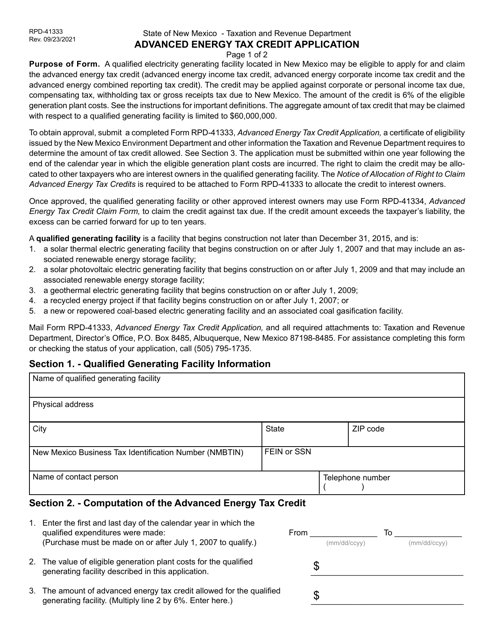

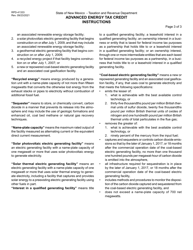

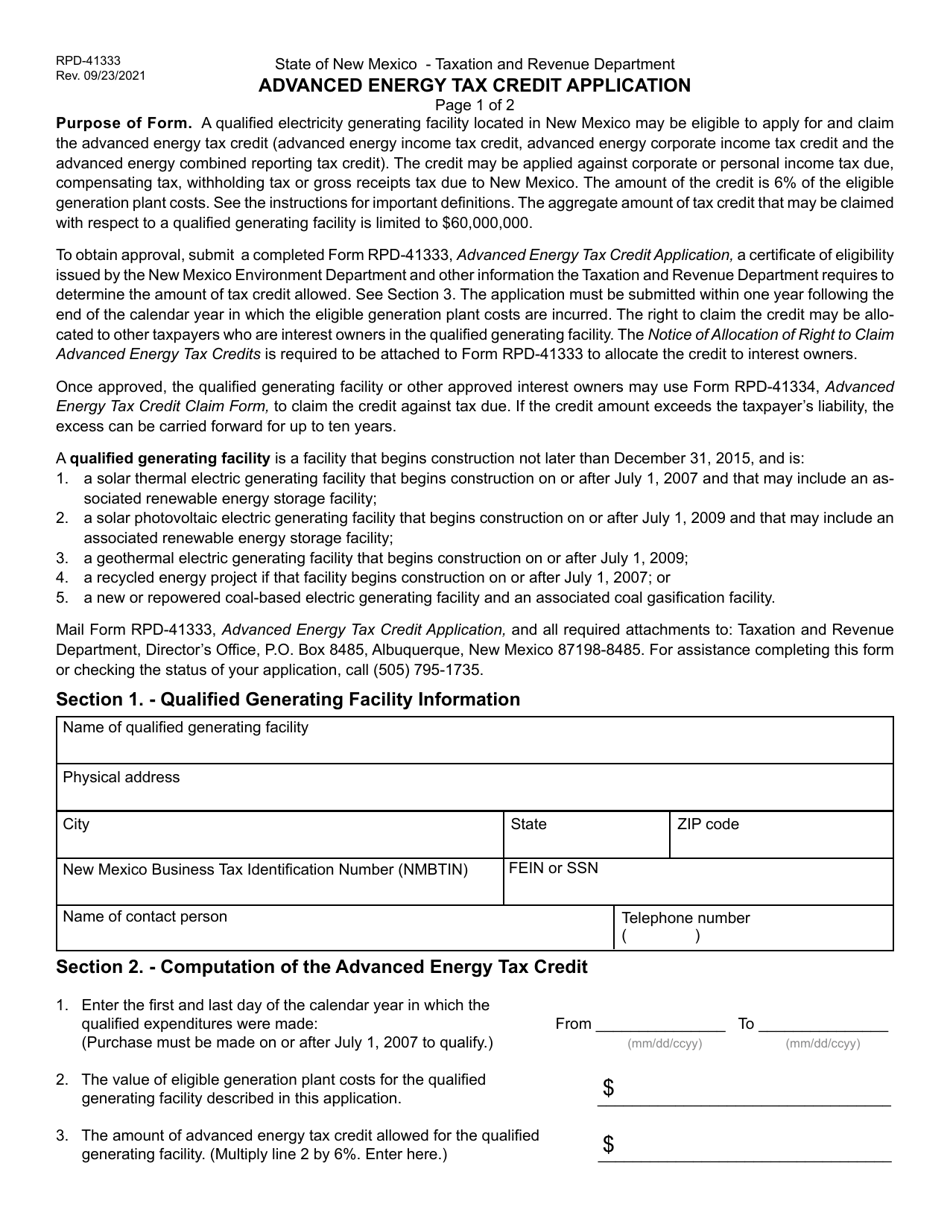

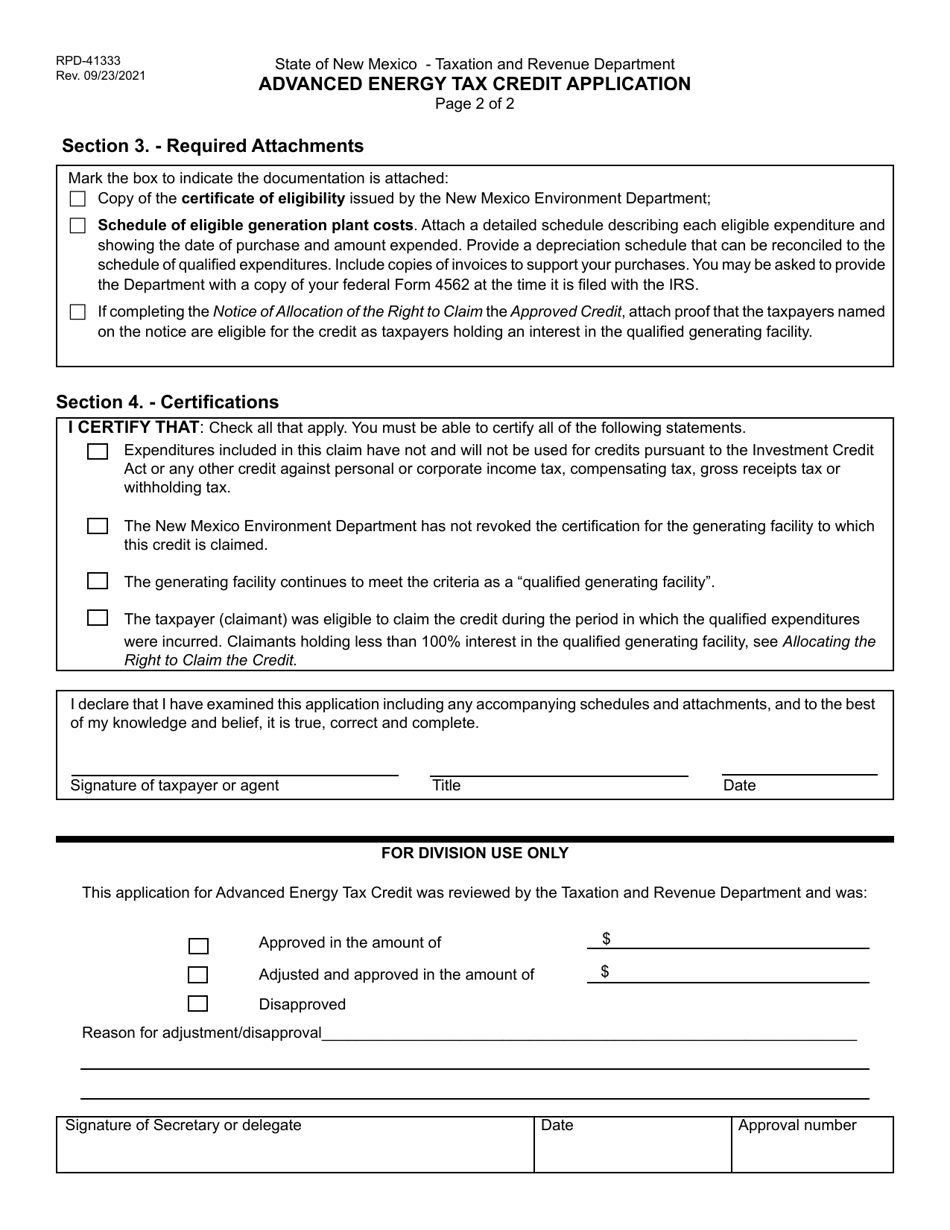

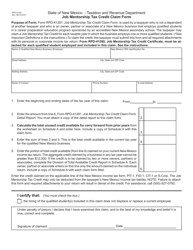

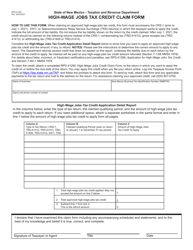

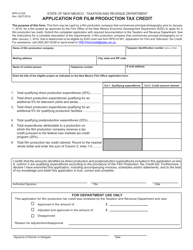

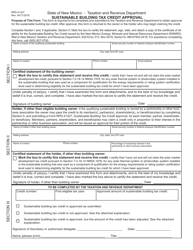

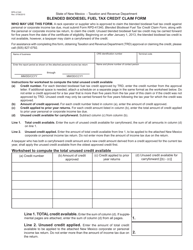

Form RPD-41333 Advanced Energy Tax Credit Application - New Mexico

What Is Form RPD-41333?

This is a legal form that was released by the New Mexico Taxation and Revenue Department - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the RPD-41333 form?

A: The RPD-41333 form is the Advanced Energy Tax Credit Application in New Mexico.

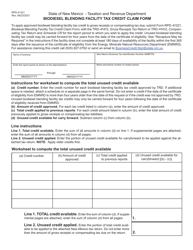

