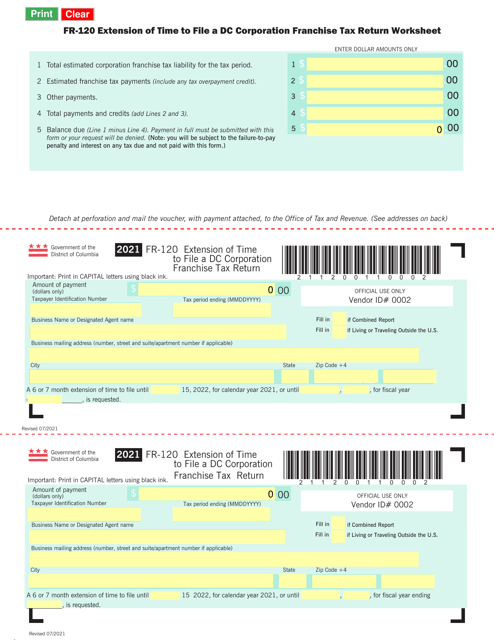

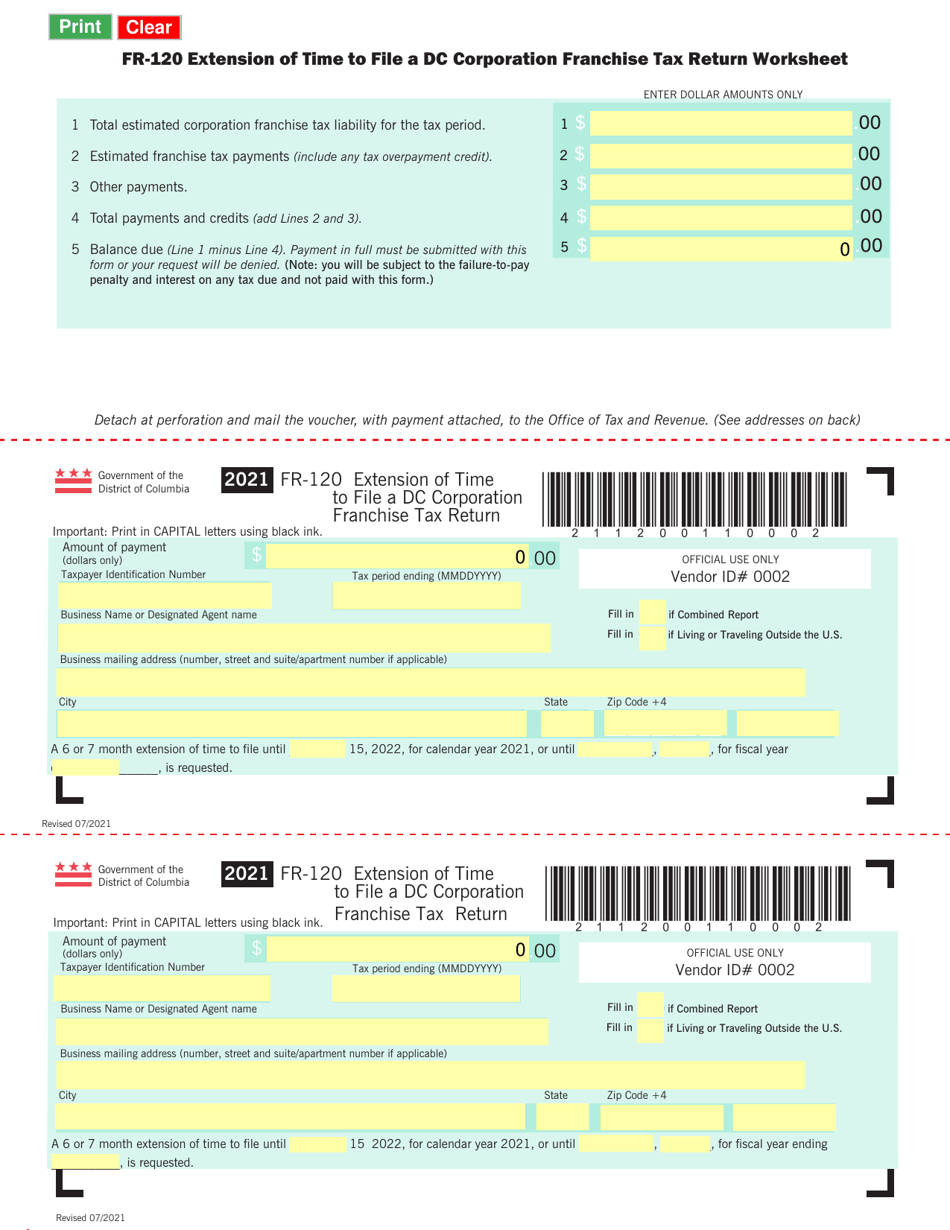

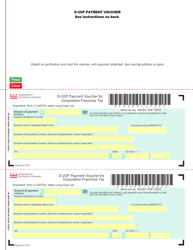

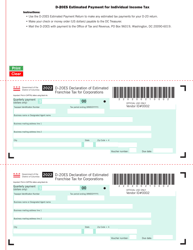

Form FR-120 Extension of Time to File a Dc Corporation Franchise Tax Return - Washington, D.C.

What Is Form FR-120?

This is a legal form that was released by the Washington DC Office of Tax and Revenue - a government authority operating within Washington, D.C.. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FR-120?

A: Form FR-120 is the extension request form for filing a D.C. Corporation Franchise Tax Return.

Q: What is the purpose of Form FR-120?

A: The purpose of Form FR-120 is to request an extension of time to file a D.C. Corporation Franchise Tax Return.

Q: Who needs to file Form FR-120?

A: Any individual or business entity that needs additional time to file their D.C. Corporation Franchise Tax Return must file Form FR-120.

Q: What is the deadline to file Form FR-120?

A: Form FR-120 must be filed on or before the original due date of the D.C. Corporation Franchise Tax Return, which is typically April 15th.

Q: How long is the extension granted by Form FR-120?

A: Form FR-120 grants a 6-month extension to file the D.C. Corporation Franchise Tax Return, making the new deadline October 15th.

Q: Are there any penalties for filing Form FR-120?

A: There are no penalties for filing Form FR-120, but interest will accrue on any unpaid tax liability during the extension period.

Q: Can I request an additional extension after filing Form FR-120?

A: No, additional extensions of time to file the D.C. Corporation Franchise Tax Return are generally not granted after filing Form FR-120.

Form Details:

- Released on July 1, 2021;

- The latest edition provided by the Washington DC Office of Tax and Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FR-120 by clicking the link below or browse more documents and templates provided by the Washington DC Office of Tax and Revenue.