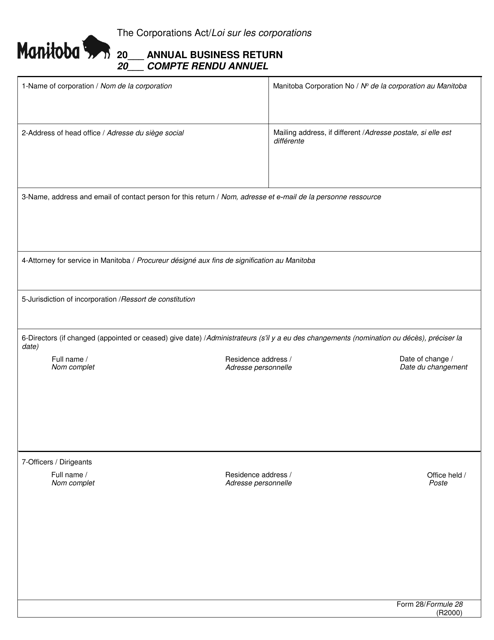

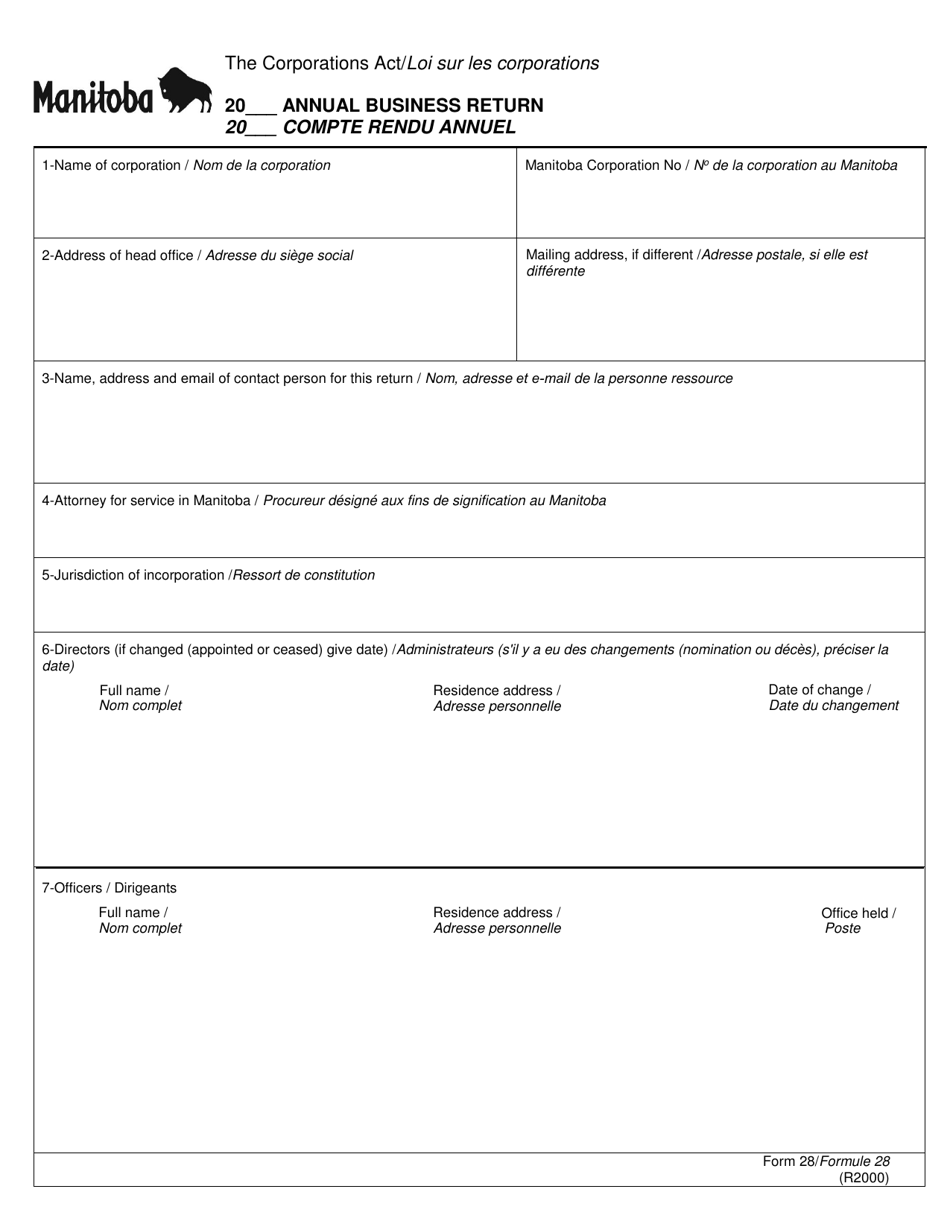

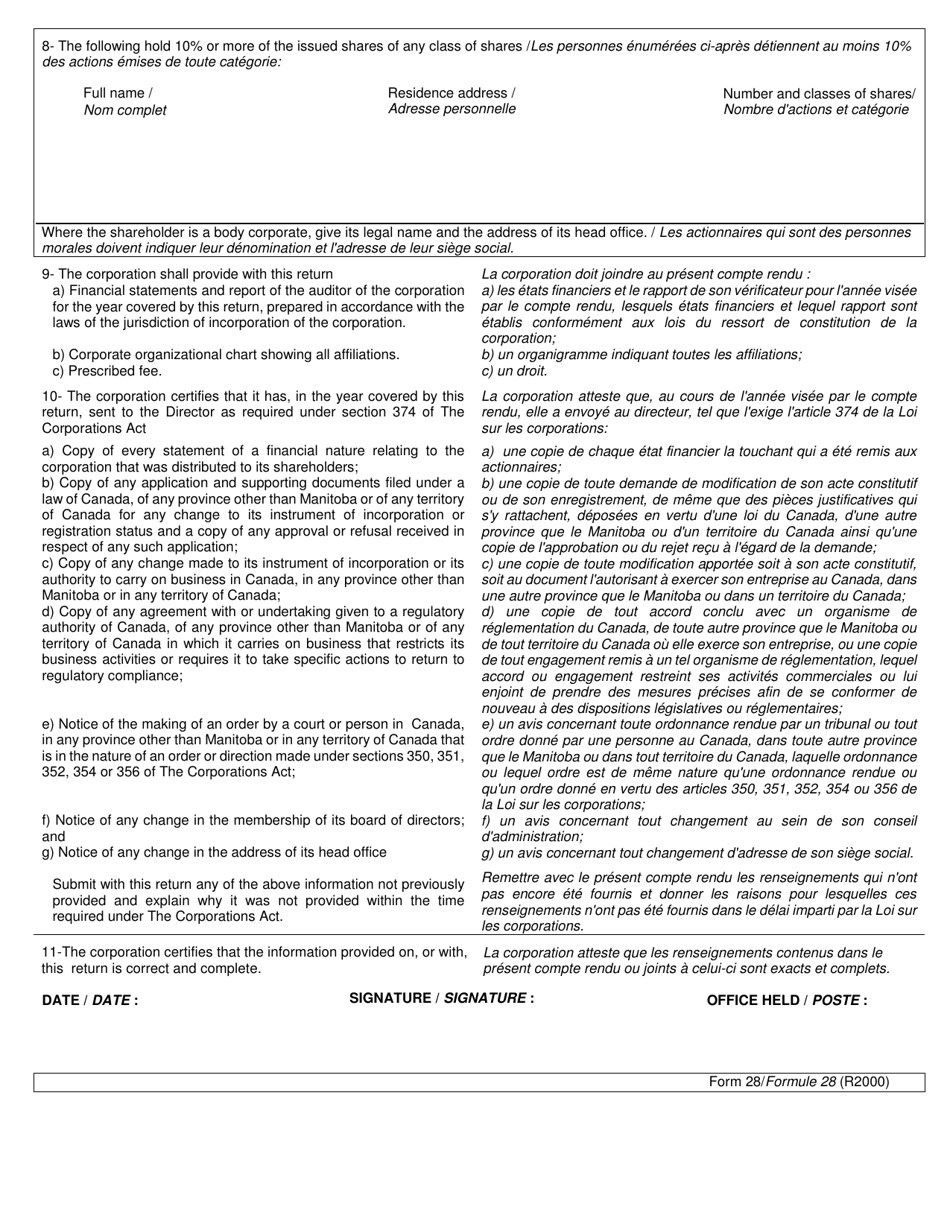

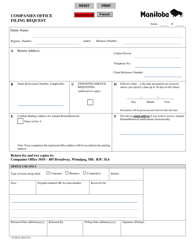

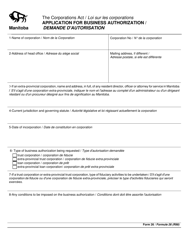

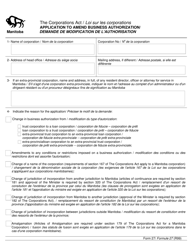

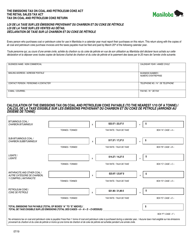

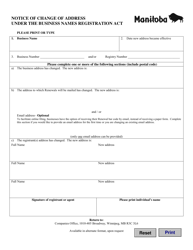

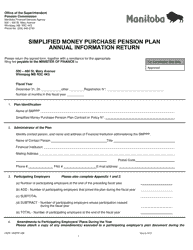

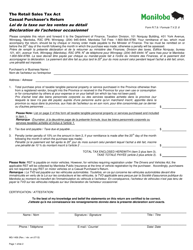

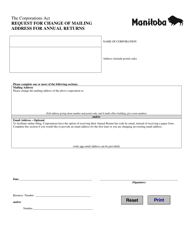

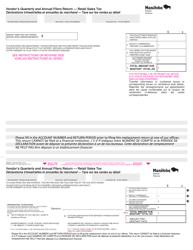

Form 28 Annual Business Return - Manitoba, Canada (English / French)

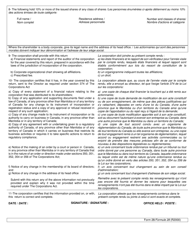

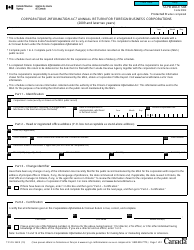

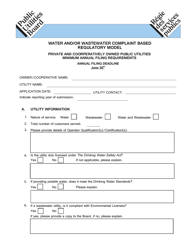

Form 28 Annual Business Return in Manitoba, Canada is used to report the annual business information and financial details of a business operating in Manitoba. It is required for tax purposes and must be submitted to the government. The form is available in both English and French.

The Form 28 Annual Business Return in Manitoba, Canada is filed by corporations and businesses.

FAQ

Q: What is Form 28?

A: Form 28 is the Annual Business Return in Manitoba, Canada.

Q: Who needs to file Form 28?

A: Businesses in Manitoba, Canada need to file Form 28.

Q: What is the purpose of Form 28?

A: Form 28 is used to report the annual business information to the government.

Q: Is Form 28 available in English and French?

A: Yes, Form 28 is available in both English and French.

Q: What happens if I don't file Form 28?

A: Failing to file Form 28 may result in penalties or legal consequences.

Q: Are there any fees associated with filing Form 28?

A: There may be filing fees associated with Form 28, depending on the type of business.

Q: Can I get assistance with filling out Form 28?

A: Yes, you can seek assistance from a tax professional or contact the government for help with filling out Form 28.

Q: Are there any exemptions from filing Form 28?

A: Certain small businesses may be exempt from filing Form 28, but it's best to check with the government to determine eligibility.