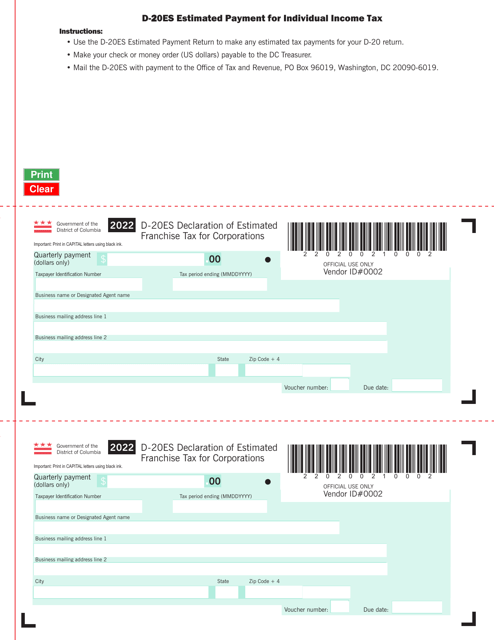

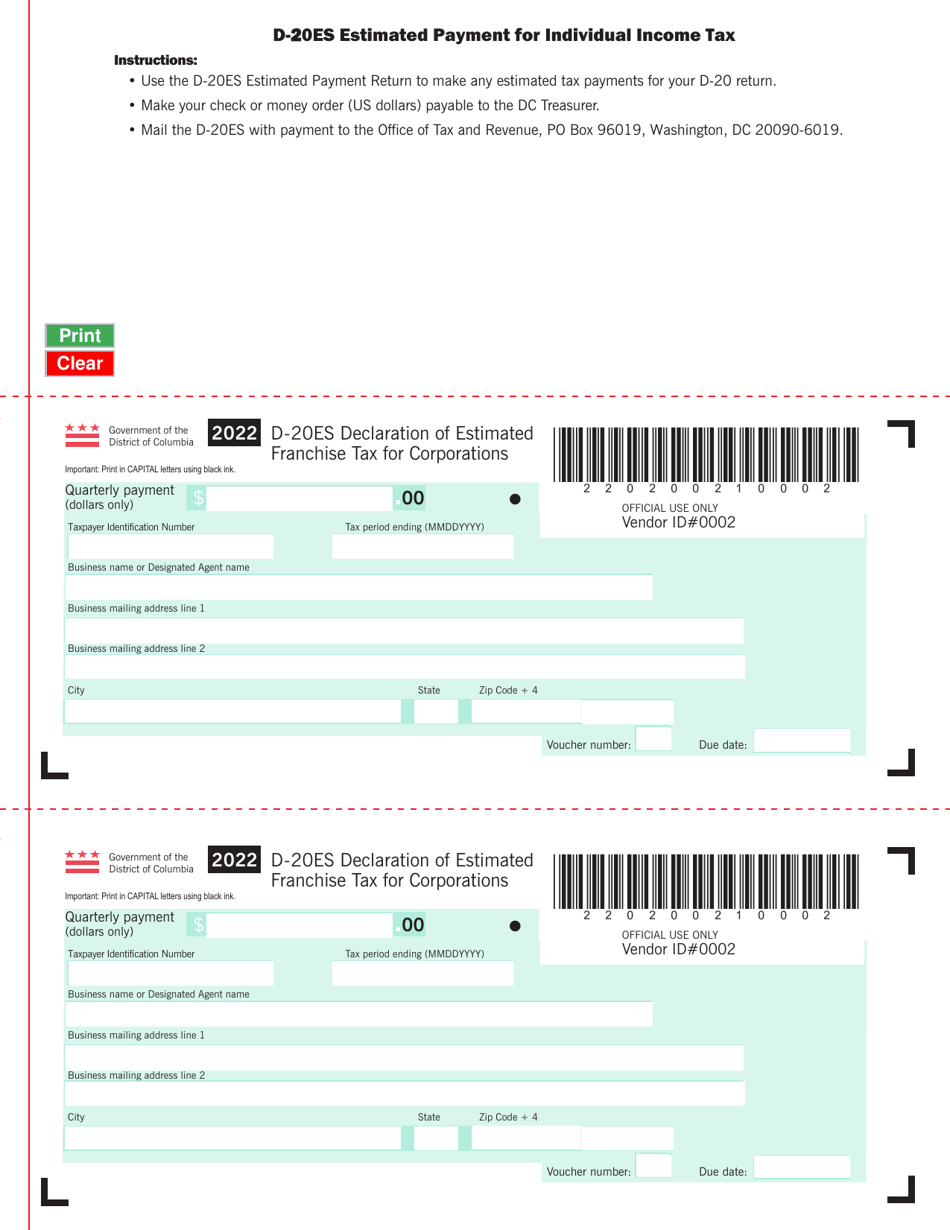

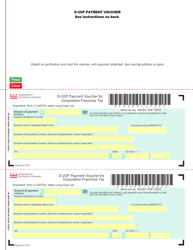

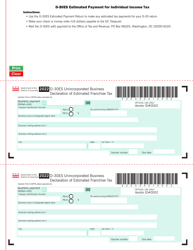

Form D-20ES Declaration of Estimated Franchise Tax for Corporations - Washington, D.C.

What Is Form D-20ES?

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form D-20ES?

A: Form D-20ES is the Declaration of Estimated Franchise Tax for Corporations in Washington, D.C.

Q: Who needs to file Form D-20ES?

A: Corporations in Washington, D.C. that are subject to the franchise tax need to file Form D-20ES.

Q: What is the purpose of Form D-20ES?

A: The purpose of Form D-20ES is to report and pay estimated franchise tax liabilities in advance.

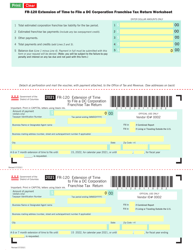

Q: When does Form D-20ES need to be filed?

A: Form D-20ES is due on the 15th day of the 4th, 6th, 9th, and 12th months of the corporation's tax year.

Q: Is Form D-20ES required for all corporations?

A: No, only corporations subject to the franchise tax in Washington, D.C. are required to file Form D-20ES.

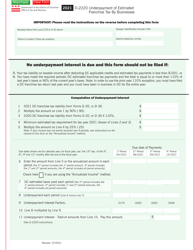

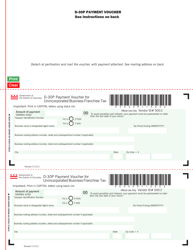

Q: What happens if I fail to file Form D-20ES?

A: Failure to file Form D-20ES or underpayment of estimated franchise tax may result in penalties and interest.

Q: Are there any exemptions to filing Form D-20ES?

A: There are no specific exemptions to filing Form D-20ES. All applicable corporations must file the form.

Q: Can I amend my Form D-20ES?

A: Yes, you can amend your Form D-20ES by filing an amended return using Form D-20.

Form Details:

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form D-20ES by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.