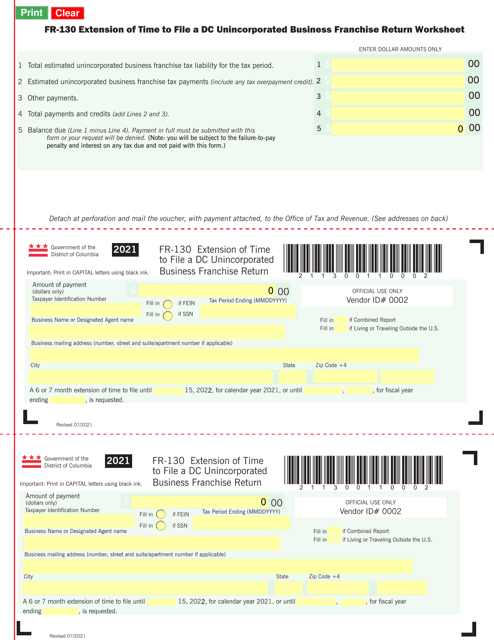

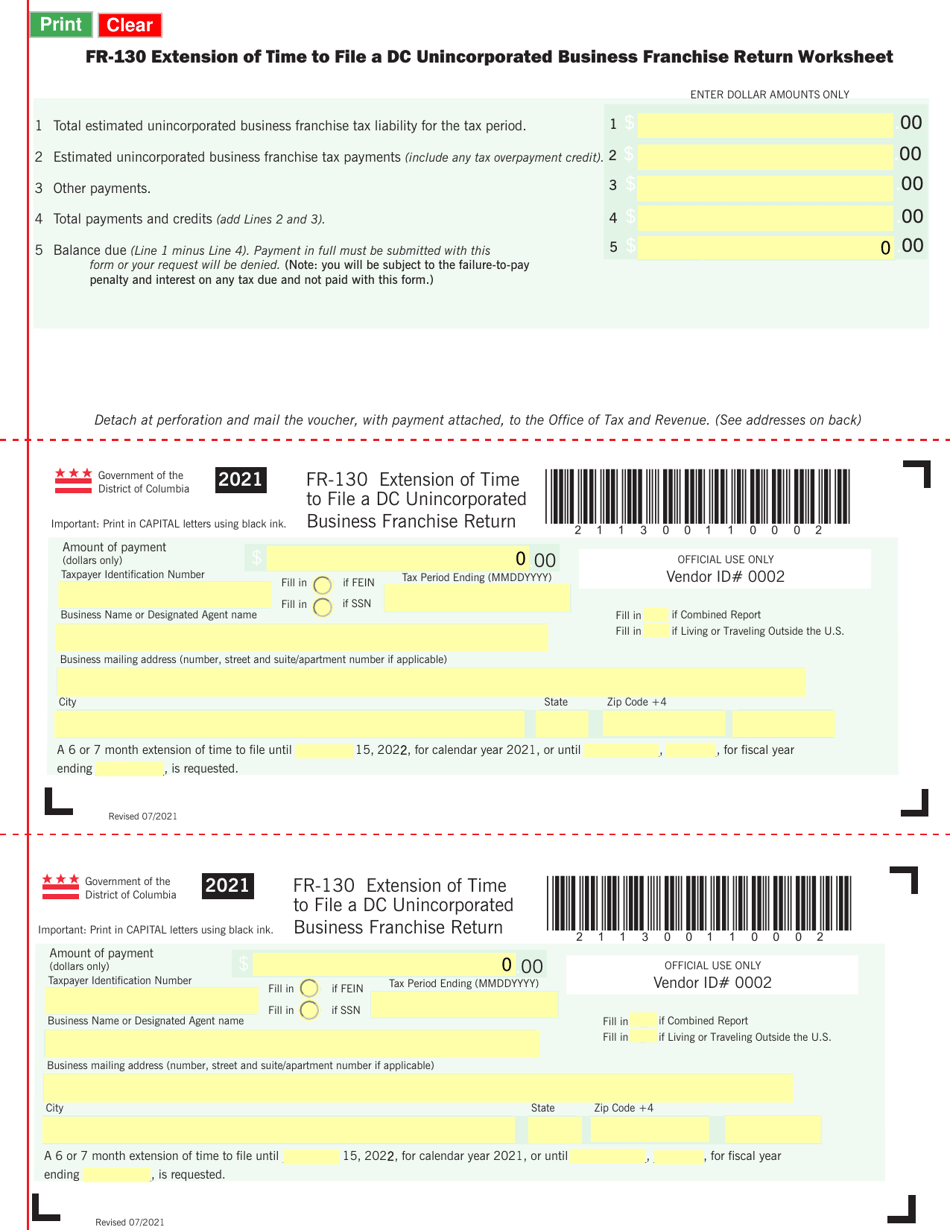

Form FR-130 Extension of Time to File a Dc Unincorporated Business Franchise Return Worksheet - Washington, D.C.

What Is Form FR-130?

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form FR-130?

A: Form FR-130 is an Extension of Time to File a DC Unincorporated Business Franchise Return Worksheet.

Q: What is the purpose of form FR-130?

A: The purpose of form FR-130 is to request an extension of time to file the DC Unincorporated Business Franchise Return.

Q: Who needs to file form FR-130?

A: Anyone who needs additional time to file their DC Unincorporated Business Franchise Return can file form FR-130.

Q: When is form FR-130 due?

A: Form FR-130 is due on the same date as the DC Unincorporated Business Franchise Return.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FR-130 by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.