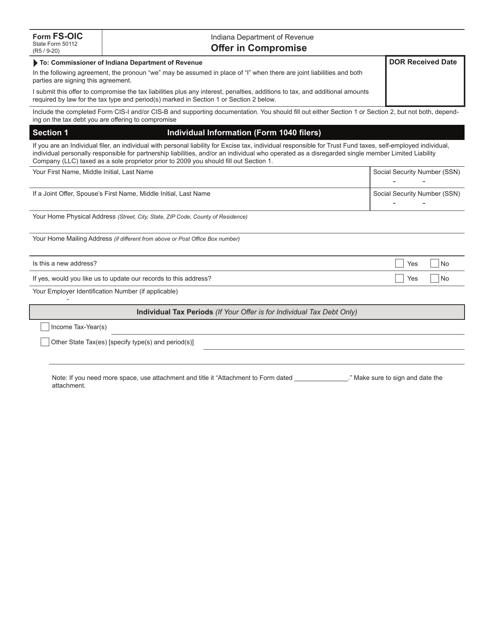

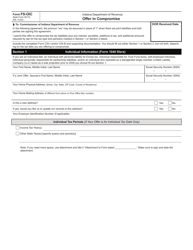

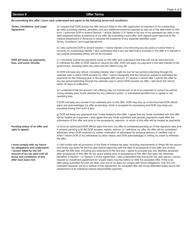

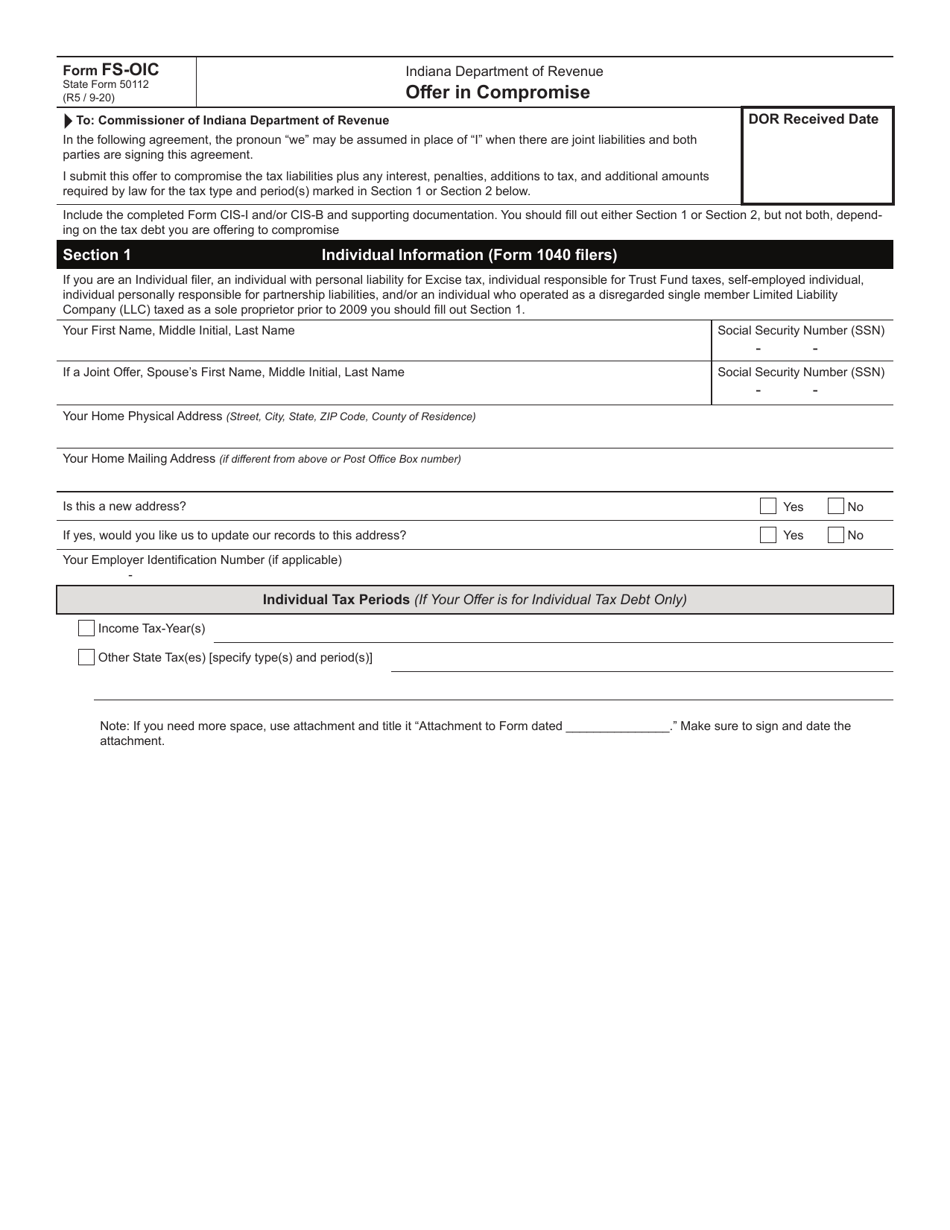

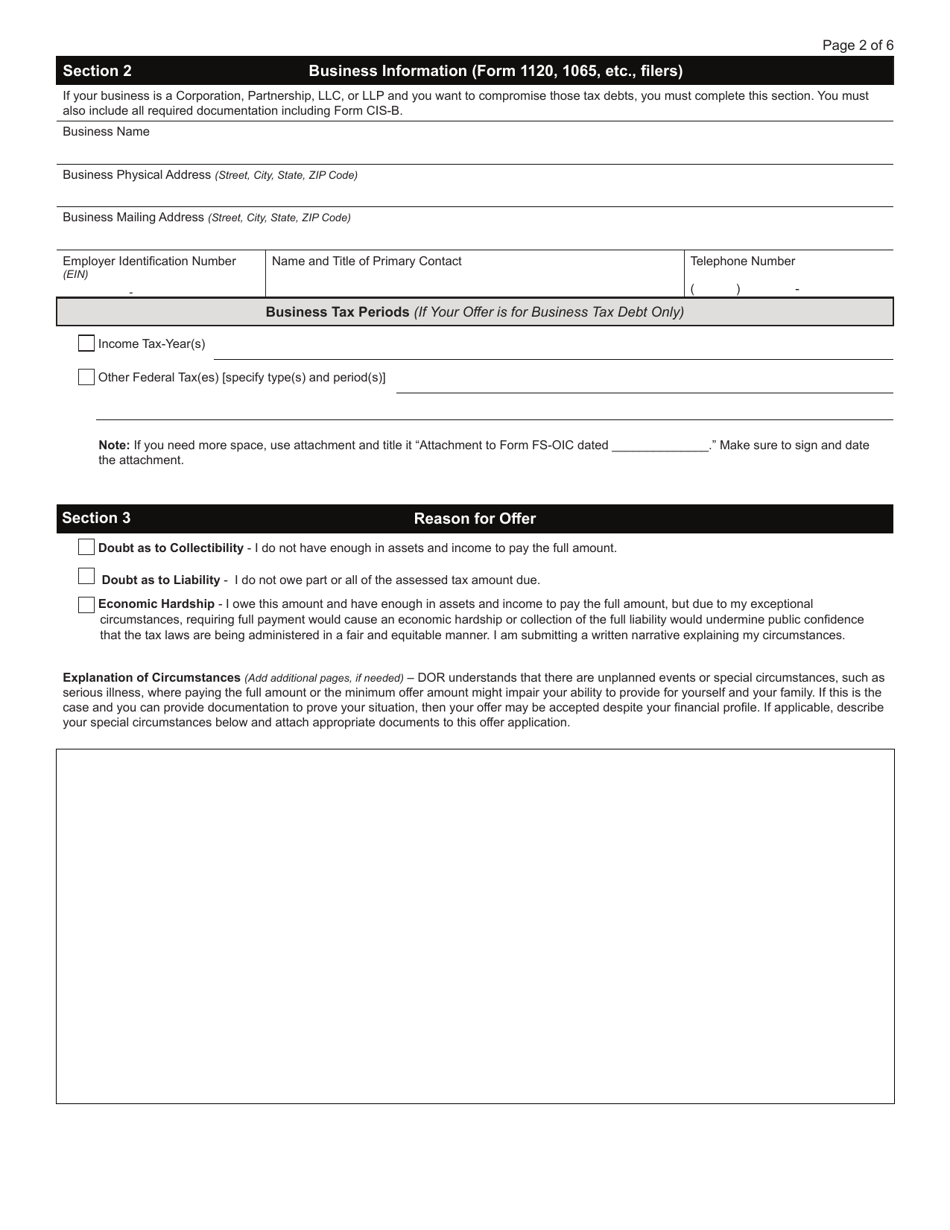

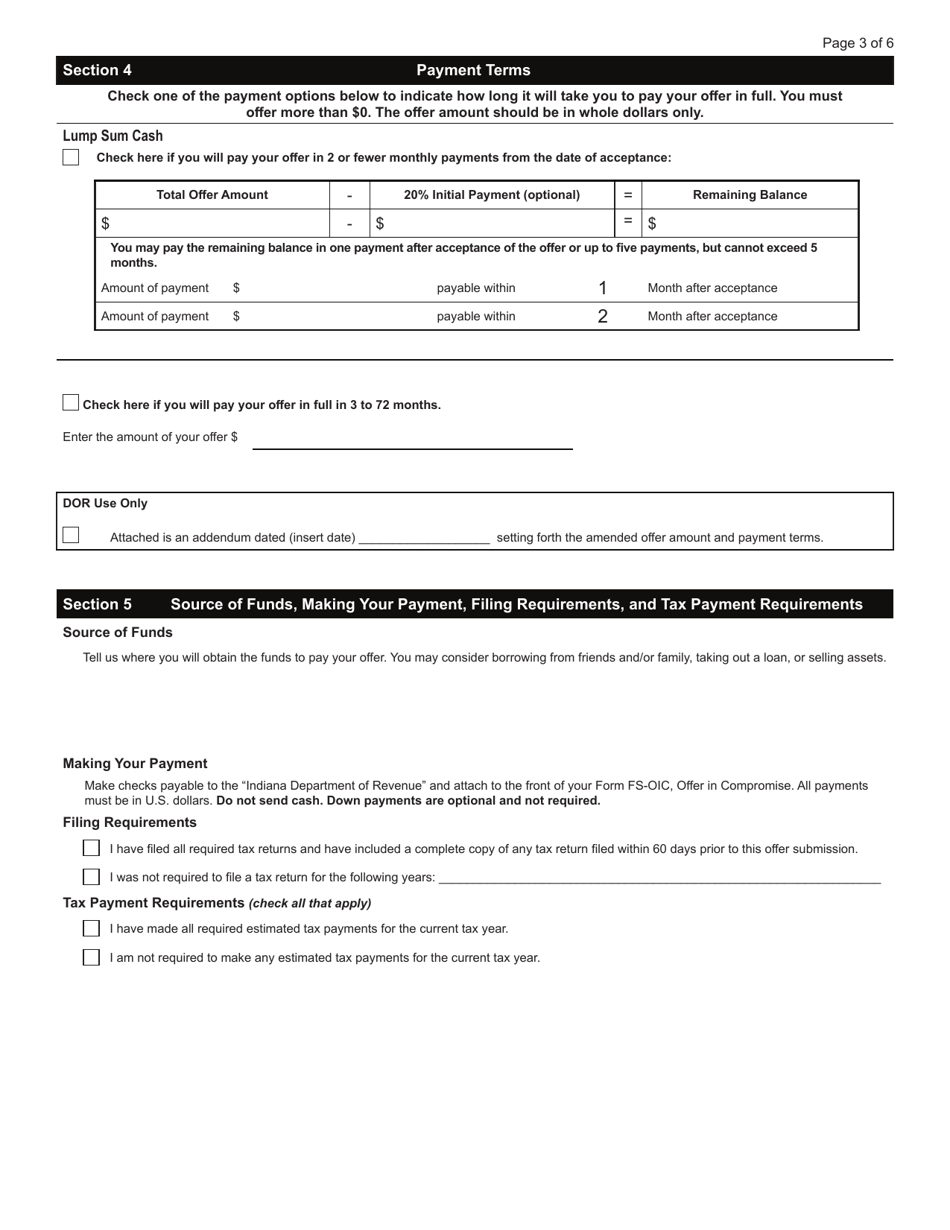

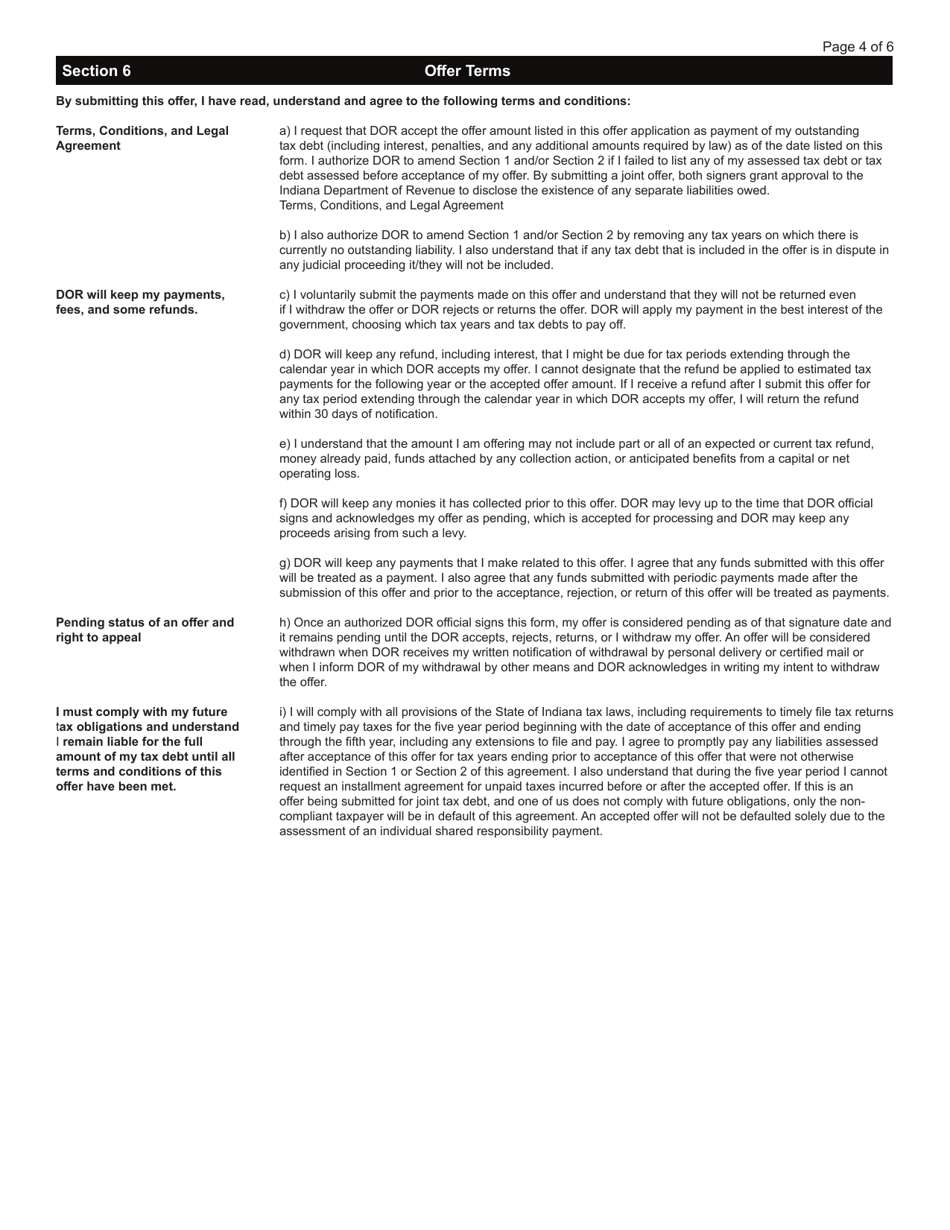

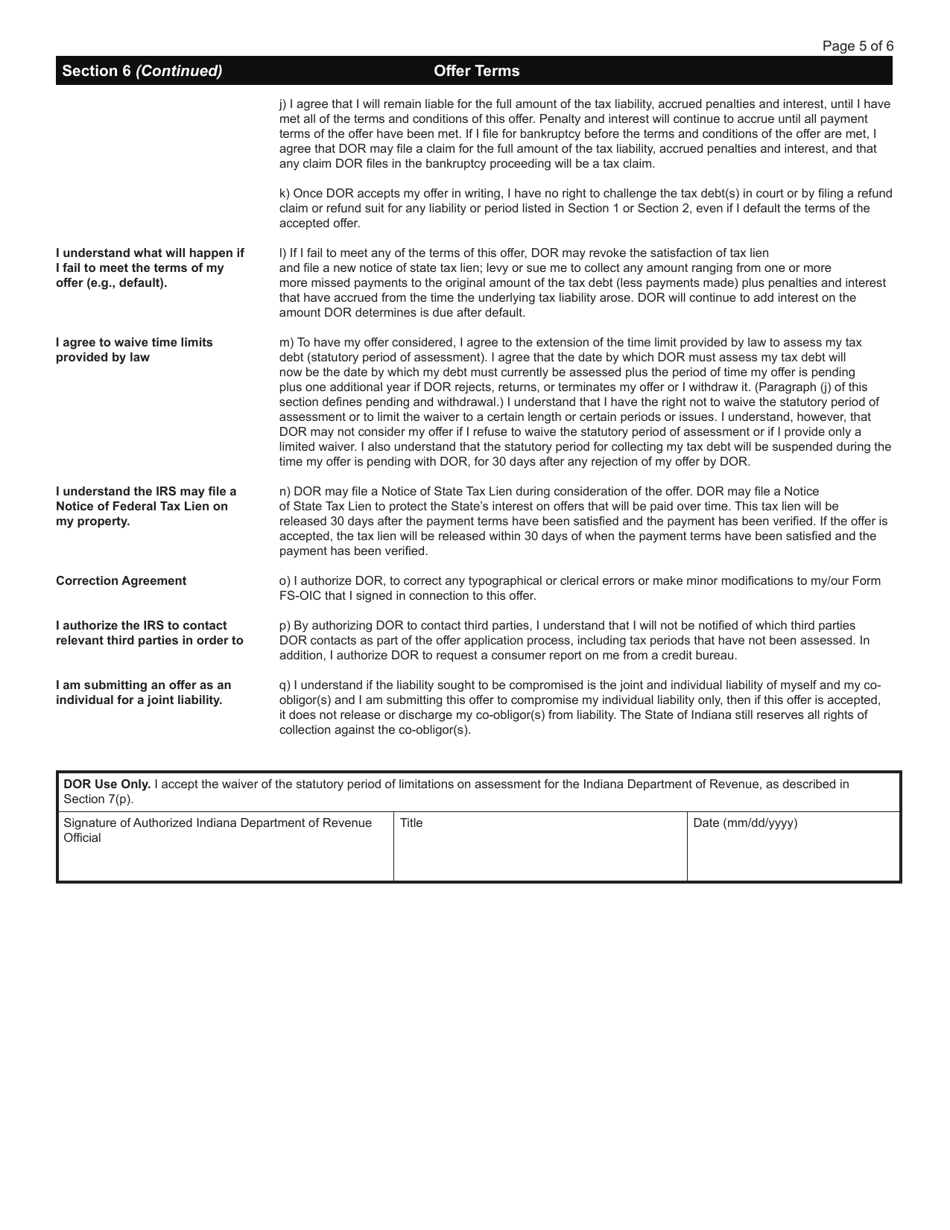

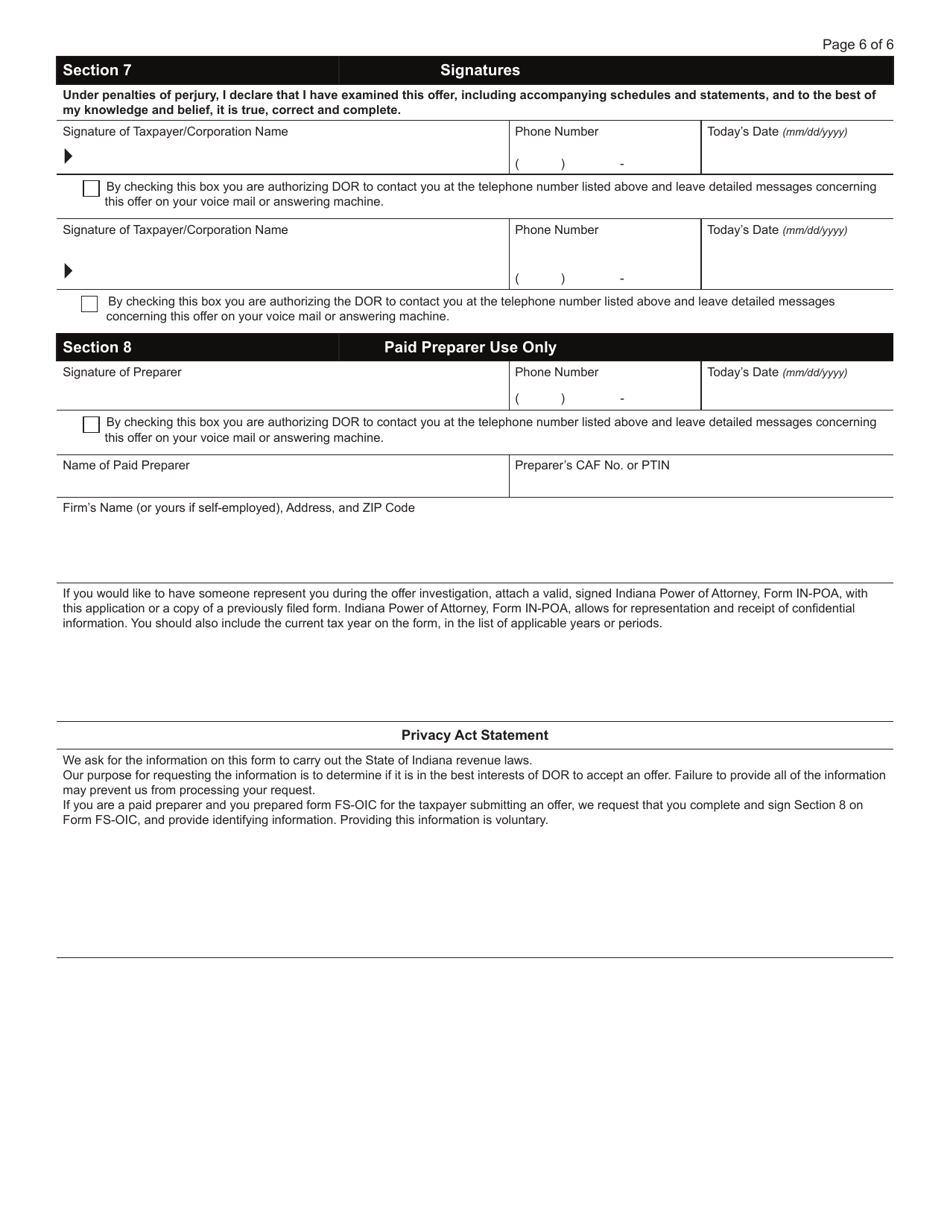

