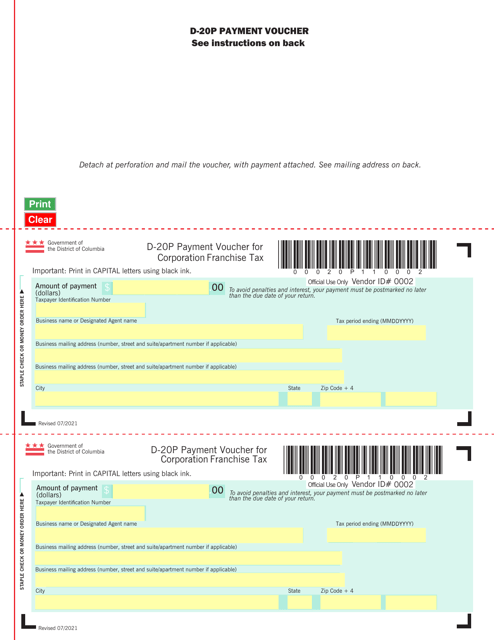

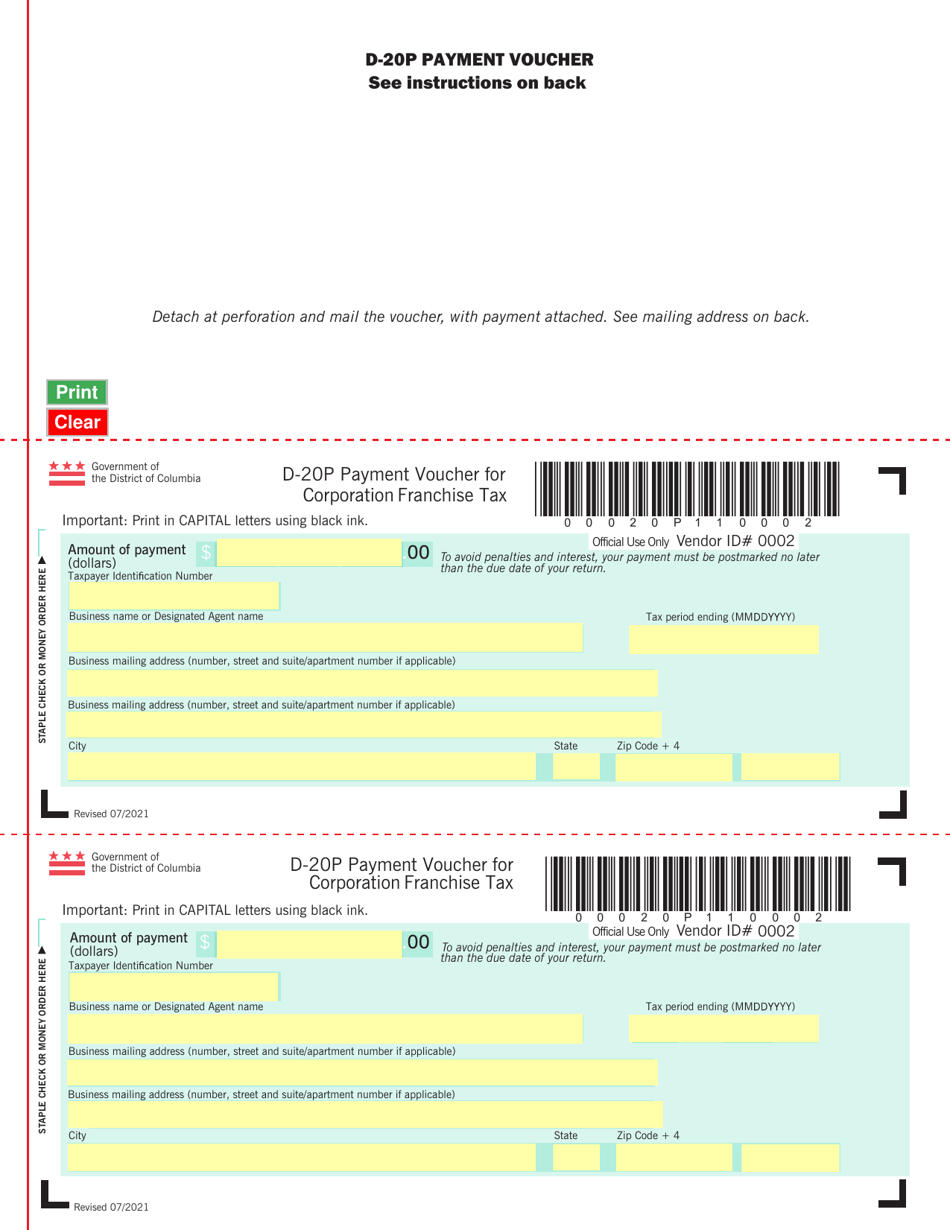

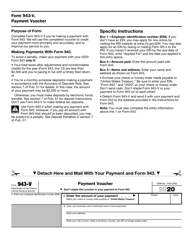

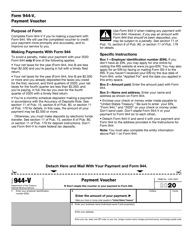

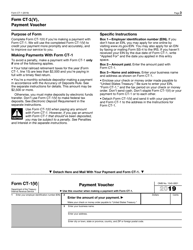

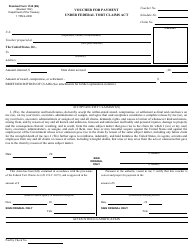

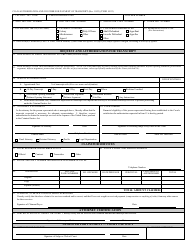

Form D-20P Payment Voucher for Corporation Franchise Tax - Washington, D.C.

What Is Form D-20P?

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-20P?

A: Form D-20P is the Payment Voucher for Corporation Franchise Tax in Washington, D.C.

Q: Who is required to file Form D-20P?

A: Corporations in Washington, D.C. that need to pay their franchise tax are required to file Form D-20P.

Q: What is the purpose of Form D-20P?

A: The purpose of Form D-20P is to provide corporations with a payment voucher for their franchise tax liability in Washington, D.C.

Q: When should Form D-20P be filed?

A: Form D-20P should be filed by the due date specified by the Office of Tax and Revenue in Washington, D.C.

Q: Is Form D-20P only for corporations?

A: Yes, Form D-20P is specifically for corporations that need to pay their franchise tax in Washington, D.C.

Q: Are there any penalties for late filing of Form D-20P?

A: Yes, there may be penalties for late filing of Form D-20P, so it is important to comply with the specified due date.

Q: Can Form D-20P be filed electronically?

A: Yes, Form D-20P can be filed electronically through the eTax portal provided by the Office of Tax and Revenue in Washington, D.C.

Q: What information is required on Form D-20P?

A: Form D-20P requires information such as the corporation's name, address, tax year, and the amount of franchise tax due.

Q: Can Form D-20P be used for other tax purposes?

A: No, Form D-20P is specifically designed for the payment of corporation franchise tax in Washington, D.C.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-20P by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.