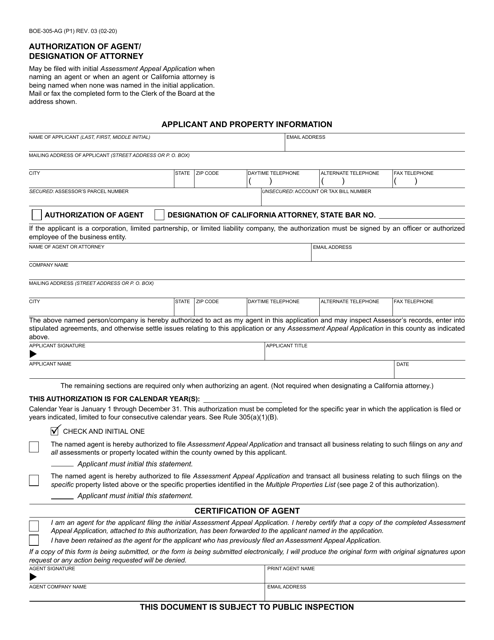

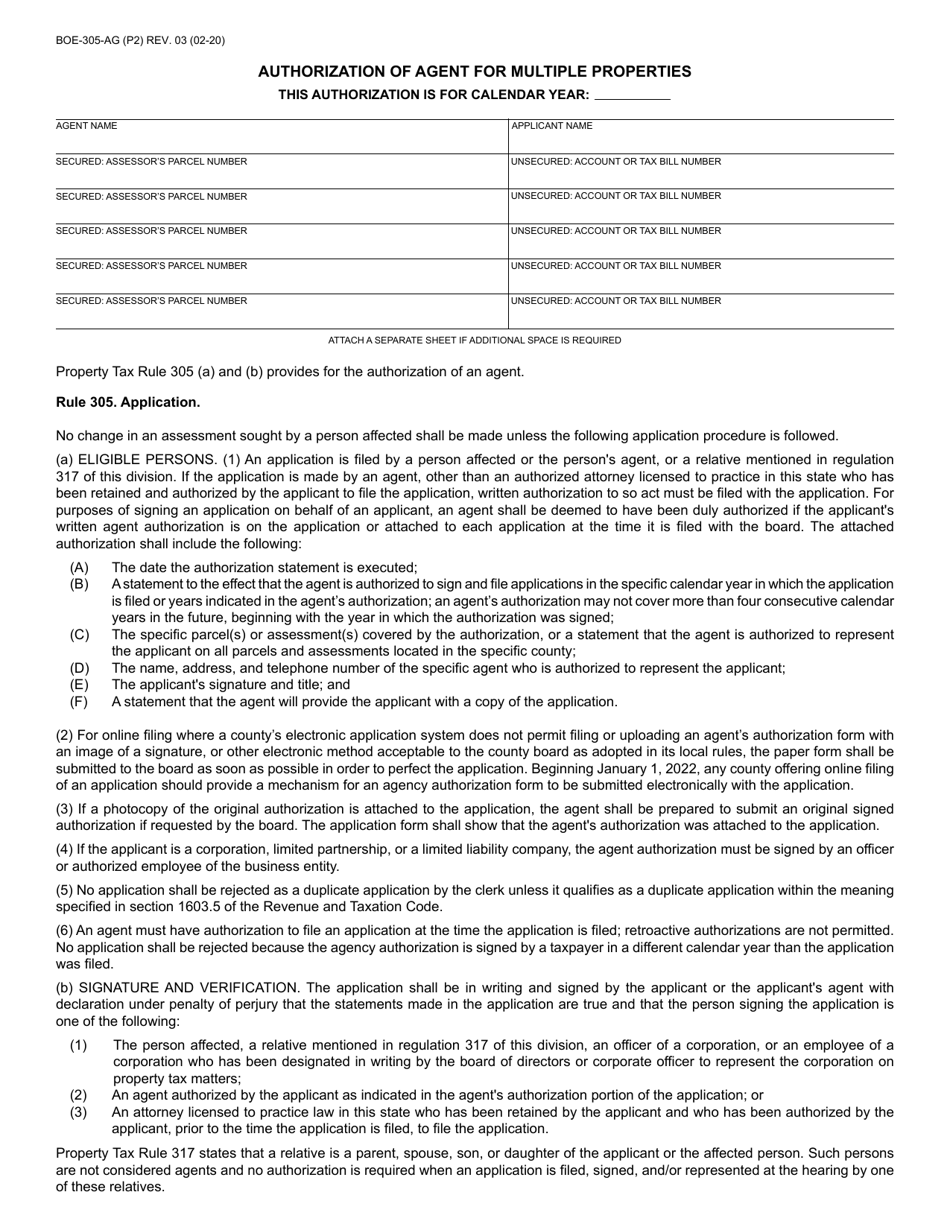

Form BOE-305-AG Authorization of Agent / Designation of Attorney - California

What Is Form BOE-305-AG?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BOE-305-AG?

A: Form BOE-305-AG is the Authorization of Agent/Designation of Attorney form in California.

Q: What is the purpose of Form BOE-305-AG?

A: The purpose of Form BOE-305-AG is to authorize an agent or designate an attorney to act on behalf of a taxpayer in matters related to California state taxes.

Q: Who needs to fill out Form BOE-305-AG?

A: Taxpayers in California who want to authorize an agent or designate an attorney to represent them in tax matters need to fill out Form BOE-305-AG.

Q: Are there any fees associated with filing Form BOE-305-AG?

A: No, there are no fees associated with filing Form BOE-305-AG.

Q: Is Form BOE-305-AG required for all types of taxes?

A: Yes, Form BOE-305-AG is required for all types of taxes administered by the California State Board of Equalization.

Q: Can I revoke or amend the authorization or designation made on Form BOE-305-AG?

A: Yes, you can revoke or amend the authorization or designation made on Form BOE-305-AG by submitting a new form.

Q: How long is the authorization or designation valid?

A: The authorization or designation made on Form BOE-305-AG is valid until it is revoked or amended, or until it is superseded by a new authorization or designation form.

Q: Is Form BOE-305-AG specific to individuals or can businesses also use it?

A: Both individuals and businesses can use Form BOE-305-AG to authorize an agent or designate an attorney.

Form Details:

- Released on February 1, 2020;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BOE-305-AG by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.