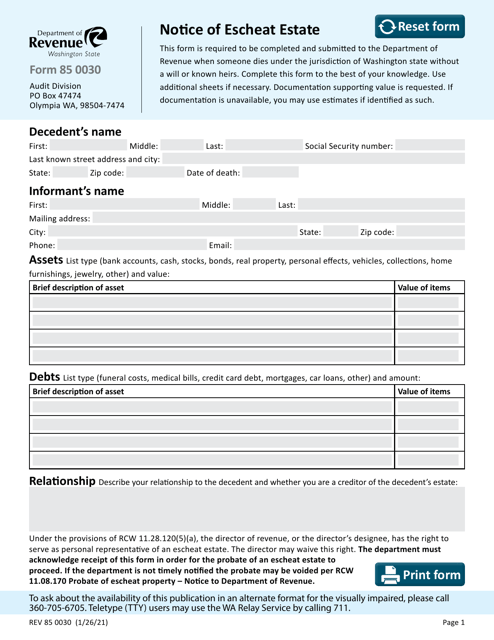

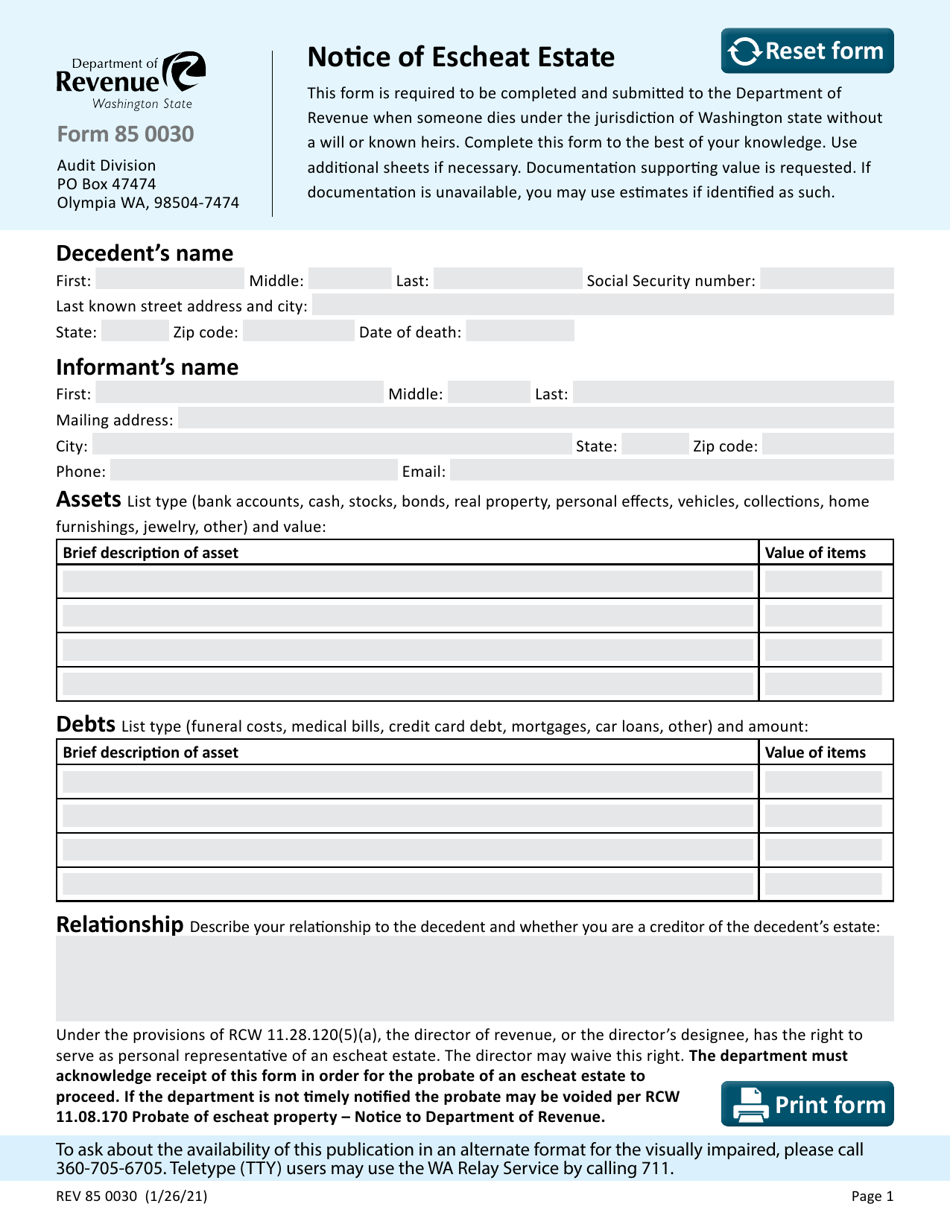

Form REV85 0030 Notice of Escheat Estate - Washington

What Is Form REV85 0030?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV85 0030?

A: Form REV85 0030 is a Notice of Escheat Estate specifically for the state of Washington.

Q: What is an escheat estate?

A: An escheat estate is property that is turned over to the state when a person dies without a will and with no known heirs.

Q: When is Form REV85 0030 used?

A: Form REV85 0030 is used to notify the Washington State Department of Revenue when an estate is being escheated.

Q: Who should file Form REV85 0030?

A: Form REV85 0030 should be filed by the personal representative or executor of the estate.

Q: What information is required on Form REV85 0030?

A: Form REV85 0030 requires information such as the decedent's name, date of death, and a description of the property to be escheated.

Q: Is there a deadline for filing Form REV85 0030?

A: Yes, Form REV85 0030 must be filed within 120 days of the date of death.

Q: What happens after Form REV85 0030 is filed?

A: After Form REV85 0030 is filed, the Washington State Department of Revenue will review the information and determine if the property should be escheated to the state.

Q: Are there any fees associated with filing Form REV85 0030?

A: No, there are no fees associated with filing Form REV85 0030.

Q: Can I get assistance with filling out Form REV85 0030?

A: Yes, you can contact the Washington State Department of Revenue for assistance with filling out Form REV85 0030.

Form Details:

- Released on January 26, 2021;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV85 0030 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.