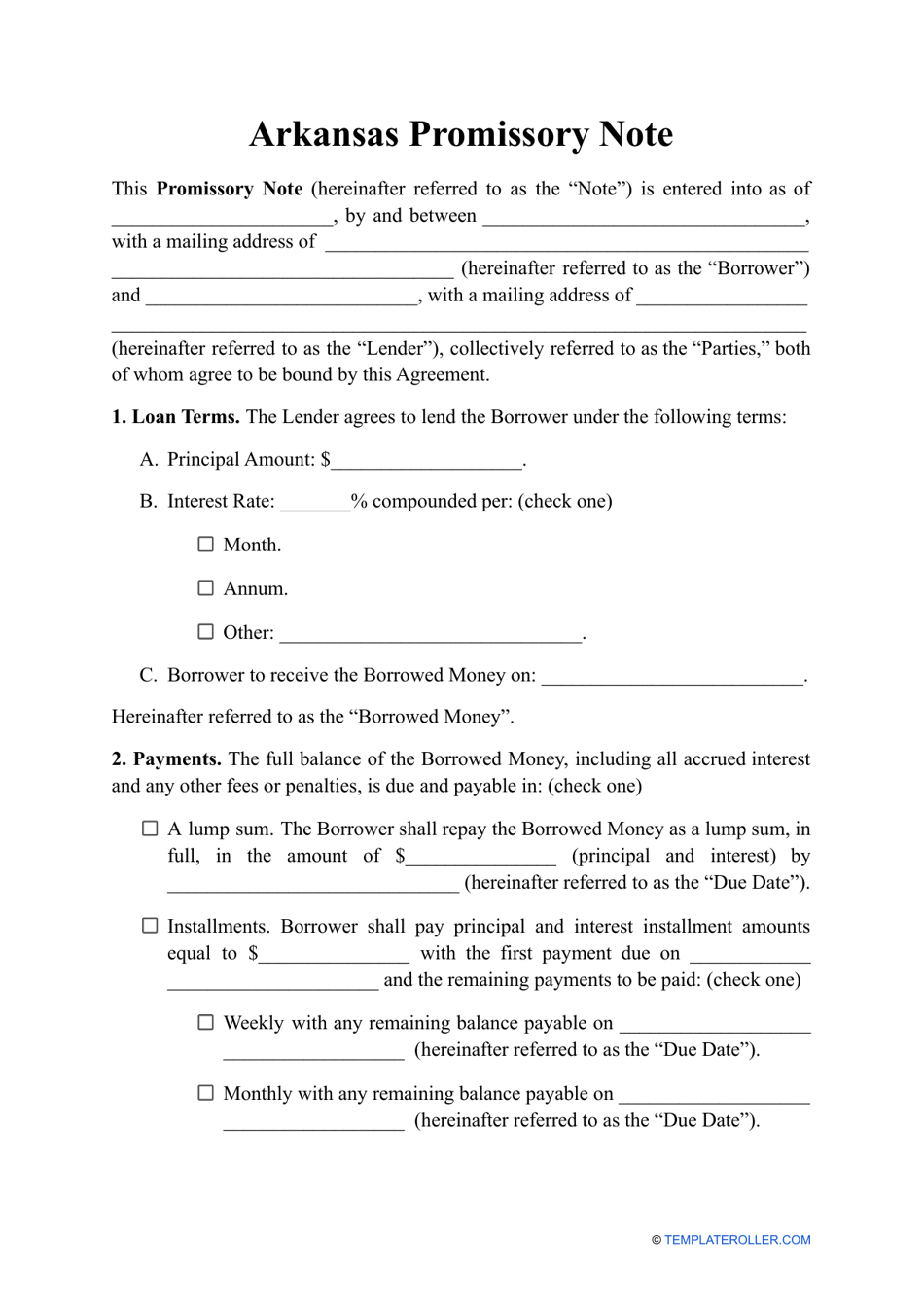

Promissory Note Template - Arkansas

A Promissory Note Template in Arkansas is a legal document that outlines the terms and conditions of a loan or financial obligation. It is used to record a promise to repay a certain amount of money by a specified date. The template serves as a template or guide for creating a personalized promissory note agreement in Arkansas.

The promissory note template in Arkansas is typically filed by the borrower.

