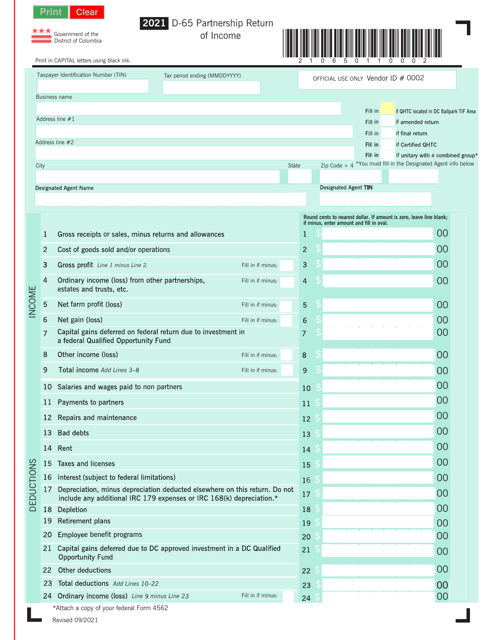

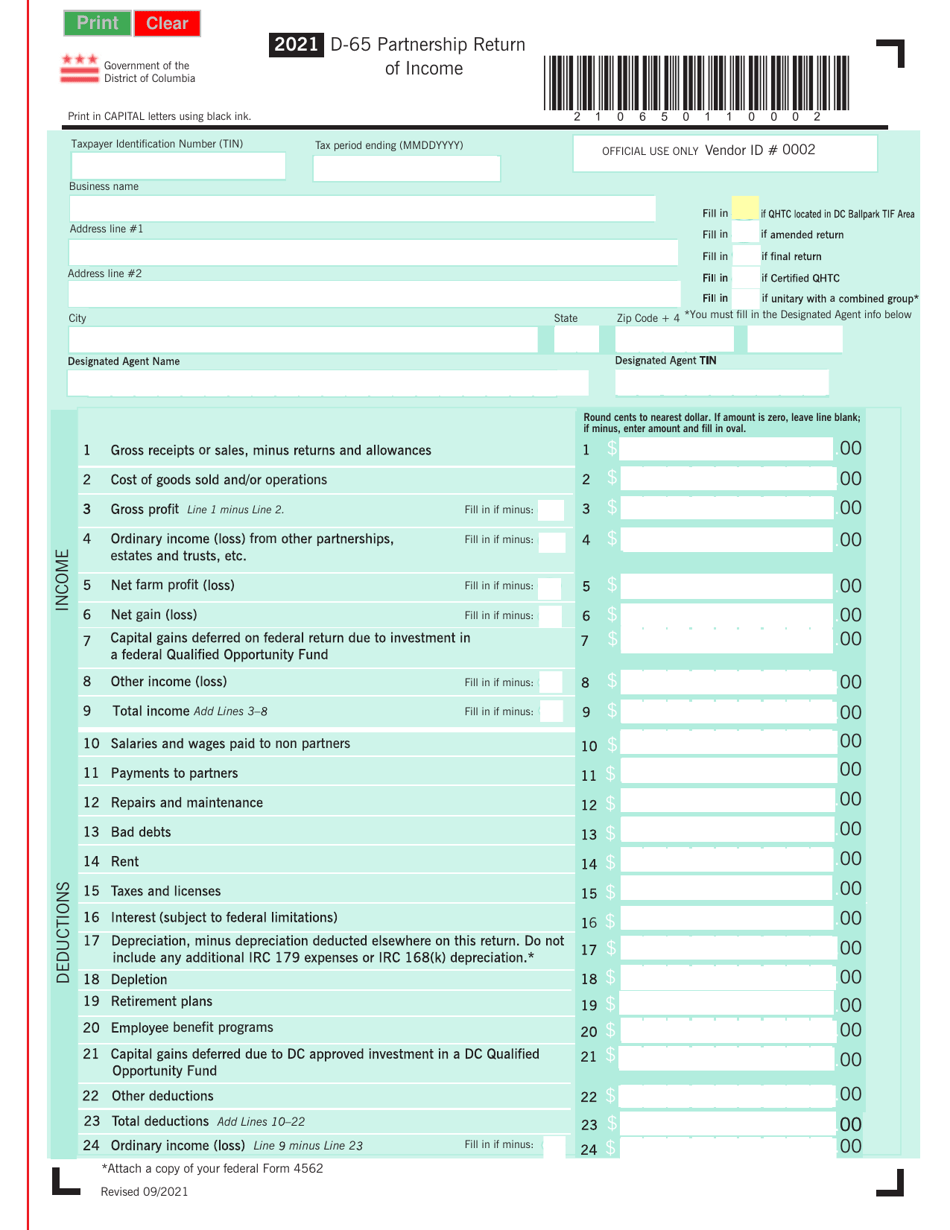

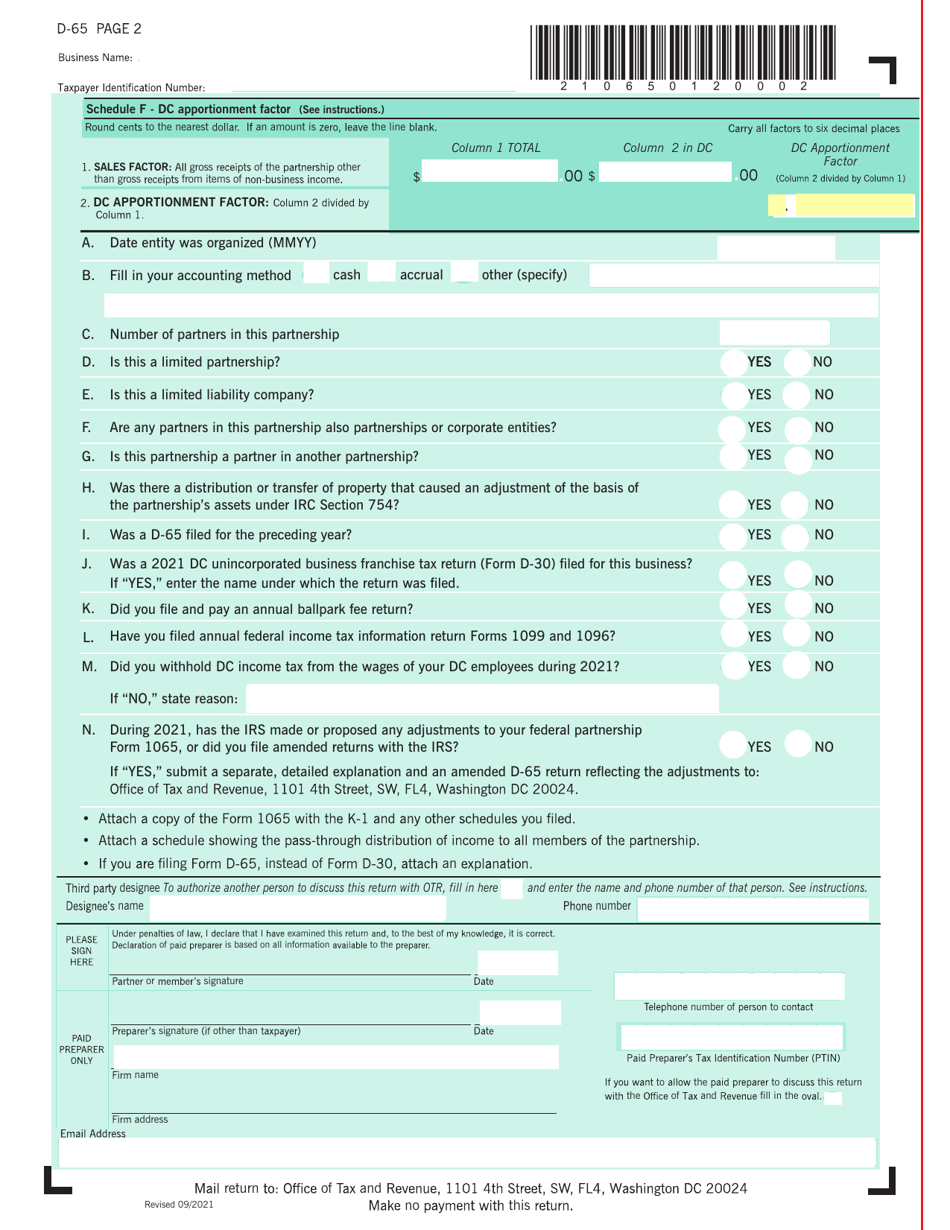

Form D-65 Partnership Return of Income - Washington, D.C.

What Is Form D-65?

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-65?

A: Form D-65 is the Partnership Return of Income form specific to the District of Columbia.

Q: Who needs to file Form D-65?

A: Partnerships that have sourced income from the District of Columbia need to file Form D-65.

Q: When is Form D-65 due?

A: The due date for Form D-65 is the 15th day of the fourth month following the close of the partnership's tax year.

Q: Are there any extensions available for filing Form D-65?

A: Yes, you can request a 6-month extension using Form FR-127, but the tax payment is still due by the original due date.

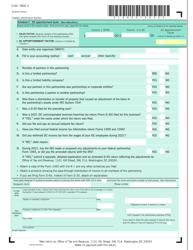

Q: What information do I need to complete Form D-65?

A: You will need details of the partnership's income, deductions, and credits for the tax year.

Q: Is there a penalty for late filing of Form D-65?

A: Yes, there is a penalty for late filing, which is based on the number of days late and the amount of tax owed.

Q: Is Form D-65 the same as the federal Partnership Return?

A: No, Form D-65 is specific to the District of Columbia and should not be confused with the federal Partnership Return, Form 1065.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-65 by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.