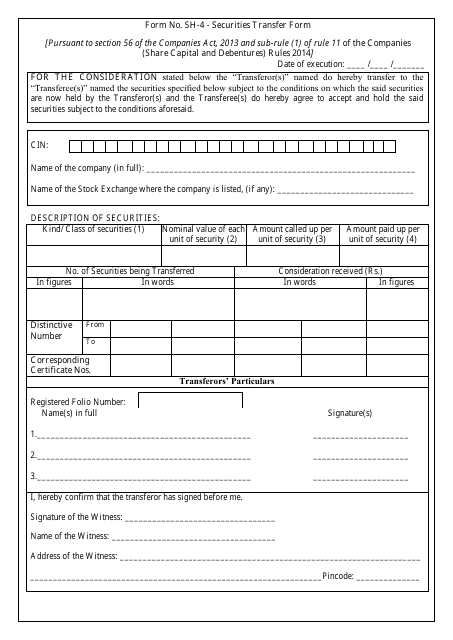

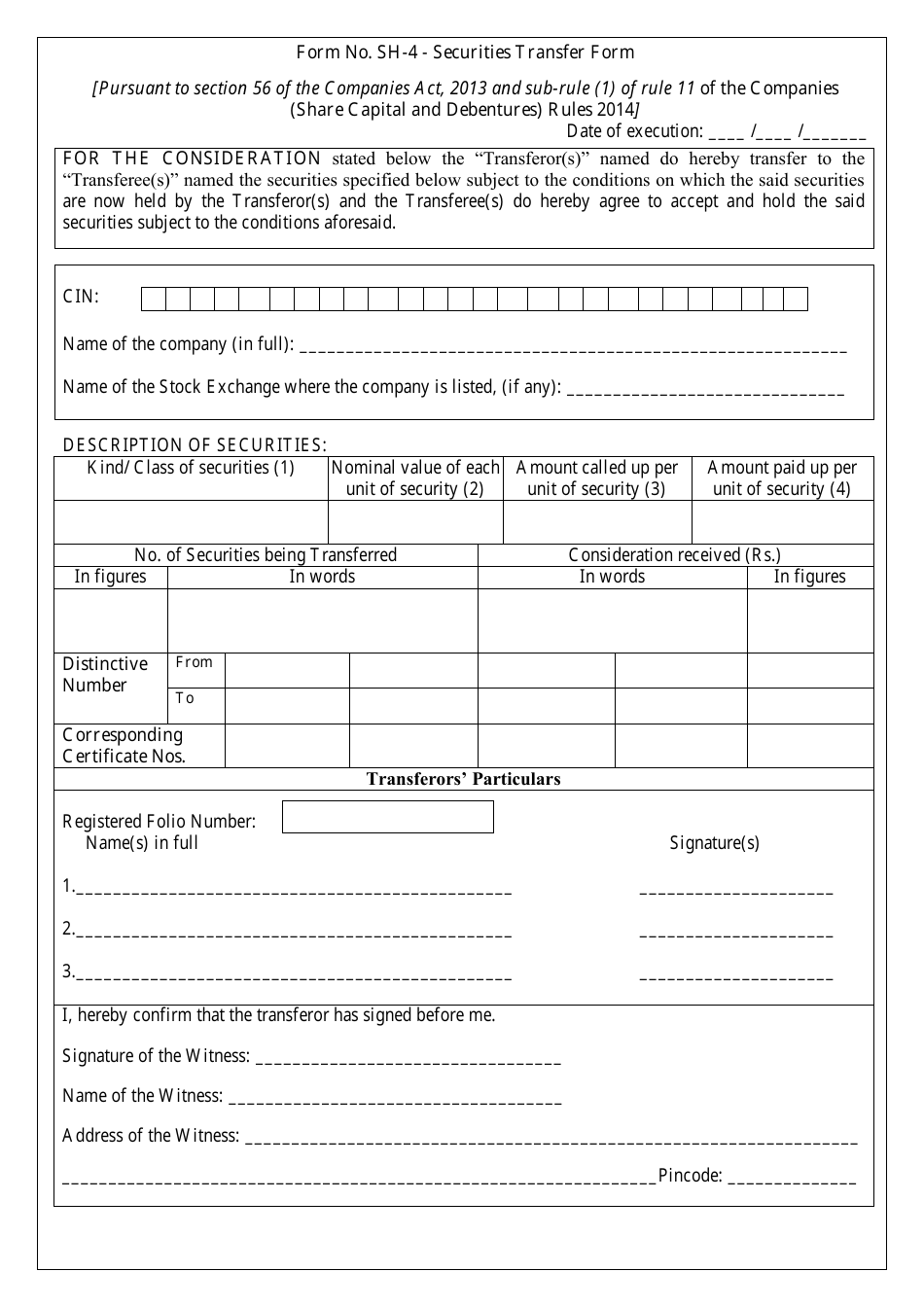

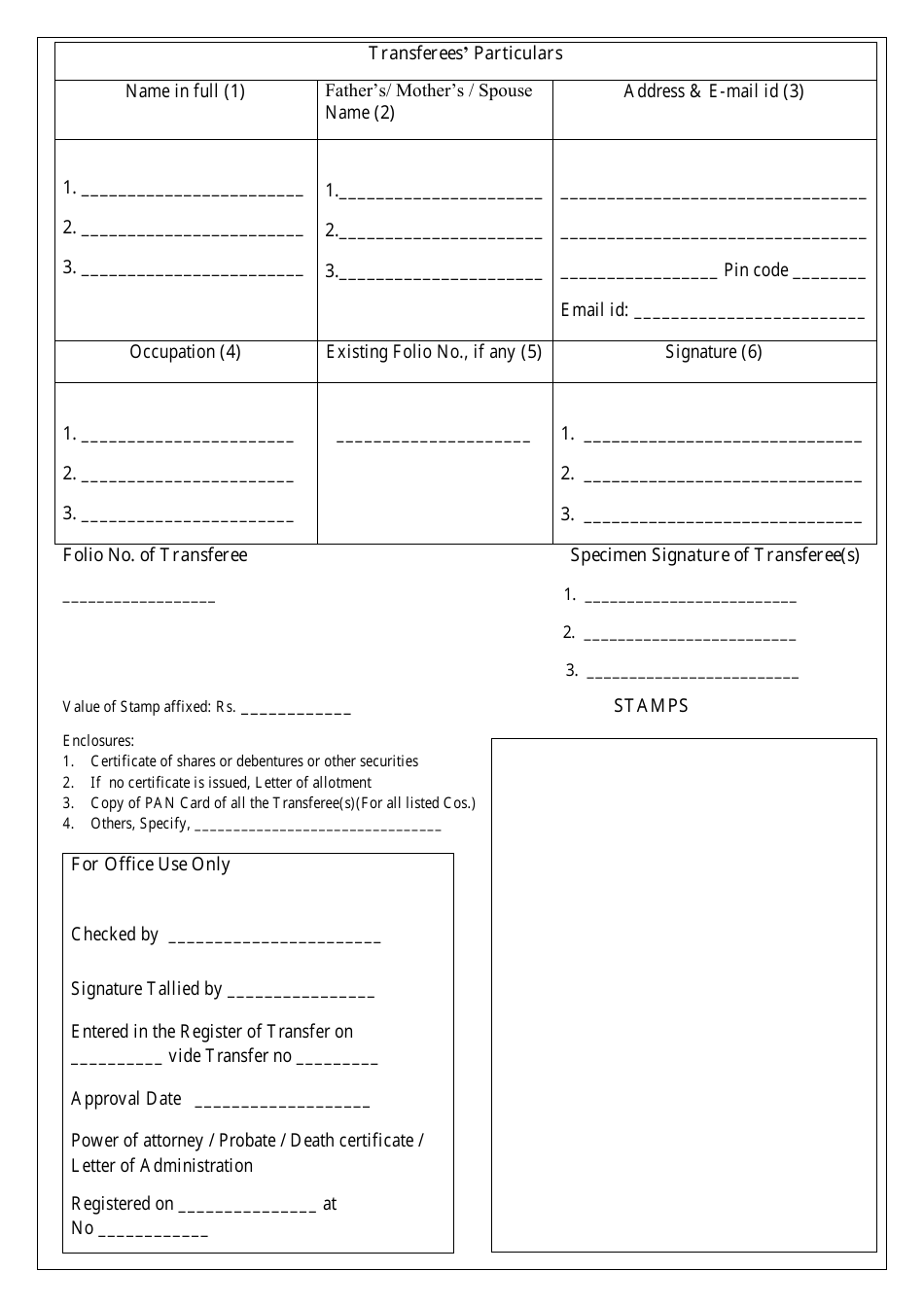

Securities Transfer Form - India

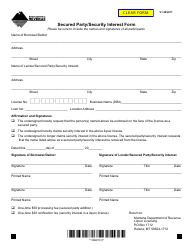

The Securities Transfer Form in India is a document used for transferring ownership of securities, such as shares or bonds, from one individual or entity to another. It serves as a legal instrument to record and facilitate the transfer of ownership rights in the Indian securities market.

In India, the Securities Transfer Form is typically filed by the seller or the transferor of the securities. This form is used to transfer ownership of securities such as stocks, bonds, or mutual funds from one person to another. The transferor completes the form with relevant details and submits it to the appropriate authority, such as the stock exchange or the company's registrar and transfer agent, for processing the transfer.

FAQ

Q: What is a Securities Transfer Form?

A: A Securities Transfer Form is a document used in India to transfer ownership of securities, such as stocks or bonds, from one person to another.

Q: Why would I need to use a Securities Transfer Form?

