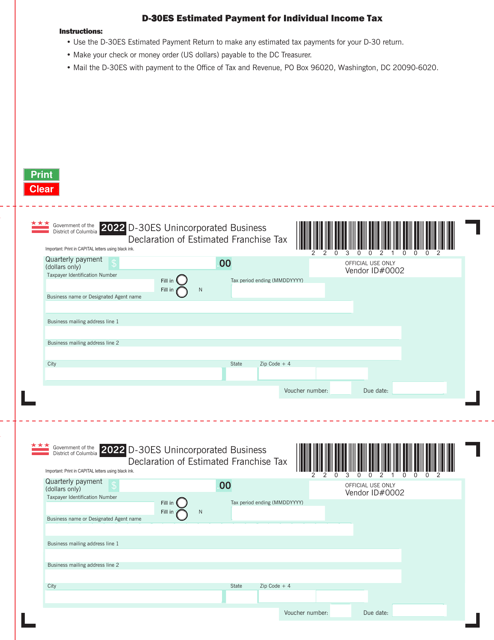

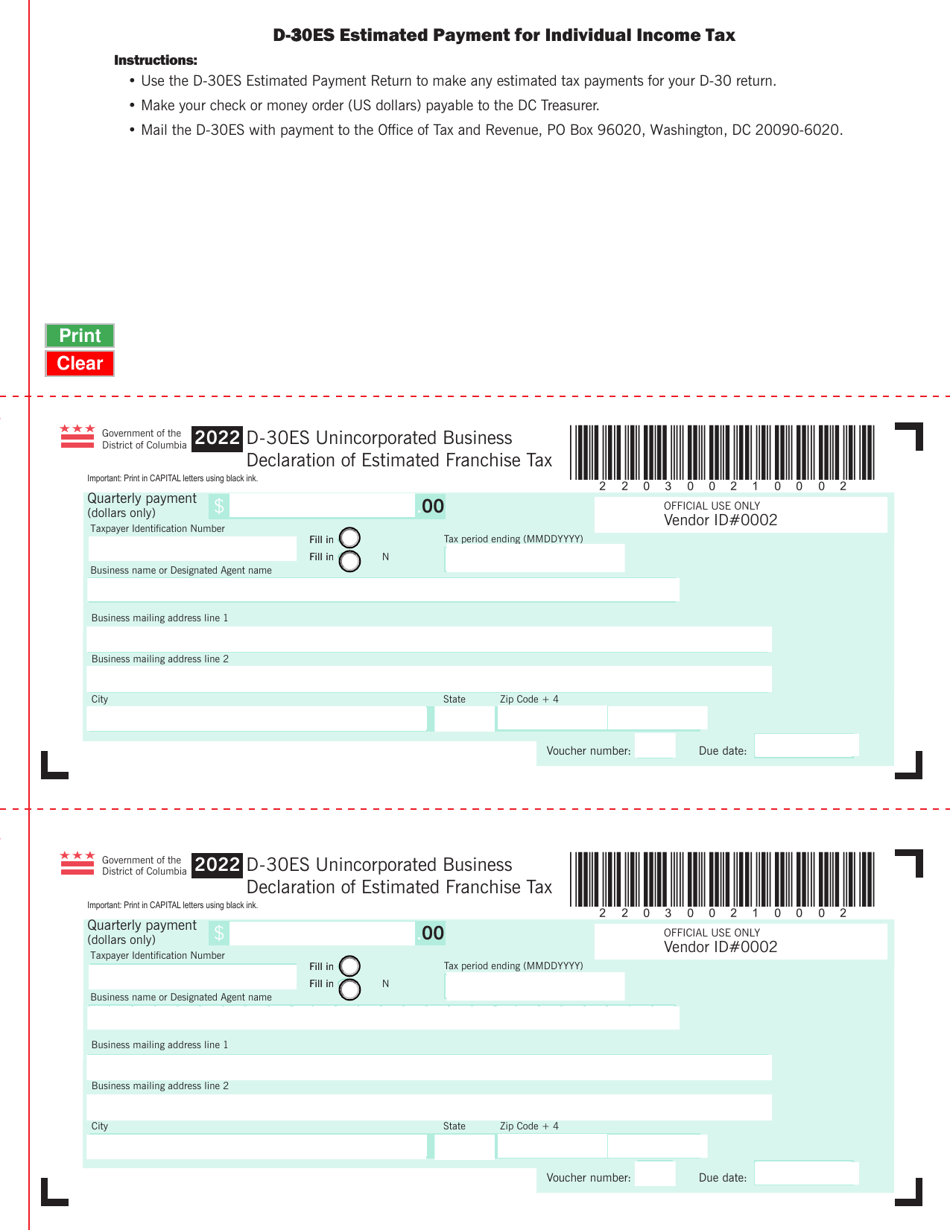

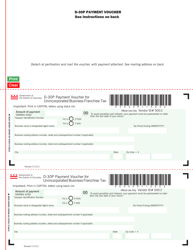

Form D-30ES Unincorporated Business Declaration of Estimated Franchise Tax - Washington, D.C.

What Is Form D-30ES?

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-30ES?

A: Form D-30ES is the Unincorporated Business Declaration of Estimated Franchise Tax for businesses in Washington, D.C.

Q: Who needs to file Form D-30ES?

A: Unincorporated businesses operating in Washington, D.C. are required to file Form D-30ES.

Q: What is the purpose of Form D-30ES?

A: The purpose of Form D-30ES is to report and pay estimated franchise tax on unincorporated business income in Washington, D.C.

Q: When is Form D-30ES due?

A: Form D-30ES is due on a quarterly basis, with the first payment due on April 15th.

Q: What information is required on Form D-30ES?

A: Form D-30ES requires information such as taxpayer identification number, address, estimated income, and tax liability.

Form Details:

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-30ES by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.