FAQ

Q: What is a promissory note?

A: A promissory note is a written agreement that establishes a borrower's promise to repay a specific sum of money to a lender, usually with interest, within a specified time period.

Q: Why would I need a promissory note?

A: You may need a promissory note when borrowing or lending money to ensure that both parties are clear on the terms of the loan.

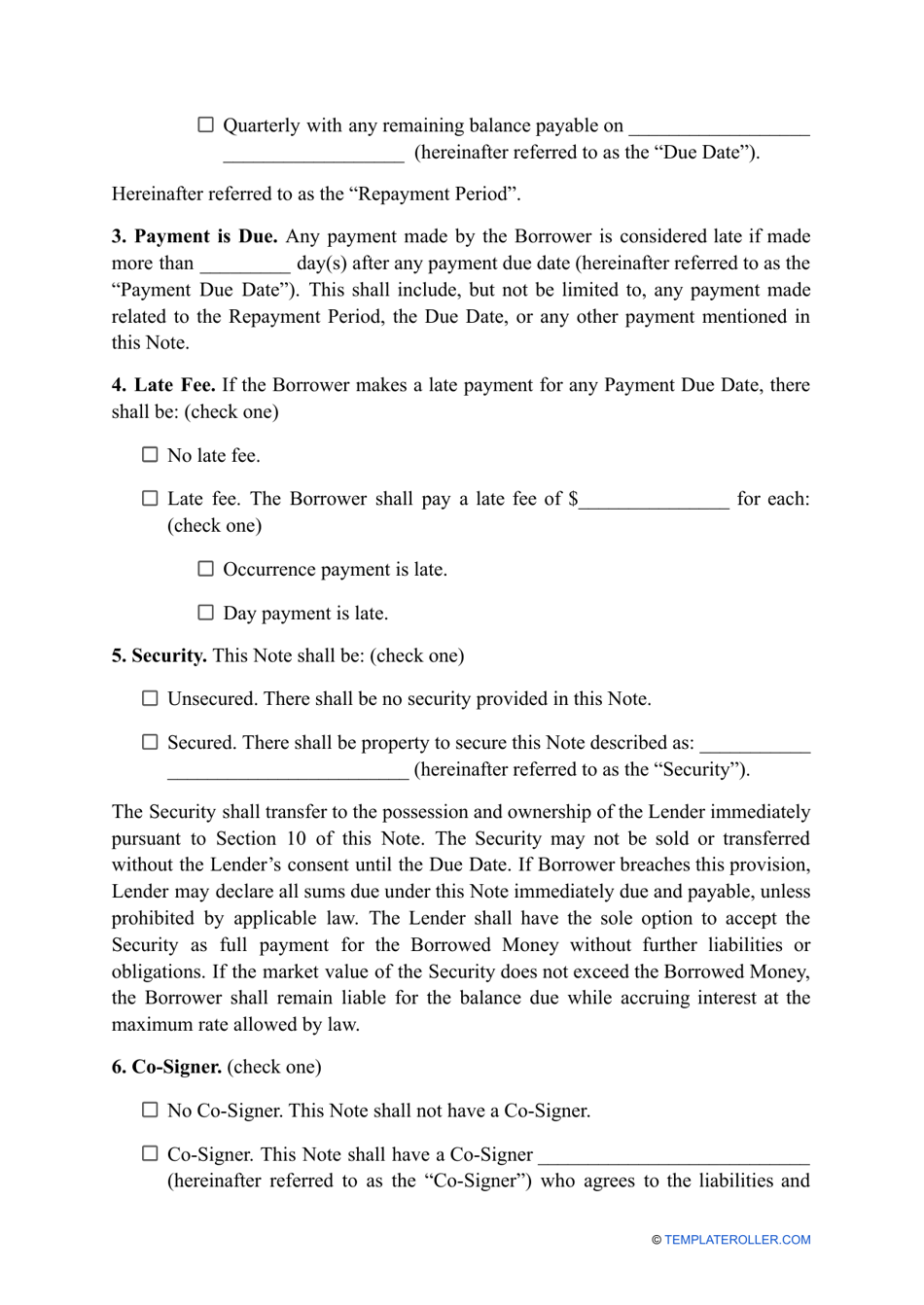

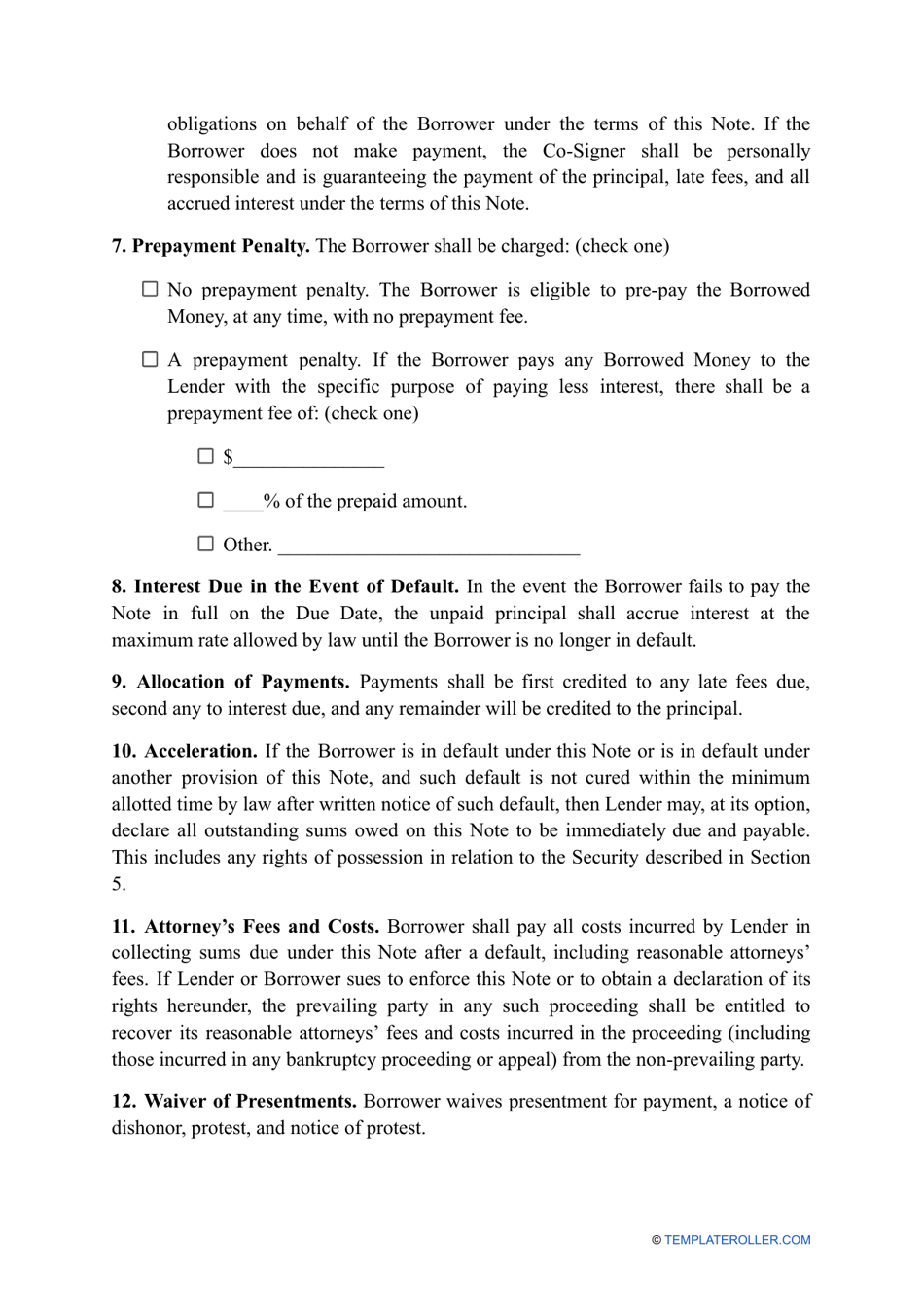

Q: What should a promissory note include?