Q: What is the purpose of the Advanced Energy Tax Credit Application?

A: The purpose of the Advanced Energy Tax Credit Application is to claim tax credits for advanced energy projects in New Mexico.

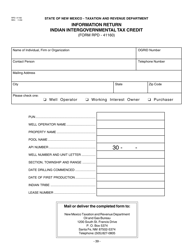

Q: What information is required to complete the RPD-41333 form?

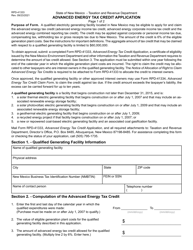

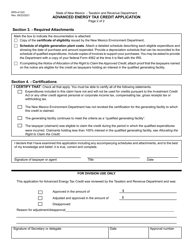

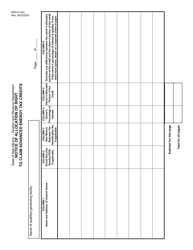

A: The RPD-41333 form requires information such as the taxpayer's name, contact information, project details, and documentation of energy efficiency measures.

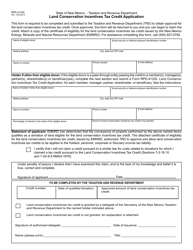

Q: Who is eligible to claim the Advanced Energy Tax Credit?

A: Individuals, businesses, and governmental entities engaged in advanced energy projects in New Mexico are eligible to claim the Advanced Energy Tax Credit.

Q: What types of projects qualify for the Advanced Energy Tax Credit?

A: Projects related to renewable energy, energy storage, energy conservation, and energy efficiency may qualify for the Advanced Energy Tax Credit.

Q: Are there any fees associated with the Advanced Energy Tax Credit Application?

A: There are no fees associated with submitting the Advanced Energy Tax Credit Application.

Form Details:

- Released on September 23, 2021;

- The latest edition provided by the New Mexico Taxation and Revenue Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RPD-41333 by clicking the link below or browse more documents and templates provided by the New Mexico Taxation and Revenue Department.