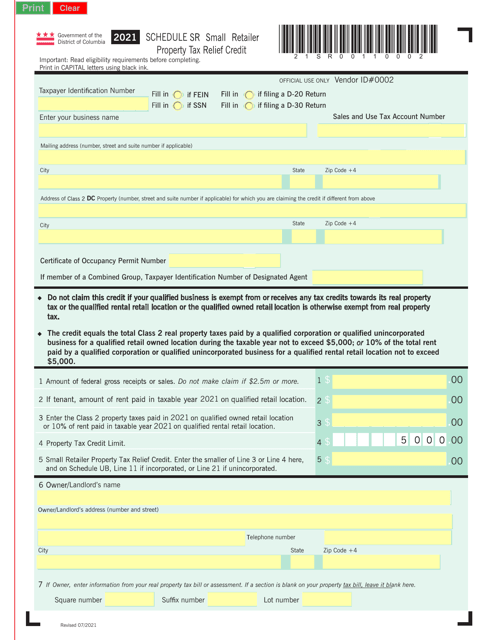

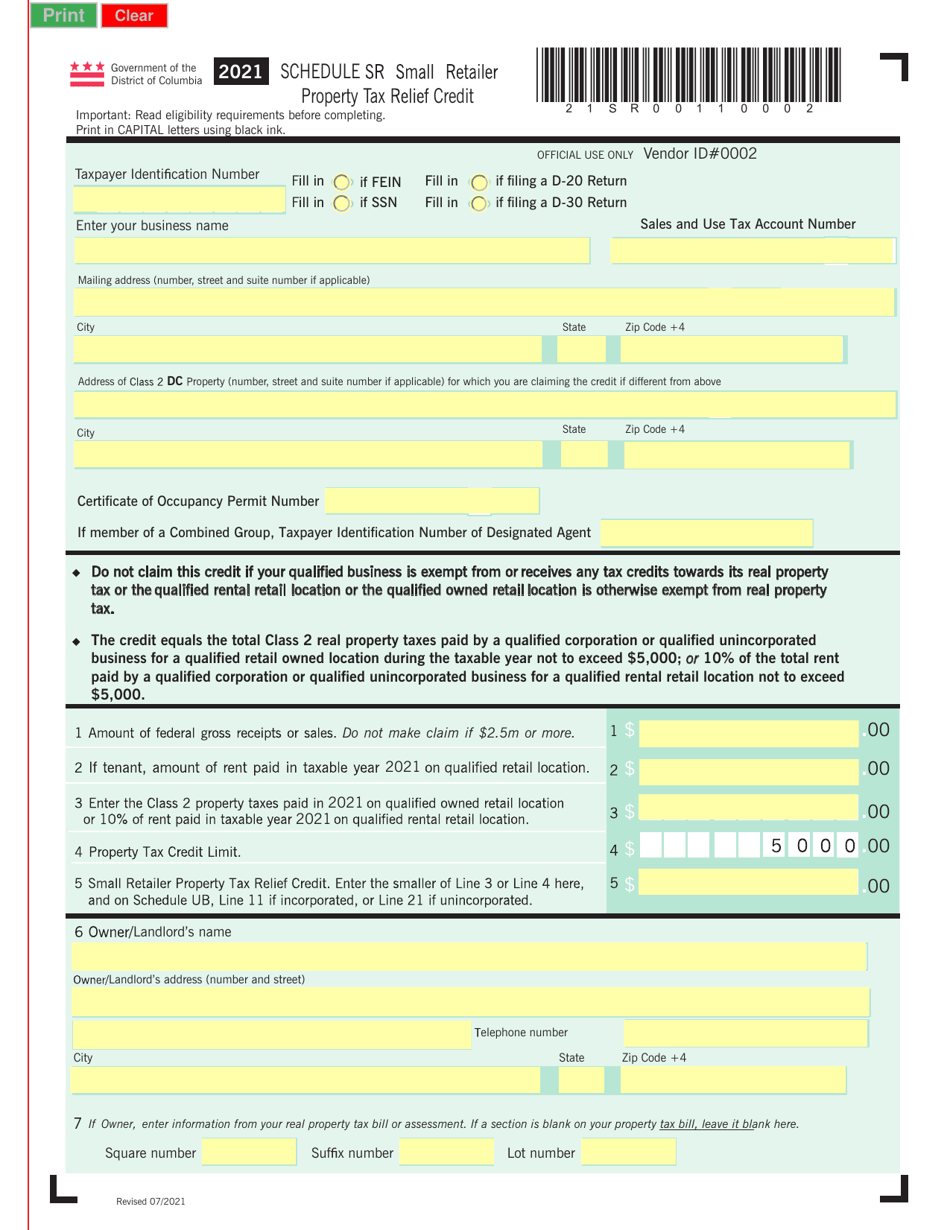

Schedule SR Small Retailer Property Tax Relief Credit - Washington, D.C.

What Is Schedule SR?

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule SR?

A: Schedule SR is a form used in Washington, D.C. to claim the Small Retailer Property Tax Relief Credit.

Q: What is the Small Retailer Property Tax Relief Credit?

A: The Small Retailer Property Tax Relief Credit is a credit available to eligible small retailers in Washington, D.C. to help offset their property tax liability.

Q: Who is eligible for the Small Retailer Property Tax Relief Credit?

A: Small retailers who meet certain criteria, such as having a physical store in Washington, D.C. and generating a certain amount of annual gross receipts, may be eligible for the credit.

Q: How do I claim the Small Retailer Property Tax Relief Credit?

A: To claim the credit, you need to complete Schedule SR and include it with your D.C. tax return.

Q: Are there any deadlines for claiming the Small Retailer Property Tax Relief Credit?

A: Yes, the credit must be claimed on your annual D.C. tax return for the tax year in which you are seeking the credit.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule SR by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.