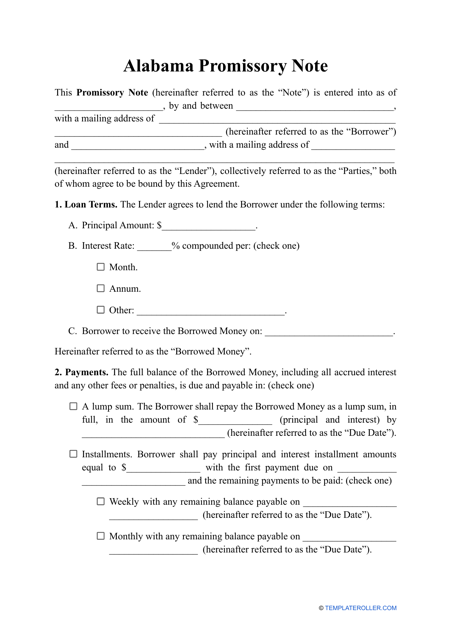

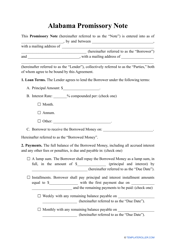

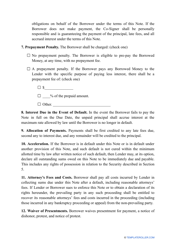

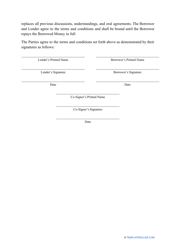

Promissory Note Template - Alabama

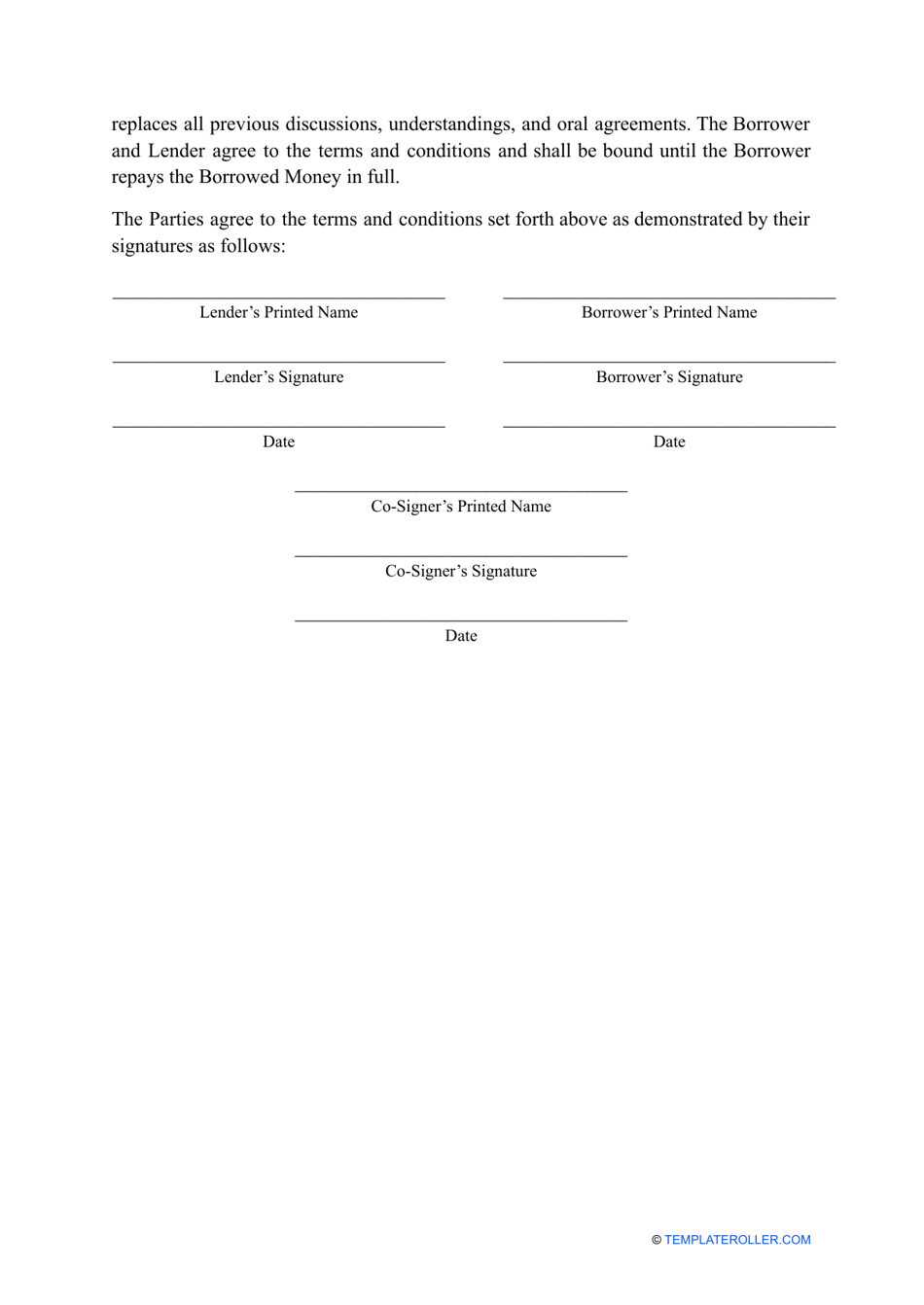

A promissory note template is a legal document used in Alabama to outline the terms and conditions of a loan agreement between a borrower and a lender. It serves as a written promise to repay a specified amount of money within a certain time frame.

