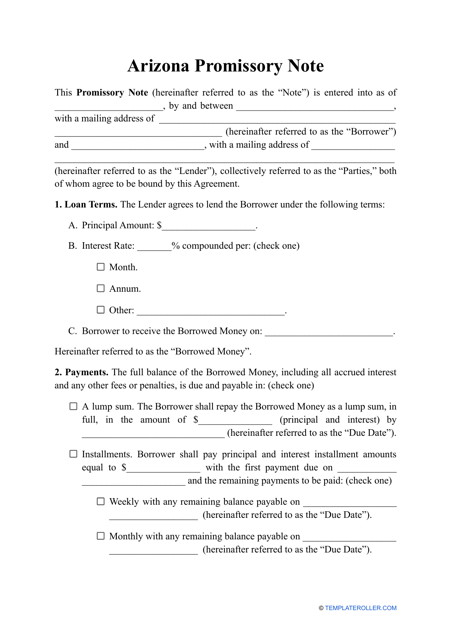

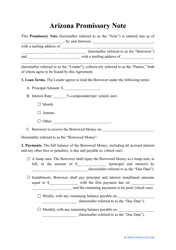

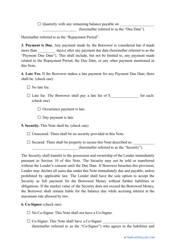

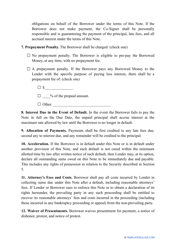

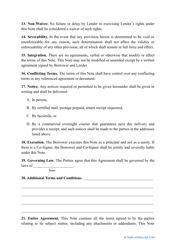

Promissory Note Template - Arizona

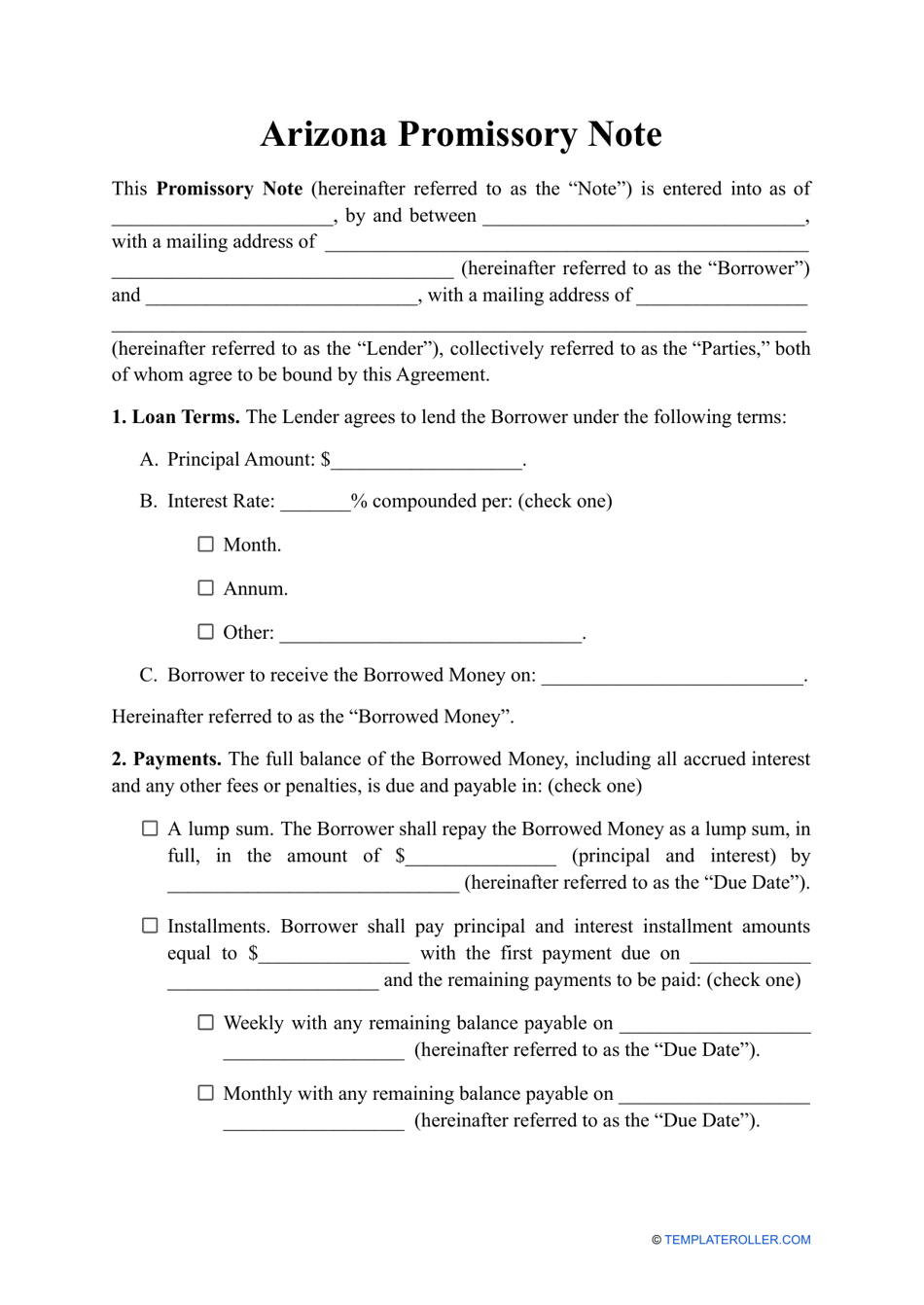

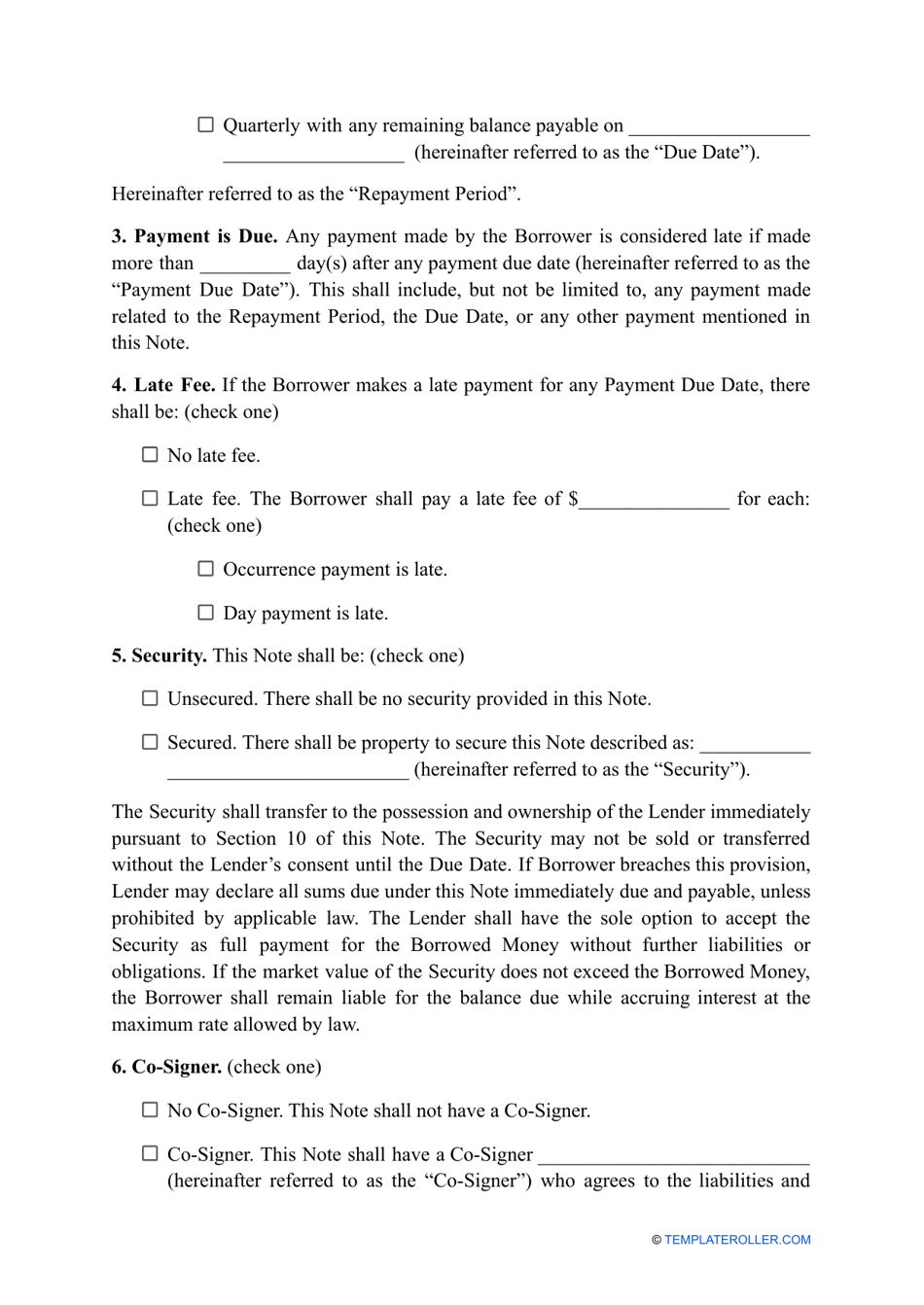

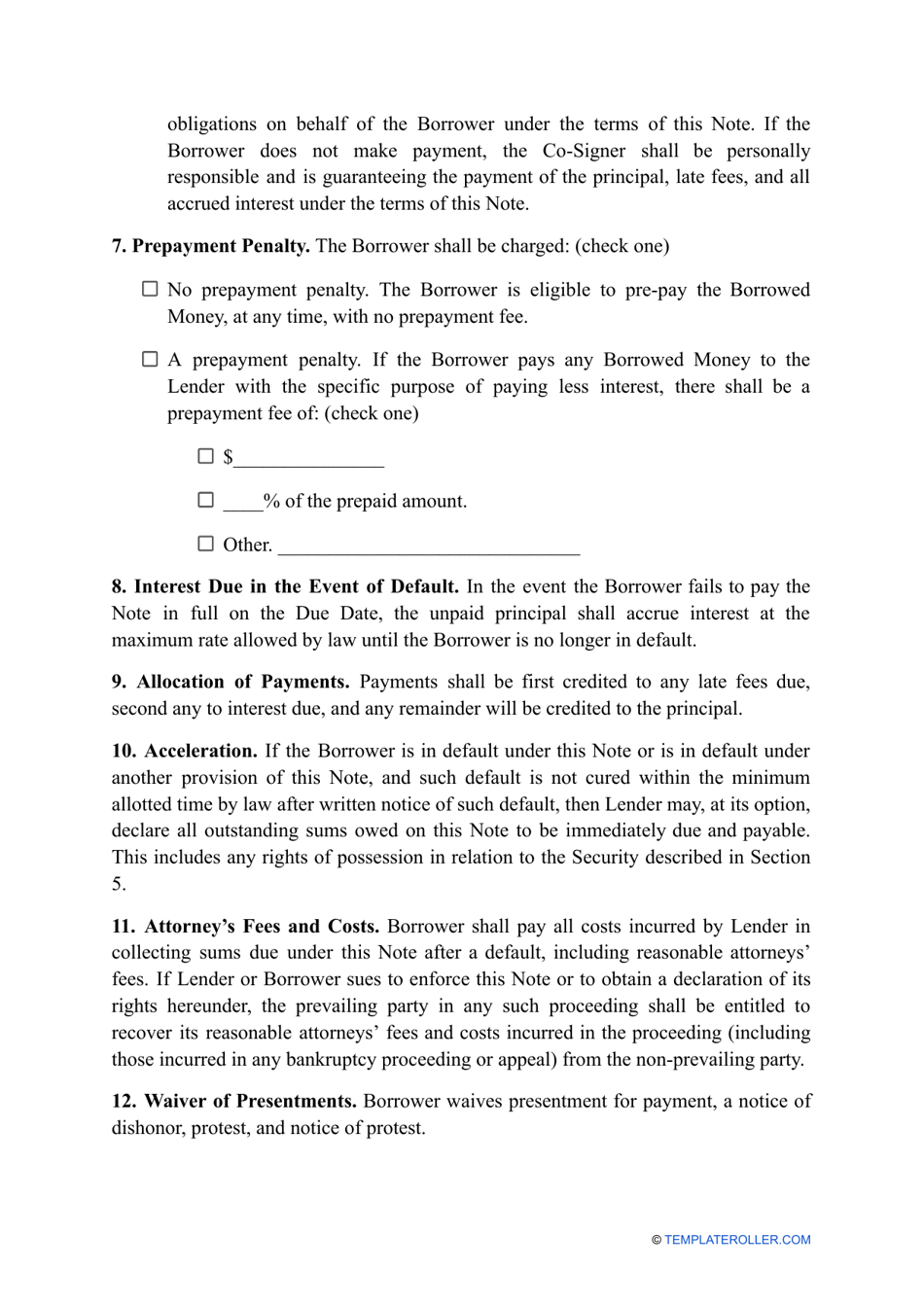

A Promissory Note Template in Arizona is a document used to outline the terms and conditions of a loan between a lender and a borrower in the state of Arizona. It is a legally binding agreement that specifies the amount borrowed, the interest rate, repayment terms, and any other conditions related to the loan.

The borrower typically files the promissory note template in Arizona.

FAQ

Q: What is a promissory note?

A: A promissory note is a legal document that establishes a borrower's promise to repay a specific debt to a lender.

