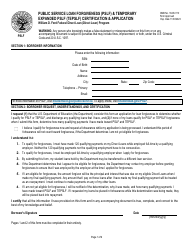

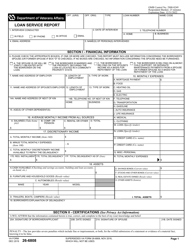

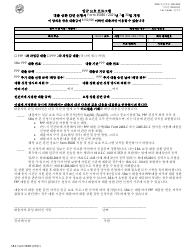

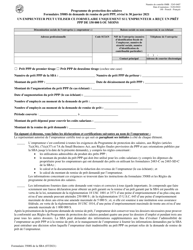

Public Service Loan Forgiveness Program Fact Sheet

Public Service Loan Forgiveness Program Fact Sheet is a 4-page legal document that was released by the U.S. Department of Education - Federal Student Aid on December 1, 2015 and used nation-wide.

FAQ

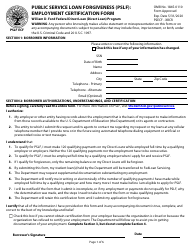

Q: What is the Public Service Loan Forgiveness Program?

A: The Public Service Loan Forgiveness Program is a program that forgives the remaining student loan balance after making 120 qualifying payments while working full-time for a qualifying employer.

Q: Who is eligible for the Public Service Loan Forgiveness Program?

A: To be eligible for the Public Service Loan Forgiveness Program, you must have made 120 qualifying payments on your Direct Loans while working full-time for a qualifying employer.

Q: What are qualifying employers for the Public Service Loan Forgiveness Program?

A: Qualifying employers for the Public Service Loan Forgiveness Program include government organizations at any level (federal, state, local, or tribal), non-profit organizations with tax-exempt status under Section 501(c)(3), and other types of non-profit organizations that provide certain types of qualifying public services.

Q: What types of loans are eligible for the Public Service Loan Forgiveness Program?

A: Only Direct Loans are eligible for the Public Service Loan Forgiveness Program. Other types of federal student loans, such as FFEL Loans and Perkins Loans, are not eligible.

Q: How many payments do I need to make to qualify for loan forgiveness?

A: To qualify for loan forgiveness, you need to make 120 qualifying payments on your Direct Loans.

Q: Do I need to be on an income-driven repayment plan to qualify for loan forgiveness?

A: Yes, you must be on an income-driven repayment plan to qualify for loan forgiveness under the Public Service Loan Forgiveness Program.

Q: Is there a limit to the amount that can be forgiven under the Public Service Loan Forgiveness Program?

A: No, there is no limit to the amount that can be forgiven under the Public Service Loan Forgiveness Program. The remaining loan balance will be forgiven after 120 qualifying payments.

Q: What happens if I don't meet all the eligibility requirements for loan forgiveness?

A: If you don't meet all the eligibility requirements for loan forgiveness under the Public Service Loan Forgiveness Program, you will not be able to have your remaining loan balance forgiven.

Q: Can I apply for loan forgiveness if I am currently in forbearance or deferment?

A: No, payments made while your loans are in forbearance or deferment do not count towards the 120 qualifying payments for loan forgiveness.

Form Details:

- The latest edition currently provided by the U.S. Department of Education - Federal Student Aid;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.