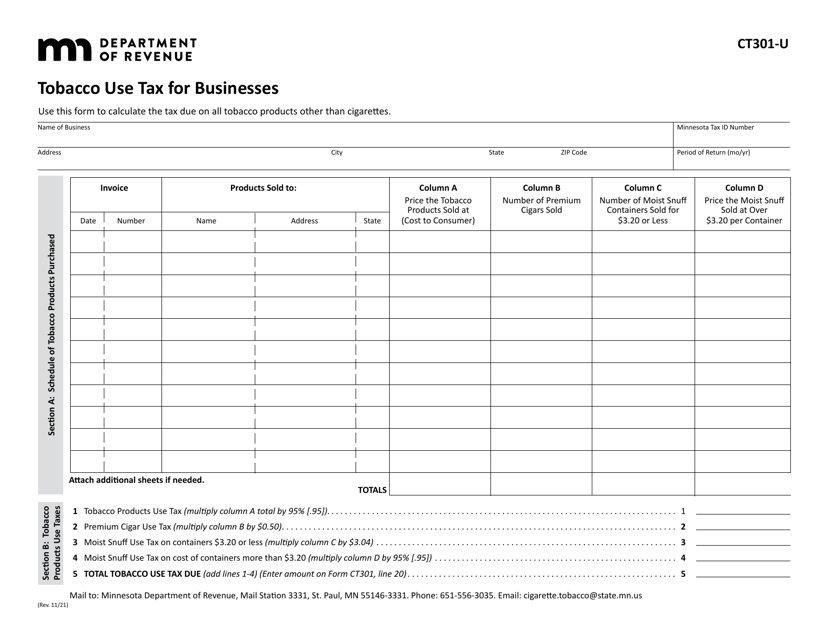

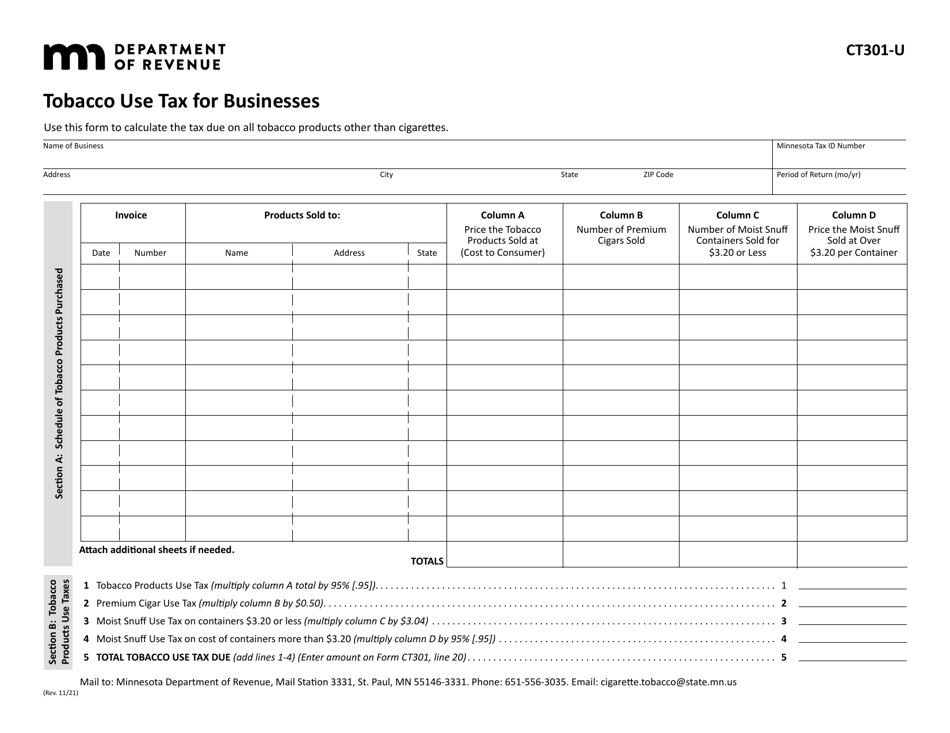

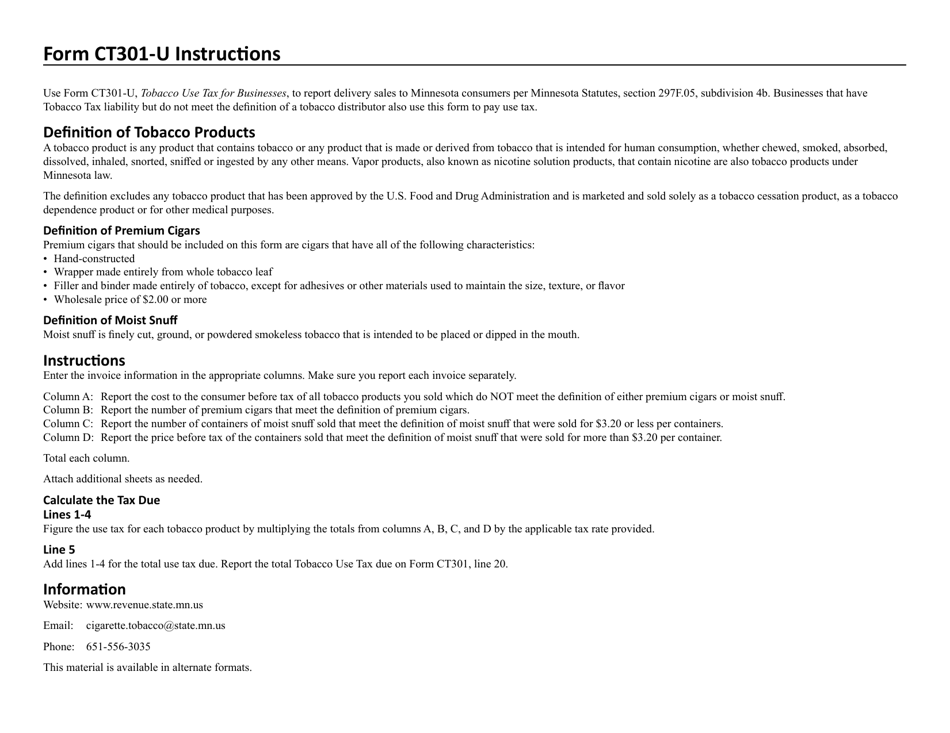

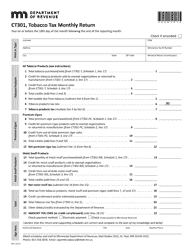

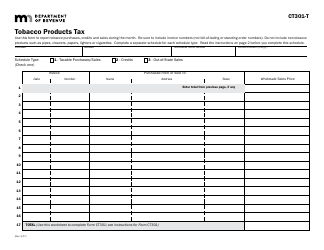

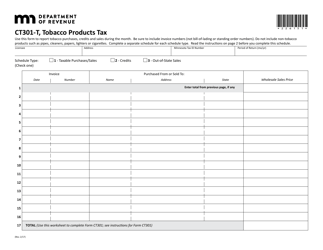

Form CT301-U Tobacco Use Tax for Businesses - Minnesota

What Is Form CT301-U?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT301-U?

A: Form CT301-U is the Tobacco UseTax form for businesses in Minnesota.

Q: Who needs to file Form CT301-U?

A: Any business that sells or distributes tobacco products in Minnesota needs to file Form CT301-U.

Q: What is the purpose of Form CT301-U?

A: The purpose of Form CT301-U is to report and pay the Tobacco Use Tax on the sale or distribution of tobacco products in Minnesota.

Q: When is Form CT301-U due?

A: Form CT301-U is due on a monthly basis, with the due date being the 18th day of the following month.

Q: How do I file Form CT301-U?

A: Form CT301-U can be filed electronically through the Minnesota Department of Revenue's e-Services system or by mail.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance, including interest charges and possible criminal charges.

Q: Can I make changes to a filed Form CT301-U?

A: Yes, you can make changes to a filed Form CT301-U by submitting an amended return.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT301-U by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.