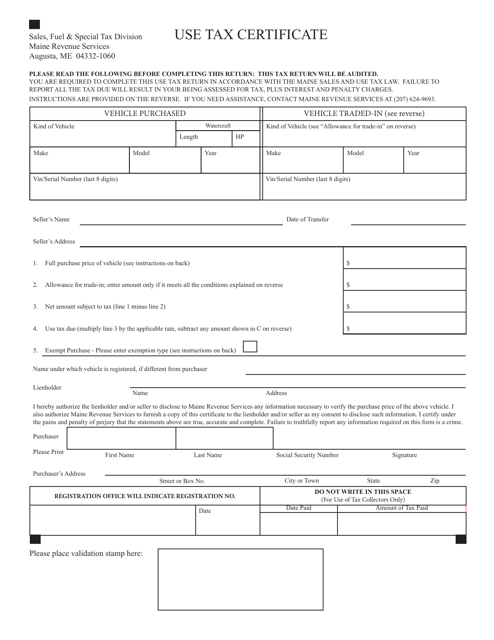

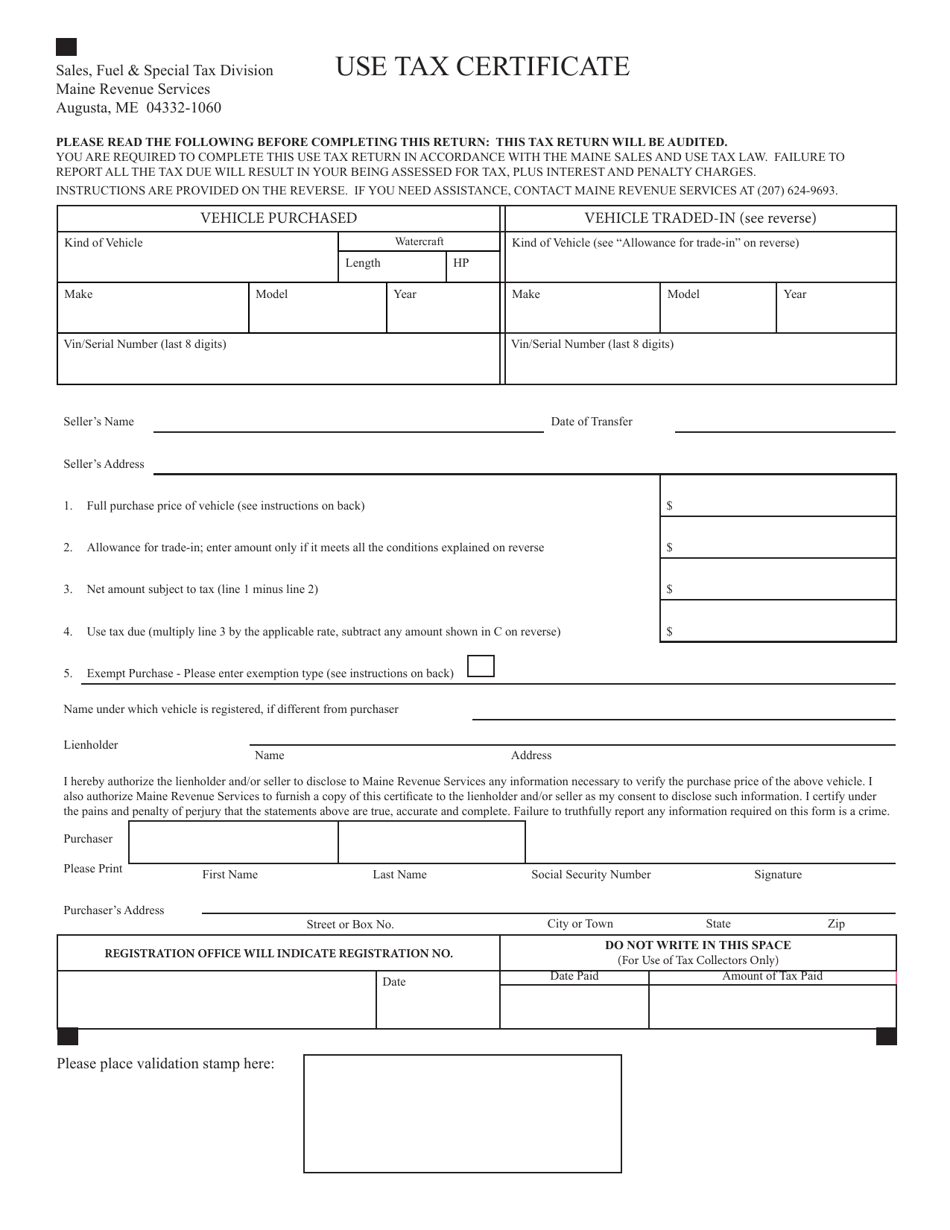

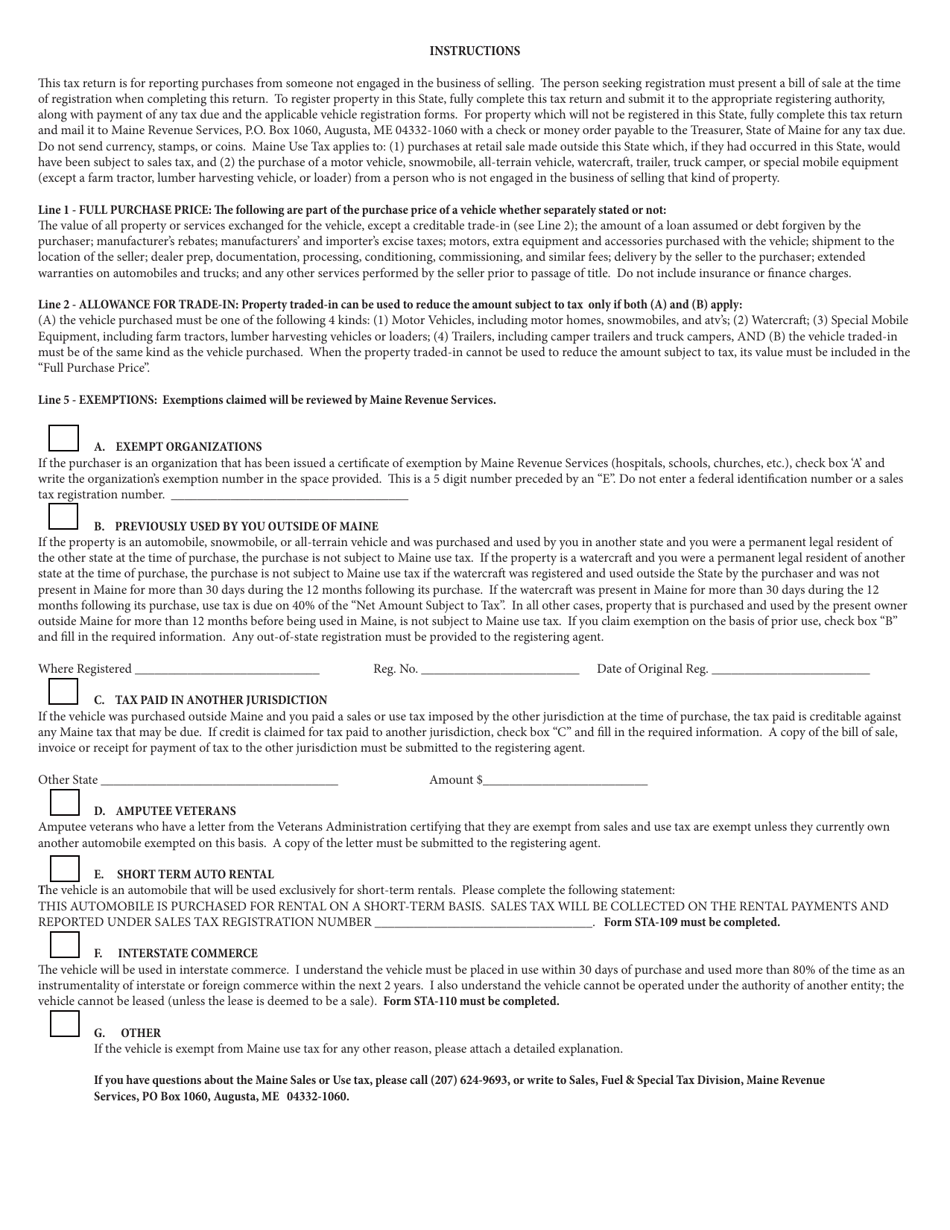

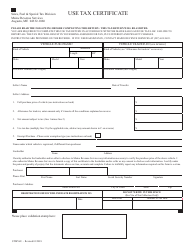

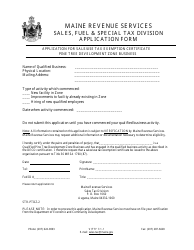

Use Tax Certificate - Maine

Use Tax Certificate is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

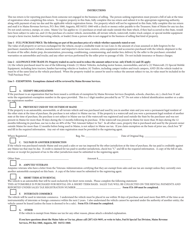

Q: What is a Use Tax Certificate?

A: A Use Tax Certificate is a document that allows businesses to report and pay the use tax on purchases made from out-of-state vendors.

Q: Who needs a Use Tax Certificate in Maine?

A: Businesses in Maine that make purchases from out-of-state vendors and are subject to use tax obligations.

Q: What information is required on a Use Tax Certificate?

A: A Use Tax Certificate should include the name and address of the purchaser, the name and address of the seller, a description of the property or service purchased, the date of the purchase, and the amount of use tax owed.

Q: How often do I need to file the Use Tax Certificate in Maine?

A: The Use Tax Certificate should be filed annually along with the Use Tax Return with the Maine Revenue Services.

Q: What happens if I fail to file the Use Tax Certificate?

A: Failure to file the Use Tax Certificate and pay the use tax owed may result in penalties and interest being assessed by the Maine Revenue Services.

Form Details:

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.