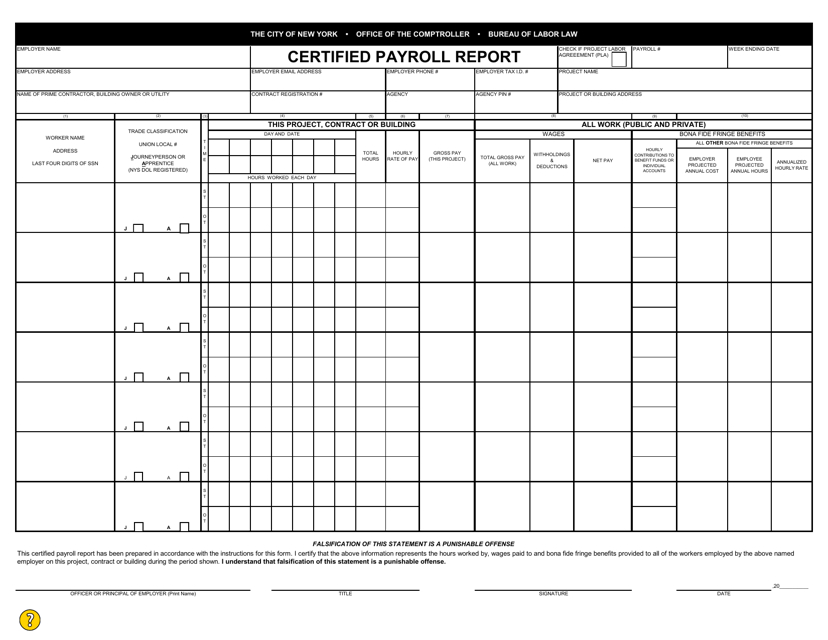

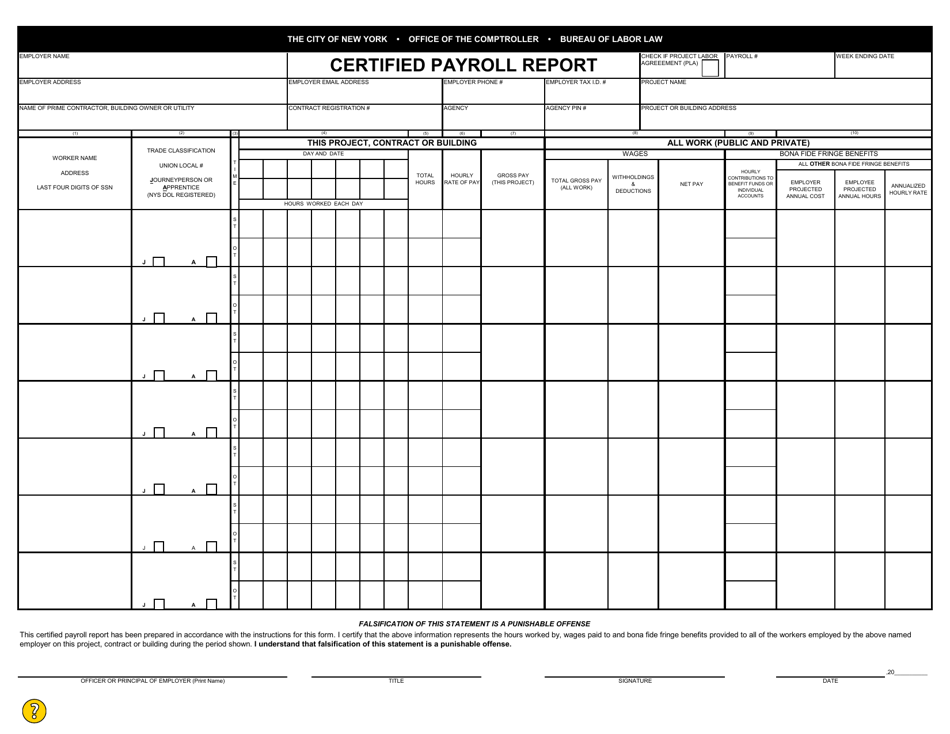

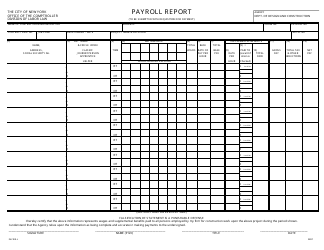

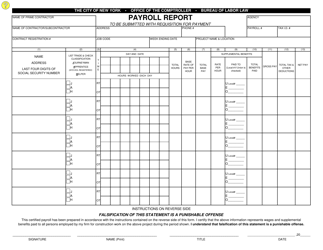

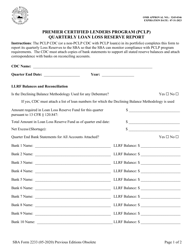

Certified Payroll Report - New York City

Certified Payroll Report is a legal document that was released by the Office of the New York City Comptroller - a government authority operating within New York City.

FAQ

Q: What is a certified payroll report?

A: A certified payroll report is a document that details the wages and benefits paid to workers on a construction project.

Q: Why is a certified payroll report important?

A: A certified payroll report ensures compliance with prevailing wage laws and helps track payments to workers on public works projects.

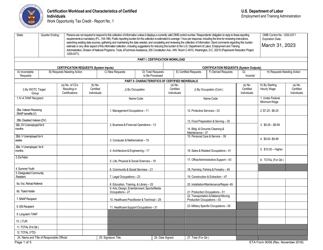

Q: Who is required to submit a certified payroll report?

A: Contractors and subcontractors working on public works projects are typically required to submit certified payroll reports.

Q: Is a certified payroll report required in New York City?

A: Yes, New York City has specific regulations that require certified payroll reports on public works projects.

Q: How often should a certified payroll report be submitted?

A: The frequency of certified payroll report submissions varies, but it is typically required weekly or bi-weekly.

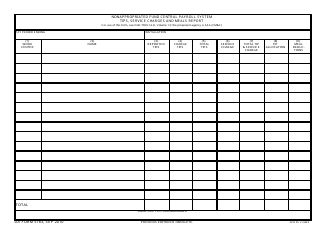

Q: What information is included in a certified payroll report?

A: A certified payroll report includes details of each worker, such as their name, job classification, hours worked, and wages and benefits paid.

Q: Who is responsible for preparing a certified payroll report?

A: The contractor or subcontractor on the project is responsible for preparing the certified payroll report.

Q: Can a certified payroll report be audited?

A: Yes, certified payroll reports can be subject to audits by government agencies to ensure accuracy and compliance.

Q: What are the consequences of not submitting a certified payroll report?

A: Failure to submit a certified payroll report can result in penalties, fines, and the loss of future public works contracts.

Form Details:

- The latest edition currently provided by the Office of the New York City Comptroller;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Office of the New York City Comptroller.