The borrower typically files the promissory note template in Alabama.

FAQ

Q: What is a promissory note?

A: A promissory note is a legal document that outlines a borrower's promise to repay a specific amount of money to a lender.

Q: Who is the borrower and lender in a promissory note?

A: The borrower is the person or entity who is taking the loan and promising to repay, while the lender is the person or entity providing the loan.

Q: What should be included in a promissory note?

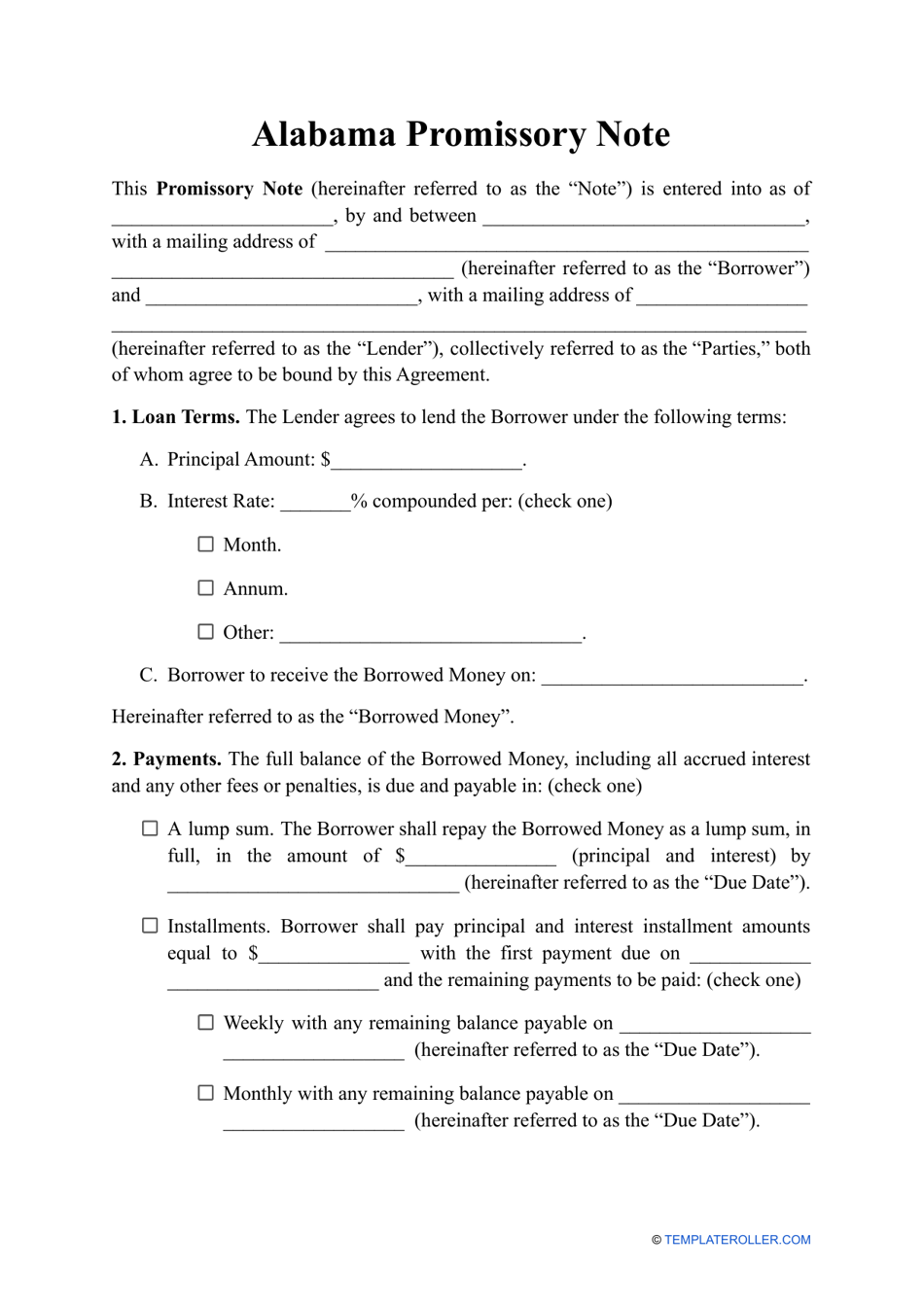

A: A promissory note should include the names and addresses of the borrower and lender, the loan amount, repayment terms, interest rates (if applicable), and any collateral (if applicable).

Q: What are the consequences of not repaying a promissory note?

A: If a borrower fails to repay a promissory note, the lender may take legal action to recover the money, which may include seizing collateral (if applicable) or garnishing wages.

Q: Do promissory notes have to be notarized in Alabama?

A: Promissory notes in Alabama do not need to be notarized, but having it notarized can provide additional legal protection.

Q: Can a promissory note be modified or cancelled?

A: Yes, a promissory note can be modified or canceled if both the borrower and lender agree to the changes and document them in writing.

Q: Can a promissory note be transferred to another person or entity?

A: Yes, a promissory note can be transferred to another person or entity through a process called assignment or endorsement.

Q: Is there a statute of limitations for enforcing a promissory note in Alabama?

A: Yes, there is a statute of limitations for enforcing a promissory note in Alabama, which is typically six years from the date of default.