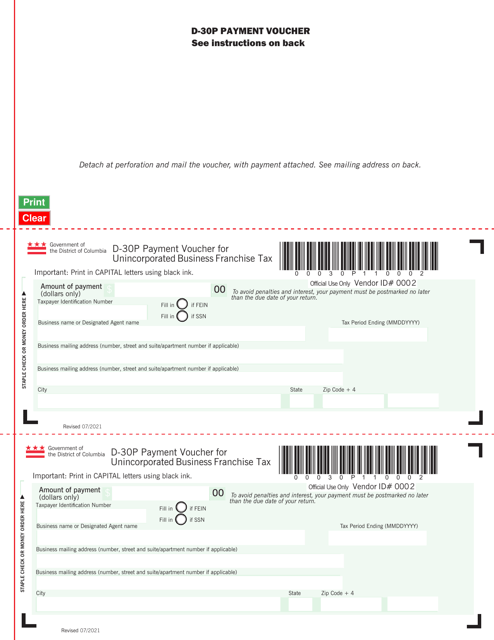

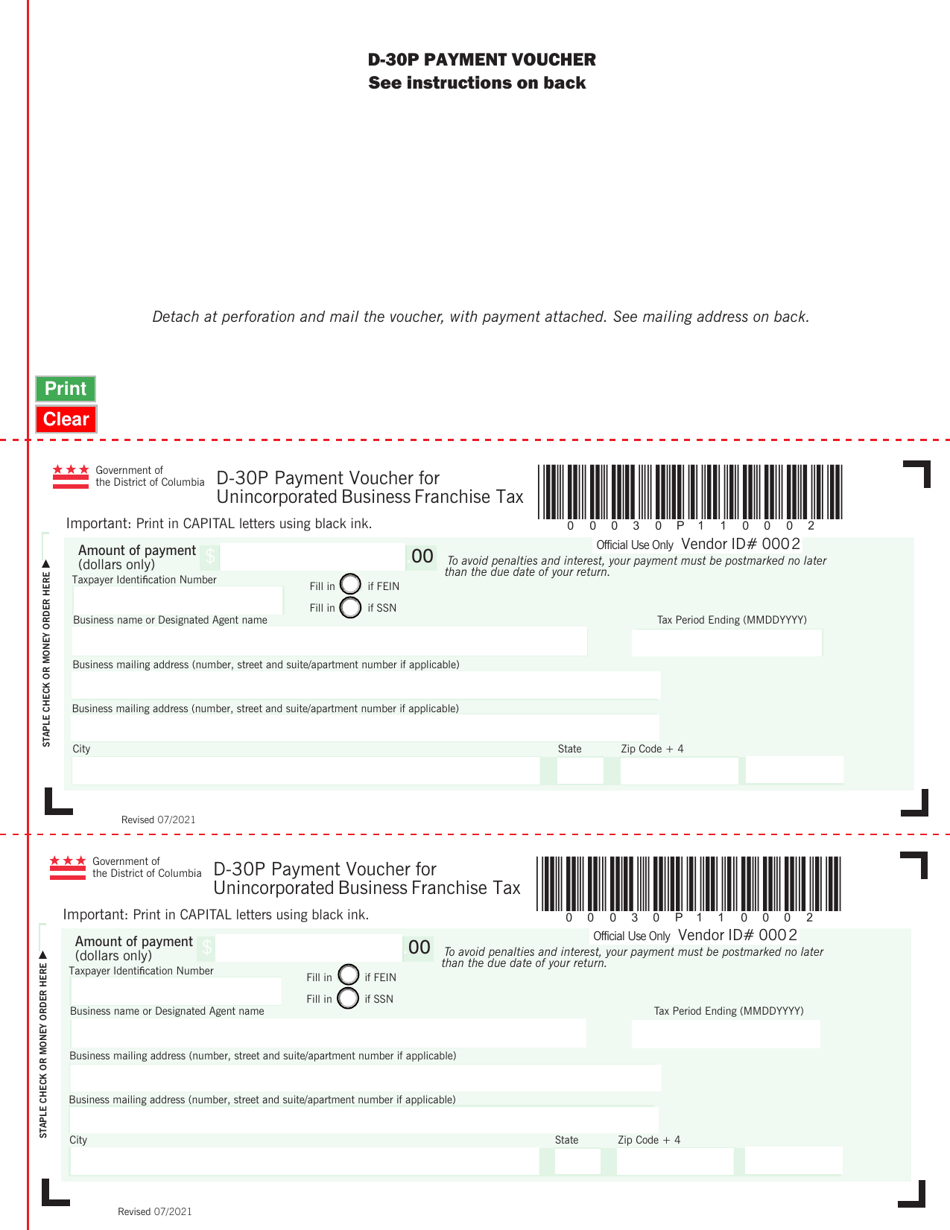

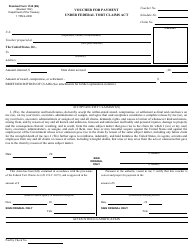

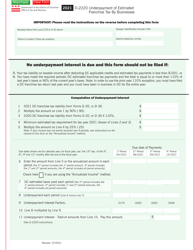

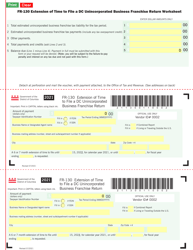

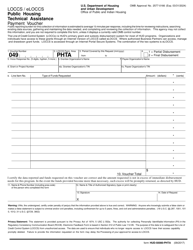

Form D-30P Payment Voucher for Unincorporated Business Franchise Tax - Washington, D.C.

What Is Form D-30P?

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-30P?

A: Form D-30P is a payment voucher for unincorporated businessfranchise tax in Washington, D.C.

Q: Who needs to use Form D-30P?

A: Individuals or businesses that are subject to unincorporated business franchise tax in Washington, D.C. need to use Form D-30P.

Q: What is the purpose of Form D-30P?

A: The purpose of Form D-30P is to make a payment of unincorporated business franchise tax owed in Washington, D.C.

Q: How do I fill out Form D-30P?

A: You need to provide your tax year, your name, address, tax identification number, the amount of tax due, and other required information.

Q: When is Form D-30P due?

A: Form D-30P is due on or before April 15th of the following year, or the 15th day of the fourth month following the close of your tax year.

Q: Can I file Form D-30P electronically?

A: Yes, you can file Form D-30P electronically through the District of Columbia eTax system.

Q: What should I do with the completed Form D-30P?

A: You should keep a copy of the completed Form D-30P for your records and submit the payment to the District of Columbia Office of Tax and Revenue.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-30P by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.