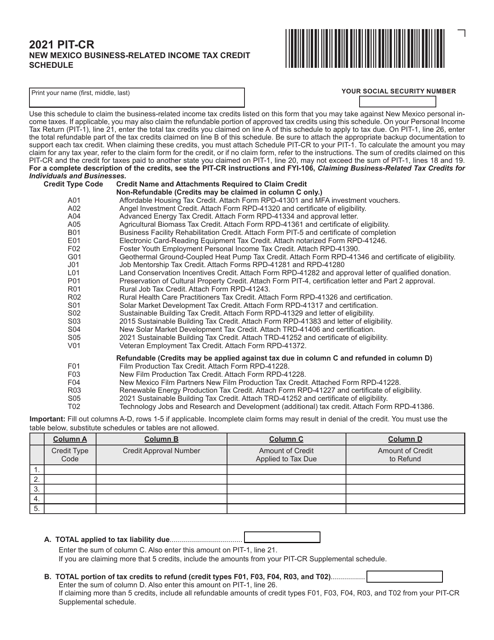

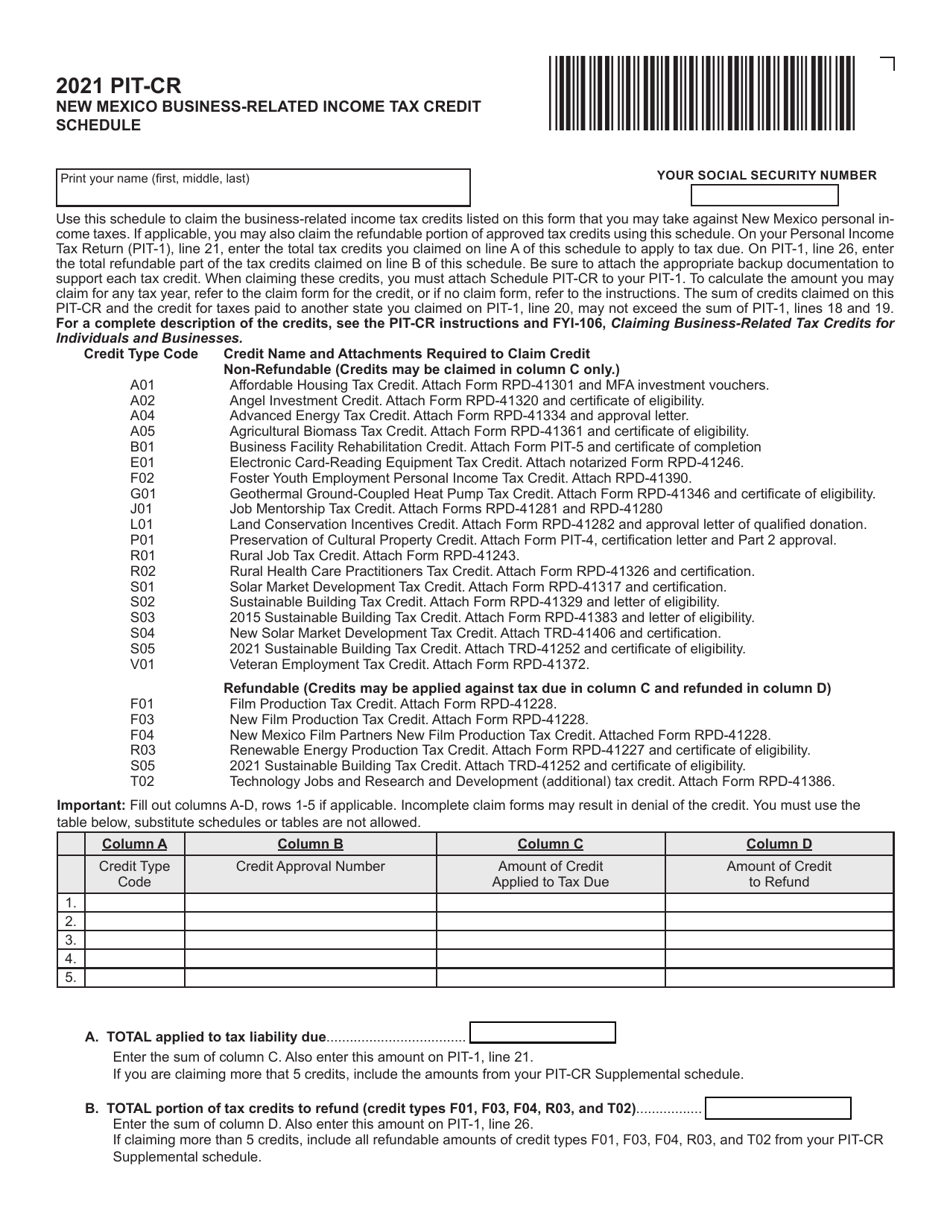

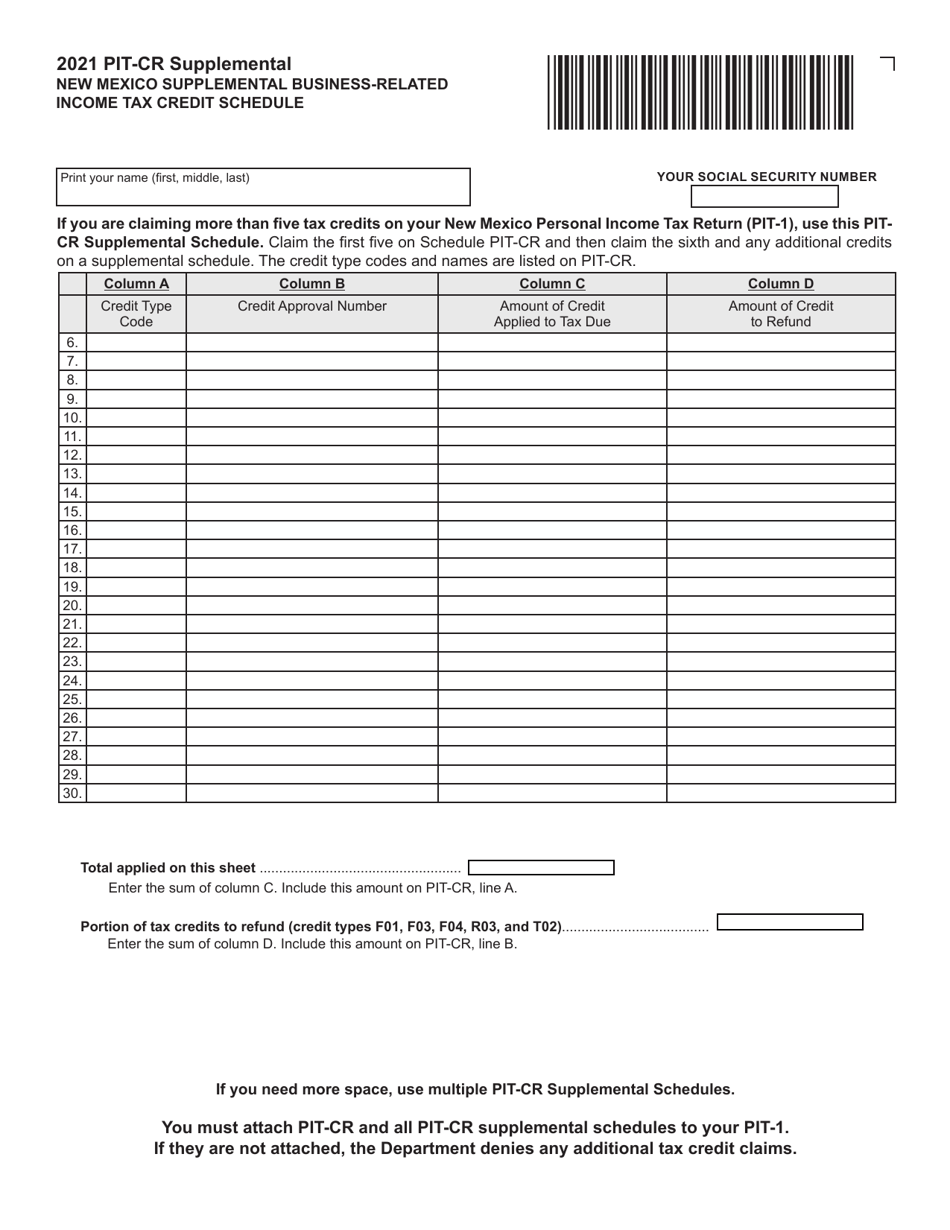

Form PIT-CR Business-Related Income Tax Credit Schedule - New Mexico

What Is Form PIT-CR?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the PIT-CR Business-Related Income Tax Credit Schedule?

A: The PIT-CR Business-Related Income Tax Credit Schedule is a form used in New Mexico to claim business-related income tax credits.

Q: Who needs to fill out the PIT-CR Business-Related Income Tax Credit Schedule?

A: Businesses in New Mexico that are eligible for income tax credits need to fill out the PIT-CR Business-Related Income Tax Credit Schedule.

Q: What does the PIT-CR Business-Related Income Tax Credit Schedule allow businesses to do?

A: The schedule allows businesses to claim various income tax credits offered by the state of New Mexico.

Q: What types of income tax credits can be claimed on the PIT-CR Business-Related Income Tax Credit Schedule?

A: There are several types of income tax credits that can be claimed on the schedule, such as the Small Business Jobs Credit and the High Wage Jobs Tax Credit.

Q: Is the PIT-CR Business-Related Income Tax Credit Schedule applicable only to businesses in New Mexico?

A: Yes, the schedule is specifically for businesses operating in New Mexico and claiming income tax credits offered by the state.

Q: Are there any deadlines for filing the PIT-CR Business-Related Income Tax Credit Schedule?

A: Yes, businesses need to file the schedule by the due date of their New Mexico income tax return, which is usually on or before April 15th.

Q: What should businesses do if they have questions or need assistance with filling out the PIT-CR Business-Related Income Tax Credit Schedule?

A: Businesses can contact the New Mexico Taxation and Revenue Department for guidance and assistance with filling out the schedule.

Form Details:

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PIT-CR by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.