Form FS-OIC (State Form 50112) Offer in Compromise - Indiana

What Is Form FS-OIC (State Form 50112)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FS-OIC?

A: Form FS-OIC is the State Form 50112, also known as Offer in Compromise.

Q: What is Offer in Compromise?

A: Offer in Compromise is a program that allows eligible taxpayers to settle their tax debt for less than the full amount owed.

Q: Who can use Form FS-OIC?

A: Indiana residents who have outstanding tax debt to the state of Indiana can use Form FS-OIC.

Q: What is the purpose of Form FS-OIC?

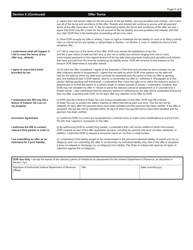

A: The purpose of Form FS-OIC is to apply for an Offer in Compromise and provide detailed financial information to support the offer.

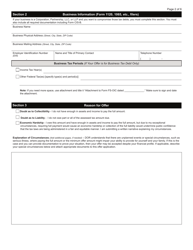

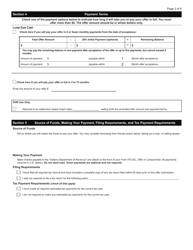

Q: How do I fill out Form FS-OIC?

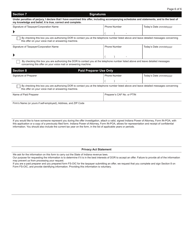

A: Form FS-OIC requires you to provide personal information, tax details, and supporting financial documents. It is important to follow the instructions carefully.

Q: What happens after I submit Form FS-OIC?

A: After you submit Form FS-OIC, the Indiana Department of Revenue will review your offer and supporting documents to determine if it is acceptable.

Q: What if my Offer in Compromise is accepted?

A: If your Offer in Compromise is accepted, you will need to fulfill the conditions outlined in the acceptance letter, such as making the agreed-upon payment.

Q: What if my Offer in Compromise is rejected?

A: If your Offer in Compromise is rejected, you may appeal the decision or explore other payment options with the Indiana Department of Revenue.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FS-OIC (State Form 50112) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.