Q: How does a promissory note work?

A: A promissory note sets out the terms and conditions of a loan, including the amount borrowed, interest rate, repayment schedule, and any penalties for non-payment.

Q: What is the purpose of a promissory note?

A: The purpose of a promissory note is to ensure that both the borrower and lender have a clear understanding of the terms of a loan and to provide legal protection to both parties.

Q: Is a promissory note legally enforceable?

A: Yes, a promissory note is a legally binding document and can be enforced in court if one party fails to fulfill their obligations.

Q: Can I use a promissory note for personal loans?

A: Yes, a promissory note can be used for both personal and business loans as long as it meets the legal requirements of the state where it is being used.

Q: Do I need a lawyer to create a promissory note?

A: While it is not required to have a lawyer create a promissory note, it is recommended to consult with one to ensure that the document is legally valid and meets your specific needs.

Q: What should be included in a promissory note?

A: A promissory note should include the names of the borrower and lender, the loan amount, interest rate, repayment terms, payment schedule, and any provisions for late fees or default.

Q: Can a promissory note be modified?

A: Yes, a promissory note can be modified if both parties agree to the changes and the modifications are documented in writing.

Q: What happens if I default on a promissory note?

A: If you fail to fulfill your obligations under a promissory note, the lender may have legal recourse to pursue collection actions, such as filing a lawsuit or seeking to garnish your wages.