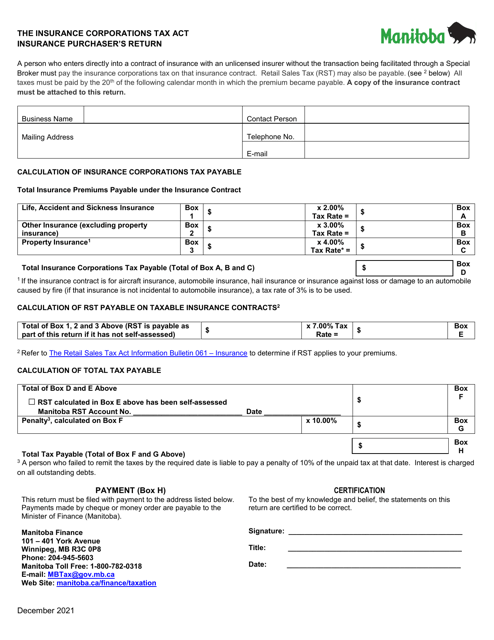

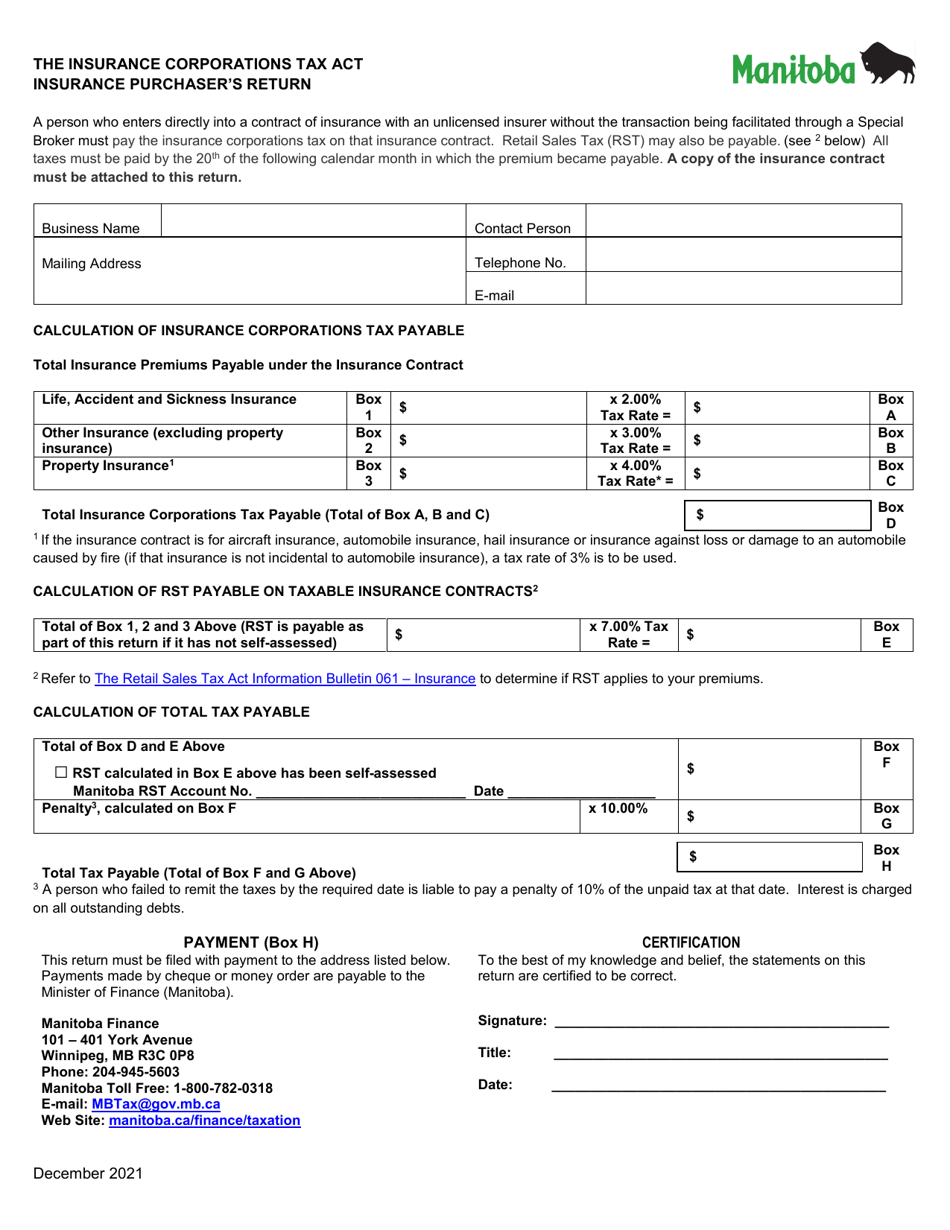

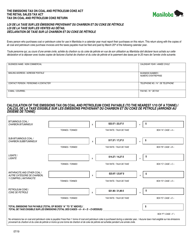

Insurance Purchaser's Return - Manitoba, Canada

Insurance Purchaser's Return in Manitoba, Canada allows eligible insurance policyholders to receive a refund or reduction in their insurance premiums based on their claims experience. It is a way for insurance companies to incentivize policyholders who have not made claims to continue their coverage.

In Manitoba, Canada, the insurance purchaser is responsible for filing their own insurance return.

FAQ

Q: What is the Insurance Purchaser's Return?

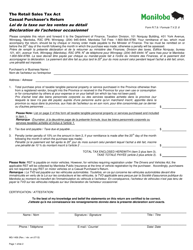

A: The Insurance Purchaser's Return is a refund on the Retail Sales Tax (RST) paid by individuals when purchasing insurance in Manitoba, Canada.

Q: Who is eligible for the Insurance Purchaser's Return?

A: Individuals who have paid the RST on insurance purchases in Manitoba are eligible to apply for the return.

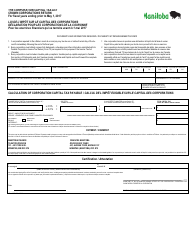

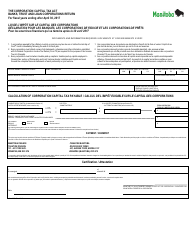

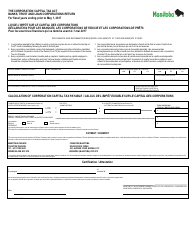

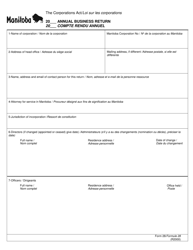

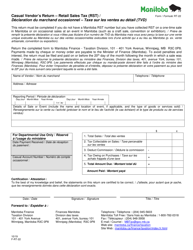

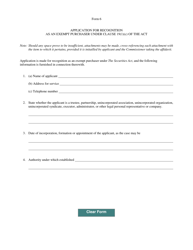

Q: How do I apply for the Insurance Purchaser's Return?

A: To apply for the return, you need to complete and submit the appropriate application form to the Manitoba Tax Assistance Office.

Q: What types of insurance are eligible for the return?

A: Most types of insurance, including home, vehicle, and travel insurance, are eligible for the Insurance Purchaser's Return.

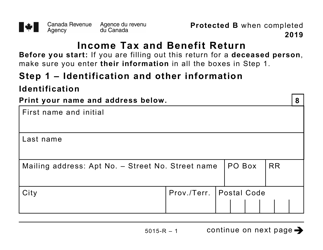

Q: Is there a deadline to apply for the Insurance Purchaser's Return?

A: Yes, applications must be submitted within four years from the date of the insurance purchase.