A: You would need to use a Securities Transfer Form to legally transfer ownership of securities. This is typically done when buying or selling securities, or when gifting or inheriting them.

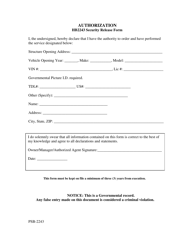

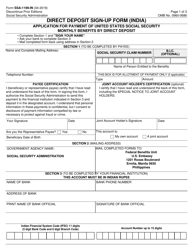

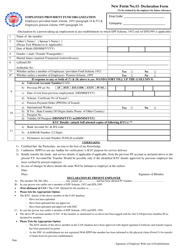

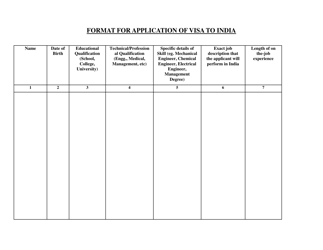

Q: What information is required on a Securities Transfer Form?

A: A Securities Transfer Form generally requires details such as the name and contact information of the transferor (seller) and transferee (buyer), the securities being transferred, and relevant details about the transaction.

Q: Are there any fees associated with using a Securities Transfer Form?

A: Yes, there are usually fees associated with using a Securities Transfer Form, such as stamp duty and transaction charges. The specific fees may vary depending on the type and value of the securities being transferred.

Q: Are there any restrictions on securities transfers in India?

A: Yes, there are certain restrictions on securities transfers in India. For example, some securities may have a lock-in period during which they cannot be transferred, or there may be restrictions on transferring securities held by non-residents.

Q: Do I need to submit any additional documents with the Securities Transfer Form?

A: Depending on the specific circumstances, you may need to submit additional documents along with the Securities Transfer Form. These documents may include supporting identification and proof of ownership of the securities.

Q: How long does it take to complete a securities transfer in India?

A: The time taken to complete a securities transfer in India can vary depending on factors such as the type of securities being transferred, the completeness and accuracy of the documentation, and the processing time of the relevant authorities. It is best to consult with your stockbroker or depository participant for an estimate of the timeframe.

Q: What happens after I submit the Securities Transfer Form?

A: After you submit the Securities Transfer Form, the relevant authorities will process the transfer request. Once the transfer is approved, the ownership of the securities will be updated accordingly, and you will receive confirmation of the transfer.

Q: Can I transfer securities electronically in India?

A: Yes, you can transfer securities electronically in India through the dematerialized (demat) format. This is a paperless method of holding and transferring securities in electronic form, which is facilitated by depository participants.