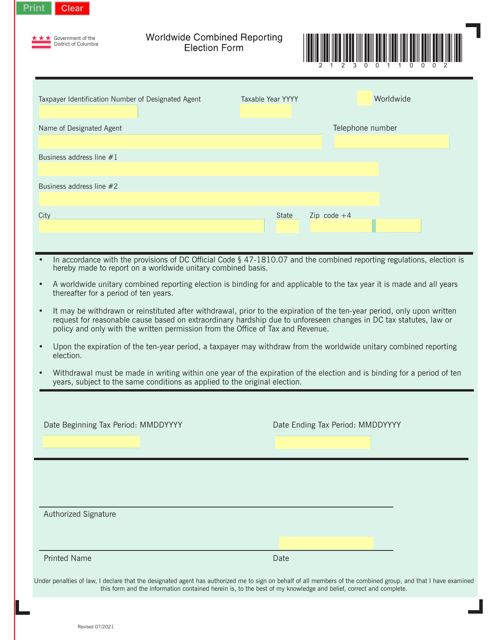

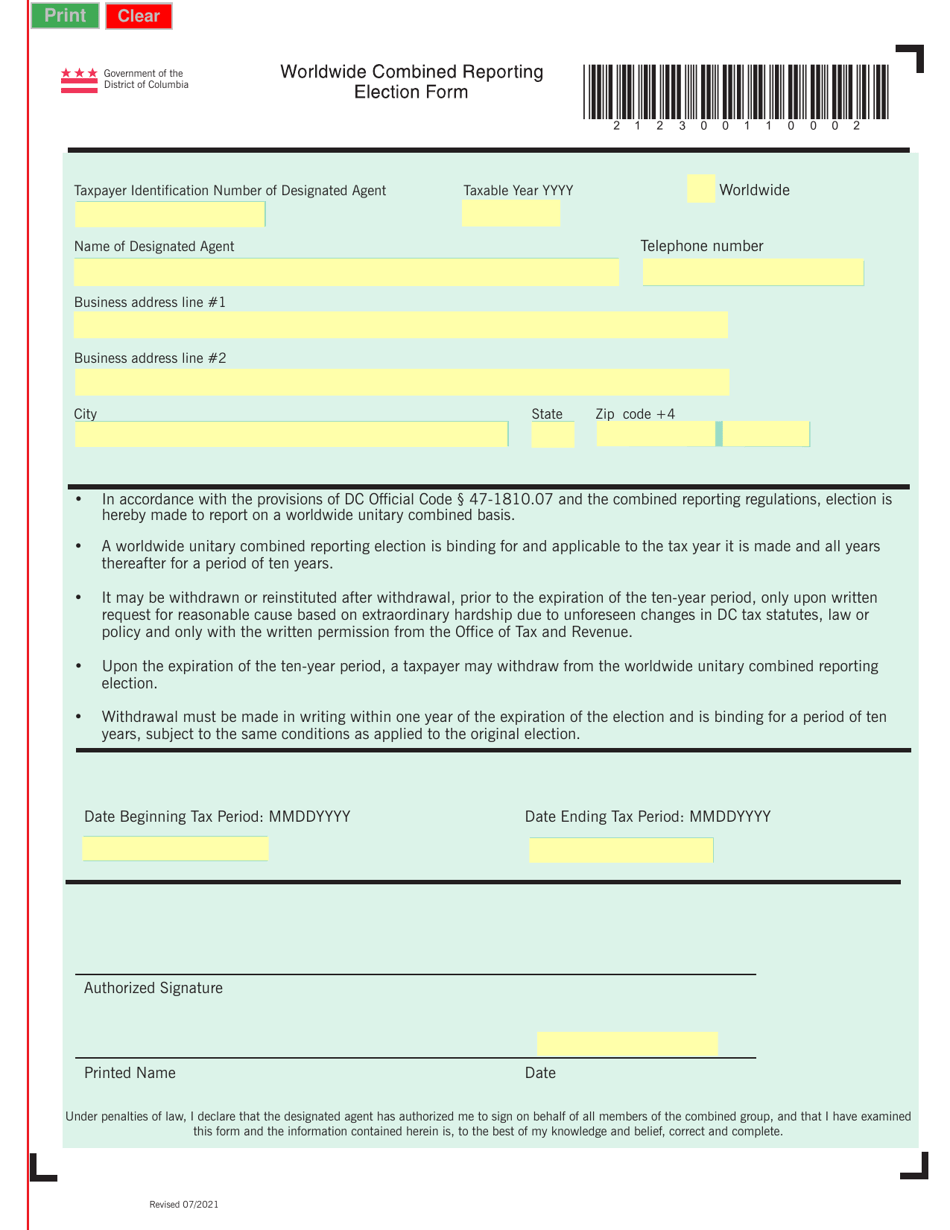

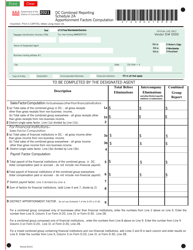

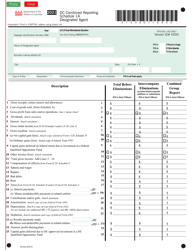

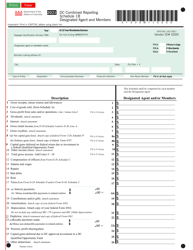

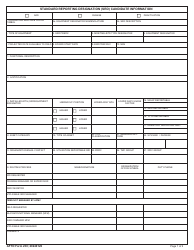

Worldwide Combined Reporting Election Form - Washington, D.C.

Worldwide Combined Reporting Election Form is a legal document that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C..

FAQ

Q: What is the Worldwide Combined Reporting Election Form?

A: The Worldwide Combined Reporting Election Form is a form used in Washington, D.C. to elect combined reporting for worldwide income.

Q: What is combined reporting?

A: Combined reporting is a method of taxation where the income of multiple related entities is combined and taxed as a single unit.

Q: Who is required to file the Worldwide Combined Reporting Election Form?

A: Entities that meet certain criteria and choose to elect combined reporting for their worldwide income in Washington, D.C. are required to file this form.

Q: What is the purpose of filing this form?

A: The purpose of filing the Worldwide Combined Reporting Election Form is to elect combined reporting for worldwide income in Washington, D.C., which may have tax benefits for the entity.

Q: Are there any eligibility criteria for electing combined reporting?

A: Yes, entities must meet certain criteria, such as having a substantial economic presence or being part of a unitary business group, to be eligible to elect combined reporting.

Q: Is there a deadline for filing the Worldwide Combined Reporting Election Form?

A: Yes, there is a specific deadline for filing this form, usually determined by the tax authority in Washington, D.C. It is important to file the form by the deadline to ensure compliance.

Q: What are the potential advantages of electing combined reporting for worldwide income?

A: By electing combined reporting for worldwide income, entities may be able to offset losses from one entity against the profits of another, potentially reducing their overall tax liability.

Q: Are there any disadvantages of electing combined reporting?

A: There may be some disadvantages, such as increased complexity in the tax calculation and reporting process, as well as potential limitations on certain deductions or credits.

Q: Can an entity change its election from combined reporting to separate reporting or vice versa?

A: The ability to change the election from combined reporting to separate reporting, or vice versa, may depend on the specific tax laws and regulations in Washington, D.C. It is recommended to consult with a tax professional for guidance on this matter.

Form Details:

- Released on July 1, 2021;

- The latest edition currently provided by the Washington DC Office of Tax and Revenue;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.