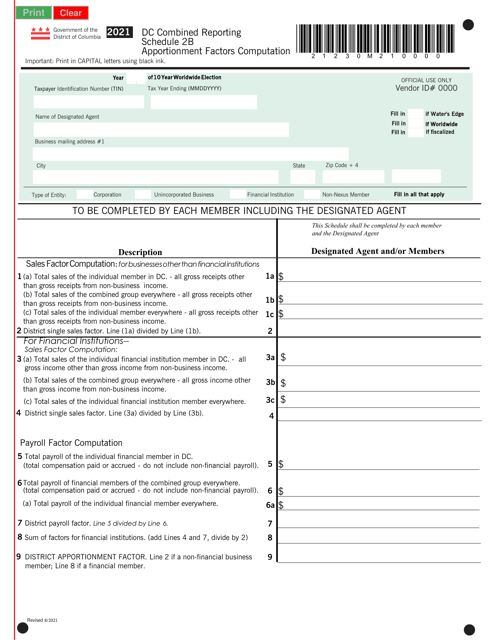

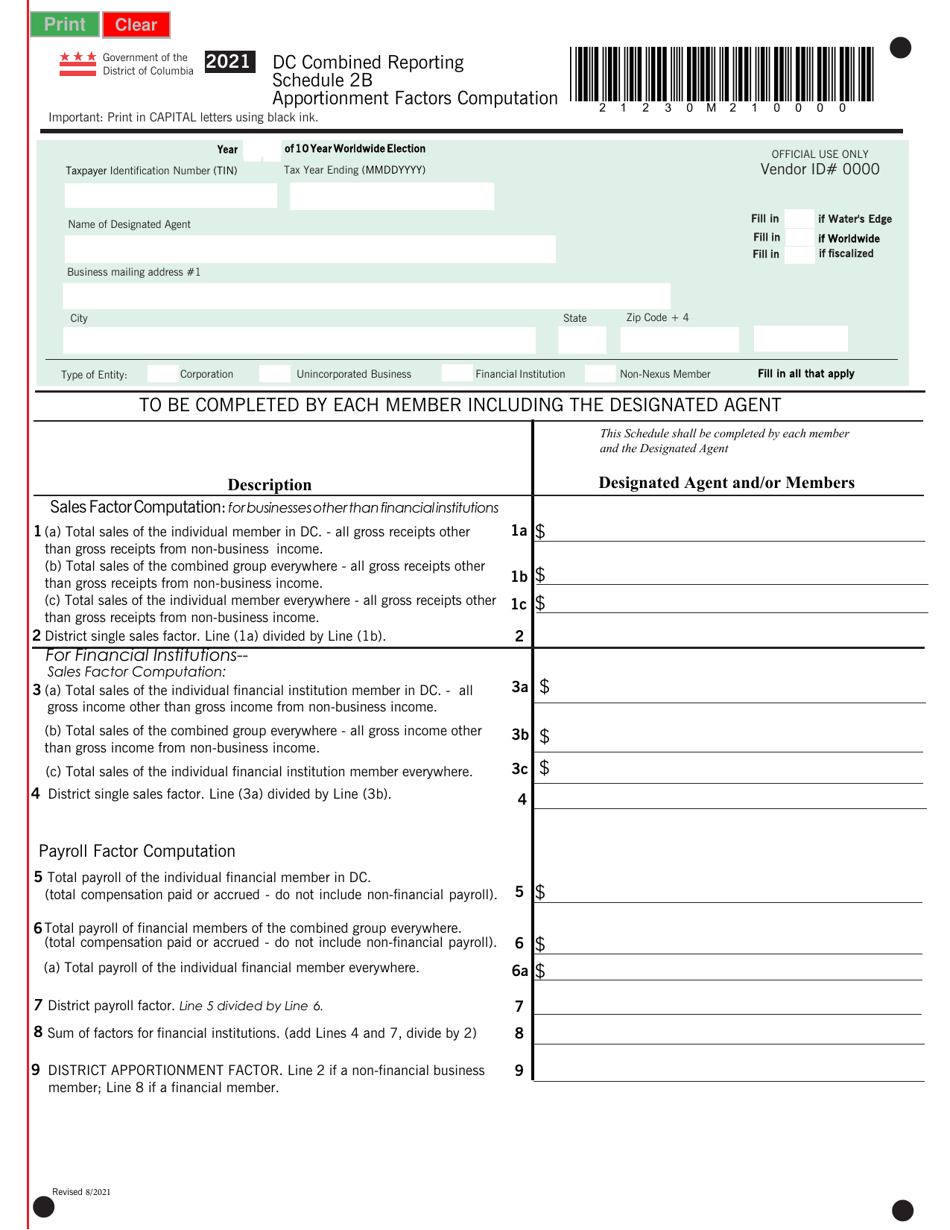

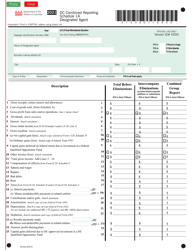

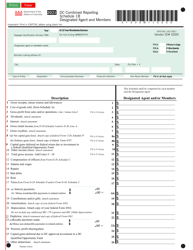

Schedule 2B Combined Reporting Schedule - Apportionment Factors Computation - Washington, D.C.

What Is Schedule 2B?

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule 2B?

A: Schedule 2B is a form used for combined reporting in Washington, D.C.

Q: What does Schedule 2B calculate?

A: Schedule 2B calculates the apportionment factors for combined reporting.

Q: What are apportionment factors?

A: Apportionment factors are used to determine how much of a company's income is taxable in Washington, D.C. versus other jurisdictions.

Q: Who is required to file Schedule 2B?

A: Companies that are subject to combined reporting in Washington, D.C. are required to file Schedule 2B.

Q: What is combined reporting?

A: Combined reporting is a method of taxing corporate income in which the income of related corporations is combined for tax purposes.

Q: How do I complete Schedule 2B?

A: You will need to provide information about your company's total sales, property, and payroll in Washington, D.C. and in other jurisdictions.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule 2B by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.