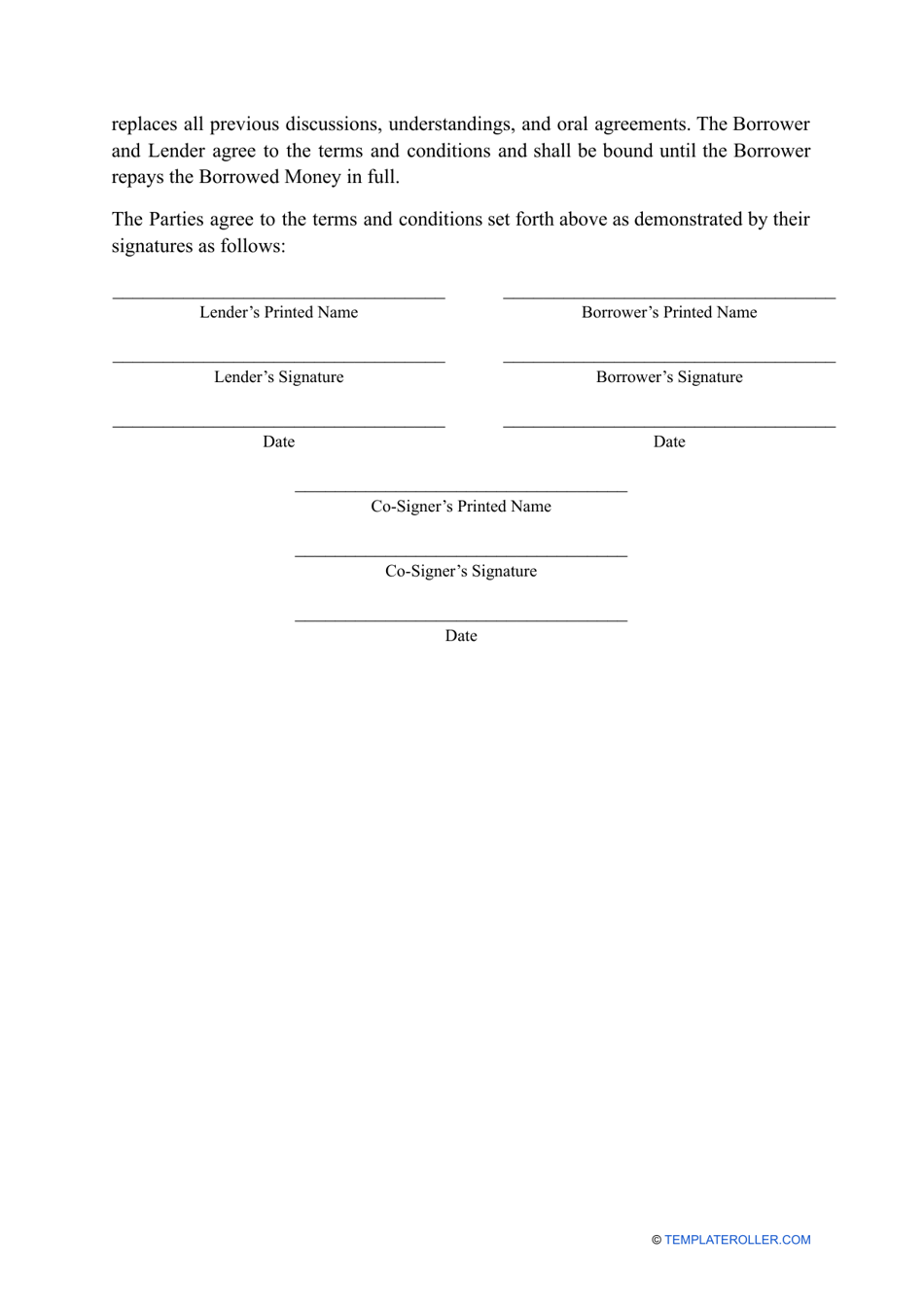

A: A promissory note should include the names and addresses of the borrower and lender, the loan amount and repayment terms, the interest rate (if applicable), and any collateral or guarantees.

Q: Do promissory notes need to be notarized in Arkansas?

A: No, promissory notes do not need to be notarized in Arkansas, but it may be a good idea to have a witness present when signing the note.

Q: Can a promissory note be legally binding without interest?

A: Yes, a promissory note can be legally binding without interest, but it is common for lenders to charge interest as compensation for the use of their money.

Q: What happens if the borrower defaults on a promissory note?

A: If the borrower defaults on a promissory note, the lender may take legal action to recover the outstanding balance, which could include seizing collateral or garnishing wages.